Technical analysis as we know it today would not be the same without the channel indicator. Forex channel strategies derived from it are popular among retail traders. Moreover, the channel indicator MT4 platform provides is useful in many ways. Every retail trader heard of the Forex channel indicator MT4 and the advantages of using it.

Retail traders open an account with a Forex broker to profit from currency pairs movements. That’s what drives them to the Forex market.

However, they come unprepared. By the time they learn about fundamental or technical analysis, the account is gone.

A trend line and a Forex channel represent the starting point in technical learning. After all, building a channel indicator from scratch is simple. Very simple.

First, traders learn to draw a trend line. They connect two points and drag the line on the right side of the screen.

Second, they copy/paste it on the opposite side of the price. This is how a channel indicator mt4 platform was developed.

The beauty of any Forex channel indicator mt4 is that one can automatically insert it on any chart. Just like that!

There’s no reason to build a Forex channel in a classical way anymore. But, this is only the start of any Forex channel trading system.

In time, technical analysis witnessed multiple changes. Traders found new ideas to tackle the ongoing changes in the market. Including how price around a Forex channel evolves.

The Channel Indicator MT4 Traders Use

MT4 stands for MetaTrader 4. This is the most popular trading platform’s version among retail traders.

In time, other versions followed. Moreover, big brokers developed their own trading platforms. However, they’ve to build them starting with the MT4 basis.

As such, the Forex channel indicator mt4 offers, appears on any trading platform. If not, traders can build a Forex channel on their own.

Yet, any trading platform splits the indicators into two main categories. Trend indicators and oscillators.

Guess what category a channel indicator belongs to? Of course, a Forex channel shows a trend.

Every trader wants to ride a trend. After all, when trading, the trend is your friend. But, trends do not form easily.

Furthermore, traders do not have patience. A Forex channel indicator mt4 traders apply on the daily chart requires time.

While it shows trending conditions, traders must have patience with this channel indicator. Moreover, the bigger the time frame, the bigger the potential reward. And, the risk, of course.

As such, traders need to properly understand what makes a Forex channel. On top of it, how to build a channel indicator. And, finally, how to use a channel indicator mt4 offers when the market trends.

But, a price channel indicator mt4 shows is not the only way to deal with a Forex channel. The edges of a channel indicator may show a straight line. Or, not!

Think of the Bollinger Bands indicator. While not a classical Forex channel indicator mt4 traders use, it is, in fact, a channel indicator.

And so, the journey in understanding a Forex channel starts…

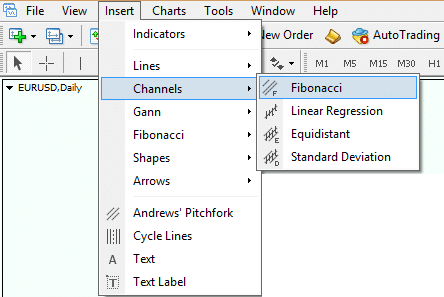

Where to Find the Forex Channel Indicator MT4

That’s super easy. First, traders must download the MT4 trading platform. Second, they must open a chart. Finally, the channel indicator mt4 platform offers is on the main menu.

Just look for the Insert tab. Next, search for the Channel button. Finally, the channel indicator possibilities appear.

The thing is, there are more option to a Forex channel. The channel indicator mt4 may use Fibonacci for displaying the parallel lines.

The Fibonacci ratios make a big part of technical analysis. No wonder the Forex channel indicator mt4 shows, uses them.

Linear regression channels, equidistant ones, standard deviation ones…all these are just different types of channeling in technical analysis.

On top of these possibilities, the classical channel indicator mt4 is part of the trading platform. Not only on mt4. But, on any trading platform.

However, what is a channel indicator if not parallel lines? Moreover, is it possible for the lines of a Forex channel to have a different angle? And, if yes, what is the best channel indicator to use?

When the edges of a channel are not parallel, the indicator shows dynamic support and resistance levels. These are even more powerful than classical ones.

It is like in the case of classical support and resistance. When these form on the horizontal, the levels are not that powerful like the dynamic ones.

Before discussing different Forex channel trading strategies, let’s look at the classical way to build a Forex channel.

How to Build a Forex Channel from Scratch

A trend channel is just this. The channel of a trend.

The difference between a trend line and a Forex channel is huge. The trend line shows only the possible buying/selling place.

On the other hand, a channel indicator shows the possible target or take profit too. Moreover, in a bullish Forex channel, once price holds a support, the take profit level is set on the opposite edge of a channel.

But, perhaps the most important thing is: how do traders know when a channel indicator mt4 break is for real? When does a Forex channel indicator mt4 break really matters?

The answer comes from another pillar in technical analysis. The lower/highs, higher/lows series.

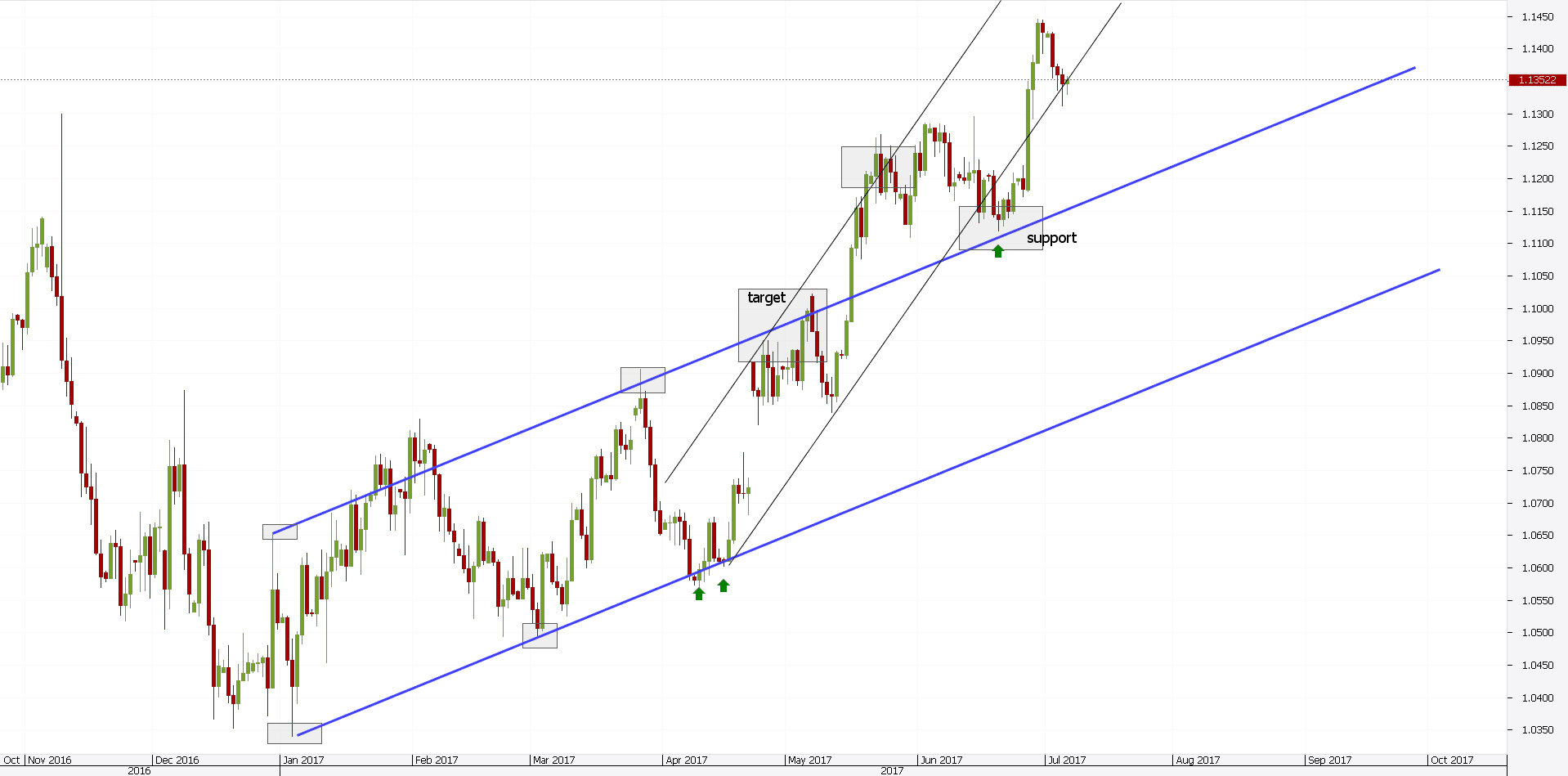

Only when the series break, the channel breaks. Below is the recent EURUSD price action.

To build a bullish Forex channel, traders use a several steps process. First, they draw the lower bullish trend line. For that, they connect the closest two points from the low.

Second, then copy/paste the trend line on the first opposite swing. The resulting Forex channel looks like any automatic channel indicator mt4 offers.

Third, they buy on the lower edge. But, they do that only if the higher lows series still exists.

Next, they set the take profit on the opposite side of the channel indicator. And, they keep continuing the same process until the channel breaks. Or, both the Forex channel and the higher lows series break.

Finally, when the price action gets really bullish, a new Forex channel forms. It has a steeper angle and is thicker.

However, the trading principle of this new channel indicator is the same. It acts exactly like a Forex channel indicator mt4 platform builds automatically.

Channel Indicator Trading Example

And now that you know the basic concept behind the channel trading, I will show you a video example of a successful trade. The video shows a trade I conducted as a result of a bullish channel bounce. I hopped into a long trade for the anticipated bullish channel impulse. Have a look at the video and share your opinion

Simply enter your details to see the video for FREE!

Other Forex Channel Indicator MT4 Possibilities

Technical analysis is filled with multiple channel indicators. In fact, any indicator that shows parallel lines is a channel indicator.

Furthermore, any indicator that shows prices moving in a Forex channel, is a trend channel indicator. Take the Andrew’s Pitchfork indicator, for example.

While not shown in this article, it plots three parallel lines. The result is a double price channel indicator.

And, the list can go on. Further, in our article, we’ll show different channel indicators mt4 offers. Moreover, some are new for retail traders. However, the resulting Forex channel should not.

The Classical Channel Indicator MT4

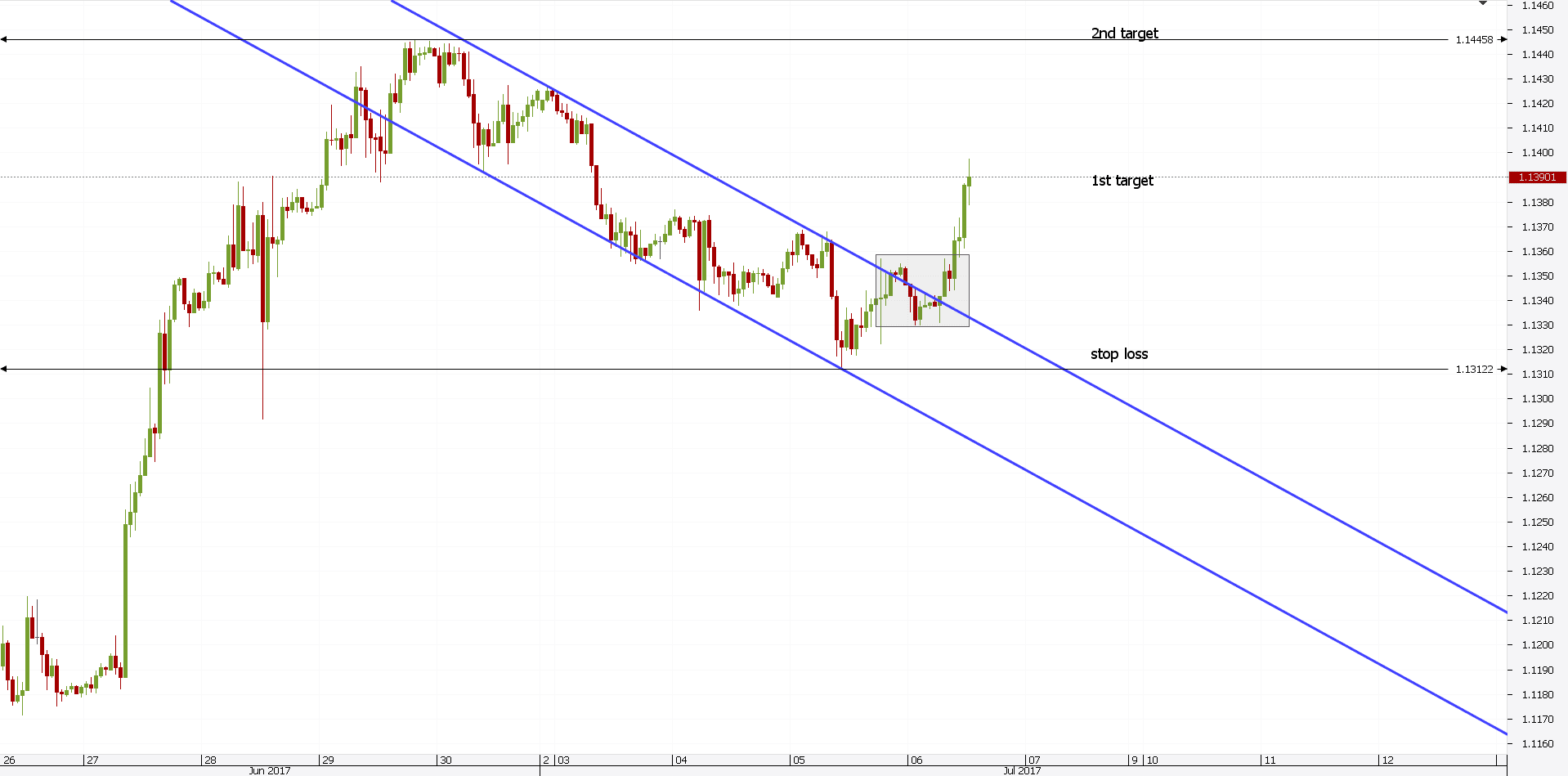

A classical channel indicator mt4 offers shows a trend. However, because of the software plots it automatically, the parallel lines stretch back on the left side of the chart.

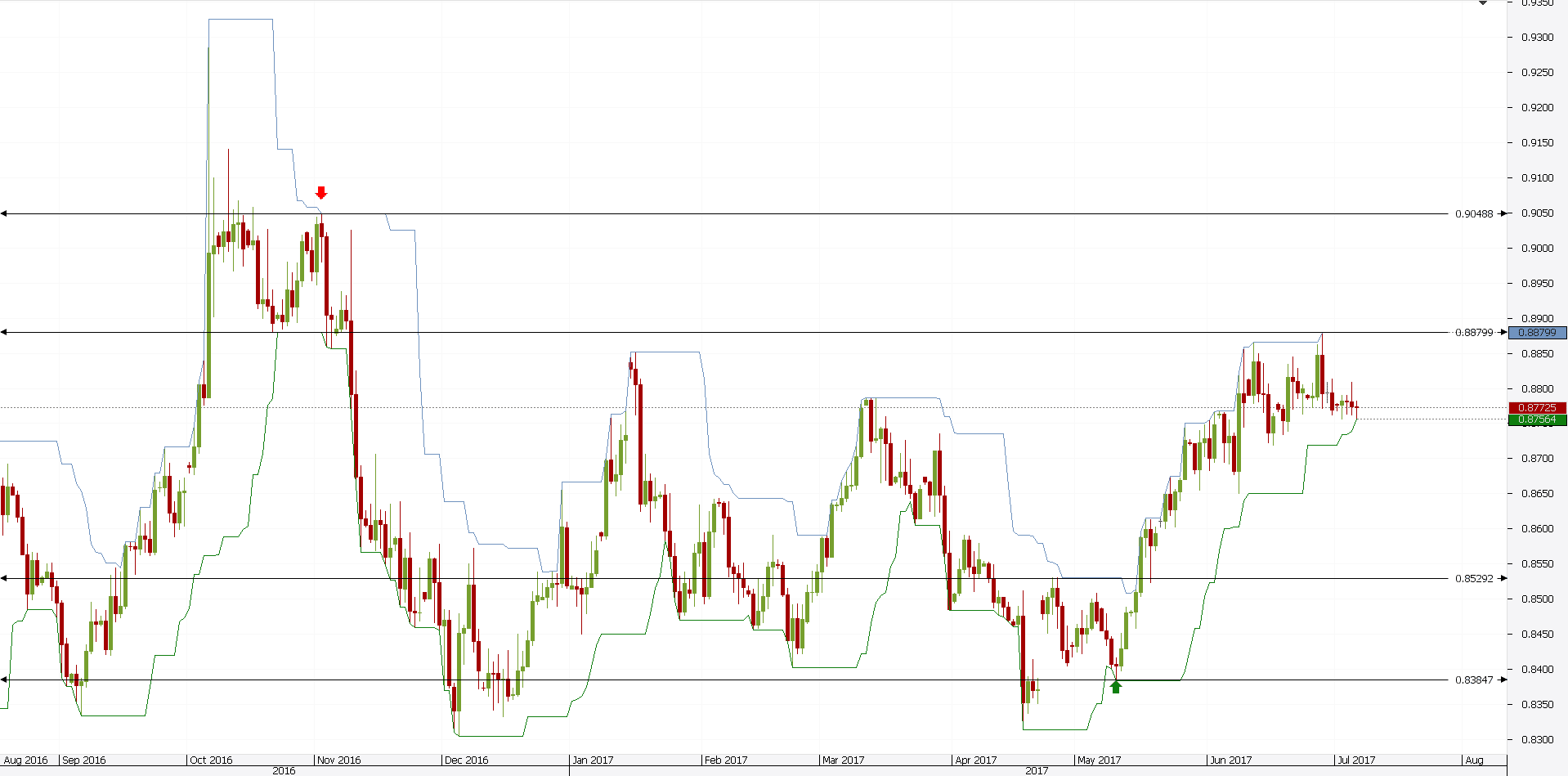

The chart above shows the EURUSD hourly chart price action. And, the blue lines show the falling Forex channel.

For the last two days, the Forex channel indicator mt4 traders saw was bearish. However, the price recently broke the upper edge of the channel indicator.

The channel, Forex traders know, is not broken until the previous lower high is. As such, that’s the entry level.

A proper stop loss is set at the previous swing’s low. At this moment, traders have two options as a result of the price channel indicator mt4 break.

First, aggressive traders will stay on for the market to make a new high. That’s the ultimate target.

When doing that, the trade offers a solid risk-reward ratio. After all, managing risk is everything in Forex trading.

Second, conservative traders will split the distance in two. The resulting first target is where they’ll book half of the profits. Next, they move the stop loss at break-even. And, finally, they stay for the 2nd target.

This is just a simple example on how to use Forex channels. Any channel indicator mt4 platform offers allows you to trade like this.

On the other hand, aggressive traders will try to buy while price still channels. This may offer a better risk-reward trade, but the risks are too high.

The market may end up staying in a trend more than the trader stays solvent. As such, the safest bet is to wait for the channel to properly break.

Other Forex Channel Indicator – The Keltner Channel

Based on the Chester W. Kelner’s discoveries when trading the commodity markets, the Keltner channel is yet another channel indicator. It shows trending conditions in the commodity markets.

Yet, it functions properly on any financial asset. As such, it represents a channel indicator mt4 traders use.

The idea behind trading with this Forex channel indicator is to interpret price closings. That is the ones outside the channel.

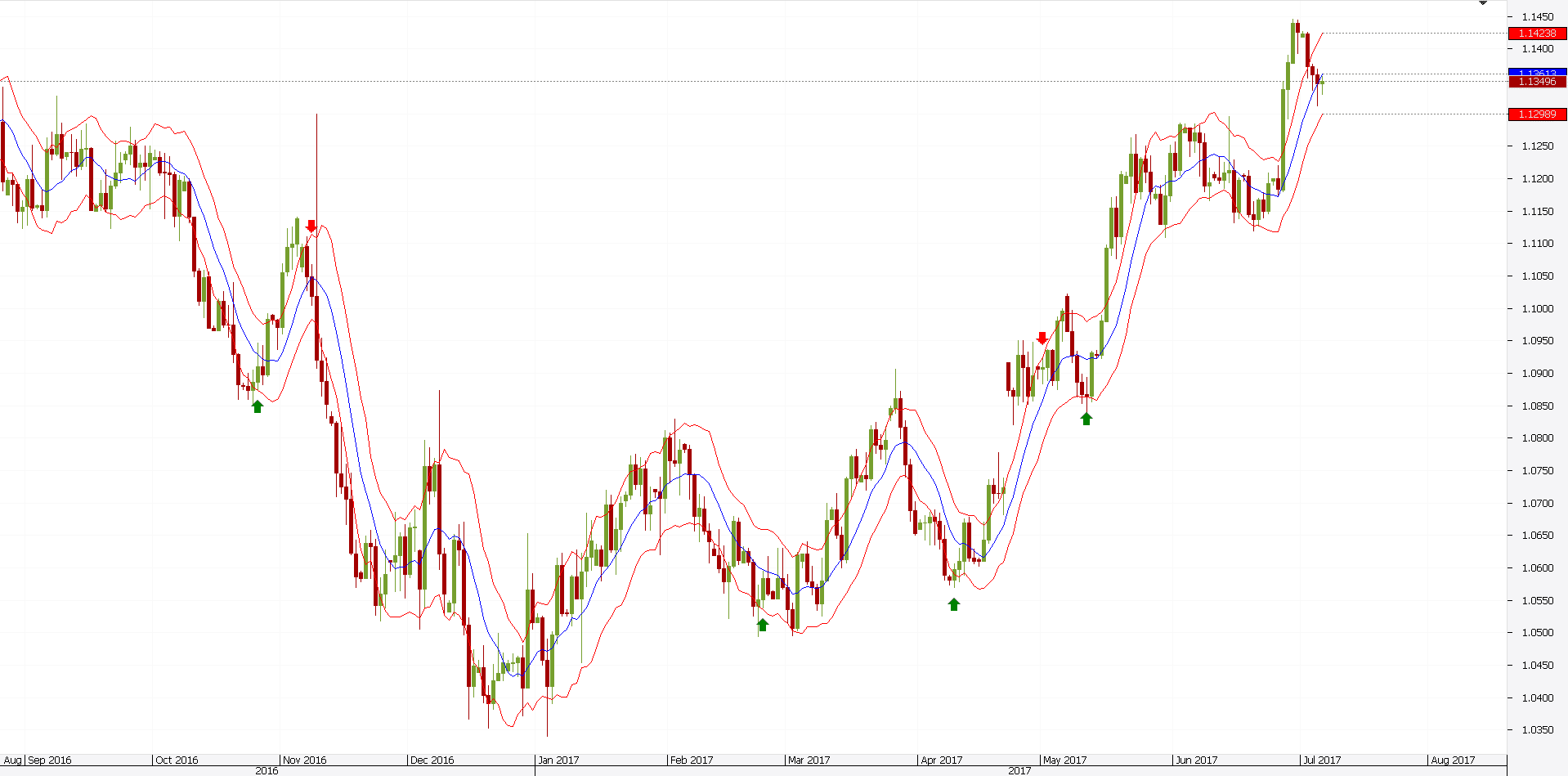

Noticed something different about this Forex channel? The channel indicator doesn’t have parallel edges.

Because of that, the channel indicator offers a dynamic perspective. It adapts to price changes. Instantly. With every candle’s close.

This trend channel indicator mt4 traders use offer great opportunities. Traders look to buy on a close below the lower edge. Or, sell on a close above the upper edge.

However, there’s a catch. Waiting for the price to get back in the Forex channel will spare you a lot of troubles.

The three lines are nothing but moving averages. Like the Bollinger Bands indicator, the Keltner Forex channel shows possible breakouts for future trades. At the same time, it represents a great trend channel indicator.

As you can see, the distance between the three bands is tight. So tight, that the breakouts become visible. That’s the whole point: to properly identify out-of-the-norm breakouts.

The Keltner’s channel is just another way to use self-adapting bands to price levels. Multiple indicators show the same thing. In fact, if you know how to trade with one, you’ll know how to use them all. Only the mathematical formula that defines the edges will differ.

Price Channels – A Different Channel Indicator Type

The price channels indicator is widely used. As a Forex channel indicator mt4 offers, this channel indicator is a mix between a trend indicator and an oscillator.

The price channels show a dynamic support and resistance. Even on the current candle, the levels move symmetrically, until the candle closes.

The way to trade with it is to treat it similar with a break-out strategy. Remember the Bollinger Bands breakouts?

Similar ones work here. Moreover, despite being a Forex channel indicator applied on the actual chart, it also shows overbought and oversold levels.

The EURGBP chart above shows the price channel indicator plotted. The indicator helps to identify strong moves. Eventually, these will turn into lasting trend reversals.

However, the standard interpretation of this channel indicator mt4 leaves room for error. The idea is to buy when the price reaches the lower edge of the channel. And, to sell when it reaches to the upper one.

If there’s one oscillator to compare with, the Stochastics shows overbought and oversold levels. Moreover, when the price touches the upper/lower edges of this Forex channel, stochastics is overbought or oversold.

But, this is not enough. Many fake signals result. Therefore, traders must filter them.

To do that, they use the breakout power of this Forex channel indicator mt4 offers. Before a breakout, the edges of the channel indicator come closer.

That is when the perfect signal appears.

The STARC Bands – A Different Type of Forex Channel

The STARC acronym stands for Stoller Average Range Channels. The channel indicator is very similar with the Bollinger Bands one.

But, is not that popular. The difference is that the Stoller channel indicator gives more accurate trades.

Two bands form the STARC Forex channel. The third one, the one in the middle, is a self-define moving average.

It can be an EMA (Exponential Moving Average) or an SMA. The outcome is the same.

The original interpretation of this channel indicator doesn’t work in strong trends. Traders should buy when the price reaches the lower band. Moreover, sell when it reaches the upper one.

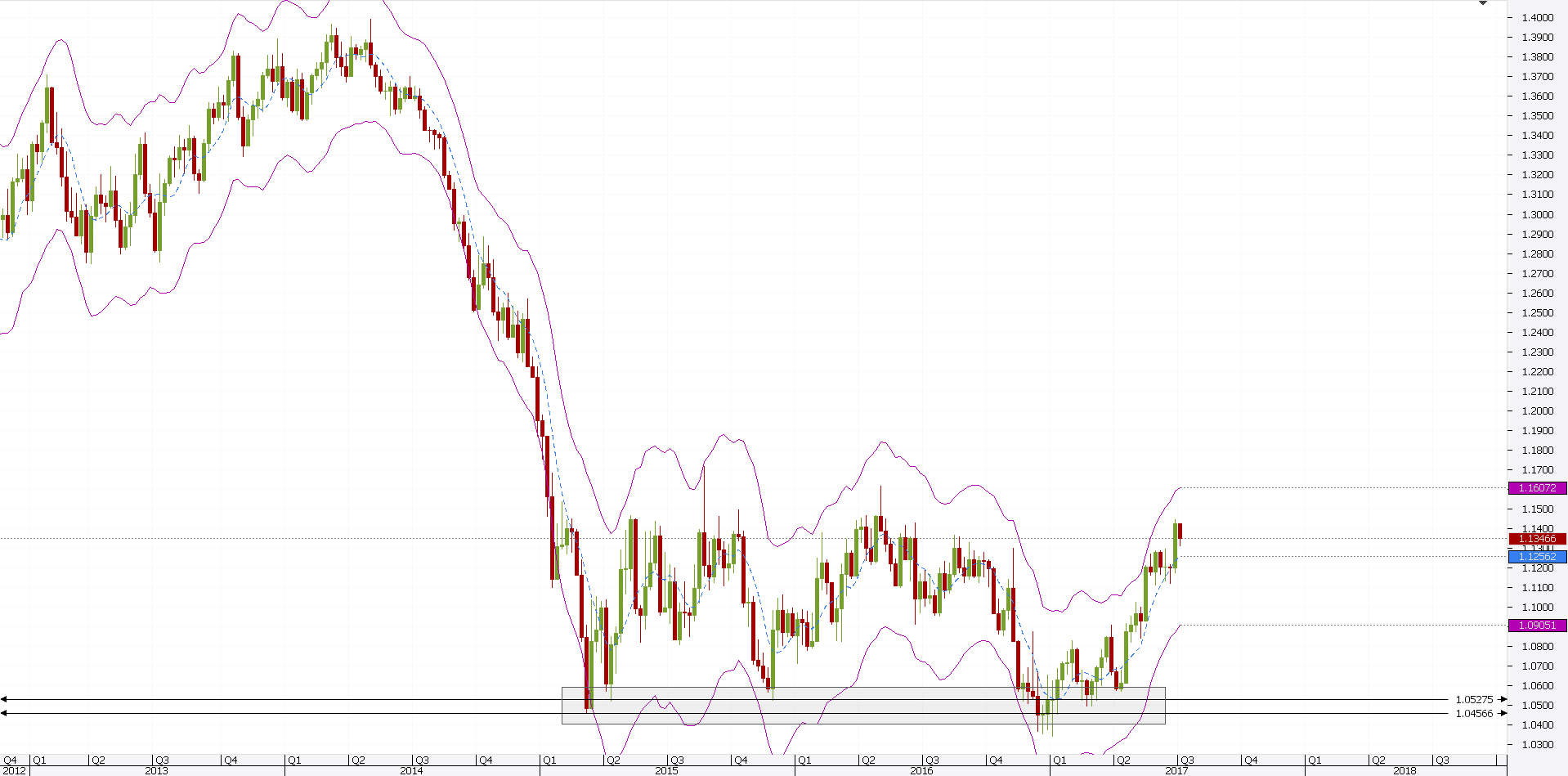

The EURUSD daily chart above shows the opposite. However, it doesn’t mean that this dynamic channel is worthless.

Why not riding a strong trend? Simply stay short until the market forms a reversal pattern. The more the price reaches the lower band, the better.

After the triple bottom reversal pattern, the EURUSD managed to break above the middle band. That’s bullish. While there’s no currency close above the upper edge, expect this Forex channel indicator to show bullish conditions as long as the price stays in the upper half of the channel.

One thing deserves mentioning here. This channel indicator mt4 platform doesn’t offer with the standard settings.

Traders must import it using the custom indicators feature. However, this is rather a simplistic thing to do.

First, you need to have it on your PC. You can search the Internet for it and download it. Second, save it in the file where the mt4 folder is. Use the Indicators folder. Finally, open the mt4 platform and search for it under the Custom Indicators tab.

Conclusion

Part of technical analysis, channeling is a great tool. Different types of Forex channels may show different things. However, the main idea is to identify a trend.

While the Forex market is the most volatile in the world, spotting a trend is not an easy job. Most of the times, this comes with a fake signal.

When trading, there’s a saying: every good move comes with a fake one. As such, traders use various channel indicators to spot the right trade.

If I were to pick a method, I’d say the classical channel indicator mt4 is the best channeling tool. However, as traders, we cannot ignore the benefits other channel indicators offer.

A Forex channel allows riding a trend. The more powerful the trend is, the better. The bigger the time frame the channel forms on, the bigger the implications.

Traders have a strong tendency to buy at support and sell at resistance. In a way, this is normal. A proper support/resistance level gives a nice risk-reward ratio.

But, support and resistance is not everything in trading. However, in channeling, it is all about support and resistance.

One Forex channel indicator mt4 offers uses a different approach. We showed it here just to signal different ways to use a channel indicator.

In the end, it is up to the trader’s strategy. There’s no holy grail in trading. Also, there’s no magical formula. Or, only one way to use an indicator.

As long as a strategy makes money, that’s enough. So, what if you end up buying on the upper side of a Forex channel. As one of the examples here showed, you may end up buying strength.

Keeping an open mind helps in trading. That’s what successful traders do.

START LEARNING FOREX TODAY!

share This:

Leave a Reply