Day trading has increased in popularity lately. Because the Forex market is open 24/5, day trading strategies appeal to retail traders. As such, day trading for beginners became possible with little financial resources. But retail traders need to learn a few day trading secrets before becoming profitable.

The surge in retail Forex trading has an explanation. When other markets such as futures, stocks, options, ETFs, and so on, became expensive, traders searched for alternatives.

For the Forex market, the amount of margin required by most brokers is negligible. As such, day trading has become a reality for many retail traders.

But, above all, day trading online is a strategy. A distinctive trading style.

Therefore, traders use various day trading strategies to profit from the Forex swings. Even if day trading for beginners is difficult to start with, retail traders insist on such techniques.

There’s a reason for that. It comes from people’s personality.

Trading doesn’t suit everyone. Luckily, various trading styles exist. What works for one, may not be suitable for another.

Scalping refers to entering and exiting a market very quickly. And for very small profits.

Swing trading takes more than a day. Most of the time, swing traders keep their trades open for days. Sometimes, even weeks.

This article looks at what is day trading and the best day trading for beginners’ tips. We’ll cover the following topics (but that’s not all):

- Trend following day trading strategies

- Scalping day trading for beginners

- Range day trading secrets

- News day trading

- Contrarian trading

It is important to see if day trading fits your style. If what you read in this article suits you, then you’re a day trader. If not, don’t despair.

Day trading is just one way of dealing with the Forex market.

Defining Day Trading

Day trading refers to speculating on a currency pair’s move, on the short term. Short-term trading is not scalping, though.

More exactly, day trading occurs when all traders get closed at the end of the day. Therefore, no matter what happens, trading takes place only within the trading day.

In a way, this is a powerful money management tool. After all, day traders take what the market gives.

Sometimes it may be a lot. Or, some trades may close at a loss.

But a rule is a rule. And following rules makes a trader successful.

As such, day traders are retail traders that do day trading. They’re not investors. But pure speculators.

To master the art of speculation, day traders must have the following important traits.

Firstly, they must have solid technical analysis knowledge. To speculate on the short term, one needs trading indicators.

Secondly, they have a set of day trading rules. And, they follow them blindly.

Finally, day traders have no directional bias. They don’t care why the price moves.

They’ll use every day trading secrets possible to beat the market. And, they do it in style.

Money management, again, is key. It’s impossible to win all trades.

Moreover, it’s not possible to win everyday. Plus, there’s not a fixed amount to make every day.

Simply, the market doesn’t move on some given days. So, day traders strive when volatility is on the rise.

That’s their best trading environment. For when the market moves, there’s limitless potential.

But a day trader may be a scalper too. Or, he/she may apply day trading strategies only on some currency pairs.

And others trade with a different time horizon. After all, what matters is to make a profit. Who cares what strategy is used if it is profitable?

Day Trading for Beginners

One of the most important day trading tips is to not start with a preset target. That’s deadly for the trading account.

Day trading strategies work both in bullish and bearish markets. So what if the market is in an uptrend?

Bearish day trading strategies allow profiting from corrections. If the time frame is big enough, day trading a correction works just fine.

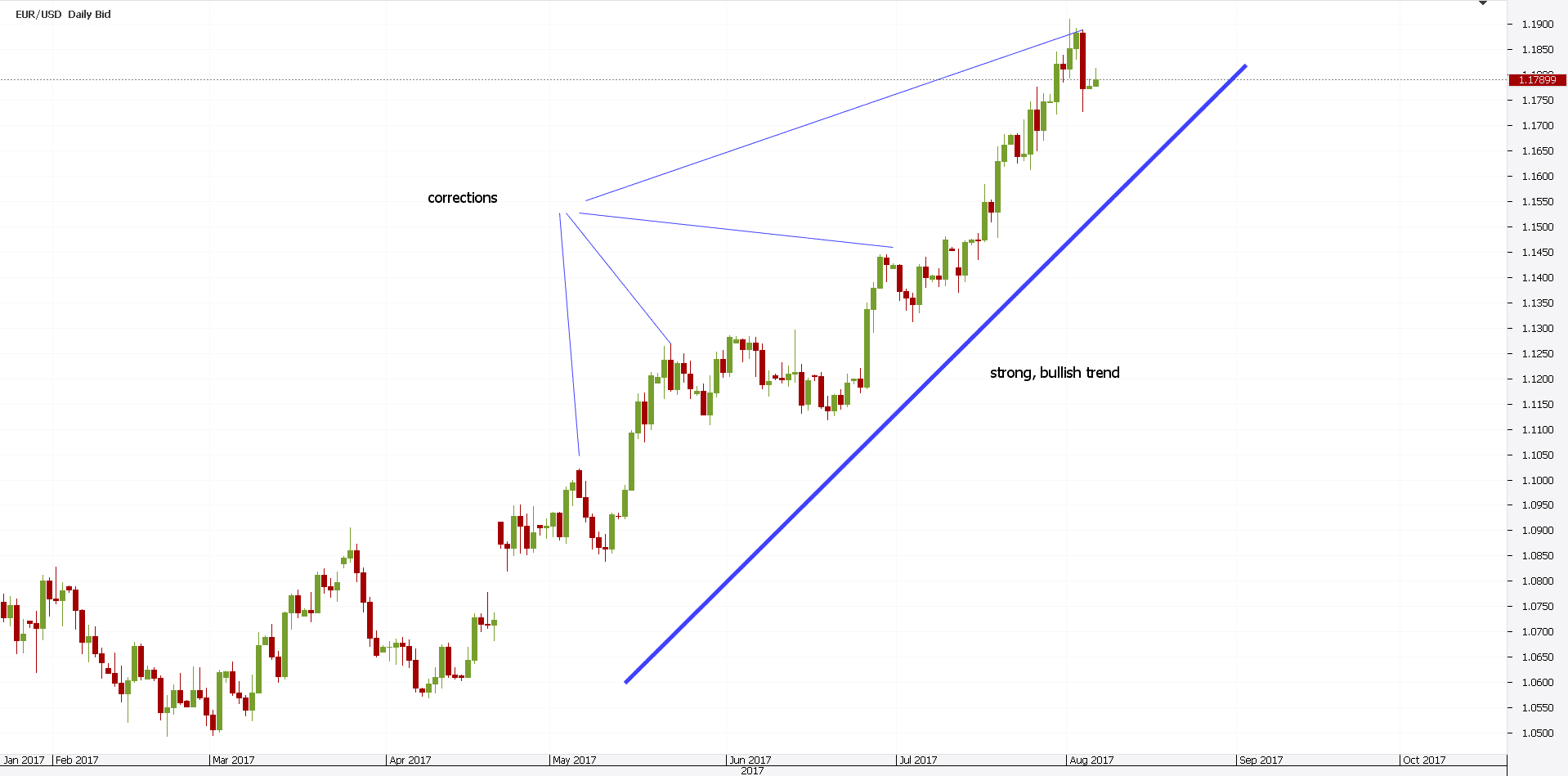

Check the EURUSD daily chart below. It shows a strong bullish trend that started in April.

In four months, the market traveled well over a thousand pips. That’s quite a move.

However, even such trends have day trading secrets. Namely, day traders easily speculate on corrective days.

Remember? When day trading for a living, the trend doesn’t matter. Or the direction.

What matters is to be there and ride the move. For the trend is on a bigger time frame than the time horizon day traders have for their positions.

How to Start Day Trading

Trading financial markets is risky. Every trader knows that.

Moreover, trading with financial leverage is riskier. While day trading results can be extremely profitable, the fortunes can change in a blink of an eye.

Hence, traders need to prepare. Day trading strategies for beginners or advanced traders exist. Even though the terminology is incorrect.

Think of it for a minute. There must be a starting point to day trading.

How about day trading secrets that make life easier? It all depends on the strategy used.

And on the money management system. Because day trading for beginners is no different than for advanced traders.

What lacks is education. Trading education.

Day Trading Secrets – Put in the Screen Hours

Before anything, put in the screen hours. That’s a must.

It shouldn’t be a problem for day traders. They have time to nurture a trade.

Retail traders involved in day trading do this for a living. They represent the true meaning of the word “trader”.

When trading for a living, there’s a huge responsibility on your shoulders. There are so many things to consider before actual day trading!

First, the capital used. Day trading FX for a living is not for everyone.

Make sure you have plenty of margin in the trading account to cover the open trades. And the moves that go against them.

Second, the risk involved. Any day trading course starts with how much you risk. And how much you’ll make.

The bigger the risk-reward ratio, the better. Improper risk-reward ratios are part of incompetent money management.

As such, regardless of the day trading strategies used, if you risk less than you’re about to make, you’re digging your own grave as a trader.

Third, emotional pitfalls matter. Everyone thinks they have what it takes to trade for a living.

But one of the dirtiest day trading secrets is that Forex trading is an emotional rollercoaster. And not everyone can handle the stress and pressure.

You may find all this info in day trading books or lessons. But nothing will prepare you for day trading Forex like putting in the screen hours.

Or, simply, watch the market. The more, the better.

When doing that, you’ll observe patterns. Behaviors.

You’ll see how the market reacts to the news. To openings and closings. And so on.

Write everything down. Keep a journal. And re-read it as often as possible.

That’s what day trading for beginners is. Looking at markets for the first time, to speculate its moves.

Day Trading Strategies

No day trading strategy is better than another. It is important to understand this concept.

What matters when day trading is for the trader to remain flexible. The market constantly changes.

As such, flexibility is a trait any day trader must have.

Trend Following Day Trading Strategies

They say, “the trend is your friend”. That’s so true!

But, they don’t say that you need to ride the trend every day. Sometimes, it is more profitable to jump in and out of it.

For that, several steps form the day trading plan. First, find a trend.

But not any kind. One that matters.

Use the day trading computer and check the bigger time frames. For day trading strategies to make sense, the trend must come from bigger time frames.

That’s one of the few tricks of the day trading secrets. If you do end up trading the five-minute chart, it will be only to pick the right entry. Or exit.

Day trading for beginners should start from the daily chart. As such, find a trend on your day trading platform. On the daily time frame.

You’ll be surprised to see that not ALL currency pairs trend on this time frame. But, the ones that do are subject to day trading strategies.

Second, use the lower time frames (hourly, fifteen-minute and five-minute charts) to trade. However, pick only trades in the daily trend’s direction.

Day trading secrets like this could spare you of a lot of trouble. Riding the trend, in this case, means entering on pullbacks.

Finally, set proper risk-reward ratios. Either in terms of pips, or in terms of money. But use realistic ones. 1:2 or 1:2.5 are such ratios.

EURUSD Day Trading Secrets Exposed

Let’s use the earlier EURUSD chart. It shows a bullish trend.

In the last four months, the EURUSD pair enjoyed a nice rally. How to trade it from a day trading point of view?

The starting point is the main direction. Bullish, so day traders want to buy.

Having said that, traders move on lower time frames. With only one intention in mind: to buy.

But, from where? That’s key.

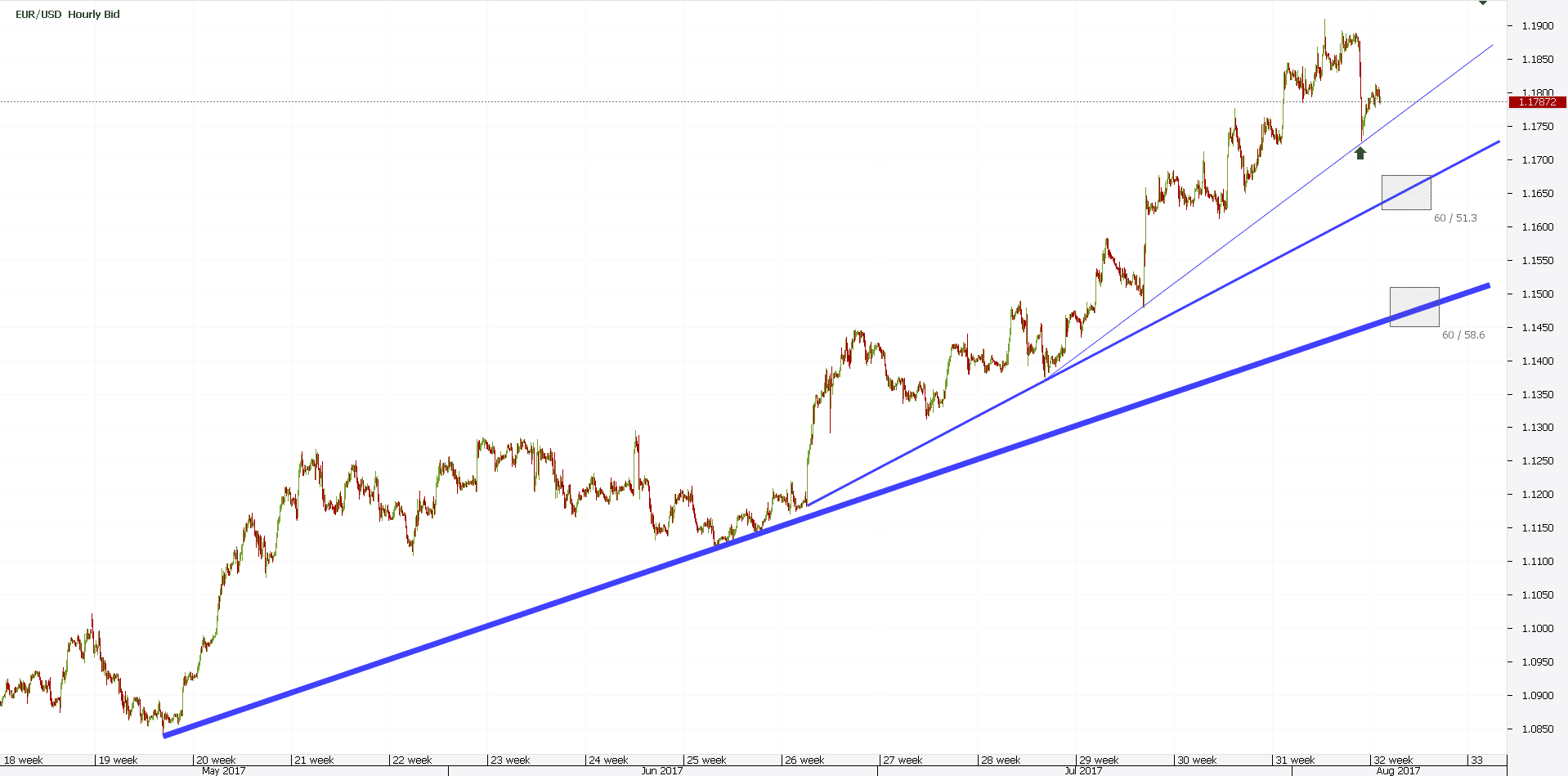

For this, they use the hourly chart. And some help in the form of technical indicators.

Day trading basics start with moving averages and trend lines. They’re part of every trader’s arsenal.

After all, a trend line shows the trend. It is the line of a trend. Right?

Above is the hourly EURUSD chart. The three blue lines show different trending conditions.

The same trend we spotted on daily, here has three trend lines. Each with its own importance.

Where the green arrow appears, the Non-Farm Payrolls (NFP) data was released. That’s one of the most important fundamental news from the United States.

Last Friday, the EURUSD dipped. The NFP beat expectations by a mile.

But, the three trend lines on the chart were there. Earlier!

Day trading for beginners should start with trend lines. When price meets them, day traders buy.

It proved to be a simple, yet effective strategy. For from the moment the price reached the trend line, it bounced.

Because day traders close their position at the end of the day, they booked the profits. When Friday ended, this trade netted about fifty pips profit.

As always, simple day trading strategies work best. Just be there to catch the move.

Scalping Day Trading for Beginners

When scalping, traders want to profit from quick and fast moves. Sometimes, scalping takes a few seconds.

At other times, it takes more than that. But the idea is the same: to profit from small market moves.

This is the main reason why high-frequency trading has evolved. To profit from even the smallest moves in the market.

But scalping when day trading is different. Trades may take more time.

However, because they end up being closed at the end of the day, these trades are part of day trading strategies.

Scalping applies technical analysis concepts like overbought or oversold levels. Typically, oscillators show such levels.

Therefore, traders need an oscillator. Next, they need to define the boundaries for day trading.

Liquidity is important here. For not all trading sessions are the same.

In general, the London session is the most liquid one. Followed by New York and Asian ones.

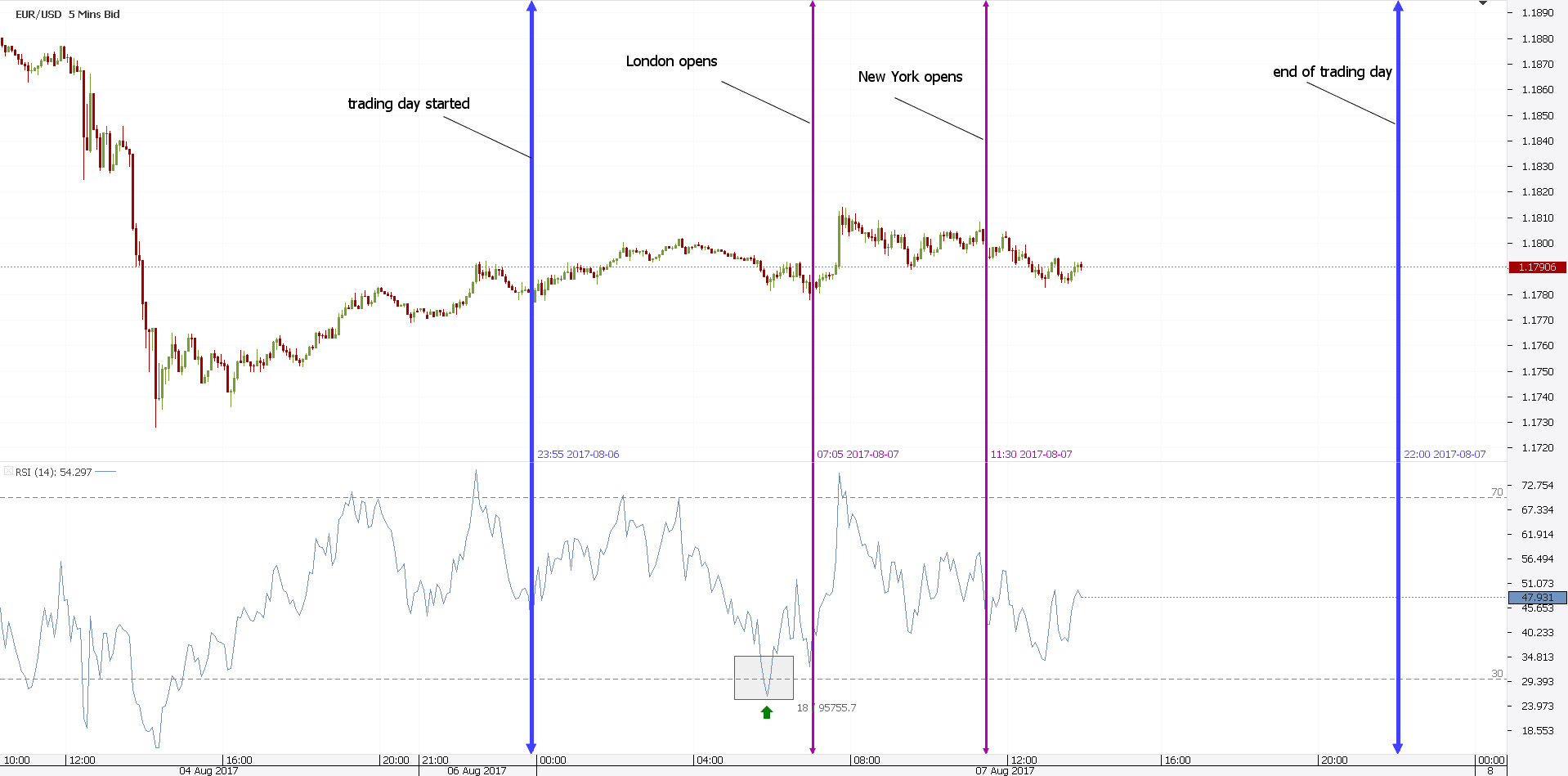

The example below shows a European day trader. He/she is active in both London and New York sessions.

The blue lines define the trading day. The other two vertical lines mark the start of the two trading sessions.

This is the five-minute EURUSD chart. Moreover, it has the RSI (Relative Strength Index) on it.

Earlier, we decided that the EURUSD is still in a bullish trend. Scalping when day trading makes sense only if traders follow the same direction. Long.

Shortly before London’s opening, the RSI dips in oversold territory. Day traders go long.

But when the overbought comes, they exit. Because the trade wasn’t kept until the end of the trading day, it’s not literally day trading.

However, such scalping day trading strategies do make sense.

While it is not scalping or day trading per se, it is a profitable trade. One that bends the rules, but makes money.

Range Day Trading Secrets

Range trading works in low-volatility environments. The Asian session has the lowest volatility in the Forex market.

Therefore, Asian traders are most likely to use range day trading strategies.

Any day trading platform offers a plethora of range indicators. Typically, these are oscillators.

No matter their names, they are designed to define a range. When the price ranges, the oscillator follows suit.

Keep in mind what an oscillator is. It is a projection of past prices on current ones.

A range trader wants to buy low and sell high. And the other way around.

They also use breakout indicators. For when the market prepares for a breakout, range trading doesn’t make sense anymore.

Before anything, range day traders must know how to identify a range. For not all ranges are horizontal.

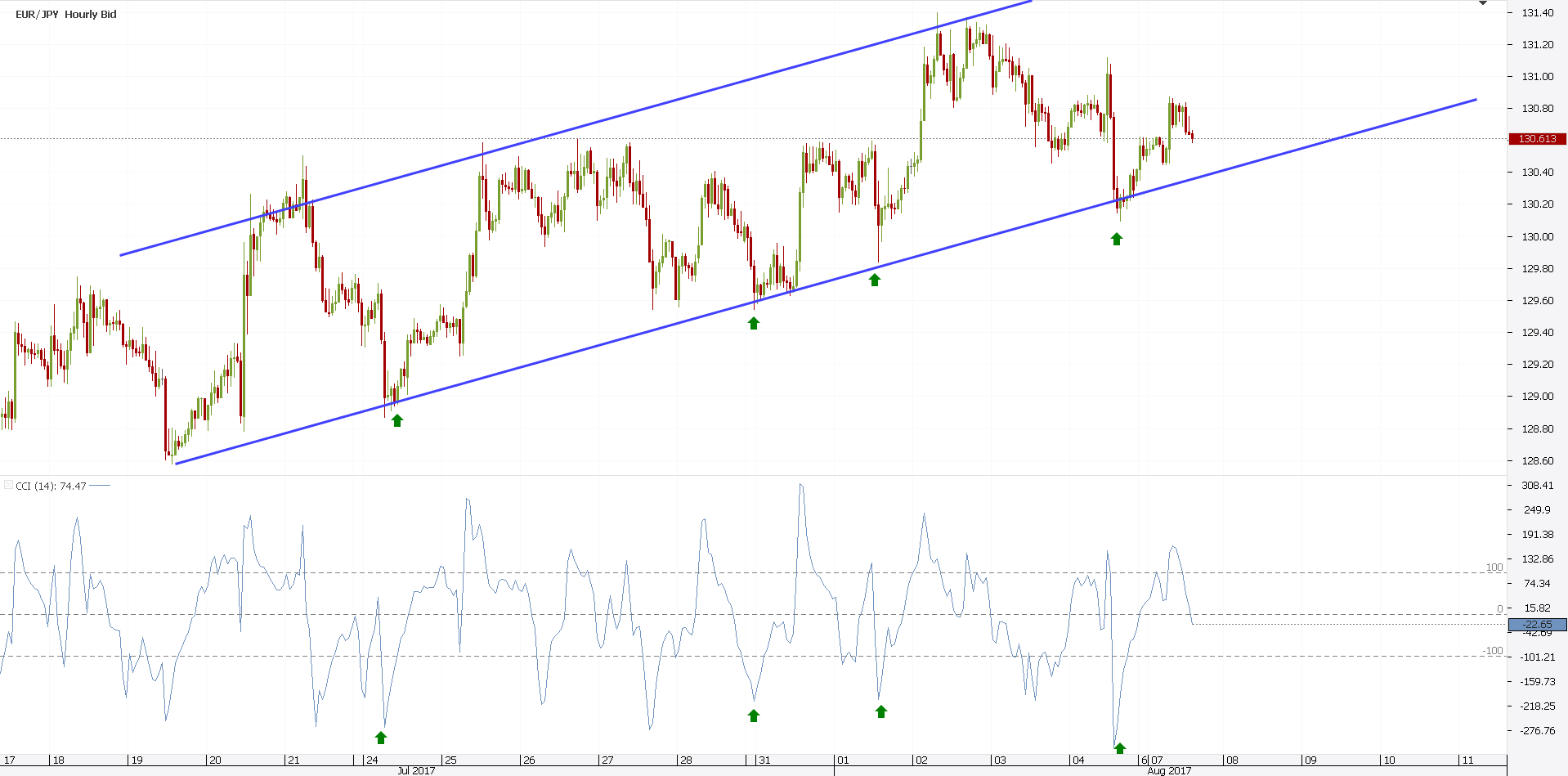

The EURJPY hourly chart above shows a rising range. Yet, a range.

At the bottom of the chart, there’s the CCI (Commodity Channel Index). This is one of the most popular oscillators.

The idea is to buy only those situations where the oscillator is oversold. And, the price is at support at the same time.

Day trading for beginners starts with simple strategies like this one. Go long when conditions align and exit when the oscillator is overbought.

Plain and simple day trading strategies work best.

Contrarian Day Trading

A market timing strategy, contrarian day trading is not for everyone. If one could define riskier day trading strategies, this is one.

Day trading for beginners should start with a day trading simulator. That’s either a demo account or paper trading on a live one.

This is where traders do “research”. What happens if I buy here, sell there, and so on.

That’s the trading plan. There’s no day trading software.

But traders may create standard conditions and rules. And they respect them every day.

Contrarian trading is like buying a falling knife. Or selling when the market keeps moving higher.

Typically, the risk on such trades is higher. But so is the reward.

Divergences work best in a market timing strategy. One of the best day trading platforms, the MetaTrader, offers some interesting oscillators with which to spot divergence.

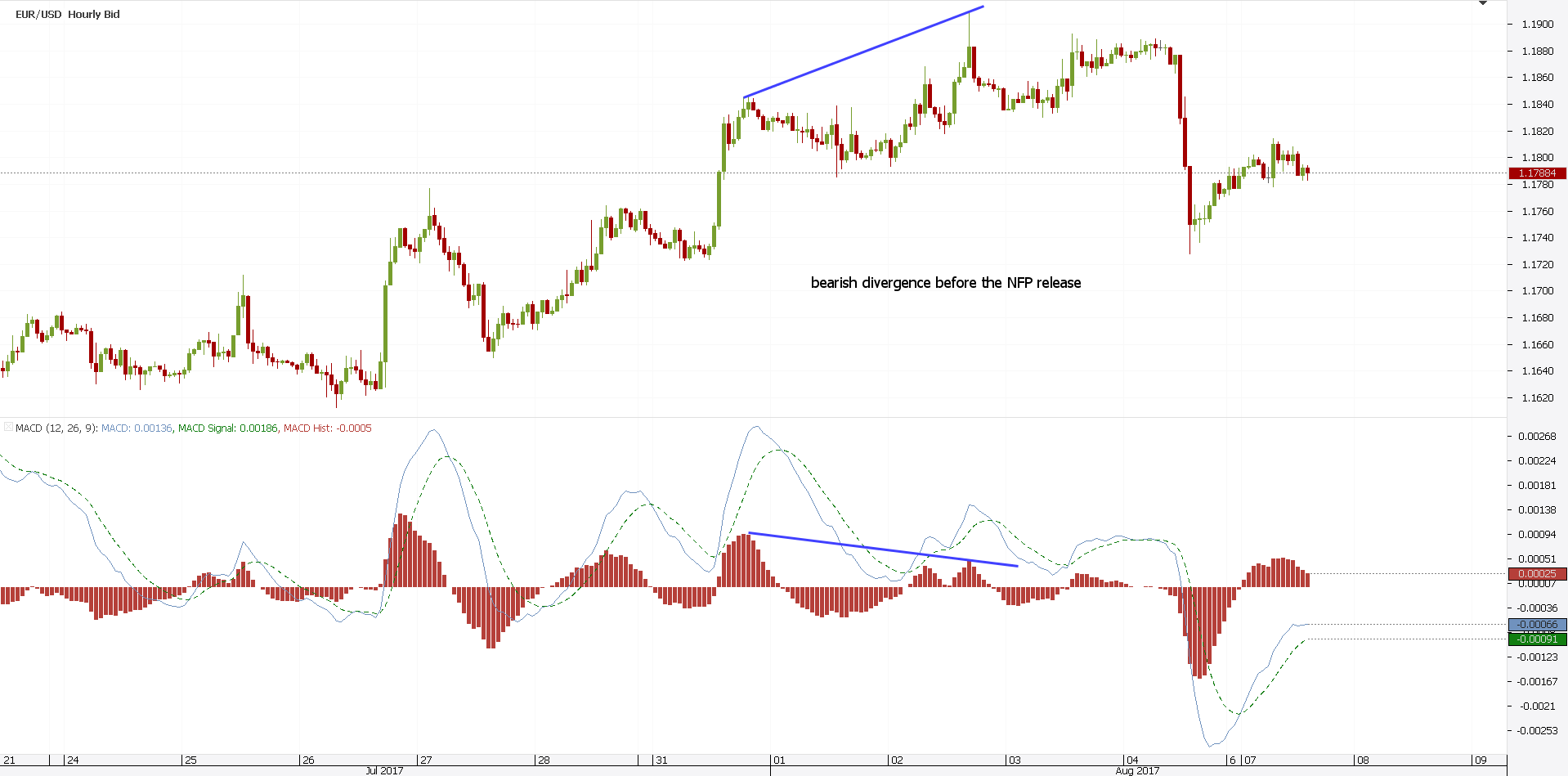

Let’s come back to the EURUSD hourly chart. This time, it has the MACD (Moving Average Convergence Divergence) oscillator.

One day before the recent NFP release, a huge bearish divergence formed. So huge, you can see it from the moon.

Now that’s a bearish day trading signal you won’t want to miss. Especially ahead of such an important economic release.

Therefore, contrarian day trading strategies work. That is if traders can back their decisions with a divergence like the one here.

Conclusion

Day trading the Forex market means buying or selling a currency pair within the same day. Depending on the type of day trading, different day trading strategies exist.

Any day trading academy starts with laying down the trading rules. The plan.

Then, traders must respect it. That’s the most difficult part.

But also, the most important one. Because one of the biggest day trading secrets stays with its money management rules.

And closing all trades at the end of the trading day is a powerful money management rule. Hence, it makes day trading a powerful approach to Forex trading.

START LEARNING FOREX TODAY!

- day trading

- day trading for beginners

- day trading rules

- day trading strategies

- trading strategy

- what is day trading

share This:

Leave a Reply