Traders have different styles, and swing trading is a medium-term trading style. As such, traders that use swing trading strategies do not scalp. Swing trading strategies that work deal with a position for days. And, the best swing trading strategy keeps trades open, even for weeks.

Like any trading method, swing trading deals with speculation. Mastering the art of speculation is not something to take for granted.

Based on the time horizon they have in mind when trading, traders are:

- Buy and sell a currency pair multiple times in a day. They aim for small/very small profits, with multiple entries.

- Day traders. These traders close positions at the end of the trading day.

- Swing traders. Swing trading strategies keep positions open for two to six trading days. Sometimes, even for weeks.

- Typically, these are long-term oriented traders. Most of the time, financial entities invest. Not retail traders.

As a market participant, a trader must fit one of the categories above. In fact, it is not about the trading style. But more about a trader’s personality.

You see, not everyone trades the same. Human beings have different personalities.

Therefore, swing trading strategies that work may not fit an impatient trader. Even if their result is proven.

In the end, either trading constraints or human nature’s constraints define the trading style. A swing trader’s definition should start with the time/time frames considered.

This article will cover, among other topics, the following:

- What is swing trading?

- How to swing trade?

- The best swing trading strategy

- Swing trading tips and tricks that make a trader’s life easier

Swing Trading’s Definition

If you hold a Forex position between one and several days, you’re swing trading. That’s the very simple definition of it.

How do you know that? It comes from the trading style involved. Or, the time frames.

If the technical analysis comes from the daily time frame, you can’t expect to close the trade the same day. Yet, if you do close it, the analysis was probably wrong.

But this trading style is not buy and hold. A buy and hold strategy is investing.

Swing trading comes from fundamental analysis too. For example, traders that look for monetary policy changes use swing trading.

Markets turn, but to make a top or a bottom takes time. When looking for one, traders keep positions open for more than a day. Most of the time, for weeks.

As such, there are different ways to use swing trading. Most of the traders use it to ride trends.

Some use it to pick tops and bottoms. And then to ride the newly born trend.

Others use it to interpret fundamental changes. It may be that economic news is bearish. But a market will turn South when it wants.

The aim of swing trading is to ride trends. Therefore, the best swing trading strategy deals with trend trading.

In trading, you should “let your profits run”. Or “ride the trend till its end”.

At least, these are two sayings every trader knows. If that’s the case, you cannot be a scalper.

Swing Trading Strategies Revealed

So far, we have established the undeniable connection between swing trading and trend trading. As such, trend trading indicators make the best swing trading indicators.

When riding a trend, the idea is to buy dips and sell spikes. That is if the trend is bullish, respectively bearish.

Every trader knows that. But, that’s an easy task only on paper.

The problem with trending strategies is that…the market rarely trends. Most of the times, prices range.

As such, to catch a solid trend, traders must go on the bigger time frames. Let’s consider the recent EURUSD price action.

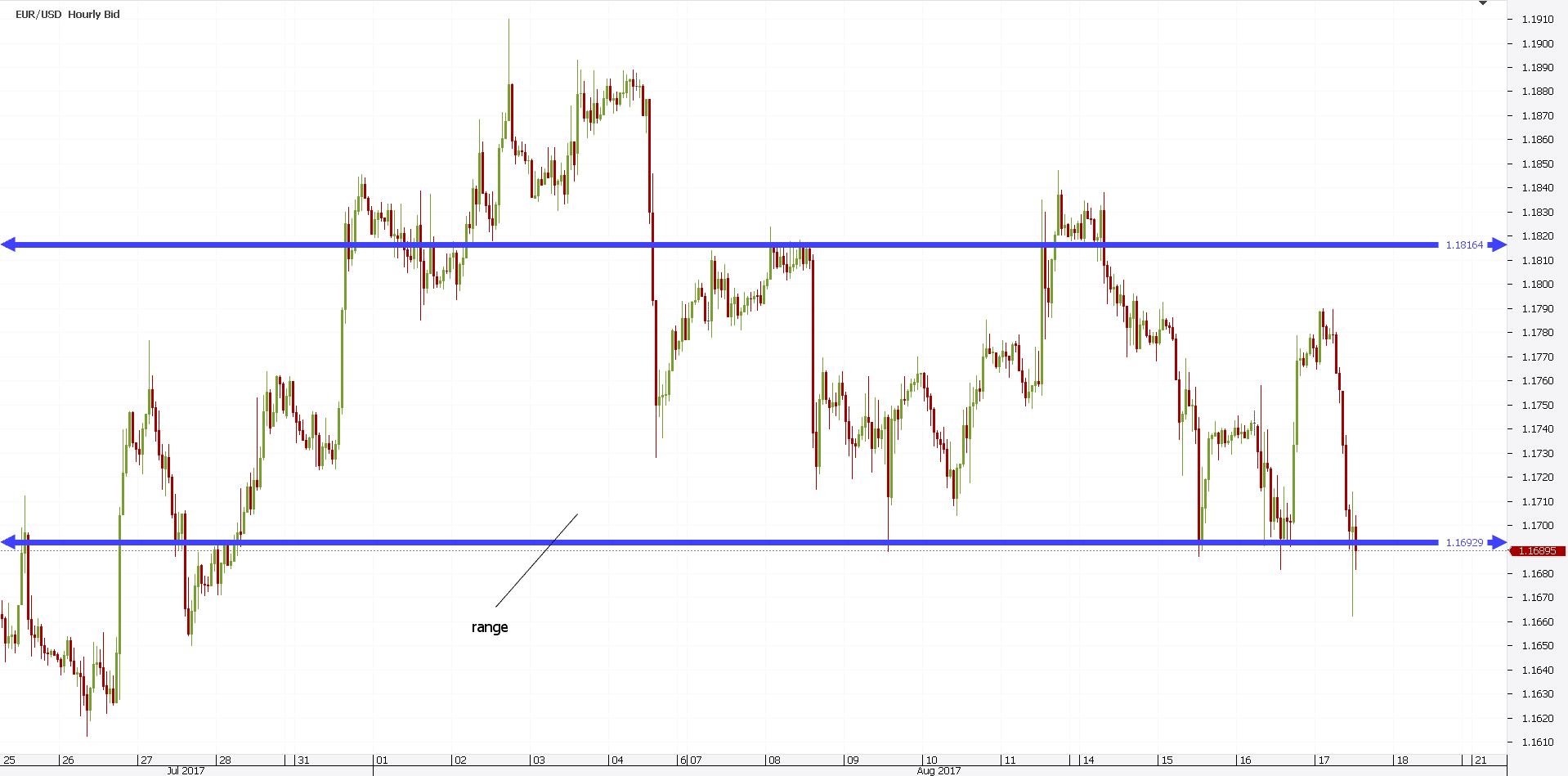

Below is the hourly chart. It shows the price movements for the last three weeks.

Where did this market go? Nowhere.

For almost a month, it moved between 1.1850 and 1.17. Of course, deviations from these levels are normal in a range.

But, the idea is that neither bulls nor bears, made money. I mean, they did. However, using other strategies. Not swing trading systems.

So, if you think the EURUSD will move higher still, you’ll be waiting. Bears will sell instead.

But the truth is that for a month the market didn’t move. How to let your profits run?

Or, how to ride a trend when there’s none? The answer comes from the bigger time frames.

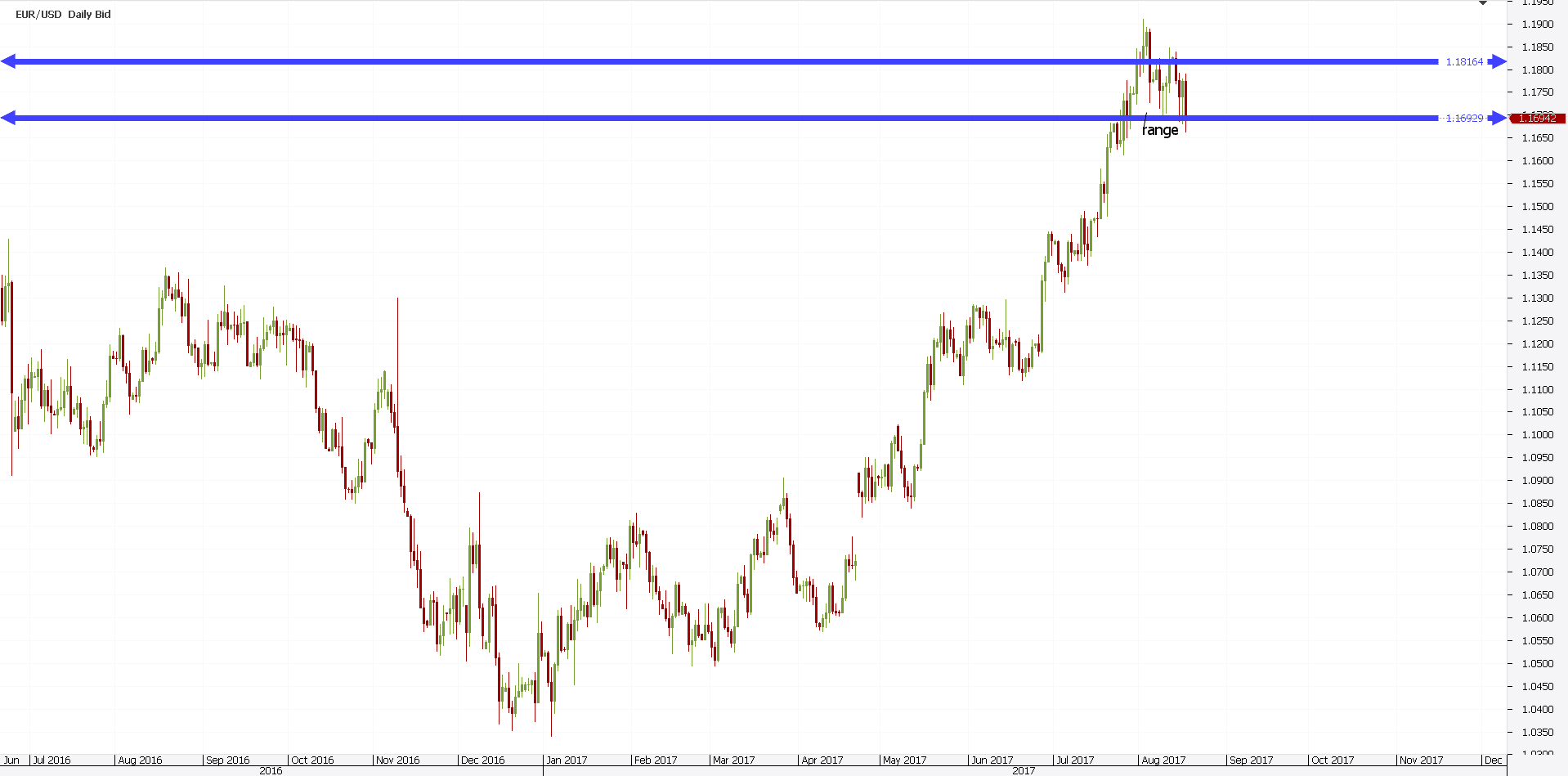

Let’s use the same EURUSD range. But from a daily perspective.

See where the last three weeks’ range formed? Now, that’s a strong bullish trend prior to it.

Moreover, if we use trend lines/channels, we can find more about the trend. After all, the best swing trading strategy uses trends. Right?

Swing trading strategies that work use entries like the one above. First, traders identify trends on bigger time frames.

Second, they sell the upper part in a bullish channel. Finally, they buy at the lower support.

Indicators for the Best Swing Trading Strategy

There’s no best indicator to use when trading. The best is the one that gives profitable trades. On, and on, and on…

There’s no such thing. Swing trading books favor trend indicators.

But swing trading strategies using oscillators work too. The secret is to apply them on big enough time frames.

I mean, it could be that one picks a top or bottom using the five-minute chart. And then, to swing trade after.

But if that happens, it’s by chance. It’s not a strategy.

The swing trading definition states trades must be kept open longer than a day. For this to be true, traders need bigger time frames.

Swing Trading Setups with Trend Indicators

Swing trading strategies that work use bigger time frames. That’s a must.

As such, traders apply the trend indicators on four-hour charts. Or, even daily ones.

We covered here most of the trend indicators. The idea is to use the ones that give an educated guess about the time taken for a trade.

The Bollinger Bands is such an indicator. Applied on a daily chart, it gives great swing trading alerts.

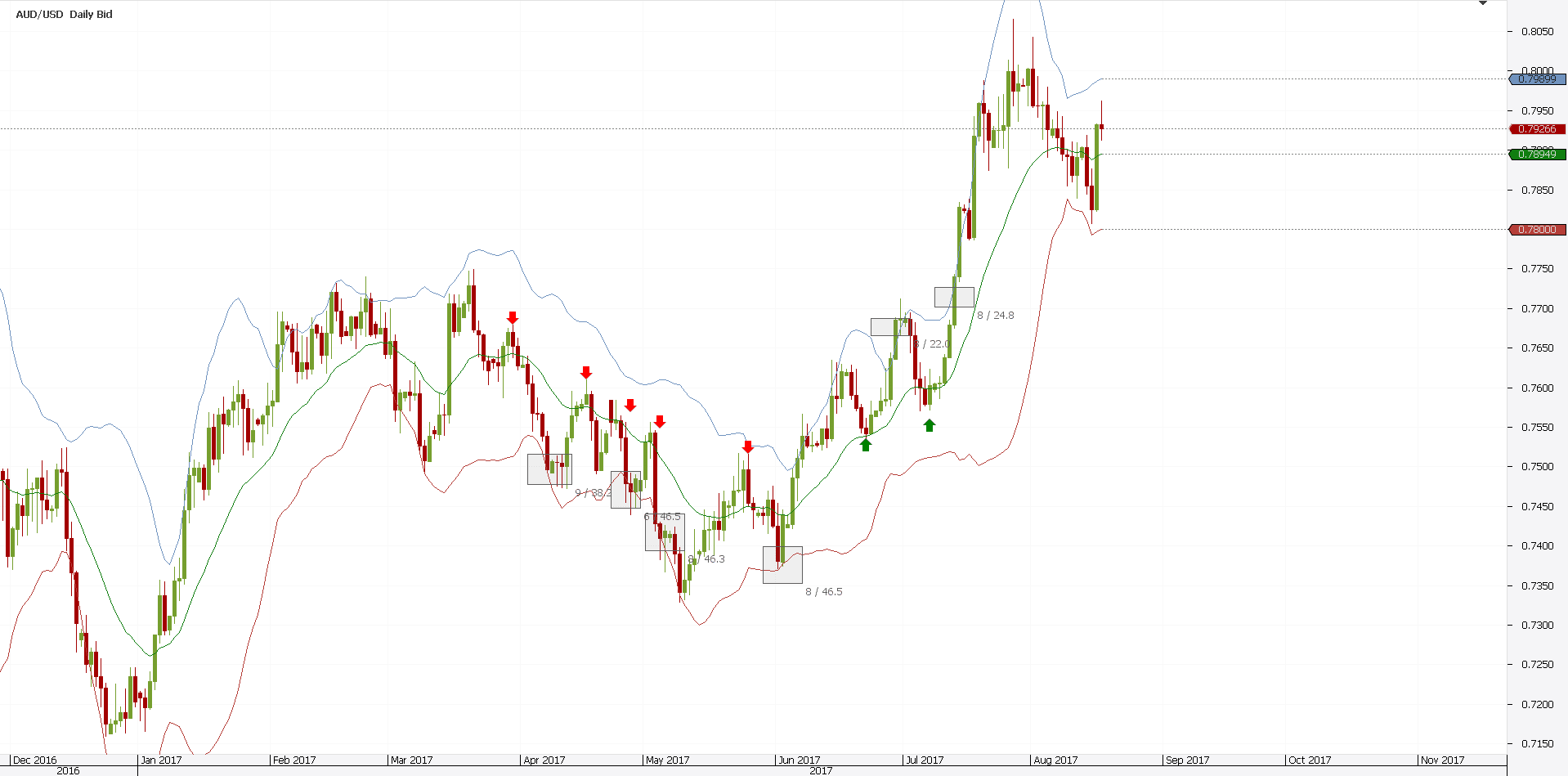

Take the chart below for example. It shows the AUDUSD pair.

And, it is the daily time frame. Therefore, you can’t expect a trade to last less than a day.

Not that it’s not possible. But, it’s unrealistic.

As such, swing trading strategies with Bollinger Bands indicator consider several steps. Firstly, traders know beforehand the entries and exits.

In trading, you better know your way out before you go in. In the AUDUSD case, when the price hits the middle line, that’s the entry.

The exit comes when the opposite Bollinger Band gets hit. Of course, a viable stop comes at the other band.

Secondly, because of the time frame, one is not scalping. In principle, the price can hit the opposite Bollinger Band in less than a day.

However, this is not a realistic approach.

Finally, such a strategy used on lower time frames ends up in day trading. Or, scalping.

As such, the key to the best swing trading strategy is the time frame used. Not too big, as traders end up investing.

And, not too small, as traders end up day trading or scalping.

To sum up, swing trading strategies that work come from the four-hour and daily charts. And, the AUDUSD examples above prove it.

Swing Trading Forex with Oscillators

Now that we’ve established what it takes in swing trading vs day trading, we can use the same principle. Namely, when one uses oscillators on the four-hour and daily time frames, that’s swing trading.

The best swing trading strategy uses the CCI. We need a fast-moving oscillator. That’s what the Commodity Channel Index does.

It moves below -100 and above 100 with the speed of light. That is, according to the time frame.

Traders use several steps when using swing trading strategies that work like this one. First, they find a trend on the two time frames mentioned.

Next, they buy (in a bullish one) every time the CCI moves below -100. And, sell (in a bearish one) when the CCI moves above 100.

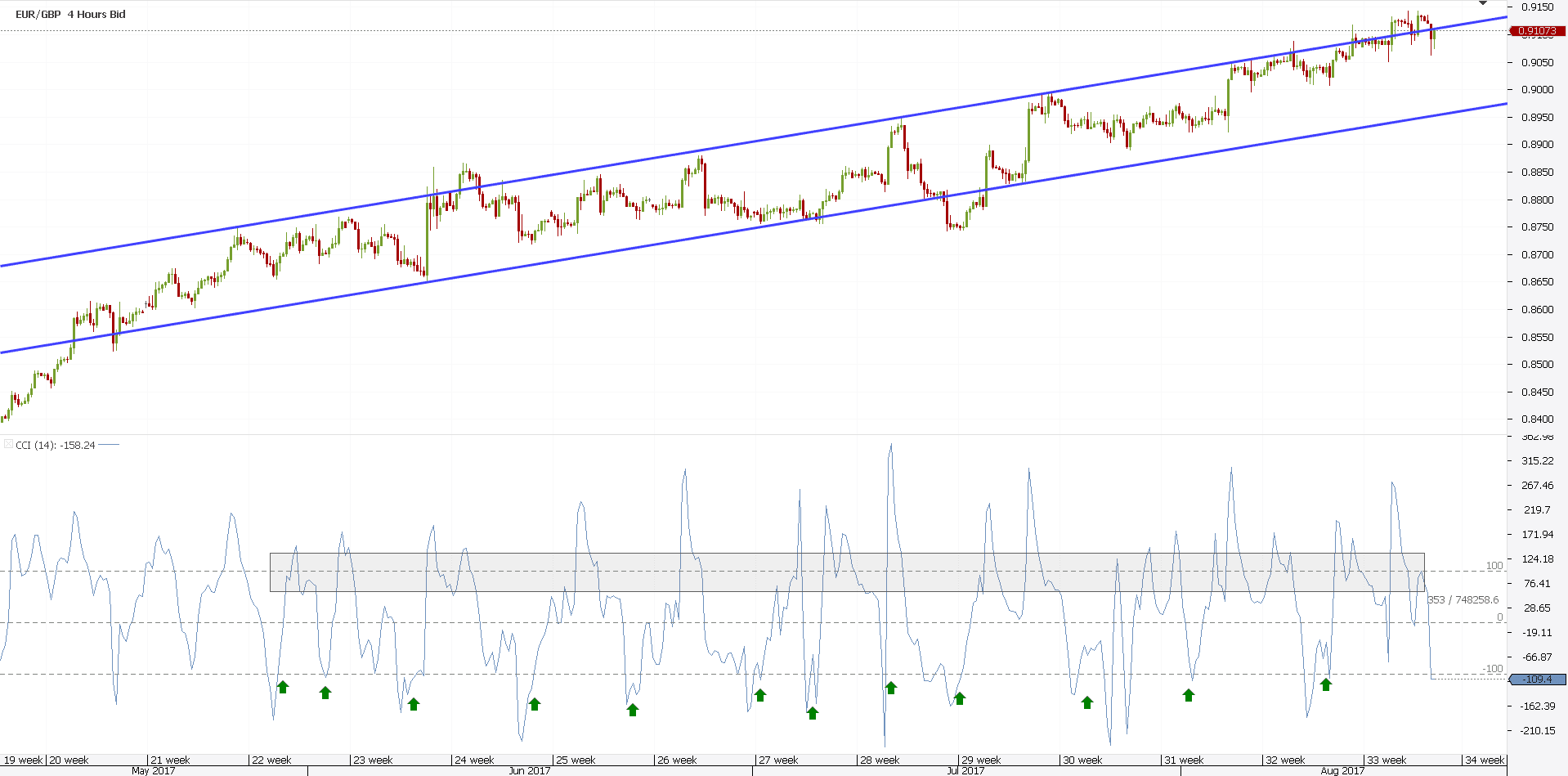

Finally, they set the target on the opposite CCI value. Let’s use this swing trading principle on the latest EURGBP price action.

For the last four months, this Euro cross moved higher. A lot!

As such, it formed a bullish trend. So, the first step is done. We established the trend!

Next, we should place the CCI on this four-hour time frame. Because of the bullish trend, we want to buy when CCI dips below -100.

With what target? When the 100 level gets hit, we exit.

All twelve (12!) trades from above represent swing trading options a trader has. Or, opportunities.

Moreover, they all ended up in profit. Isn’t the best swing trading strategy supposed to look like this?

Swing Trading Strategies That Work with Trading Theories

Trading theories try to map a currency pair’s movement. Some of them go even further: if properly used, they claim to know all future movements.

The Elliott Wave Theory is such a trading theory. In fact, it is just another swing trading technique.

Elliott said the market moves in cycles. That is, cycles of different degrees.

In Forex trading, these degrees are easy to spot. They’re the time frames of a currency pair.

As such, when the Elliott Waves count reaches the daily and four-hour time frames, that’s swing trading. Any resulting trade fits in this category.

In fact, the overall theory is a swing one. Elliott found the market moves in waves.

Or, it swings. As such, a bullish cycle has five swings. Three to the upside, and two in the opposite direction.

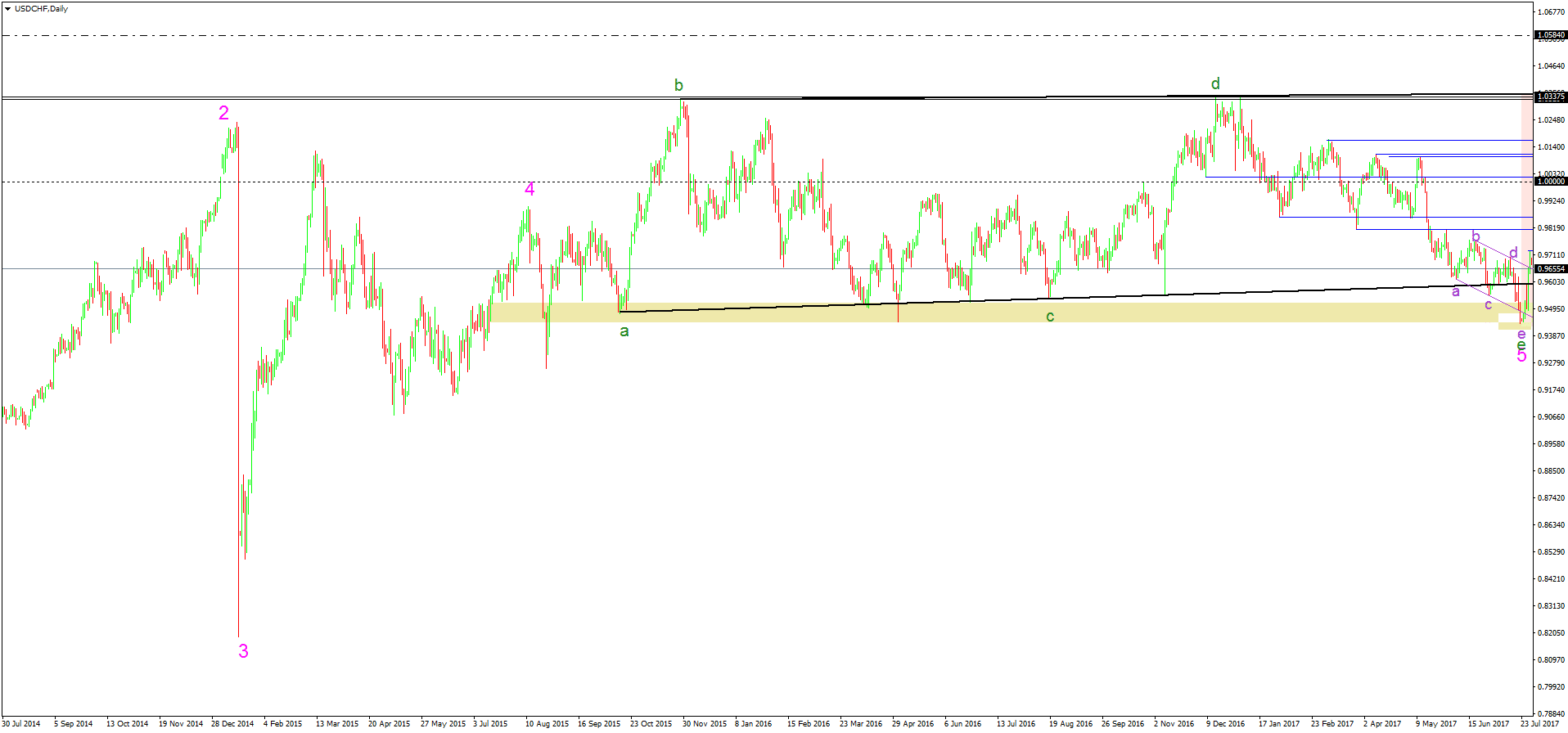

Swing trading strategies Forex traders use with the Elliott Waves Theory are counts like the one above. This is the result of a top/down analysis approach.

Under such analysis, swing trading strategies result from interpreting all the time frames. From monthly to the hourly chart, a currency pair is “mapped”.

When the resulting trade comes from either daily or four-hour time frame, that’s swing trading.

Similar swing trading strategies derive from other trading theories. Gartley, Gann, Drummond, Price Action, Point and Figure…they all end up giving swing trading strategies that work.

Any trading strategy is subject to swing trading. Either picking tops and bottoms, or trend trading…what matters is the time horizon of a trade.

Swing Trading Strategies with Fundamental Analysis

So far, we have looked at the best swing trading strategies from a technical analysis point of view. But, is that all?

How about fundamental analysis? Can it be used in swing trading?

The answer is yes. And, again, time is key.

The starting point is the economic calendar. A swing trading bot (or trading algorithm) buys and sells a currency pair mostly based on economic news.

More exactly, on interpreting the economic news.

And, out of all news, the ones related to a central bank’s monetary policy matter the most. Therefore, traders look for clues when trading.

You’ll be surprised, but not everyone believes in technical analysis. Analytical minds look for an economic reason behind it.

As such, some of the best indicators for swing trading are not technical. But fundamental.

The CPI (Consumer Price Index) is one. Or, in plain English, inflation.

Inflation is on every central bank’s mandate. When it differs from the forecast, central banks act.

Traders know that. On top of it, they have a time span to use.

Because inflation is released before a central bank’s meeting, swing trading appears. Or, the opportunity of a swing trade.

If inflation differs from the forecast, traders bet the central bank will change interest rates. But, typically, the inflation data comes out a couple of weeks earlier.

As such, the best swing trading strategies from a fundamental point, use inflation data. The central bank will hike rates on higher inflation. And, will cut them if it disappoints.

In both cases, the currency moves. This was just an example.

It aimed to show swing trading strategies that work using fundamental analysis. Many traders use them.

But plenty of other economic data is used the same way. All you need is to pay attention to details.

Trading with a Swing Trading Software

Anything that moves can be programmed. As such, traders can build an algorithm.

The most popular trading platform, the MetaTrader, allows for Expert Advisors building. Traders can program their own swing trading strategies.

In fact, today’s trading is mostly automated. Almost all trades are the result of a computer program.

Expect this trend to continue. With technology changing so fast, trading will change too.

It has changed and will continue to change. Traders have adapted as a consequence.

Expert advisors are easy to create, install and use. Over eighty percent of today’s trades come from an automated source.

If you come to think of it, every trader uses automated trading. When you place a pending order…that’s automated trading.

Or, when you set the take profit for your swing trading. Or the stop loss.

The system (trading platform) will close your trade automatically.

Coming back to swing trading strategies that work, they can be automated. All examples used here can.

But the idea is to understand how to use them first. It comes secondary to how trading takes place.

Moreover, the best swing trading strategy is one that wins most of the times. But, it doesn’t mean it must win all the time.

Therefore, trades have a stop loss in the first place.

Conclusion

Just like any speculative process, swing trading is risky business. But this is not news to Forex trading.

This is one of the riskier ways to make money. However, it is extremely rewarding.

This is what attracts people to it. And this is what trading strategies try to achieve.

Swing trading strategies work best when they’re part of a money management system. Successful trading must have rules.

A rule-based trading approach leads to correct market interpretation. No matter the approach, traders stand better chances when following rules.

In swing trading, the first condition is to trade four-hour and daily time frames. As such, you’re forced to consider a medium-term horizon for your trades.

The best swing trading strategy can only come from these two time frames. Anything above, it’s investing. And, anything below, it’s scalping.

That’s a different approach to trading. Or, different trading styles.

All in all, swing trading strategies that work appeal to traders who have patience. Traders who know what they’re after.

Moreover, these traders have more freedom. They’re not “trapped” in front of the screens.

When a trade appears and a setup is in place, you must give it time. That’s what swing trading is: trades that take a bit more time than day trading. But, not as much as buy and hold strategies. Or, investing.

Because it deals with “in-between” time frames like the daily and the four-hour ones, swing trading is not for everyone. However, the ones that master it will never try anything else.

Or, if they do, they’ll always have a special place for swing trading strategies that work. After all, if a profit is made, who cares about the strategy it came from?

START LEARNING FOREX TODAY!

share This:

Leave a Reply