The Forex Market, short for foreign exchange market, makes over $5 trillion worth of transactions per day, making it the largest financial market in the world. Aside from the liquidity that this behemoth of a market brings, Forex also has a low barrier to entry, with live trading accounts starting as small as $10. So, can you trade Forex with $10?

Yes, it is possible to start Forex trading with a $10 account and sometimes less than that. Some Forex brokers have minimum account requirements as high as $1,000. Some are as low as $5. Become familiar with Forex trading, and do research beforehand on prospective brokers to see which ones allow deposits of $10 or less.

The account size is not the only factor to consider when trading Forex. Read on to explore the other things you’ll need to get started with your Forex trading career, such as leverage, risk management techniques, trading psychology, and how to grow a small Forex live account with strategies that complement your personality and risk profile.

Table of Contents

Trading Forex With $10

What to Look for in a Live Trading Account

Features and services that come with a live trading account can greatly impact your long-term bottom line as a trader. 24/7 access to technical support, usable leverage, number of tradable currency pairs, and lot sizes are all things that you should look for in a trading account. Let’s expand on each:

- 24/7 Technical Support. Account and platform support are both important, especially in times of high market volatility. Your broker’s customer service team should be able to address queries or issues in a fast and conclusive manner; otherwise, you might miss a planned trade entry or fail to close a losing position before it becomes worse.

- Leverage. Leverage in trading refers to a facility that allows you to secure a bigger position in the market you’re trading in than the total dollar value deposited on your account. For instance, if you deposit $1,000 into your account and are able to buy a standard lot of New Zealand Dollar vs. US Dollar pair – a standard lot being $100,000 – then it is said you are using 1:100 leverage. Every broker has their own maximum leverage, with some offering 1:10 and others as much as 1:1,000. Although this sounds like a win-win situation for the trader, there are pros and cons to using leverage on your trading account. We’ll discuss this later on.

- Number of Tradable Currency Pairs. There are over a dozen currency pairs you can trade in Forex. These are categorized into Major, Minor, and Exotic currency pairs. Major currency pairs, such as EUR/USD and USD/JPY, are traded most frequently worldwide and thereby offer higher liquidity. This means you can trade them essentially 24/5. The spreads – or the cost of opening a position in a currency pair – are also comparatively lower to minor and exotic pairs.

- Lot Size. Having the ability to trade micro and mini lots are necessary if you are planning to deposit a small amount i.e., $10 into your trading account. A standard lot in Forex is equivalent to $100,000, while a mini lot and micro lot are $10,000 and $1,000, respectively.

- Financial Stability. A broker should be financially stable enough to weather tough economic climates. If your broker files for bankruptcy tomorrow, it can be a stressful ordeal to retrieve any remaining balance on your trading account.

The Pros and Cons of Leverage

Leverage is often considered a double-edged sword in the trading realm. It lets you magnify your trading sizes and therefore magnify any potential profits that the position can make. That being said, if the trade turns sour and starts to lose money, the potential losses can also be greater.

Responsible use of leverage is key to minimizing large and unsustainable losses that could blow your account out. As a smart rule of thumb, never risk more than 1 percent of your account in one single trade. In addition, having a good risk/reward ratio is essential for long-term growth and profitability.

Risk/reward ratio refers to how much you stand to lose vs. how much you stand to gain on any particular trade. For example, a 1:5 ratio means that the trader is willing to risk losing $1 in order to make $5. Ideally, traders would want, at the very least, a 1:2 risk/reward ratio, which means they stand to double whatever dollar amount they are prepared to risk in a trade.

Aside from amplifying your potential losses on a trade, leverage can also force you to trade more frequently to recoup said losses.

Risk and Money Management

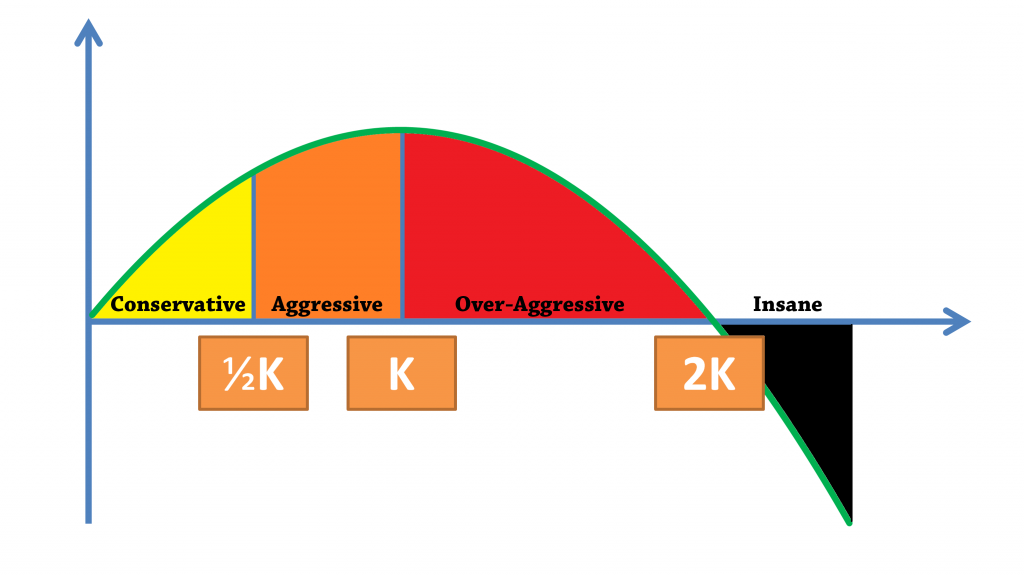

The Kelly Criterion is a risk management approach that helps shed light on how trading too large a position can inevitably lead to losses over time. According to the Kelly Criterion strategy, traders that use more than 50 percent of their account per trade will only break even over time. Any trade using above 50 percent is expected to return net losses over time. The Kelly Criterion strategy uses what is called the Kelly Formula, which uses optimal percentage risks, odds of winning, and expected payout on each trade to calculate the Expected Value or EV of an investment.

Transitioning From Demo to Live Trading

A demo trading account is excellent for backtesting your Forex strategy, but a lot of novice traders skip this step and go straight to a live trading account in hopes that they can start making real, spendable cash quickly. It may be worthwhile trying your strategies and your ability to stay mentally disciplined and focused on a demo account before going into live trading.

Although a demo account does not pay out real money, it also guarantees that you do not lose any money. This offers you the opportunity to see how your technical strategies and risk management plan does in the foreign exchange market. Using the data you gather from back- and forward-testing, you can then refine your strategies for improved profitability.

Once you get at least an 80 percent win rate on your Forex trading strategy, you can consider opening a small live account with $10. A small live account gives you exposure to real-time market conditions and volatility. It also gives you a firsthand experience of the risk involved in Forex trading.

While a demo account can help hone your strategy, it cannot prepare you for the mental toll of losing real money.

The Importance of Mindset and Patience

Mindset and patience both play vital roles in a trader’s performance. A successful trader’s mindset is centered on discipline, focus, and patience. You must have a strong will and discipline to get out of a losing trade when it hits your stop-loss target. You should also be disciplined enough to sit on the sidelines when market conditions become dangerously volatile.

Having the patience to pull the trigger on your trades can be especially difficult due to FOMO, or the fear of missing out. Novice traders feel like they are missing the opportunity to make money when they don’t have a trade open. As such, they trade the market 24/5, thinking that more frequent trading can lead to higher profitability. On the contrary, it actually increases your risk as much as over-leveraging and over-sizing of positions do.

Psychology, in general, goes hand-in-hand with the technical aspect of trading. You cannot succeed without a solid base of both elements. Keep in mind that a $10 live account won’t make you rich overnight. Nonetheless, starting small and slow is a step in the right direction. It’s a good way to understand fundamental trading principles and the ever changing and unforgiving nature of the Forex market.

How Do You Grow Your Forex Live Account

Growing your Forex live account will take time, during which you’ll have to endure a lot of painful losses and modifications of your initial trading strategies and risk management plans. Here are a couple of tips to consistently grow your live Forex trading account:

- Journal Your Trades. Record all the trades you take and include key data, such as the currency pair you traded, whether you bought or shorted the pair, how many lots, what conditions the market was in i.e., trending or ranging, and what indicators you used to pull the trigger.

- Always Have a Stop Loss. A stop loss is a hard out when the price hits a certain number or level. It’s a price point where the broker can automatically close your position, thereby mitigating any further losses.

- Always Have a Profit Target. A profit target is the price point in which you automatically exit a winning position. Not having a profit target can lead to a net positive position turning negative. Having a profit target ensures that you do not succumb to greed and fear of missing out on any possible future moves.

- Avoid Listening to Others. Successful traders know best not to base their final trade ideas and decisions on news stories and leads from self-proclaimed investment pundits and coaches. Avoid listening to background noise and do your own research about the value of a currency against another currency.

- Avoid Trading During Times of High Volatility. Volatile market conditions can be catastrophic to your trading account. A volatile market is when the price is moving erratically, and traders are gambling more than they are trading or investing.

- Use Higher Time-Frame Charts. The higher the time frame, the more reliable the trade signals. You’ll want to use either the hourly, 4-hour, or the daily chart to identify the prevailing price trend. The shorter time frames, including the 5-minute and 1-minute, are good for scalping trades or trades that last only for a few seconds.

Related Questions

What Is the Minimum Deposit for Forex?

$10 is the minimum deposit that most brokers will allow. Keep in mind, however, that minimum deposit requirements will vary between brokers, with some possibly requiring higher deposit amounts.

Can You Start Forex With No Money?

You can start forex trading using a demo account and then transition to a small live account once you’ve familiarized yourself with the environment and have developed a reliable trading strategy. Forex trading is similar to traditional businesses in that it also requires some capital to start. $10 is enough capital to open a live account, albeit limited.

Who Is the Richest Forex Trader?

Since not all traders disclose their profits and losses, and there is no way of verifying the data even if they do disclose it, it is difficult, if not impossible, to determine who the richest forex trader is at any given time. Arguably, Warren Buffet and George Soros would be at the top of the list of people whose portfolios are exposed to currencies.

What Strategies Can You Use and Copy?

There are three main strategies in trading: technical, fundamental, and market sentiment based trading. Technical analysis refers to the use of quantitative indicators to predict future price action. Fundamental analysis, on the other hand, uses macroeconomic data to gauge market conditions and currency valuations. Lastly, you have market sentiment which pertains to looking at charts and identifying the main direction of price.

What Are Technical Indicators?

Technical indicators use historical data to predict future price action. Some popular indicators for technical traders include MACD, Stochastics Oscillator, Relative Strength Index, Bollinger Bands, etc.

What Are Fundamental Indicators?

Fundamental or macroeconomic indicators include GDP, interest rates, central bank policy changes, consumer confidence, employment and unemployment numbers, etc.

What Is a Good Currency Pair to Start With?

USD/JPY and EUR/USD are the more common currency pairs that traders start with before they explore more exotic currency pairs, such as the USD/KRW or EUR/NZD. The former pairs are often more liquid and stable than exotic pairs whose underlying economies remain developing and riskier than developed economies, such as the US and the European Union.

Do You Pay a Fee To Your Forex Broker When Trading?

There are no fees at the time you open up a live account. Any broker that asks you for a one time or recurring fee should raise a red flag. You only pay a spread each time you open a position, which is how brokers make their money. The spread can cost anywhere between two to ten pips, depending on market hours and volatility. Pips pertain to the unit of measurement of currencies in the Forex market.

Final Thoughts

Can you trade Forex with $10? Certainly. Can you make a good sum of money through Forex trading? Not with $10. You’ll have to invest time and effort into learning and mastering the art of trading. Remember, it is a balance between strategy and your own mindset and psychology. Without a good strategy, no amount of patience or focus can grow your account. At the same time, if you have mental endurance, but lack a good strategy or plan, you’ll still fail. Use the tips mentioned in this article, and you’ll be on your way to becoming a successful and consistently profitable Forex trader.

Leave a Reply