Fundamental and technical analyses represent the core of any Forex trading process. These two concepts represent major schools of thought in approaching and understanding the markets. Both have the same goal: understanding the historical behavior of markets to forecast future trends; however, the path towards that goal is different. Fundamental analysis in Forex focuses on […]

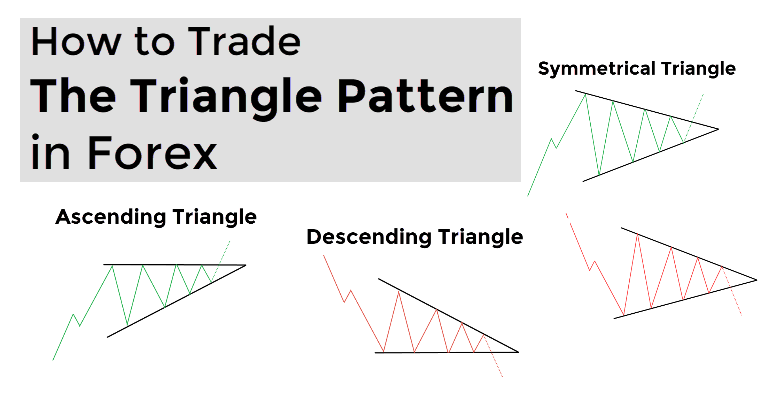

Most traders love continuation figures like the triangle pattern; this makes it one of the most commonly traded chart formations in Forex. Unlike reversal patterns that signal an impending change in the trend direction, triangles are used to make profits in trend extensions. The Triangle Pattern in Forex is a price formation that signals a […]

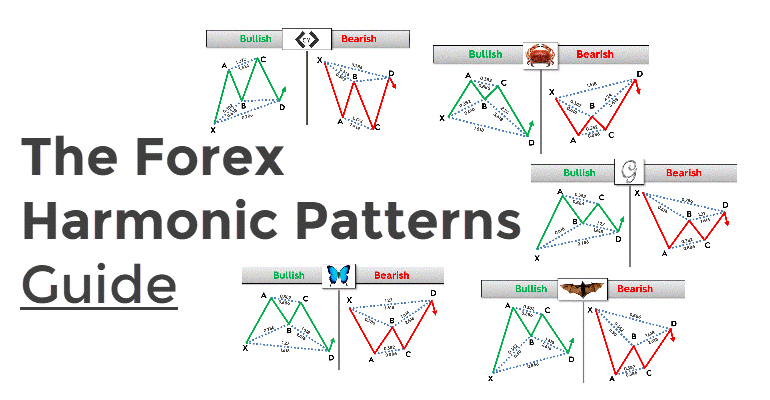

Traders and analysts forecast future price movements in Forex using different chart patterns. These formations can range from the most basic ones that consist of a few trend lines only, such as triangles, wedges, flags, pennants, double top/bottom, to more advanced setups like Harmonic Patterns. Forex Harmonic Patterns are geometric price formations that derive from […]

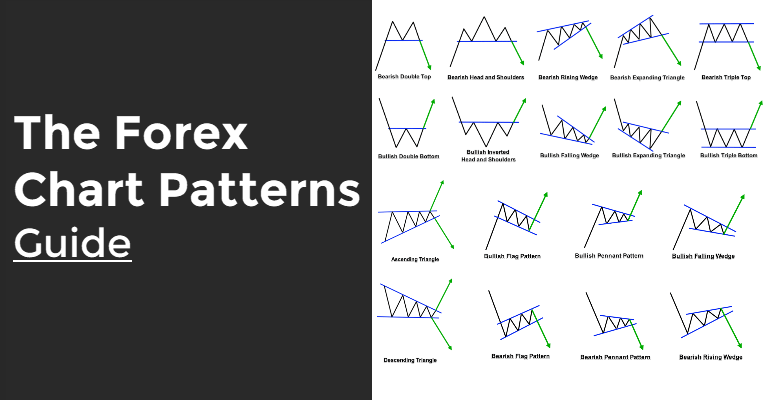

One of the most important skills for successful trading is Forex chart patterns analysis. Learning to recognize price formations on the charts is an essential part of the Forex strategy of every trader. Then, it is vital that you learn about these figures, their meaning and how you can use them to your advantage. There […]

As a trader, you should always have different tools available in your arsenal to analyze and trade the market. The Fibonacci and its retracement levels are a must-learn for you. The Fibonacci retracements are a technical tool used in Forex to define support and resistance levels. Based on a numerical series, the Fibonacci displays horizontal […]

Shooting stars often appear in Forex. These candlestick patterns are a must-learn when getting started in trading. Most seasoned traders consider the shooting star to be a powerful price formation due to its effectiveness and reliability. It is also is one of the most common candlestick patterns in the market. The shooting star is a […]

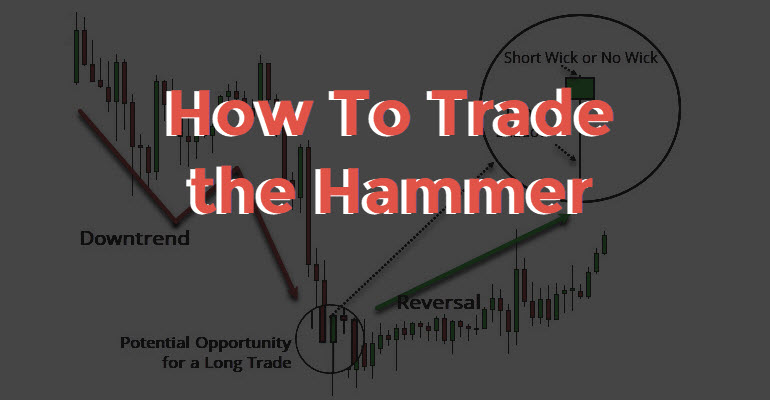

In Forex trading, sometimes simplicity and recognizing easy-to-spot patterns can pay off big. The hammer candlestick is one of them, being the most recognized formation by Forex traders. The hammer candlestick is a reversal pattern of bullish nature that consists of a single candle with a small body and a long shadow. The open, high and […]

As a Forex trader looking for profit opportunities, you need to learn how to identify market reversal patterns. The hanging man is a clear example of a potential reversal that may occur at the top of an uptrend. The hanging man is a bearish price formation that consists of a single candle with a small body […]

Capturing market reversals by trading an Inverted Hammer Candlestick is one of the top skills you need to develop as a Forex trader. This pattern is very attractive since it offers a chance to enter a trade at the beginning of a new trend, increasing the chances of getting profits. The Inverted Hammer Candlestick is […]

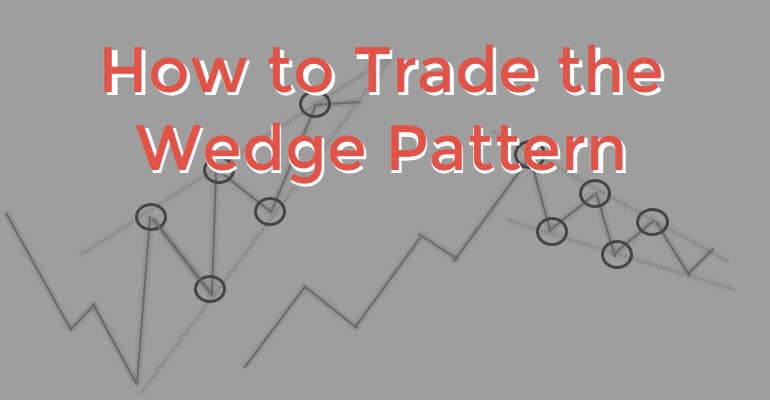

The wedges are one of the most common patterns in Forex trading. Also, it is one of the most familiar figures in Forex as it consists of two converging trend lines that can be easily spotted in a chart. Essentially, a wedge pattern is a price formation that consists of two converging trend lines, which […]