Forex money management should be every trader’s first concern. Managing Forex money means managing risk and a Forex money management strategy must exist. Traders use various tools, with a Forex money management calculator being one of them.

It may sound fancy, but it’s true. No matter how good you are, or how good your trading system is, in the end, you’ll lose.

Statistics prove that. Almost all retail traders lose their first deposit. How come?

Discipline is one thing. But hey, a disciplined trader already has a Forex money management strategy in place.

Patience is another one. But again, being patient is a virtue and shows Forex money management skills.

Knowledge helps. However, it won’t make you reach.

What will make you reach is to get to know yourself first. Then to use that in your trading.

Managing Forex money is not a video game. That is, despite many retail traders treating it like one.

Moreover, a Forex money management strategy helps any trading account. No one tells you to manage other people’s Forex money.

Do it with your own portfolio first. But can you do it? Easy to say than done.

From all the articles posted on this blog, this one should make the cut. It is the one that makes a difference between winning and losing. Between living and dying on the market.

We’ll address, among others:

- How to diversify a portfolio

- Proper risk-reward ratio for the currency market

- Habits of successful Forex money managers

Our journey into Forex money management starts with risk. More precisely, with defining and understanding risk.

Risk in Forex Trading – Forex Money Management Tools

Managing money is not for everyone. Even if it’s your own money, you’ll have a hard time at this job.

To manage Forex money means you must invest it. That is, to buy or sell some currency pairs. Of course, the idea is to make a profit, not to lose.

What do you do when the market goes against you? Human nature plays tricks on all of us. However, it appears in trading.

So many variables influence the outcome of a trade that handling them all requires more than just knowledge. Ability, too.

Here’s a list of things to watch:

- Spreads. They vary from currency pair to currency pair. And, from broker to broker. A good idea is to use a Forex money management calculator to help to deal with different spreads.

- Swaps. Like swing trading? Well, that’s a costly habit. Keeping positions overnight means paying a negative swap. That’s especially true nowadays with negative interest rates and easy monetary policy.

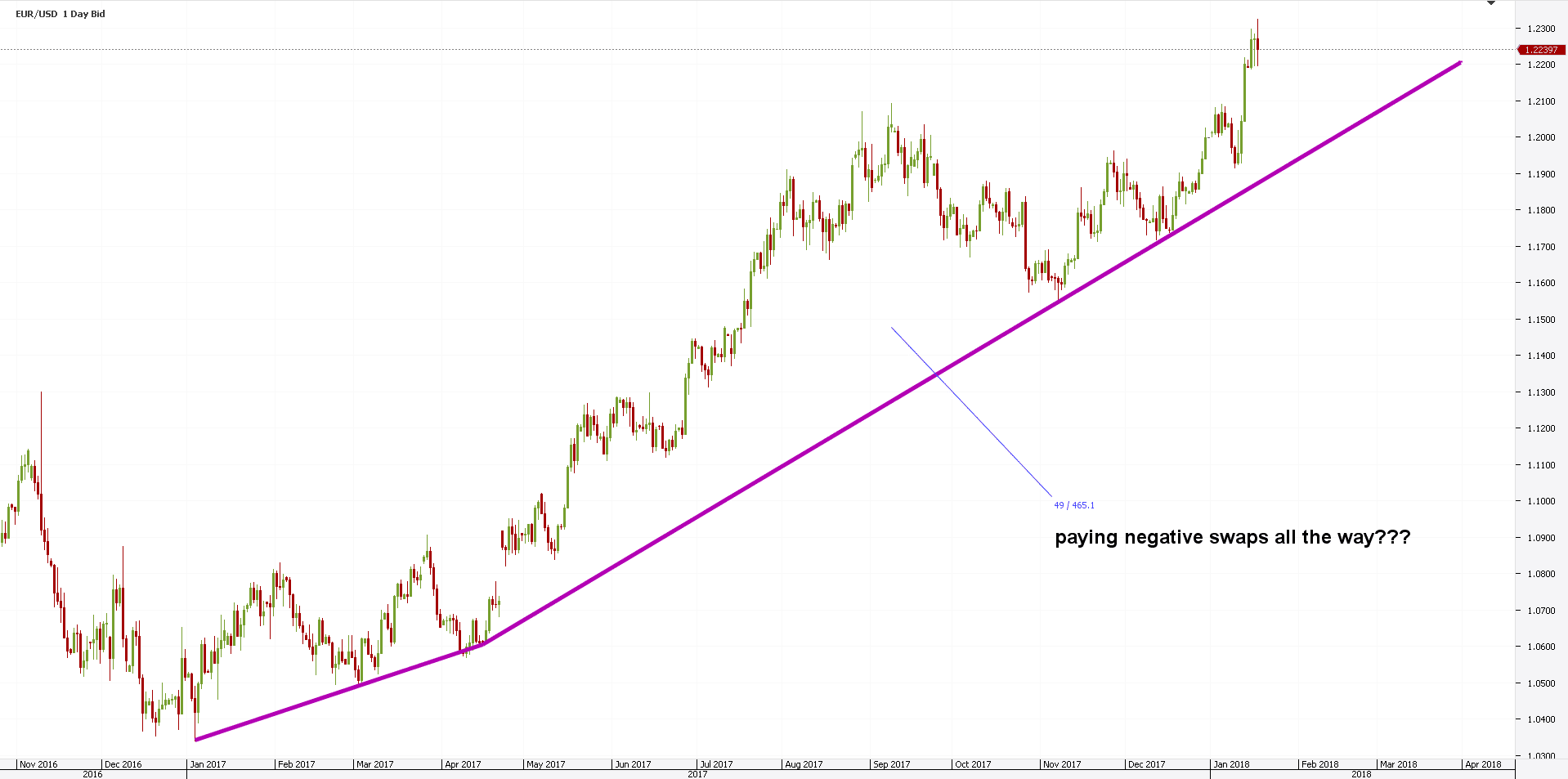

I’m sure you recognize the EURUSD bullish trend. It took place in the past twelve months.

Care to ride it? Prepare yourself to pay some negative swaps before going long!

- Weekend gaps. Many traders choose to close positions over the weekend. This way, they’re mitigating the risk of a gap open on Monday. That’s Forex money management

These are just a few examples, highlighting the complexity of managing Forex money. Or, a portfolio, as a matter of fact.

There’s an entire arsenal of tools to use to help manage money. Above all, managing money means risk. Hence, it all starts with how traders perceive risk.

The 1% Rule – The Best Forex Money Management Strategy

Trading should start with one aim, and one goal only: not to lose. Learn how to avoid losses, and then you can focus on how to make some money.

For that, you need a strategy. A money management system with clear rules gives the desired result.

Percentages work best in this situation. After all, the amount invested/traded doesn’t matter, if the Forex money management calculator uses percentages.

The one percent rule says you shouldn’t risk more than one percent on any given trade. Sound and simple!

No matter what happens, no matter the fundamentals, the “noise” in the market, you don’t break it. Can you do that?

You must! Because following this simple rule, you need over seventy (70!) consecutive losing trades to wipe out only HALF of your account.

Well, if this happens, you’re not ready to trade in the first place. To have so many consecutive losing trades, it means something is wrong. You’ve got to fix that as quick as possible.

To do that, you still have half of your initial trading account to use. Either going into trading education (e.g., here at Forexboat.com we offer a plethora of solutions) or just take a break and give trading a serious thought.

Greed and fear play an essential role. It is extremely difficult to keep calm when the market drops like a falling knife.

However, if you know your stop is in place, you’re safe. After all, you cannot lose more Forex money than the calculated risk. Therefore, a given risk per trade helps.

The 30% Rule – Forex Money Managers’ Choice

While the 1% rule is well-known among traders, this one isn’t. There’s a reason for that.

To use it, discipline is key. Moreover, it requires constant monitoring.

Most of the retail traders have a job. They trade for fun, like a hobby, in their spare time. As such, the 1% rule works because:

- It gives a predefined level. Set and forget!

- Pending orders work great

But the 30% rule differs in every aspect. Firstly, it deals with the equity in a trading account. And, as all traders know, equity changes with the market.

Second, it deals with the leverage too. In fact, the percentage refers to the margin invested, rather than the equity.

Let me explain. For every trade, the broker blocks a margin. You know, like a bank asking for a collateral before giving you a loan.

The 30% rule deals with the margin level. No matter what, when the margin blocked exceeds 30% of equity (not balance!!!), you should start getting out.

Getting out means freeing margin. Hence, you open the possibility for new trades.

Diversifying a Portfolio

Money management in Forex trading starts with diversification. If you want, this is the name of the game.

Because dealing with risk implies diversifying the risk, money management in Forex implies spreading the risk.

On old saying states “never put all your eggs in the same basket”. That’s so true in Forex trading!

Typically, the spread happens over various asset classes. A macro-fund will spread the risk over equities, emerging markets, options, bonds, FX, and so on.

But this doesn’t mean one can’t spread the risk when dealing with Forex money management. Just the opposite!

Here’s a quick guide on how to build a Forex money management strategy that uses diversification:

- Cash position. Make sure you always have a cash position available. If not, how to enter on pullbacks?

Typically, cash takes around 15%-20% of the portfolio size. Cash is still king, right?

- The USD. This is the world’s reserve currency. Moreover, it splits the Forex dashboard in majors and crosses. Divide the rest of the portfolio with 75% allocated to majors, 25% to crosses. (majors travel more than crosses, hence the difference).

- Scaling. Scale into a position. When doing that, you diversify your entries. Therefore, you spread the risk of a wrong entry across multiple levels.

The above represents the basics of diversification. Complex algorithms help the Forex money management industry to find the best portfolio allocation across various currencies. More on this, perhaps another time.

Diversification helps dealing with overtrading too. As such, knowing risk-off/risk-on environments end up in diversifying the overall money management Forex portfolio.

Forex Money Management and Risk-Reward Ratios

To start with, a risk/reward ratio deals with how much you plan to lose, and how much to win. Anything below 1:1 doesn’t work. Not even that.

1:1 means you risk $1 to make $1. That’s not good enough.

Because trading is not a certainty, you need to give room for failure. Loosing is part of the game. Embrace losses! But, do that in a calculated way.

In trading, you better know your way out, before you go in. As such, one must know the risk tolerance. But, also the reward.

Because risk and reward go hand in hand, dealing with the two makes sense for every Forex money management strategy. The question is, how to combine the two?

How much is enough? Or, more precisely: how much is too much?

Trading is a game of expectations. Unrealistic ones lead to wiping out the trading account.

A risk-reward ratio must adapt to the market used. Such ratios differ from market to market, of course.

Volatility differs too. Because of that, the approach to every market differs.

What works on the Forex market, doesn’t work on stocks. Or, what works on stocks, fails in bonds. And so on.

Forex money management deals with two risk-reward ratios. Because the currency pairs belong to two different categories, that’s why:

- Majors (e.g. EURUSD, USDCAD, USDCHF, GBPUSD)

- Crosses (g., EURGBP, AUDCAD, NZDJPY)

They have a different velocity. Hence, the risk-reward ratios differ.

Majors and Proper Risk-Reward Ratios

A major pair deals with the U.S. Dollar. And, the dollar’s implied volatility allows for larger reward when compared with the risk involved.

A proper risk-reward ratio, in this case, would be anywhere between 1:2.5. Or, even 1:3.

What does it mean? Essentially, if you win one trade and lose three, you’ll end up at break-even in a 1:3 rr ratio.

Or, if you risk $100 you’ll make $300 if the take profit comes. However, there’s a catch.

As always, discipline matters. Any arbitrary involvement in the process means “messing” with the odds.

Would you do that? Most likely yes. All rookie traders do. That is until they lose their deposit.

After that, hearing what Forex money management is, they start doing things the right way.

Setting the Risk when Trading Crosses

Most crosses range. By most, we talk about over two thirds.

Because of a tight range, it makes no sense to use bigger risk-reward ratios. But also, you shouldn’t go below 1:1.

Using 1:2 makes sense here. However, sometimes even this is difficult to achieve.

Not on all crosses, though. Some traders find it difficult to handle Forex money when trading risk-associated crosses (e.g., GBPCHF, EURAUD). They travel a lot.

Some trading instruments have a direct link to risk. Take gold, for example.

When something goes wrong, flows pour into it. That’s investors looking for safety.

The same with currencies. CHF (the Swiss Frank) represents the best example. Troubles with the Eurozone? Everyone flocks into the Swiss currency.

Such risk is seen in crosses too. However, in general, crosses range more than majors. Depending on the currencies involved, ranges differ, of course.

But still, the risk-reward ratios associated with trading crosses should be smaller.

Forex Money Management Calculator to Use

Today’s trading world depends on robots. Expert advisors and high-frequency machines rule today’s Forex market.

As such, it only makes sense to use a “robot” or a “system” as a Forex money management calculator. After all, if everything is automated, why not automate the Forex money management?

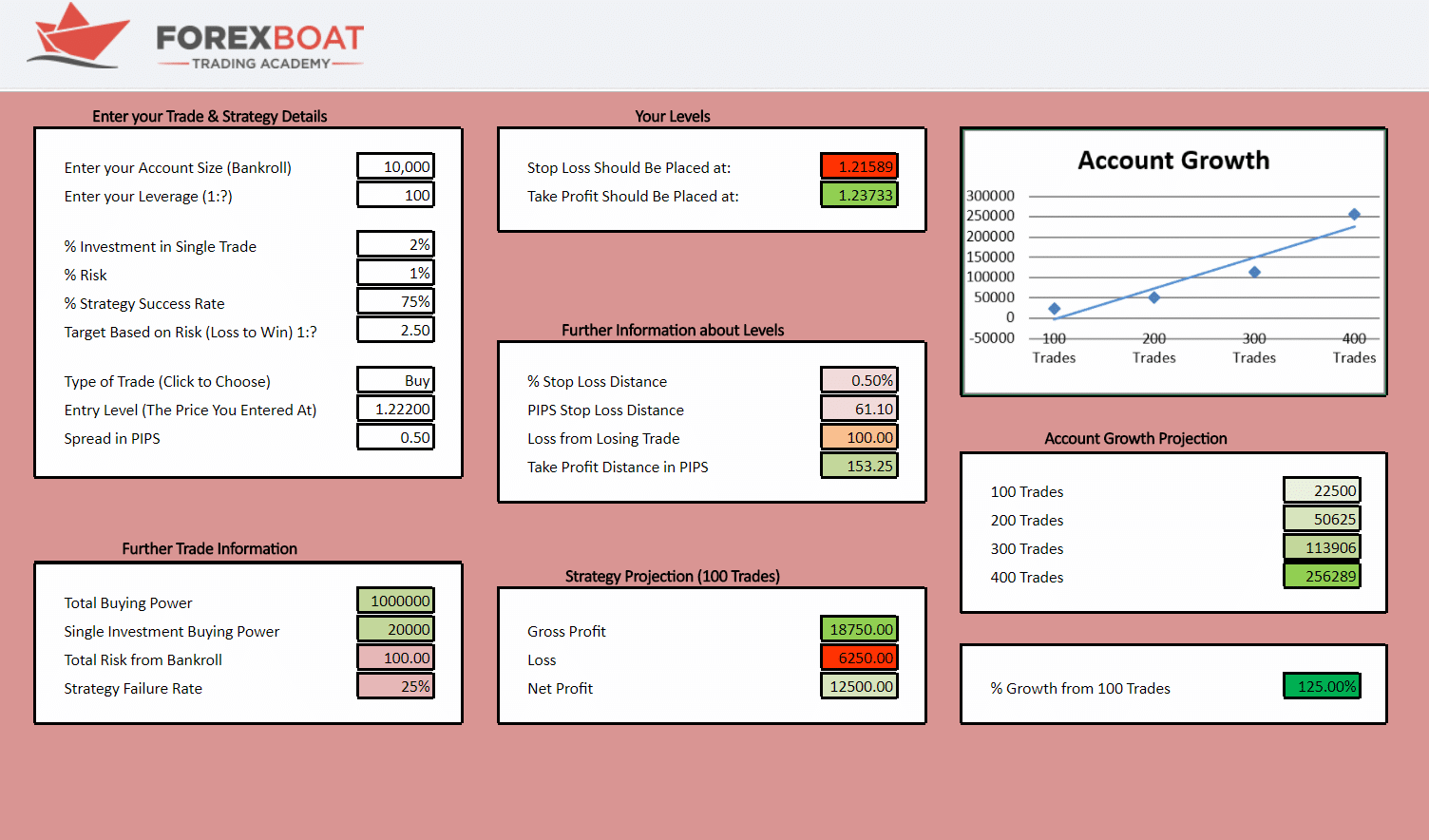

Just click on the image above, and you’ll be redirected to our Forex money management calculator. A brilliant tool!

Here’s a quick step by step guide on how to use it:

- Put the account size in. That’s how much you have = the balance. We’ll use 10000.

- Enter the leverage. 1:100, 1:200….and so on, depending on your broker and the type of the trading account you have. We’ll use 1:100 for this example.

The combination of nr. 1 and 2 gives you a Total Buying Power of 1000000. Not bad!

- How much you want to invest in any given trade. We’ll use 2%

- 1% risk, as per the rule.

- This point refers to the strategy’s performance. Remember, no one wins 100% of the times. As such, you can grow your account with lower percentage wins. We’ll use 75%, as an arbitrary and realistic level.

- 5 as a risk-reward ratio, as discussed earlier.

- Now we need to use a trade. Let’s assume we buy the current 1.2220 EURUSD level. With a spread of 0.5. Most brokers offer that.

Interpreting the Forex Money Management Calculator Results

So far, we entered the variables. Now it’s time to see the results provided by this tool.

Before doing that, please focus on the strategy used. By all means, this represents just a plausible forecast based on the risk parameters. This is what this article is about: to find the best way to interpret/manage risk.

The tool gives:

- The level to place the stop loss

- Where to place the take profit

- Pips until stop loss reached

- How much you lose on the trade

- The take profit distance in pips

Basically, it tells you everything you need to now. As such, you can interpret the Forex money strategy you use, to see if it fits the goals.

Moreover, it offers a projection for the next one hundred trades. But, with one condition: to use the same variables in terms of the defined risk for the first trade.

This Forex money management strategy defined earlier gives a 125% return on one hundred trades.

Of course, like any tool, it offers just that: a projection. Everything else depends on the actual strategy, entry level, execution, broker’s conditions, and so one.

Yet, it is a great tool to project the account growth. And, in a disciplined manner.

Conclusion

This time it feels right to end as we started. Namely, if you learned something from this article, it is worth more than you can imagine.

I would associate Forex money management with coaching. You can have all the greatest players on one team. It doesn’t guarantee the victory.

A coach comes with the strategy. He/she knows the game, the strategy, what works best, what won’t, and so on.

The same in trading. Forex money managers deal mostly with the overall environment, and not with a specific trade only

They look at the whole picture and plan stating the goals to reach. Realistic goals, not fantasies.

People come to the Forex market looking for reaches they can’t build anywhere else. To some extent, that’s understandable.

But what makes one think that’s easy? It isn’t, and proper planning is the road to success.

Moreover, the market consolidates most of the time. Statistically, over sixty or even more of the time the market spends time in ranges.

What to do then? Closing the trades? If yes, you pay the commissions. And the spread.

Keeping them open? Well, most likely you pay negative swaps overnight.

You see, a good Forex money management strategy deals with all these aspects. It is the result of a proper market understanding. And, of risking in such a way as to make it possible for the account to grow.

But anything related to trading bears risks. Even the most successful Forex money managers have bad years. It’s only normal.

If there would be a crystal ball for investing, you won’t be here, reading this article. Right?

START LEARNING FOREX TODAY!

- Best Forex Money Management Strategy

- Calculator

- FOREX

- Forex Analysis

- Forex Money Management

- FOREX Strategy

- Money Management

- Money Management Strategy

- Risk-Reward Ratios

- Technical Analysis

share This:

Leave a Reply