As a trader, you should always have different tools available in your arsenal to analyze and trade the market. The Fibonacci and its retracement levels are a must-learn for you. The Fibonacci retracements are a technical tool used in Forex to define support and resistance levels. Based on a numerical series, the Fibonacci displays horizontal […]

The bias is bullish while the price remains above $1450. Buying seems to be reasonable near $1500 physiological level. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice. This analysis was done using MetaTrader 4. Click below to open a Free Demo Account […]

The bias is bearish while the price remains above 1.0647. It is important to watch the closing price of H1, H4 and Daily candles. If the price closes above 1.0593 on these three timeframes, the bearish outlook will no longer be valid. Disclaimer: The analysis presented in this article is for educational purposes only and […]

The bias is bearish while the price remains below 2.0080. Any sort of pullback up could provide a trade opportunity. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice. This analysis was done on MetaTrader 4. Click below to open a Free Demo Account […]

Shooting stars often appear in Forex. These candlestick patterns are a must-learn when getting started in trading. Most seasoned traders consider the shooting star to be a powerful price formation due to its effectiveness and reliability. It is also is one of the most common candlestick patterns in the market. The shooting star is a […]

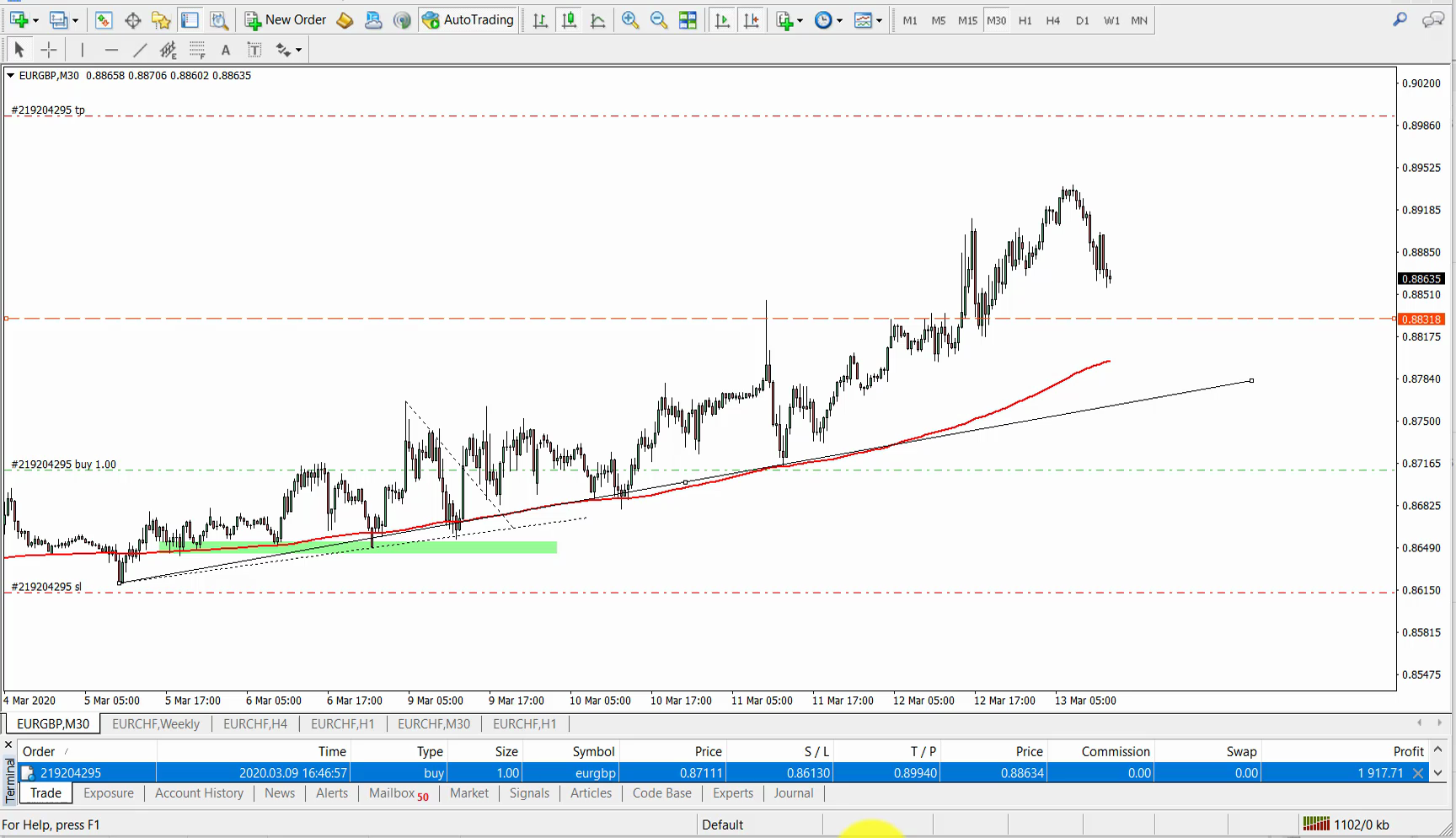

The bias is bullish while the price remains above 0.8640. This could only change if 1h and 4h candles will close below this level. Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice. This analysis was done on MetaTrader 4. Click below to open […]

In Forex trading, sometimes simplicity and recognizing easy-to-spot patterns can pay off big. The hammer candlestick is one of them, being the most recognized formation by Forex traders. The hammer candlestick is a reversal pattern of bullish nature that consists of a single candle with a small body and a long shadow. The open, high and […]

Forex trading is the biggest financial market in the world, dwarfing the stock market. Although the numbers vary from source to source, all agree that Forex trading is larger than the combined value of what is traded daily on the New York, London, and Tokyo markets. Think upwards of 5 trillion dollars—that’s the daily volume […]

As a Forex trader looking for profit opportunities, you need to learn how to identify market reversal patterns. The hanging man is a clear example of a potential reversal that may occur at the top of an uptrend. The hanging man is a bearish price formation that consists of a single candle with a small body […]

Capturing market reversals by trading an Inverted Hammer Candlestick is one of the top skills you need to develop as a Forex trader. This pattern is very attractive since it offers a chance to enter a trade at the beginning of a new trend, increasing the chances of getting profits. The Inverted Hammer Candlestick is […]