The bias is slowly changing to bullish and the pair feels the urge to fill the price gap. Higher highs and higher lows are being printed, support levels and indicators are being rejected. Al-in-all, AUD/JPY remains in the strong demand zone, and the price could start rising within the next 48 hours.

Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice.

This analysis was done on MetaTrader 4.

Click below to open a Free Demo Account with our trusted brokers:

Get a 30% deposit bonus with your new live AxiTrader account (only for non-US residents)

Trade Idea Details:

AUD/JPY symbol

Trend: Bullish

Key support levels: 66.00, 65.73

Key resistance levels: 67.26, 67.70, 69.57

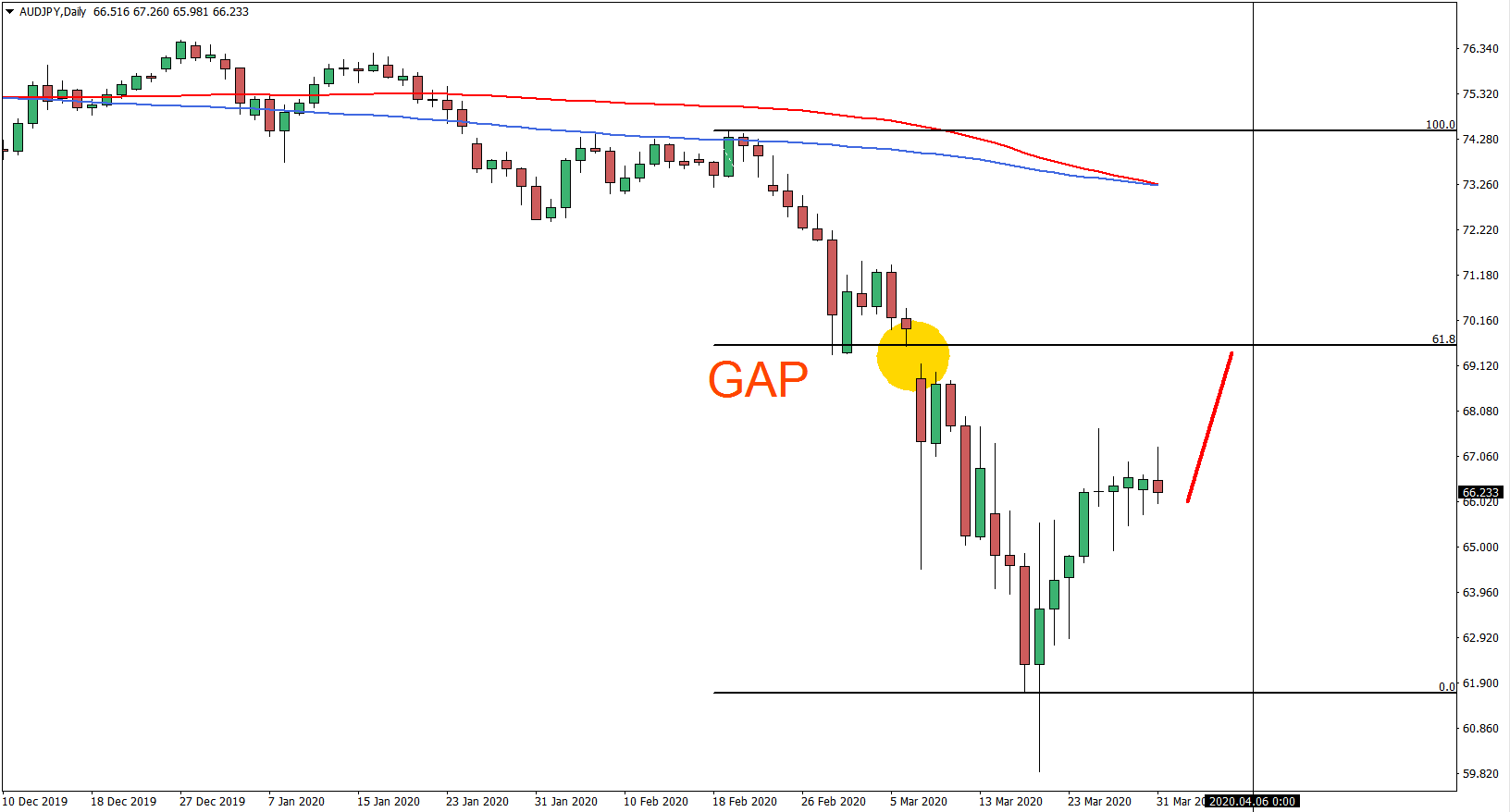

Price Action: on the Daily chart, we can see that the price has formed a gap between 6-9 March. In most instances, price gaps are being filled sooner or later. This brings the potential buy idea on the AUD/JPY currency pair. In order to fill the price gap, AUD/JPY has to move up at least to 69.55 level. This price corresponds to the 61.8% Fibonacci retracement level, making it a perfect upside target.

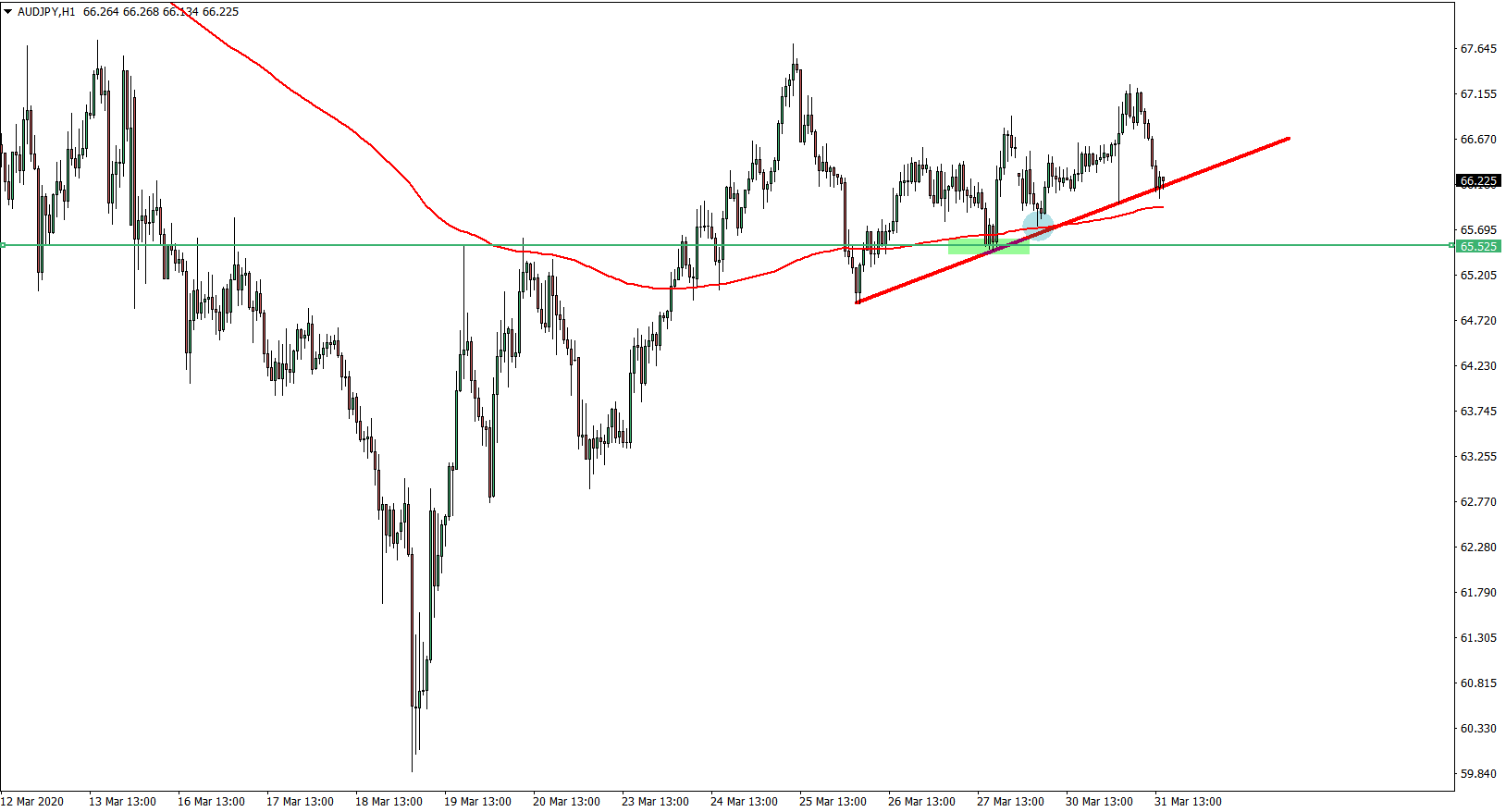

On 1-hour chart AUD/JPY rejected the support level at 65.52, which previously was a resistance. It also broke above the 200 Exponential Moving Average where it found the support after rejecting 65.52 level. At the same time, the uptrend trendline is being rejected, which might result in the continuation of the correctional move up.

On 1-hour chart AUD/JPY rejected the support level at 65.52, which previously was a resistance. It also broke above the 200 Exponential Moving Average where it found the support after rejecting 65.52 level. At the same time, the uptrend trendline is being rejected, which might result in the continuation of the correctional move up.

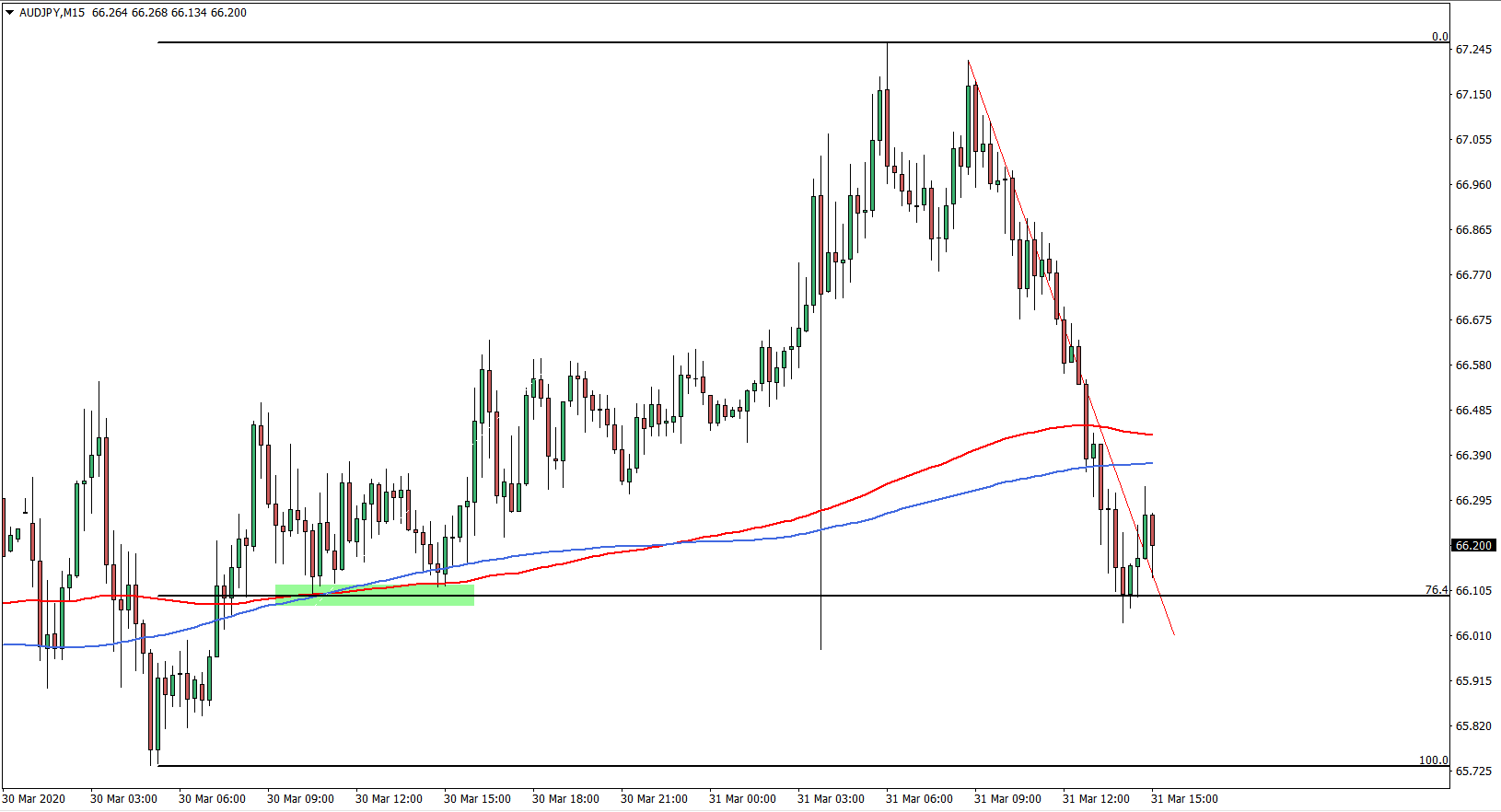

Finally, on the 15-minute chart, we can see that AUD/JPY has reached 76.4% Fibonacci retracement level and failed to close below. Price has stopped right at the previously formed support area, where 200 EMA was rejected twice.

Potential Trade Idea: currently the AUD/JPY is trading near 66.20, which seems a very attractive price for buyers. The buying opportunity could be between 66.00 (strong psychological level) and 66.50. The upside target is seen at 61.8% Fibs, which is 69.57 price level. The stop loss should be considered below 65.73 low, but at the same time first signals of a downside pressure could be 4h break and close below the 66.00 support.

Leave a Reply