As you trade, you will often come across the term “Lot Size”, otherwise known as “Position Size”. These are crucial when you are trading in Forex as it is the way to manage your risks while preventing the loss of your account over one trade. You are able to utilize Lot Size calculators to determine the most optimal Lot Sizes when trading.

The Lot Size refers to the amount of currency that you are able to control. It is variable and has designations for every lot – Standard Lots, Mini Lots and Micro Lots. The size of these lots is able to affect the amount of risk that you take directly. Lot Size Calculators are able to help you in managing your risk by determining the estimated amount of currency to buy or sell.

Today, we shall discuss a little more about Lot Sizes and how to use Lot Size calculators to your advantage when trading.

Calculating the proper Lot Size when Trading Forex

What aspects you should take into account

To determine the most optimal lot size for you to trade with, you would need a calculator for risk management. The calculator would be able to use information regarding your trading account and assets to decide the risk management that would suit you best.

You would have to keep in mind that the size of lots would affect your account based on how much the market fluctuates. The difference in impact of a 10-pip fluctuation can be felt between small trades and large trades. You will encounter numerous lot sizes as you trade.

How are Risk Management, Risk-Reward Ratio and Lot Size related?

Risk management in Forex helps traders to reduce their losses caused by the fluctuation of exchange rates. This allows traders to trade more safely, while feeling more controlled and less stressed over-trading. The risk-reward ratio refers to the amount of money that is at risk, as compared to the amount of money that can be possibly earned. This can be targeted before placing a trade.

So, how are Lot Sizes related to Risk Management and Risk-Reward Ratio?

You would need to make use of Lot Sizes in order for you to have a proper Risk Management. That means that as long as you have the correct position sizes, you should be able to effectively manage your risk in the market.

You are also able to use a position sizing method with your Risk Reward Ratio. This means that you will take bigger lots if the trade appears to be more profitable. You are able to enhance your trades successfully if the risk take is still acceptable.

Micro Lots, Mini Lots and Standard Lots

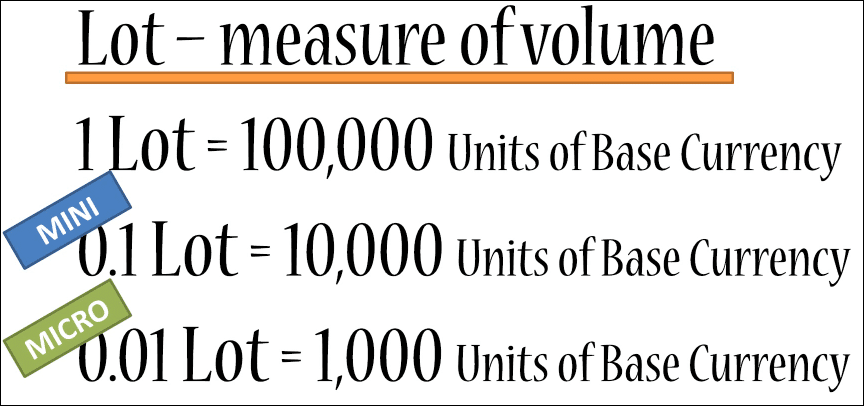

Micro Lots are lots with the smallest value that most brokers can trade with. It holds 1,000 units of the currency that your account is being funded with.

Assuming that your account uses USD as its funding, a Micro Lot would be worth $1,000. Let’s say that you are trading a pair that is dollar-based, this means that 10 cents would be a pip. Micro Lots are recommended for beginners as you are able to minimize your risk as you trade.

Besides the Micro Lot, there are also Mini Lots, which is 10,000 units of the currency that your account is being funded with. This is essentially 10 times more than a Micro Lot. Let’s say that you are trading a pair that is dollar-based, while using the USD as your account currency, then every pip is a dollar.

Do ensure that you have sufficient capital if you are a beginner that intends to trade with Mini Lots as even though a dollar for a pip may seem small, the Forex market may move around 100 pips a day, or even an hour. This means that if the trade is against you, you would have to bear with a $100 loss.

Of course, you are the one deciding on how much you want to risk, but you should have a minimum of $2,000 in your account to trade comfortably.

Lastly, the Standard Lot is a lot for 100,000 units. If you are using dollars, this means that the trade is $100,000. The value of your account will fluctuate by $10 for every pip movement. Assuming that you have $3,000 in your account, a 30-pip movement would cause a 10% change in your account’s balance. As a result, most traders with small accounts would not trade in Standard Lots.

In conclusion, the majority of traders in the Forex market would generally trade in Micro Lots and Mini Lots.

Though it is not as glamorous, trading in Micro Lots and Mini Lots, relative to your account size, would assist you in preserving your trading capital so that you are able to trade in the long run. To learn more about leverage, check this guide.

How to use a Lot Size Calculator

Scenarios where you need to calculate a lot size

Let’s talk about a possible situation in which you have to calculate a lot size when you trade. Our main character for the day is Alan and his account is in USD.

In the first scenario, Alan is trading the AUD/USD pair, so his account denomination and the counter currency is the same.

Alan has $5,000 USD in his trading account and intends to trade the AUD/USD, with a risk of 100 pips for every round of trading. He does not want to have more than 1% of his account risked for every trade, so he would need to calculate his position size in order for him to feel comfortable trading.

Risk = 1% x $5,000 USD

= $50 USD

Value per pip = $50 USD / 100 pips

= $0.50 USD per pip

Assuming that each pip move is worth $1 USD,

Units = $0.50 USD x 10,000 (10,000 units of AUD/USD / $1 USD per pip)

= 5,000 units of AUD/USD

In order for Alan to stay comfortable with the level of risk that he is taking on this existing trade setup, he should trade 5,000 units or less of the AUD/USD pair.

In the second scenario, Alan is trading the same currency pair, AUD/USD, but this time round, his account is in AUD. This means that his account denomination and the base currency is the same.

Similarly, Alan deposits $5,000 AUD, while using the same trading scenario (AUD/USD with a pip stop of 100). He would now need to determine his position size if he is, like before, risking 1% of his account size.

Risk = $5,000 AUD x 1%

= $50 AUD

Assuming the exchange rate for $1 AUD is $0.7000 USD,

USD value = $50 AUD x $0.7000 USD

= $35 USD

Value per pip = $35 USD / 100 pips

= $0.35 USD per pip

Assuming each pip move is worth $1 USD,

Units = $0.35 AUD x 10,000 (10,000 units of AUD/USD / $1 USD per pip)

= 3,500 units of AUD/USD

Alan needs to limit his position size to 3,500 units or less in order to take a risk of maximum $50 AUD on a 100 pip stop for the AUD/USD pair.

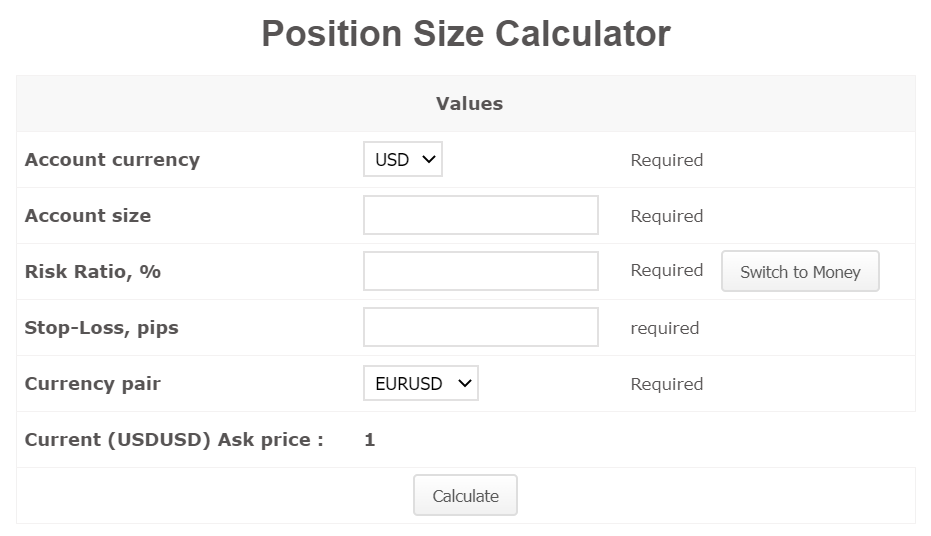

Using myFxbook Position Size Calculator

You are able to use myFxbook to calculate your position size when trading in Forex. It is a relatively simple and self-explanatory process in which you are able to do it by yourself on their website here.

Once you have landed on the website, you should see the screen below.

From here, all you need to do is to

- Select the currency and size of your account

- Key in your desired risk ratio (in percentage), pips and stop losses

- Select your currency pair

Once you have filled in this information, hit the “calculate” button below.

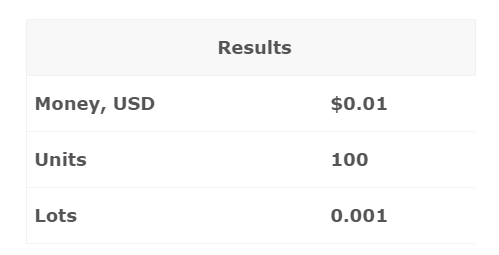

The website will automatically calculate your position size and present it to you in a table below. It should look something like this.

From here, you are able to see the number of units and lots for your position size. You should use position size calculators such as this to help you when trading.

Frequently Asked Questions

Which lot size is better for beginners?

This question would depend on how serious you are as a trader. If you are really serious and very enthusiastic about live trading, then we would suggest you to start trading with only micro lots. You can gradually increase your lot size to mini lot as you become more experienced and confident.

While you choose your desired lot size, we would like to remind you to keep sufficient balance in your account, as well as for you to utilize stop loss and targets when trading.

What does 0.01 mean in forex?

The number 0.01 represents the size of a lot in Forex. This is the size of a micro lot, which if you want to earn a dollar, you would need 10 pips of this lot size. The same goes if you want to earn ten dollars. You would need 100 pips of micro lots.

While you are winning, do remember that the lots work exactly the same if you are losing. You would lose as much money.

How many pips is a lot?

Pips are the most minimal increment in every pair and are mostly quoted in decimal places of a currency, mostly around 4 or 5 decimals.

A lot is the least amount of a single security that you are able to trade, whereas the pip is the most minimal quantity that currency quotes are able to fluctuate on. Generally, a lot is $100,000 while a pip is worth $0.0001. This happens in most dollar currencies but would differ based on currencies, such as the case of the JPY.

Leave a Reply