One of the oldest principles in technical analysis, the Dow Theory guides traders to this day. For almost a hundred years, the Dow Theory technical analysis principles fascinated traders. Those still wondering what is Dow Theory, will find this article useful for Forex trading too.

Traditionally, there are two ways to look at a market. A fundamental method and a technical method.

In Forex trading, fundamental analysis deals with interpreting the economic news. Mostly.

Or, trading on long-term time frames. Traders interpret changes in macroeconomic policies around the world.

Moreover, they speculate on them.

But technical analysis is more pragmatic. It deals with indicators that act as tools to forecast price.

Or, future prices. Speculation has never been easier as is today.

Simply open a trading platform. Next, put some indicators on a chart. Finally, buy and sell when indicators tell you to.

With the right money management approach, chances are you’ll make some money. But there’s more to trading than that.

How about understanding why the market moves? Or, how it will move?

Many tried to put an order in the market’s chaotic moves. From Elliott and Gartley to Gann and DeMark…technical analysis is full of such examples.

But none influenced it like Charles Dow. To this day, the Dow Theory treats markets like no other before.

This article will cover:

- What is Dow Theory?

- Influential thinkers that shaped Dow Theory

- The three stages of Dow theory technical analysis

- Pros and cons of Dow Theory technical analysis

All trading theories mentioned above (Elliott, Gartley, Gann, etc.) have their origin at the start of the last century. And, Dow Theory is no different.

It all started with how the market moves…

What is Dow Theory?

Nowadays, every trader heard of DJIA. It stands for Dow Jones Industrial Average.

What many don’t know is that the name comes from one of its founders. Charles Dow.

A brilliant thinker, Dow was fascinated with how the market moves. Relentlessly, he tried to find a logic to it.

We all know now that the market swings result from supply/demand imbalances. More buyers, the market rises. More sellers and the market falls.

Of course, volume matters too.

However, this is the starting point. The idea is that the market moves in waves. And, such imbalances create them.

The Dow Theory was born on this principle. Like Elliott later, Dow tried to figure out human nature’s influence on market behavior.

After all, a combination of swings creates a trend. What if one can put an order in the market swings?

The Dow Theory is not the only approach Dow had to understand markets. He wrote many reports that served as a barometer of general business activity.

But, he never put his ideas together. It was someone else that did.

Sam Nelson, a market technician of the time, coined the phrase Dow Theory. He put everything together.

He made sense of Dow’s principles. And so, the main pillar of technical analysis was built.

Today, the Dow Theory principles shape the way traders look at trends. Moreover, Dow Theory technical analysis concepts have a great forecasting power.

Later, William Hamilton refined the theory into what it is today. And, in 1932, Robert Rhea went even further.

He put together Dow’s, Nelson’s and Hamilton’s findings. As such, the Dow Theory technical analysis concepts were born.

Basic Tenets of Dow Theory

Before going into details, we must cover the basics of this beautiful theory. Or, what is Dow Theory?

But, keep in mind that the original Dow Theory technical analysis principles were modified in time. The following are the most important considerations:

- The market discounts all news. A powerful statement, especially for the Forex market today.

With trading algorithms interpreting news and snippets, discounting the news gets difficult. Yet, a market moves based on human interaction.

And, humans program robots. As such, the market, in the end, WILL discount all news.

- The market moves in cycles. Either bullish or bearish one. Dow identified three cycles: the main movement, the medium swing, and the short swing.

At least, those were the original names. Time distorted the notion. But, the idea remained.

To this day, the Dow Theory has three market movements going on simultaneously. That’s important!

- Volume confirms trends. That’s tricky in the Forex market.

The volume shows only the broker’s transactions. However, it offers an educated guess.

- Trends exist until they Any trend has its pullbacks. Dow tried to spot true reversals from fake ones.

With these basic points in mind, let’s try to see what makes Dow Theory fascinated?

The Three Stages of Dow Theory Technical Analysis

The Dow Theory considers the market makes three price movements:

- Primary movement. Or, a primary trend. This is where the Dow Theory Forex traders focus. It can last from a few months to several years.

- Secondary movement. This is a reactionary move. It goes against the main trend. Or, the primary one. It goes from few weeks to a few months.

- Daily fluctuations. They can go with or against the main trend. And, can take from a few hours to a few days.

In today’s Forex trading, there’s a trading style for each movement. Traders involved in the biggest cycle, the primary movement, are long-term traders.

The next cycle belongs to swing traders. Finally, intraday traders deal with day-to-day movements. Or, daily fluctuations.

You probably noticed that the Dow Theory addresses the market cycles. But, in today’s technical analysis, the three movements represent a bullish or bearish trend.

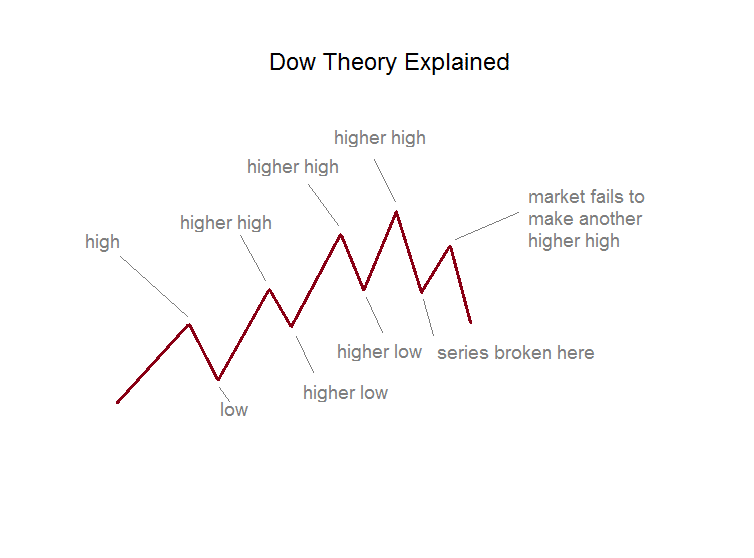

Or, a series of higher highs and higher lows, in a bullish trend. On the other hand, a bearish trend shows a series of lower lows and lower highs.

A closer look at the image above shows what all Forex traders know. A trend’s definition.

After all, what is Dow Theory if not a concept to ride trends? But, as always, there’s a catch.

The Dow Theory technical analysis deals with bigger trends. In today’s Forex trading, it starts from the bigger time frames.

EURUSD Dow Theory Forecasts

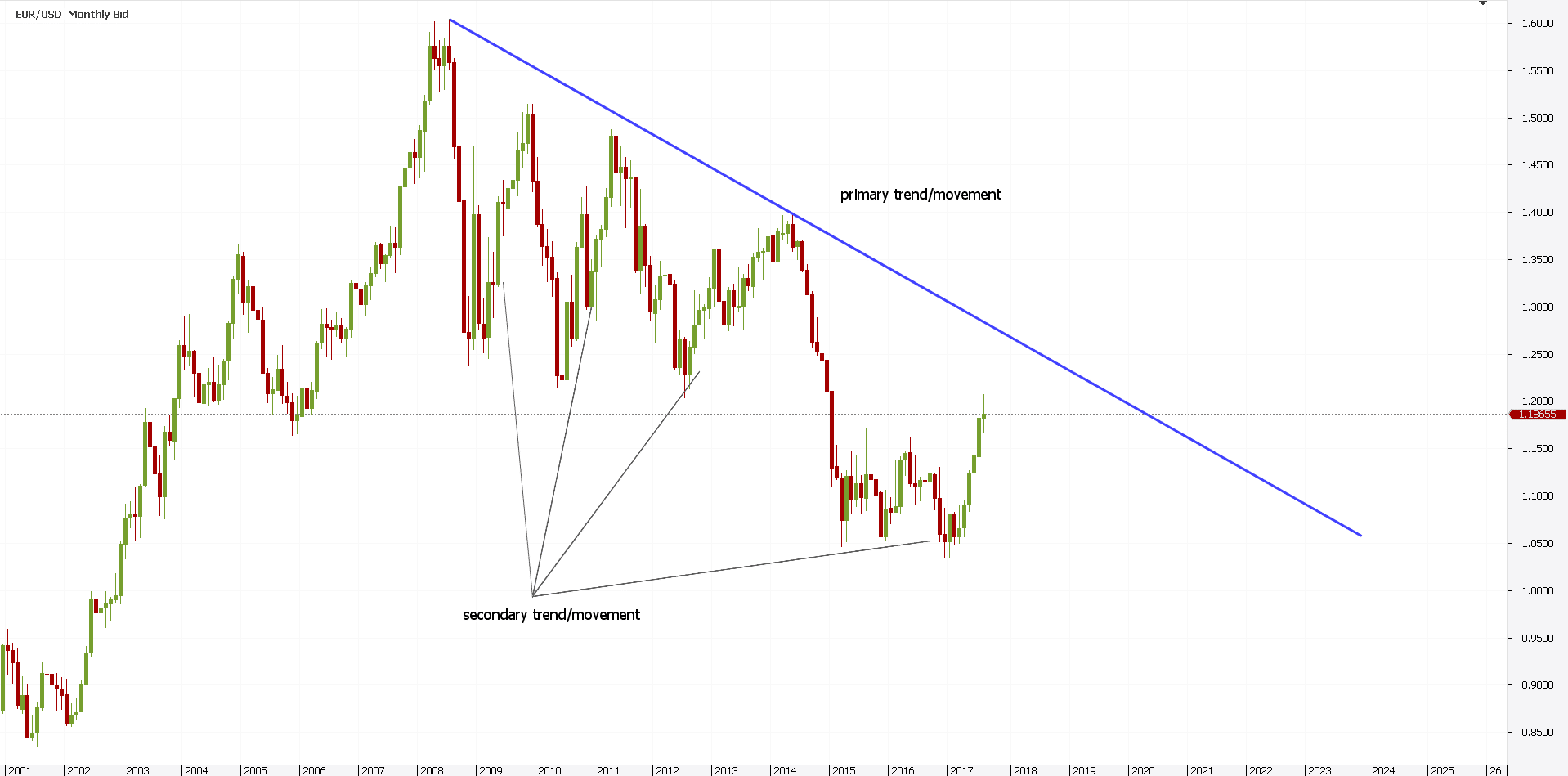

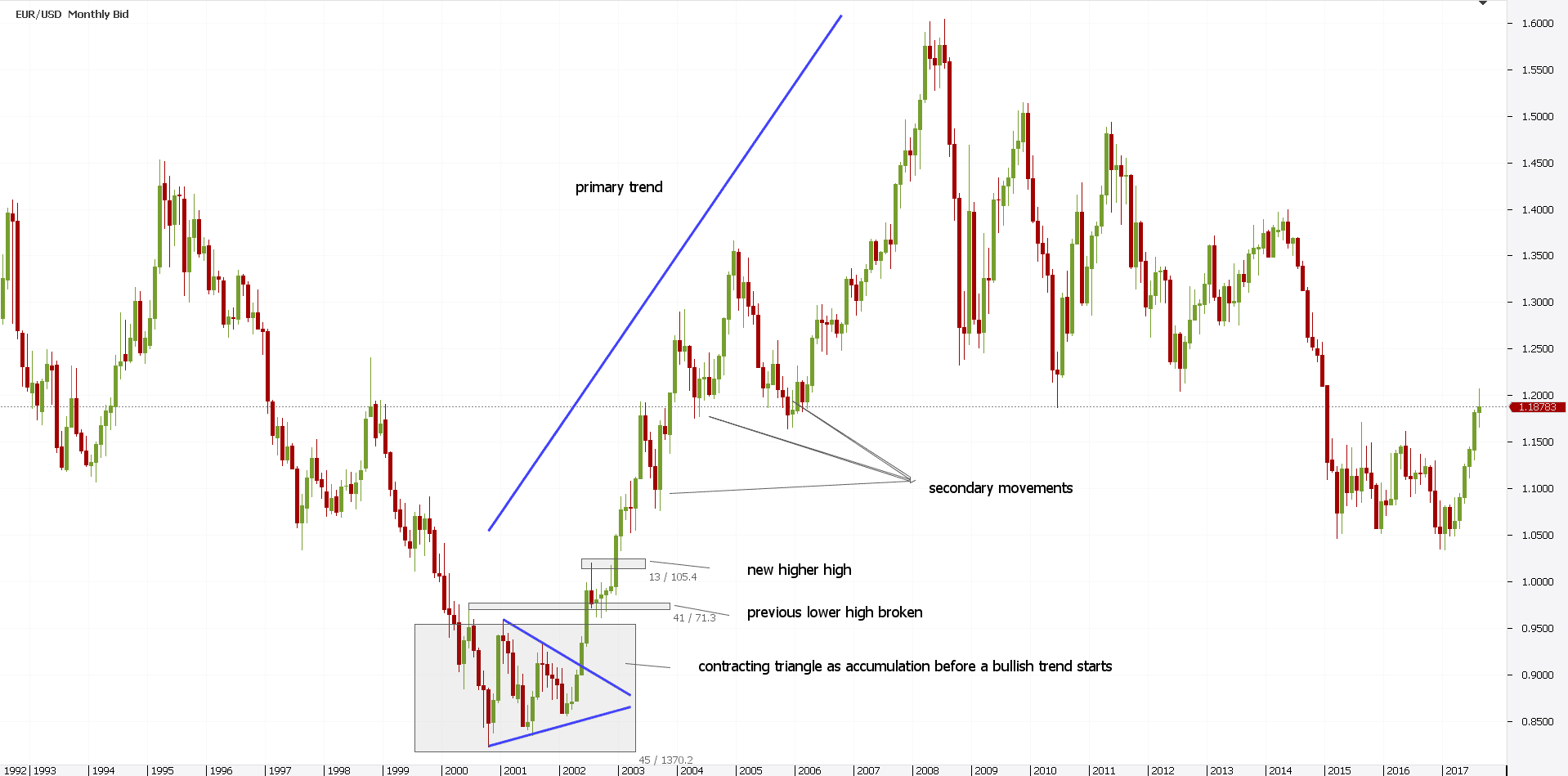

Check the chart below. It shows the EURUSD on the monthly chart.

The Dow Theory focuses on the primary trend. But, if this one takes several years, traders must address the right time frame.

In this case, the monthly chart. Remember the Dow Theory technical analysis principles?

A series of lower lows and lower highs makes a bearish trend. That’s exactly what we have here.

The blue line shows the primary movement. Or, the main trend. Bearish.

Everything in between makes the secondary movement. Or, the reaction to the main trend.

These are pullbacks. Designed to be sold. Until when?

Until the market breaks the main trend line. And, the lower highs series gets broken.

For the downtrend to reverse, a higher high and a higher low must occur. If not, the market simply makes secondary movements.

Basically, the Dow Theory gave us the definition of a trend. Remember, this was a hundred years ago!

Dow Theory Primary Trend – Stage 1 – Accumulation

The three stages of any Dow Theory analysis consider market psychology. They differ in a bull and a bear market.

Before a bull trend starts, the market accumulates. If you want, it builds energy to break higher.

Excessive pessimism at the end of the previous bearish trend ends. Only the brave ones buy here.

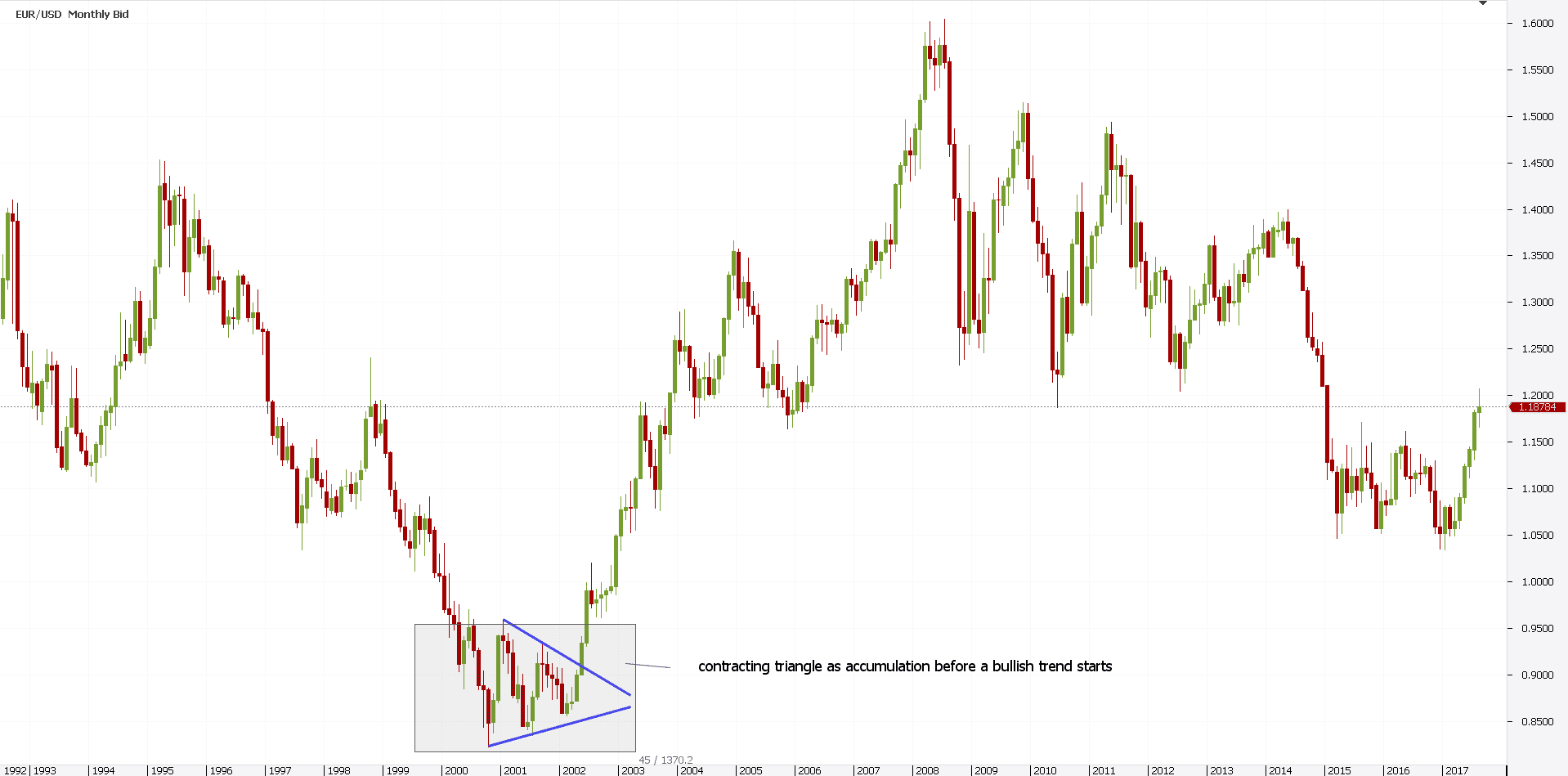

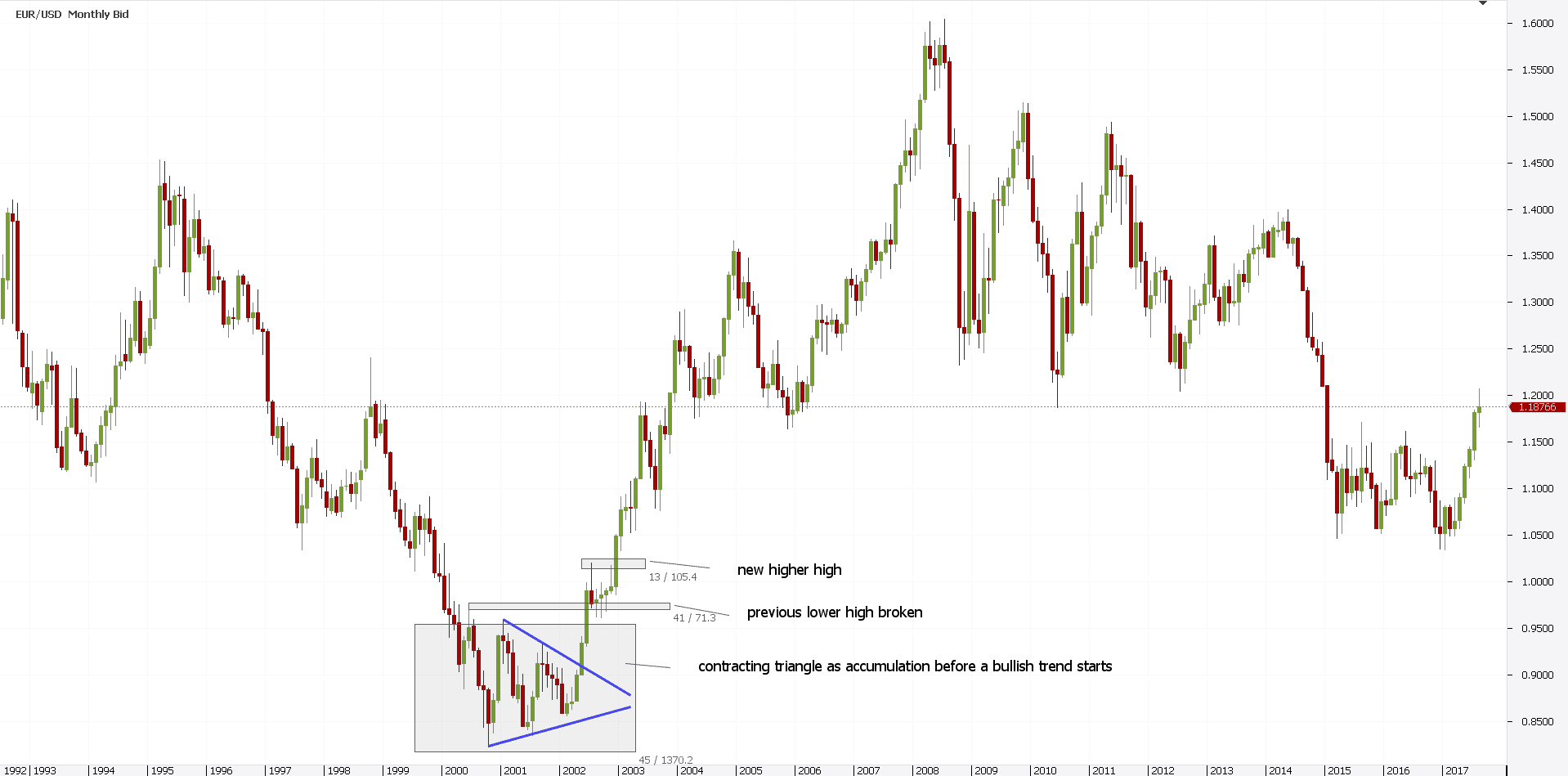

In today’s Forex trading, triangles show accumulation. More exactly, contracting ones. Or, the ones that act as a reversal pattern.

The EURUSD monthly chart shows a triangle. Not any kind. But, one that acts as a reversal pattern.

Dow Theory technical analysis principles call this accumulation stage. Or, the first stage in a new, bullish trend.

How do we know the previous trend ended? Remember the lower highs series? Here’s where we use it.

It took some time until the pair consolidated. Accumulation started.

Next, the price broke higher. Finally, it broke the previous lower high.

With all conditions in place, a new trend started. A bullish one.

From now on, the opposite moves are secondary. Or, simple corrections. Until the series reverses.

Traders wondering what is Dow Theory used for, here’s the answer. It tells with great accuracy conditions for market turns.

And, it does that way ahead of time. Traders only need to pay attention to details.

What is Dow Theory – Stage Two – Big Move

This is the longest stage of a primary trend. Or, primary bull market.

Typically, fundamentals come to help. Interest rates rise, because of improving economies.

Central banks react. They tighten monetary policy.

Money becomes expensive. As such, the most powerful currency in a currency pair rises.

It’s the easiest stage to make money with. In Elliott Waves Theory, this is the third wave in an impulsive move.

Bears are crushed. Bulls are thrilled.

The chart above shows the big move. The blue line tells what the primary trend is.

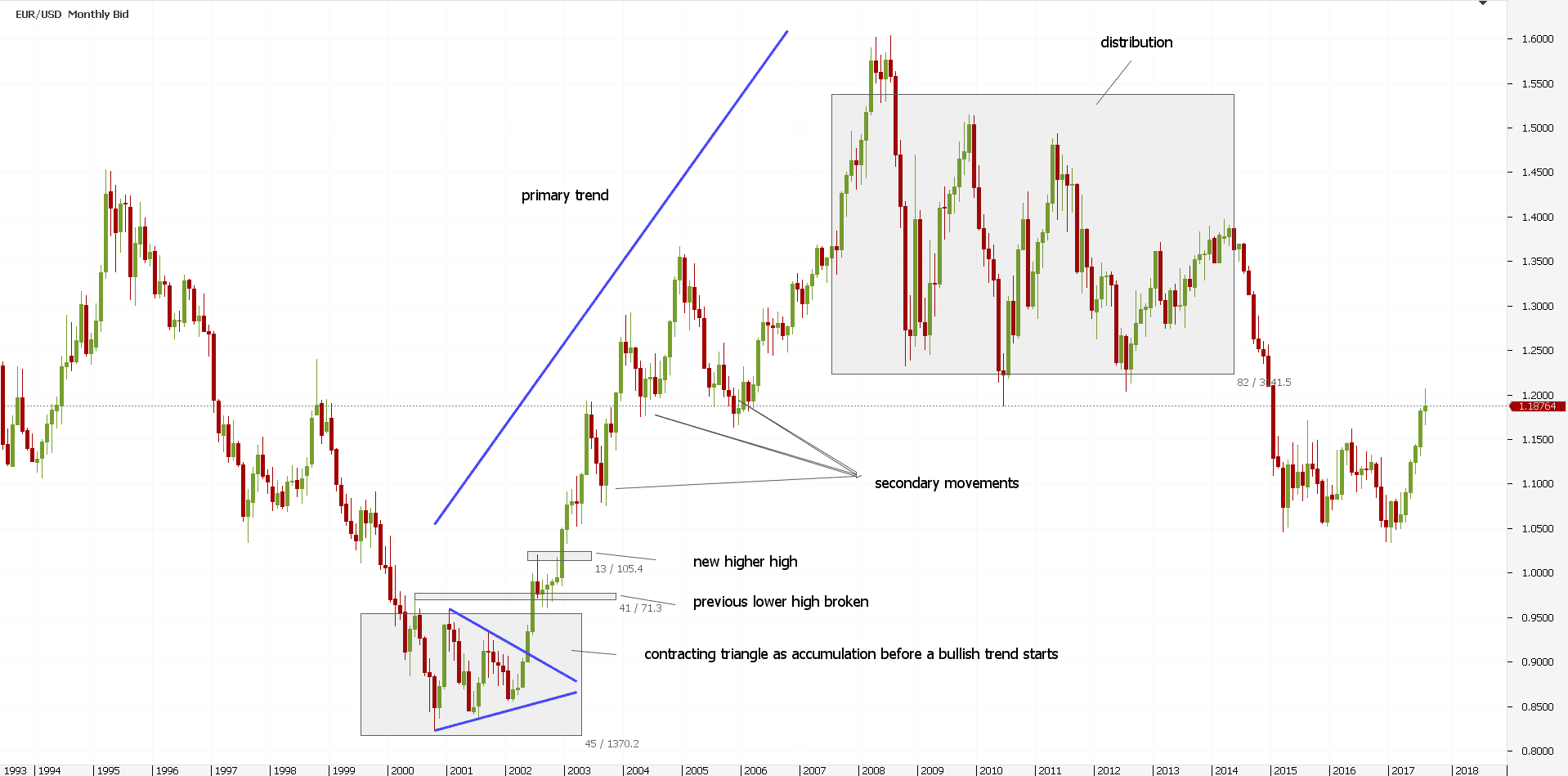

Dow Theory Bull Market – Stage Three – Excess

And then, bulls get a reality check. Secondary pullbacks become more powerful.

Moreover, excessive speculation is visible. However, confidence is still high.

Any meaningful pullback sees buyers stepping in. Yet, “smart money” sense something is wrong.

Sellers appear. And, in the end, the trend turns.

In a bearish trend, the first stage is identical to the third one in a bullish trend. Only that it has a different name. The Dow Theory calls it distribution.

As such, the third stage in a bull market is the first one in a bear. What next?

Again, the series of higher lows must be broken. And so, a new trend starts. A bearish one, this time.

By now, you know to interpret a market with the Dow Theory. We won’t discuss the next EURUSD cycle. You’ve already got the picture.

As such, the three stages in a bearish trend are:

- Distribution.

- The big move, or the main trend.

- Despair.

But this is not all. As Dow Theory introduced theoretical concepts too.

Ones that forever changed the way traders looked at charts.

“The Averages Discount Everything” – What is Dow Theory?

One of the biggest believes Dow had was that everything is priced in. That all known information is already in a market’s move.

After all, this is the very core belief of technical analysis. Technical traders have analytical minds.

No matter what the fundamentals say, a technical concept remains a technical concept. The market already discounted the news.

As such, technical traders have great results if they don’t think of the news. They strive to remain unbiased.

That’s the core trait of the Dow Theory. Once a move started, everything is in.

Dow Theory and the Concept of Confirmation

But perhaps the most powerful concept is confirmation. The Dow Theory technical analysis calls for trend reversals to be confirmed.

In today’s technical analysis, this concept is widely used. Think of it for a bit.

What do current Forex traders use to spot a reversal? Let me help you. Oscillators.

More exactly, divergences with an oscillator.

The original Dow Theory stated that a change in the primary trend must be confirmed by other indices. In today’s technical analysis, a change in the primary trend must be confirmed by a divergence.

As such, today’s Dow Theory technical analysis is incomplete without a divergence. Traders use either the RSI (Relative Strength Index) or other famous oscillators.

The idea is to stick with the oscillator. And not with the price.

Because the oscillator considers more candles, chances are the price makes a fake move. That’s the confirmation the Dow Theory looked for.

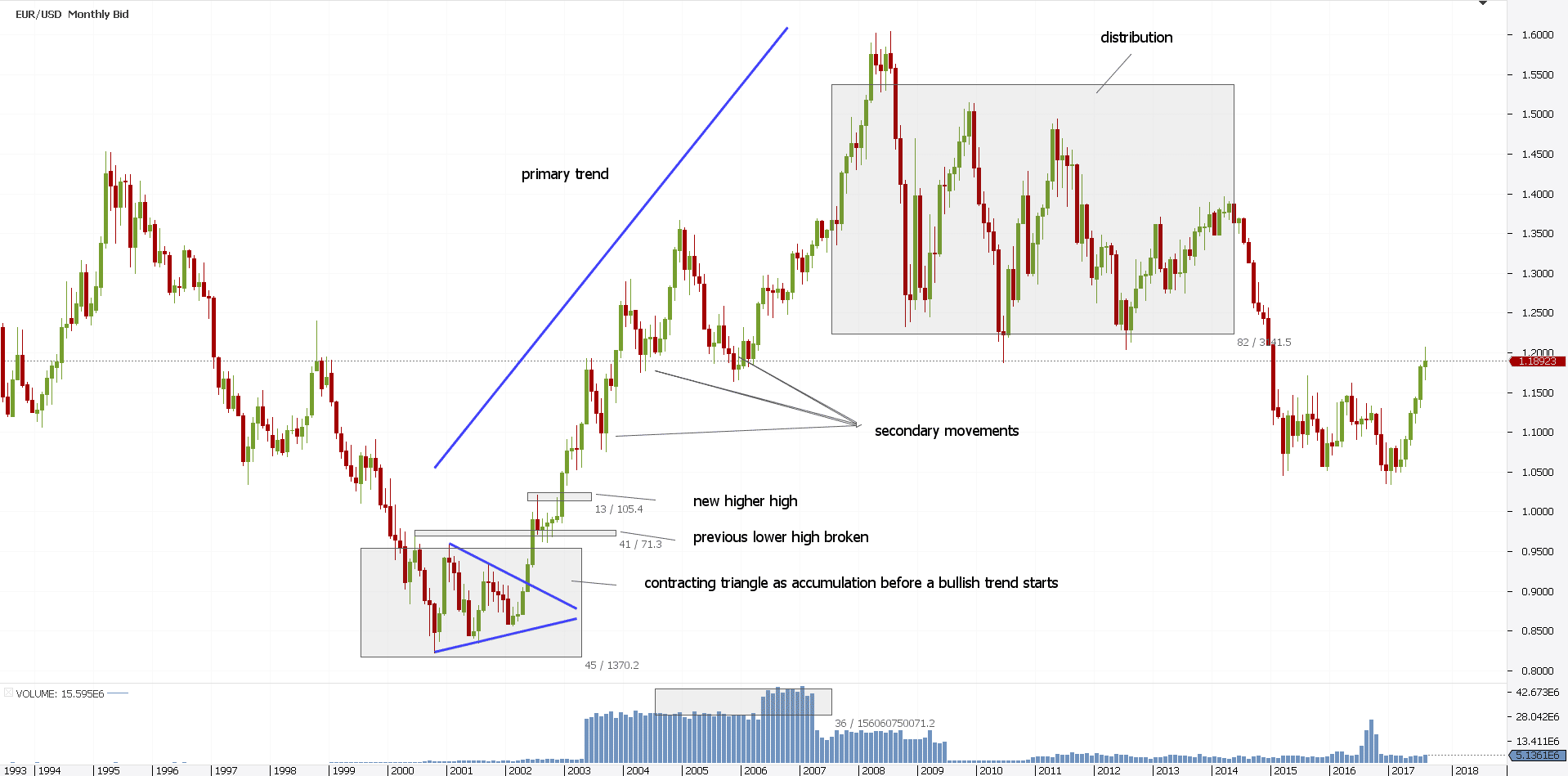

What is Dow Theory – Volume Confirmation

Rhea and Hamilton expanded Dow’s idea about confirmation. Volume came into discussion.

The idea is the following. In a primary trend, the volume should increase.

However, not in any direction. But, in the direction of the primary trend.

Let’s consider a bullish trend. The volume should be bigger when the market advances than during corrections.

The chart above shows the volumes on the EURUSD earlier analysis. We notice an increase in volume after the biggest secondary move.

That’s a confirmation of the bullish trend. Yet, another one set by the Dow Theory.

However, in the Forex market, the volume is relative. As mentioned earlier, it shows only the volume of the broker.

Because the Forex market is so big, it is impossible to see all parties that change hands. Over five trillion dollars change hands every day. Such volume is impossible to track on the long run.

Cons of Dow Theory Technical Analysis

Many argue that the Dow Theory is not really a trading theory. It is more a concept.

This may, or may not be true. But the Dow Jones theory, as it is also called, shows powerful trends that Forex traders can ride. One hundred years later, the concept is still valid.

Others say that the theory is late. It lags prices.

Of course, that it is easier nowadays to say that. We have personal computers.

We simply open a trading platform and can time reversals. Sometimes, by the pip.

A hundred years ago it was about understanding. More than about actual trading.

And, the markets are different. The Forex market today is not the same as the stock market at the start of the 1900’s.

Because of that, the Dow Theory detractors say that it is outdated. However, one cannot ignore the benefits it brings to understanding cycles.

What is Dow Theory if not the start of understanding waves? Or, better: what is Dow Theory if not an early version of the Elliott Waves Theory?

Even better: what is Dow Theory if not the cornerstone of today’s technical analysis? It’s the main pillar. That’s what the Dow Theory is.

Conclusion

The Dow Theory was the first one to treat market psychology. A closer concept to the Dow Theory technical analysis is the Elliott Waves Theory.

Elliott went into more details. He took the main trend and found a five-wave structure unfolds. Of a lower degree.

Or, waves within waves. Then, the secondary movements, or the reaction, he called them corrections. Or, corrective waves.

This is the Elliott Waves Theory. A five-wave structure corrected with a three-wave one.

Did Elliott continue Dow’s work? We don’t know that.

However, we know he was inspired by it. For what is Dow Theory if not a way to understand market psychology?

To sum up, the Dow Theory calls for a primary trend. One that forms on bigger time frames.

It keeps building higher highs and higher lows, or lower lows and lower highs. The trend goes until the series breaks.

Three stages make a trend. And, confirmation is needed when the trend breaks.

Confirmation comes from a divergence. Or, from a correlated market that doesn’t confirm the move.

In Forex trading, it comes from a similar currency pair. For example, if the GBPUSD and other dollar pairs don’t confirm the EURUSD moves, the markets diverge.

Or, there’s no confirmation.

Other traders use volume. This works extremely well in the stock market. To some extent, it works in the Forex market too.

Today, the Dow Jones theory technical analysis is widely used in Forex trading. Like it or not, know it or not.

Are you an Elliott Wave trader? If yes, you use basic Dow Theory concepts.

Are you a technical trader that uses divergences? Yet, another Dow Theory technical analysis concept.

All in all, Forex traders have an edge when using the Dow Theory principles. They understand what drives the market.

START LEARNING FOREX TODAY!

- Dow Jones

- Dow Jones Theory

- Dow Theory

- Dow Theory Analysis

- Dow Theory Technical Analysis

- Forex Technical Analysis

- Price Action

- Technical Analysis

share This:

Leave a Reply