It’s not easy to choose a Forex Broker. You have to do lots of research to eliminate unreliable companies and find the rare gems.

Much is at stake. The price for making the wrong choice can be very high –as high, in fact, as losing your whole initial balance.

Personally, I have found a broker I am satisfied with in all respects, and today I want to tell you about them. However, this will NOT be one of those B.S. articles that says “This is the BEST Broker in the world, I like them soooo much. Trade with them…!”

No! I’ve seen enough of that in the FX World already.

I know you’re here because you trust me. I know you’re here because you want facts, honesty, and the truth. I won’t let you down.

What I will offer you is a full-fledged review of this broker. I will share with you my diligent four-step investigation and testing, which spanned several months.

I’ll give you all the facts, and you can make the final decision yourself.

Ready?

Let’s go!

I came across AxiTrader (now Axi) in mid–2015. ForexBoat was growing rapidly, and the number of students was already in the thousands.

I realised that if this trend was going to continue, we would soon need a reliable broker to call “Home”.

So why AxiTrader?

To answer this question, we’ll apply the following four tests to AxiTrader:

- Trustworthiness

- Trading Conditions

- Customer Service

- Funding

Buckle up! This is going to be a fun ride.

Note: A quick heads up: unfortunately, this broker cannot accept U.S. residents.

1. Trustworthiness

How do you establish a broker’s trustworthiness?

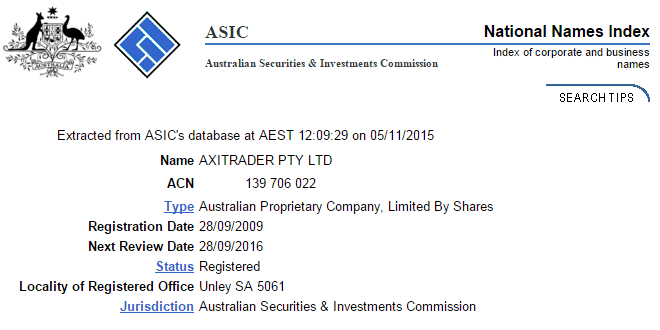

The first thing I checked was whether AxiTrader is regulated by any government body.

Yes, they are.

AxiTrader holds Australian Financial Services License number 318232 and is regulated by the Australian Securities and Investments Commission (ASIC): Source: search.asic.gov.au

ASIC is the regulatory watchdog that oversees securities and investments markets in Australia. I have been in this country for 5+ years, and know first-hand what a tight ship they run.

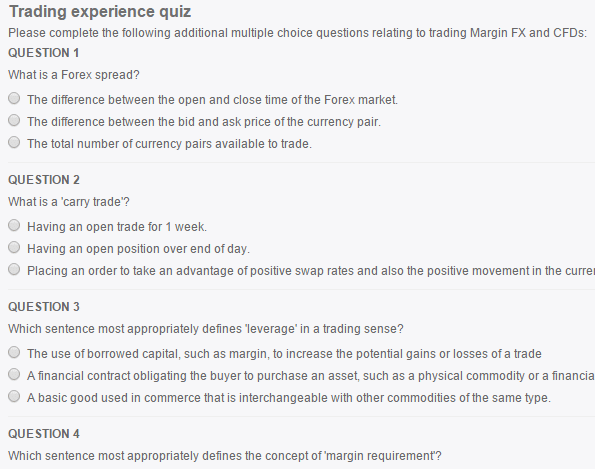

For instance, as an Australian resident, when you want to open an account you first must show that you have prior trading experience. If you don’t, you have to complete a Forex Quiz to open your account:

For some, this may sound too Big-Brother-like. To me, this is strong evidence that if a company is regulated by ASIC, there will be NO shady business.

Update: UK residents can open accounts under FCA (Financial Conduct Authority). Also, Axi is registered with the Financial Services Authority in Saint Vincent and the Grenadines (SVG), number 25417 BC 2019 by the Registrar of International Business Companies. Accounts under SVG offer more leverage and benefits.

The second check was to see what credible industry reports said about the company.

In Australia, there is a financial-services research organisation called Investment Trends. You may have heard of them:

They survey thousands of people on a regular basis, and are very diligent about what they do. That’s why companies pay thousands of dollars for their reports.

Investment trends found that AxiTrader had the strongest brand association for being “trustworthy” among current FX traders.

– Source: Investment Trends Dec 2014 Australia FX Report

Now, that says a lot about a broker.

For me, stringent regulation by ASIC and positive findings by Investment Trends certainly puts AxiTrader on the list of brokers I can trust.

2. Trading Conditions

Now that the main points are out of the way, we can finally get to the fun stuff: Trading Conditions. And by conditions, I mean everything from Account Types to Spreads and Execution.

Let’s look at these key points, one by one:

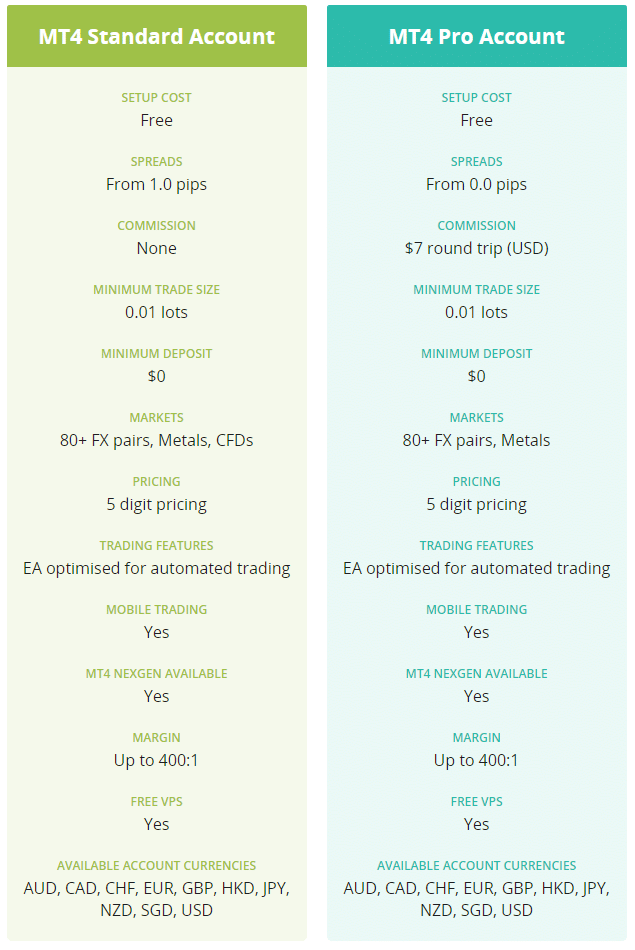

Account Types

There are two account types: Standard and Pro. Here are the specs (breakdown underneath):

Nice and simple, isn’t it? Two account types, and both use MetaTrader 4.

The main difference between the two account types is:

- Standard accounts have no commissions (all costs are built into the spread)

- Pro accounts have commissions (hence the spread is much lower, like ECN)

As you can see, both account types are EA-optimised. Score! More on that when we get to execution.

Pro accounts are specifically good for scalping-type EAs, since they have much lower spreads. I’m using one as I’m typing this review.

The other distinctive feature you will notice here is MT4 NexGen. It’s a really cool set of tools, but hold on! 🙂 We’ll talk about MT4 NexGen when we get to the assessment of Customer Service.

Spreads

If you know me well, then you know I mostly trade with Robots (scalpers, in fact). This means that I don’t take spread lightly. Spread is crucial to the performance of my strategies.

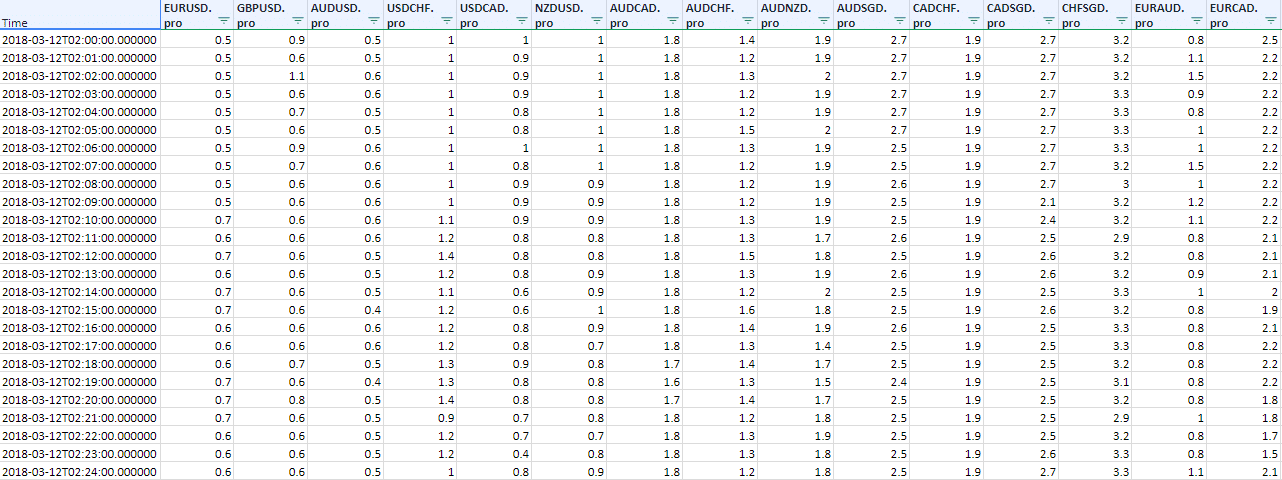

For March 2018 I monitored and recorded the live spreads I was getting on a PRO account I had opened with AxiTrader:

There are over 7081 rows in the Datafile. Each one corresponds to a separate minute. Each cell stores the Maximum Spread for that minute for a given currency pair.

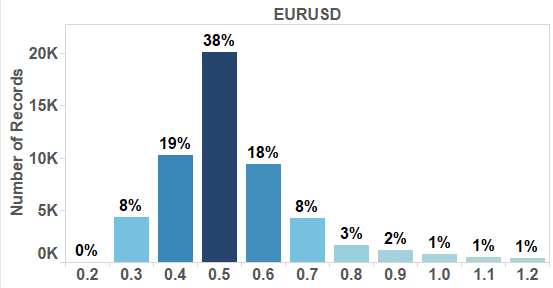

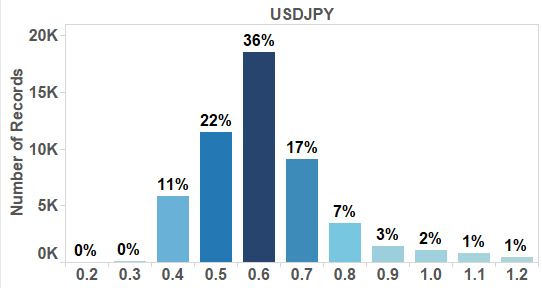

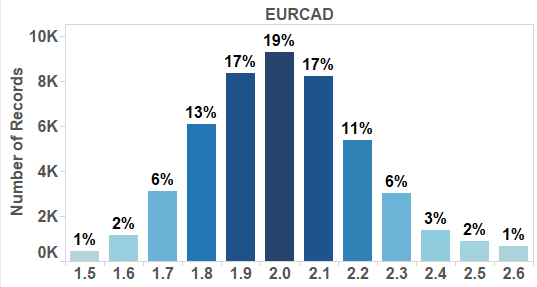

Being a Data Scientist, I didn’t stop there. I went ahead and built distribution curves for the recorded MaxSpreads. Here, for example, are two of the majors and a popular scalping pair (which I am interested in):

Findings:

- EURUSD: mostly between 0.3 and 0.7

- USDJPY: mostly between 0.4 and 0.8

- EURCAD: mostly between 1.7 and 2.3

These are just some of the results – I checked more currencies. For the most part, the findings align rather well with what is reported on the company’s website.

Let’s not forget that the script I was using records the Maximum Spread within every minute, meaning that we’re looking at the worst-case scenario. The real situation is even more favourable.

Here’s the file if you want to investigate for yourself: Download Datafile

Execution

Now I’m going to reveal, hands down, one of my favourite features of AxiTrader.

Are you ready for this?

Are you sure?

Their servers are in New York!

That’s right. I was shocked, too!

We’re talking about an Australian broker, whose servers are in the US. What a great solution to the Australian latency problem!

This country is so far away from everywhere else. Why host our trade servers here? Let’s put them smack-bang in the middle of New York, right next to the biggest liquidity providers. Genius!

This way you get the best of both worlds: stringent Australian regulations, and lightning-fast US execution.

Better yet, if you’re using a VPS server, chances are good that your provider is in the US. Meaning that your FX Robots will be performing at or very near their maximum execution speeds. For me, this is the ideal setup.

You might ask, “What more could one want?”

Which brings us to the next point.

3. Customer Service

With the FX market becoming more competitive by the day, spreads and execution across different brokers are getting more and more similar (although trade servers in New York are hard to beat).

This means that Customer Service is starting to become the key differentiator. Traders will go where they are understood, looked after, and, ultimately, treated in the best way possible.

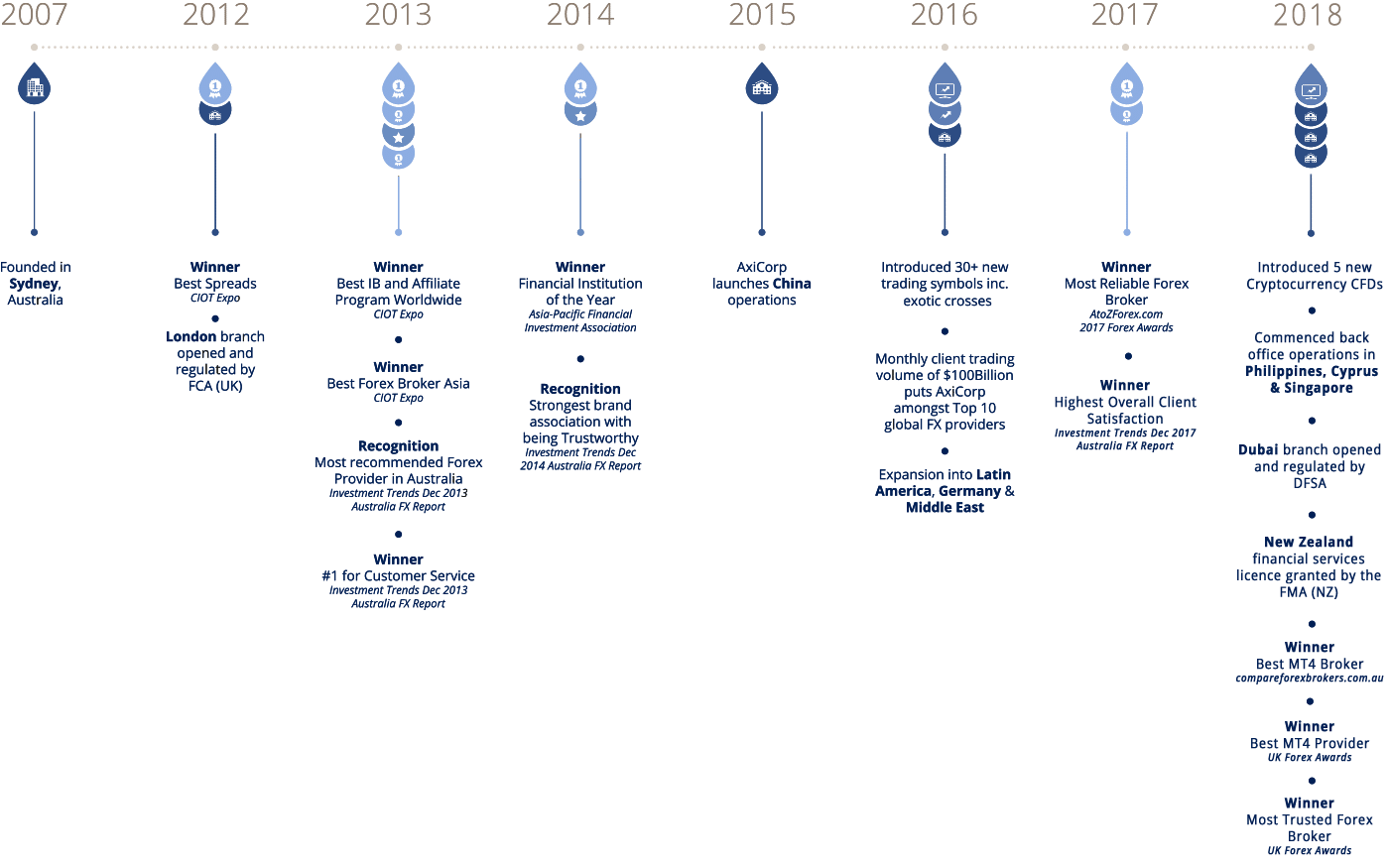

AxiTrader excels in this realm. It truly puts itself well ahead of the competition. Here are just some of the awards they have won in recent years:

“Most Recommended”, “#1 For Customer Service”, “Financial Institution Of The Year” – the list goes on.

One of the more apparent reasons is that, unlike many other brokers, AxiTrader’s customer support is available 24 hours a day, Monday through Friday. And this includes all channels: email, chat, and even phone support. You can call anytime! International phone numbers also available.

Everywhere you look, it seems that everything this company does is aimed at improving the trader’s experience.

And if previous examples (such as great spreads, simplicity of Account types, lightning execution) are insufficient, then how about this:

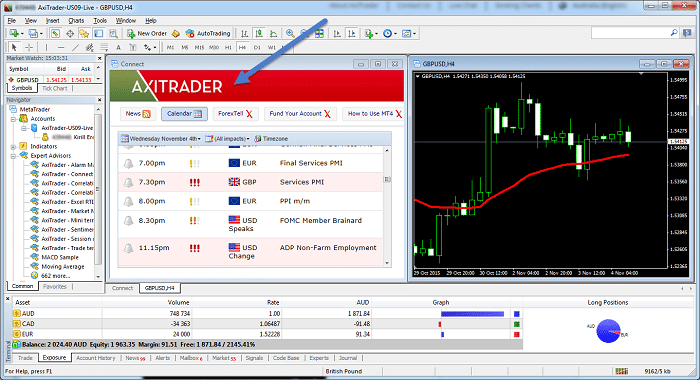

MT4 NexGen

Not available anywhere else, MT4 NexGen is an invention of AxiTrader that will forever change your trading experience.

MT4 NexGen is a set of tools designed specifically for MetaTrader 4. Think of them as plugins that enhance everything you do on the platform. In total, there are 10 tools:

Once you attach one of these features onto your chart, it either adds to it or transforms it completely. Let’s have a look at a couple of examples to illustrate what it’s all about.

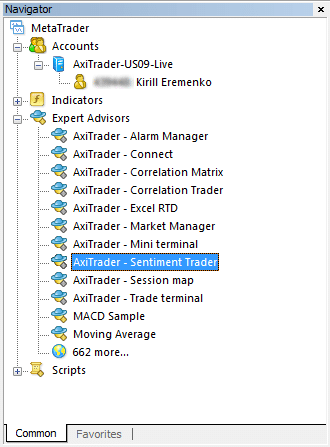

One of my favourite tools is the Sentiment Trader:

As you can see, this feature adds a gauge-style view to your chart that shows the percentage of traders that are in buy or sell positions. The information is based on a relatively large sample of retail traders.

How good is that? Normally this information is not available in the MT4 terminal at all.

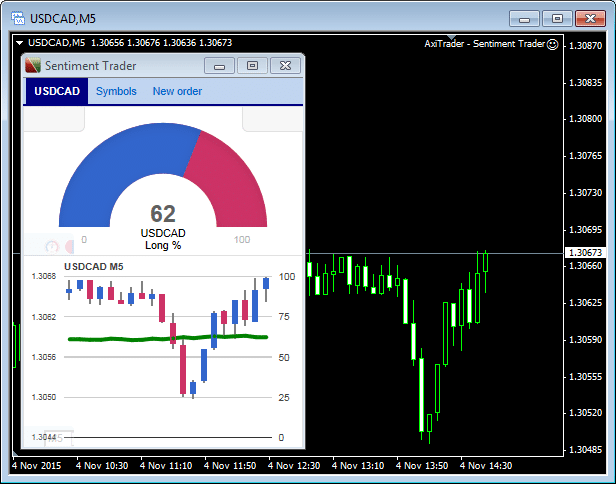

Another invaluable feature is the MT4 NexGen Calendar:

It actually adds an Economic Calendar into your MT4! And that’s not all – it also adds news feeds, helps you analyse your trades, and more. Plus, you can even un-dock the feature and place it anywhere on your desktop.

These are only two of the 10 tools. When you experience all of them, you’ll wonder why MT4 doesn’t come with them natively …

The best part is that AxiTrader provides MT4 NexGen for FREE to all traders who open an AxiTrader live-trading account with a minimum deposit of $1,000. I would take this deal 10 times out of 10.

4. Funding

The final, but still very important, question: How can you fund your account?

One way is to fund your account is via Bank Wire. It takes 1–3 working days.

A much faster way is via Credit Card.

“But commissions are high for credit-card transactions,” you say. Maybe as most of the brokers take up to 3.2% in funding fees.

Well, speaking of customer service … AxiTrader has another surprise for you:

For your AxiTrader will waive Credit Card fees!

Yep!

That’s right you can save a lot on funding taxes – so make it count!

A quick calculation below is actually showing you how much you can save:

When you deposit $5,000 into your account.

You save: 3.2% x 5,000 = $160

Not bad, huh?

Conclusion

I started trading Forex back in 2007. Since then I have seen many brokers rise and fall. I have worked for brokers, I have worked with brokers, I have liked some, I have hated others, but never has any broker satisfied all my quality criteria.

This investigation took me three months, and I was pleasantly surprised by the results. AxiTrader not only deliver on spreads and execution, but they are trustworthy and go above and beyond when it comes to customer service.

Let’s tally up the points for AxiTrader:

- Trustworthiness:

- Regulated by ASIC (FCA in the UK). This is a no-B.S. broker!

- Award for most “trustworthy” among current traders

- Trading Conditions:

- Account Types: two. Simple and to the point

- Spreads: Verified tight spreads, good for expert advisors

- Execution: Servers based in New York maximize proximity to liquidity providers

- Customer Service: Multiple awards, 24-hr support

- MT4 NexGen: I had to put this separately. It’s that good!

- Funding: Fees waived for first-time funding via Credit Card

That’s five points out of four possible, and a solid Five-Star review. Hands down, the best I’ve seen:

That sums up this assessment. Personally, I’m very satisfied with AxiTrader and plan on growing my real trading account with them over the years to come.

Also, based on this review, AxiTrader is now officially the broker of choice for ForexBoat! If you’re a student of mine make sure to check them out:

Special Bonus

On top of what you have read above, there is another reason why I like AxiTrader so much…

If you are ForexBoat student or reader, you could get an exclusive 30% deposit extra credit* with a new AxiTrader Live Account, this can help you ease the fund barrier every trader faces when transitioning from a demo to a live account.

Click Here To Open An Account With AxiTrader and Get a 30% Deposit Bonus*Terms and Conditions Apply

November 21, 2015 at 4:02 am, Ahmed Elshemy said:

M/ Kirill

i m a big fan here from egypt …i follow all your post …amazing

for us in middel east .we have no experiance with australian broker

with your post like that ..i m going to open with them soon ,, after your nice investigation they deserve to give them my trust too

thanks at all

November 25, 2015 at 5:05 am, Kirill said:

Hi Ahmed,

Thanks for the great comment! Axi are definitely a great broker and worth checking out!

Cheers,

Kirill

November 22, 2015 at 10:23 pm, John Doyle said:

Im looking for opinion about MFX Broker. Right now i work with demo account. I think they have good offer but I cant find many information about them. Any informations?

November 25, 2015 at 5:04 am, Kirill said:

Hi John, haven’t worked with MFX – and unfortunately cannot comment from experience. Try applying the same test framework to them as above.

Kirill

November 25, 2015 at 4:46 pm, RD said:

Hi Kirill,

Do you have a similar recommendation for a trader in US?

December 01, 2015 at 7:24 am, Kirill said:

Hi RD, unfortunately, I do not.

November 28, 2015 at 7:40 am, Gluay said:

Hi Kirill,

Thanks for the post and your effort for this great review. I have just opened an account with this broker. There service is indeed great and quick.

However I was shocked with the spreads I saw in MT4. I have Standard account and the spreads are about 21 pips (around 212 points). I’m wondering if I should switch to PRO account instead. I know that PRO account has commission, but I think having large spread makes the short trade difficult. I prefer to trade intra-day or hold the positions not more than a week. What do you think? Do you have any advice?

Kinds regards,

Gluay

November 30, 2015 at 6:02 am, Gluay said:

Hi Kirill,

I just noticed that when the market is opened, the spread is about 2-3 pips.

December 01, 2015 at 11:37 pm, Kirill said:

Hi Gluay,

That’s a huge difference! Are you happy with the spread now? 🙂 Was the 21 pips spread because of the weekend?

Kind regards,

Kirill

December 02, 2015 at 6:13 pm, Gluay said:

Hi Kirill,

Yes, I’m happy indeed. I will see if the spread becomes 21 pips again in the weekend.

Kind regards,

Gluay

December 05, 2015 at 12:36 pm, Kirill said:

Awesome let us know how you go!

December 05, 2015 at 7:41 pm, Gluay said:

Hi Kirill,

I just want to inform that this weekend the spreads become 212 points again.

Kind regards,

Gluay

December 12, 2015 at 1:41 am, Kirill said:

Hi Gluay,

Sometimes spreads are shown higher for the weekend. In my view, it doesn’t really matter since there’s no access to Forex on Saturday and Sunday anyway. However, you can always call up AxiTrader and discuss this with them if you require more info.

Regards,

Kirill

November 30, 2015 at 8:32 pm, RS Y said:

so Axitrader is top 1.. so what is the top 2 & 3 broker?

December 01, 2015 at 7:24 am, Kirill said:

I have moved away from recommending 3 brokers. Nobody really ever looks at number 2 and 3 – and rightly so… Why settle for second-best?

December 27, 2016 at 9:03 pm, Soffeah Sanell said:

Were your 2 & 3 brokers serving US residents? If so, as a student of the udemy course I would be very interested in hearing your 2 & 3 listed brokers.

February 18, 2017 at 4:33 pm, John said:

Restrictions. This broker for example don’t accept customers from Japan, perhaps the numbers 2 ou 3, do.

December 02, 2015 at 10:57 am, Victor Gs said:

Hi Kirill, is this broker available in Europe (Spain, particularly)?

Thanks

December 02, 2015 at 1:32 pm, Kirill said:

Hi Viktor, sure is! They take clients from nearly everywhere. Simply follow the link to open an account.

Happy trading!

Kirill

December 03, 2015 at 7:08 pm, RS Y said:

Hi Kirill, I’m a newbie and would want to open an account with axitrader. I enrolled in one of your courses about Forex Robot. Which one would you recommend? The Standard or the Pro?

December 05, 2015 at 12:35 pm, Kirill said:

Hi RS,

This largely depends on your financial situation, objectives and needs and therefore would be classified as personal advice. I am only licensed to provide general advice and therefore cannot help you make this decision – it’s entirely up to you.

Just make sure you check the minimum deposits on both types of accounts – for instance, if your starting balance is quite small then that might rule out a PRO account.

Good luck!

Kirill

February 02, 2016 at 5:25 am, harsha said:

Please reply me. I’m seeing very bad reviews for this broker, I can’t understand what to believe . Can you please conclude this ?

Thanks.

February 02, 2016 at 8:03 am, Kirill said:

Hi Harsha, there will always be good and bad reviews. Pretty much for any broker out there. My opinion is up above. It’s up to you to do your research and understand where you want to trade. Kirill

December 18, 2015 at 1:33 pm, Sam said:

Kirill, have you used Autochartist, which is heavily advertised by Axi? Is it useful?

February 02, 2016 at 8:04 am, Kirill said:

Hi Sam, haven’t used Autochartist, so can’t help you there.

February 01, 2016 at 1:53 pm, harsha said:

I can’t understand, you’re saying it is the best, when I searched for more reviews, I found people saying it is the worst. Can’t able to judge this. can you please explain ?

February 02, 2016 at 8:05 am, Kirill said:

Hi Harsha, there will always be good and bad reviews. Pretty much for any broker out there. My opinion is up above. It’s up to you to do your research and understand where you want to trade. Kirill

February 02, 2016 at 7:33 am, Raymond said:

I tried to open axytrader website. The browser warn me about the site is not safe. “The owner of http://www.axitrader.com has configured their website improperly. To protect your information from being stolen, Firefox has not connected to this website.” How about it now?

February 02, 2016 at 7:34 am, Raymond said:

and it seems a lot of people reviewing the axitrader such a scam. are you sure this is the best forex broker out there? the way you choose this broker make me wonder about your credibility.

February 02, 2016 at 8:09 am, Kirill said:

Raymond, you are entitled to wonder about whatever you like. My review is above and to me that is solid because I did this research myself. I don’t care what others say. You are in a different situation – you are reading my review here, reading somebody else’s somewhere else etc. The best solution in this case is to go and do your own research and decide for yourself what is the best place for YOU to trade. Take care, Kirill

February 02, 2016 at 8:09 am, Kirill said:

I have never had this issue. I checked just now and the website is opening fine for me.

February 28, 2016 at 10:52 am, Freddy said:

One important problem that is missing here is WITHDRAWAL. We find a lot of brokers who seem very good till we ask our money back. Then they procrastinate, they add more rules, etc.

One of the important points is to NEVER accept bonuses as they are usually meant to “block” any withdrawal that you would like to make.

What about AxiTrader?

March 22, 2016 at 9:39 am, Kirill said:

Hi Freddy,

Withdrawal is covered under regulation. AxiTrader are a licensed broker in Australia (and not on Cyprus or other offshore) – I cannot imagine how they could NOT withdraw your funds and still keep their license. The regulatory watchdog in Australia is very strict.

Hope this helps,

Kirill

March 09, 2016 at 10:25 am, Richard said:

Thanks Kirill for recommendation. I opened an account with AT and satisfy with the customer support so far. 5 star from me. Also thanks for the 500 credit bonus upon signing up with your form :).

I saw you used Alpari in one demo. Any feedback on this broker? I wanna test for the second option to compare.

March 22, 2016 at 9:37 am, Kirill said:

Hi Richard, I’m a bit cautious with Alpari after one of their companies went bankrupt last year.

March 24, 2016 at 2:19 pm, Amar Desai said:

HI Krill, I am a newbie and have been taking your courses, which have been excellent. I’ve been looking at your recommendations for using a FX Broker. Unfortunately, the broker you have mentioned does not permit clients in the US. Do you have any recommendations for any other FX Brokers?

Thanks!

April 05, 2016 at 12:45 am, Tom Martin said:

Hi Kirill, Why is it that most Forex brokers do not except US clients?

April 16, 2016 at 11:06 am, Kirill said:

Hi Tom,

Please refer to the article here:

https://www.forexboat.com/metatrader-4-vs-5/

Kirill

May 19, 2016 at 6:16 pm, Sam said:

Hi Kirill, AxiTrader has a Refer a Friend campaign https://www.axitrader.com/uk/promotions/refer-a-friend . One needs to “start trading” to qualify. “Start trading” means to place at least 1 standard FX trade (1 standard lot round trip) within 60 days of opening their account. This seems to be a standard practice with brokers to entice new clients. What they say is rather terse and cryptic: “1 standard FX trade.” Maybe you could please clarify what it means either here or in your review? Is it feasible for small retail novice trader to fulfil this requirement in 60 days?

August 22, 2016 at 1:12 pm, Andrew said:

what happen to roboforex? I thought previously you recommended roboforex?

is there any reason you change it?

August 30, 2016 at 7:58 am, Jose said:

Hello Kirill,

I currently trade with Axitrader; however, lately I’ve seen a lot about a broker called Avatrade that has a pretty good subscription or welcome bonus and similar spreads to Axi. I am really interested in this broker but I’ve read a lot of bad and good reviews so I do not know who to trust. By any chance do you know something about this broker?

Thanks in advance!

September 01, 2016 at 5:43 am, Shivan Lane said:

OK so this Broker is Awesome, Unless you live in the USA. So for all of us who live in the USA, are we just screwed or do you have a suggested broker for us? This blog post reads to me like, hey I found the most awesome thing in the world but too bad or you Americans, you can’t be a part of our awesome club. Better luck next time.

March 20, 2017 at 12:17 pm, Elia Burstein said:

Hi. As an american you are not allowed to trade with any broker that is not located in the USA and regulated there. You can thank Mr. Obama for that. So you can only chose from very few brokers that are still licensed there (Recently FXCM is out of US too). Since the choice is limited the commisions are high. There are major restrictions on accounts like 1:50 leverage, no hedging allowed and FIFO enforced. Not recommended to anyone except US residents that have no choice.

November 23, 2016 at 7:43 pm, Kevin C. Franck said:

Hey Kirill! Any other brokers you reviewed? Thanks!

November 23, 2016 at 8:09 pm, Kevin C. Franck said:

Hey Kirill, any other broker reviews you have made? thanks

December 28, 2016 at 8:53 pm, Sahil Biswas said:

Can you please recommend any broker with cents accounts, I cant afford the large deposits.

December 28, 2016 at 8:56 pm, Sahil Biswas said:

Hi, Can you please recommend any broker with cents accounts, I can’t afford the large deposits.

January 13, 2017 at 7:59 pm, Alejandro Romero said:

Hi Kirill, I have done some of your Udemy courses which I found very interesting and finished the demo period of 30 days with Axitrader UK. They are asking to open a live account with real money if I want to extend the demo. They offer two account types, standard and pro.Apparently the only difference is the $7 commission in the “pro” per operation against 1 extra pip in the “standard”.

Could you give some advise on what type of account I should open?, my calculations say that the “pro account always charges less. Are the $7 commission for open and close order together?

As a separate note,as you know in UK spread betting is tax free and apparently spread betting is almost the same as forex trading, I have no education at all about this, all I know is about forex trading is what I have learnt from your courses.

Thanx in advance.

Regards,

Alejandro

February 18, 2017 at 4:30 pm, John said:

Unfortunately it is not have a way to work with this broker from Japan.

🙁

April 27, 2017 at 8:51 am, anonymous said:

Thanks for your comprehensive review. In your forex-trading course on Udemy, you mention a “Which forex broker is right for you” survey, where you compared 3 brokers (lesson 1, section 8 https://www.udemy.com/forex-trading/learn/v4/t/lecture/2081098?start=0) . Where can I find that survey?

April 28, 2017 at 2:30 pm, Damyan Diamandiev said:

Hello trader!

I regret to tell you that the 3 brokers article you are referring to was replaced by the article in this page.

If there is something else I can help you with, feel free to ask! 🙂

June 21, 2017 at 3:22 pm, Brendan de Faria said:

Seeing that MT4 is what you going to be using to make your money, it is really nice that they went the extra mile with it!

June 21, 2017 at 4:22 pm, Michael Montano said:

Axitrader isn’t available in US correct? I’m looking for a good US broker

June 21, 2017 at 5:48 pm, Calvin F. said:

Very nicely laid out information. I learned a lot about brokers!

June 21, 2017 at 5:51 pm, Sandi Tymchuk said:

I’m here reading your post to enter the contest to win $3000 USD in trading money. My investment strategy is more conservative, but I appreciate the opportunity nonetheless.

June 21, 2017 at 6:08 pm, SarahJ said:

For someone who doesn’t know anything about trading this was a great review. Thanks.

June 21, 2017 at 7:21 pm, Ashif said:

Join the Free Give Away

June 21, 2017 at 8:59 pm, Natalie said:

Trustworthiness is important in any broker!

June 21, 2017 at 9:26 pm, OneFlip said:

AxiTrader looks like a great Forex broker for anybody outside the U.S. Unfortunately, I’m U.S-based and can’t use it. Otherwise, the above review points to AxiTrader as a top-notch broker.

June 21, 2017 at 10:54 pm, Olayide Oluwatobyloba Oluwagbe said:

Well with a broker with all this feature is dame worth a shot interesting features

June 21, 2017 at 11:15 pm, Sihem Sihem said:

great article thank you

June 22, 2017 at 12:18 am, Jeff T. said:

Very interesting information.

June 22, 2017 at 1:17 am, Ray said:

I’m ready to trade

June 22, 2017 at 2:01 am, Rogue_Femme said:

Great review; and especially the breakdown of services and functions available. Thanks.

June 22, 2017 at 3:23 am, sharpLess said:

One can learn a whole lot from this information… I sure did… Thanks!

June 22, 2017 at 3:54 am, Suri said:

Great article

June 22, 2017 at 5:17 am, diana said:

This is a whole bunch of stuff that don’t make sense to me. 🙂

June 22, 2017 at 7:38 am, fegeme said:

Well, a further broker review …

June 22, 2017 at 7:39 am, Patrick Kowalski said:

Nice! Great info! First time trader here.

June 22, 2017 at 8:44 am, Judy Thomas said:

I have to admit that most of the info goes right over my head but it is interesting.Thanks