Forex Factory is one of the most popular sites for forex traders online today. Its calendar provides great information for all types of traders. Using it will help you to understand the impact of news on the market, which could reflect on increased profit on your account.

So, how do you use the Forex Factory calendar? To use the Forex Factory calendar, you’ll need to:

- Go to Forex Factory

- Understand each column, including the actual and forecast results.

- Set up your time zone,

- Set up your event filter, and

- Filter your news.

Table of Contents

The Forex Factory Economic Calendar

The Forex Factory calendar provides a list of news releases that impact global economics. The schedule includes significant news releases like:

- Housing data

- Employment data

- Inflation data

- Interest rates

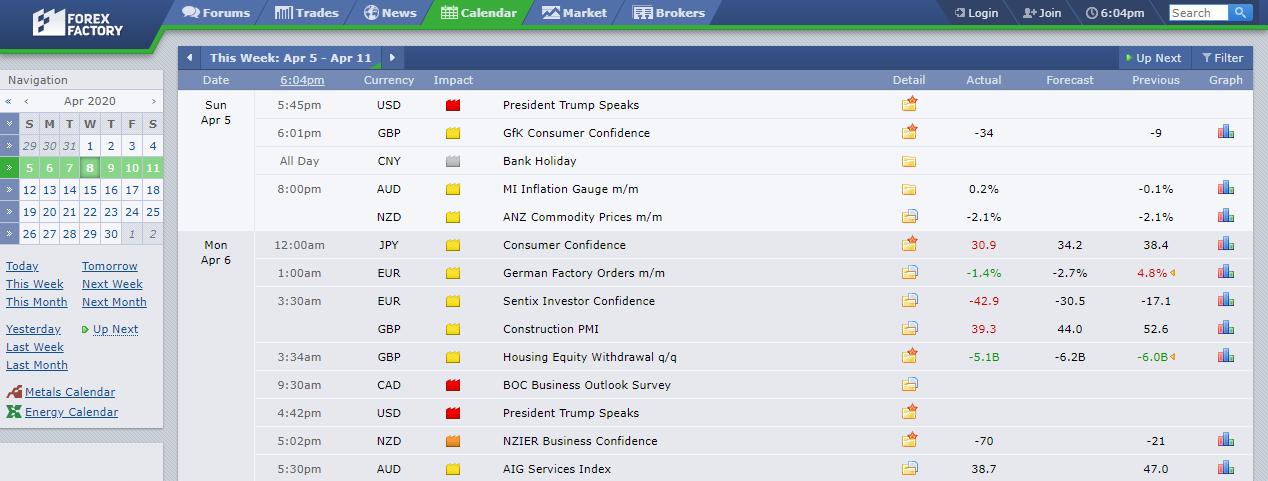

The different news releases are posted for many countries at different times and dates. You’ll see these displayed on the calendar:

So, how do you access it?

One of the things that’s great about Forex Factory is that you won’t have to download anything onto your computer to use the calendar. Then all you need to do is simply go to the Forex Factory calendar website here.

Once you do that, let’s have a look at the different columns on the calendar so that you can customize them to suit your needs.

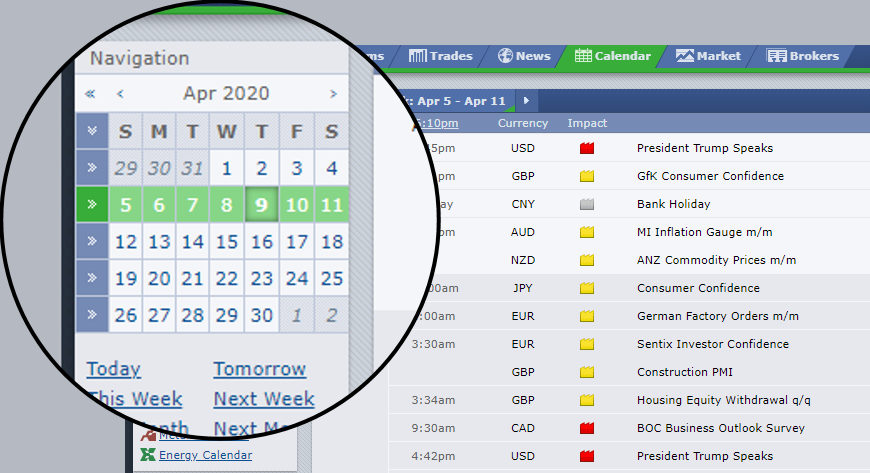

The section on the right of the screen the navigation panel. Inside it, you’ll notice a few useful items. The first item is the current month. If you want to select any dates from that month, you’ll move to an area where a schedule of upcoming forex news data will be made available.

You can also choose dates that have passed, and you’ll see news and information that was posted on that particular day.

You’ll also notice a few options for short cuts with some links that say:

- Up next

- Today

- Yesterday

- Tomorrow

If you click on those links, they’ll give you the news information for that day, or the schedule of news:

The Currency Column

In the currency column, you’ll see information about currency pairs that will be affected by the release of particular forex information. For example, let’s say that the United Kingdom decided to announce interest rates. That means that GBP and the currency pairs that are linked to it will be affected.

The Impact Column

The impact column discusses the possible impact forex news will have on a particular currency and its pairs. These are the four colors used:

- Red means that a high impact will occur due to upcoming forex news.

- Brown means that there will be a medium impact depending on the forex news to come.

- Yellow means the upcoming forex news will have a low impact.

- Grey is used to highlighting bank holidays. So most probably the currency will have a low trading volume that day.

The Name of News Column

There’s nothing particularly fancy about this column. With this column, you’ll see a list of news information that is expected to be released and their schedule.

The Detail Column

The Detail column displays a yellow folder icon. By selecting that icon, you’ll get a section displayed that contains more information about a specific event. You can use this feature to access more information about items like:

- What the forex event indicates

- How it might impact currency

- The source of the event release

- When similar news will be released

- The history of both the actuals and forecasts

The Actual Column

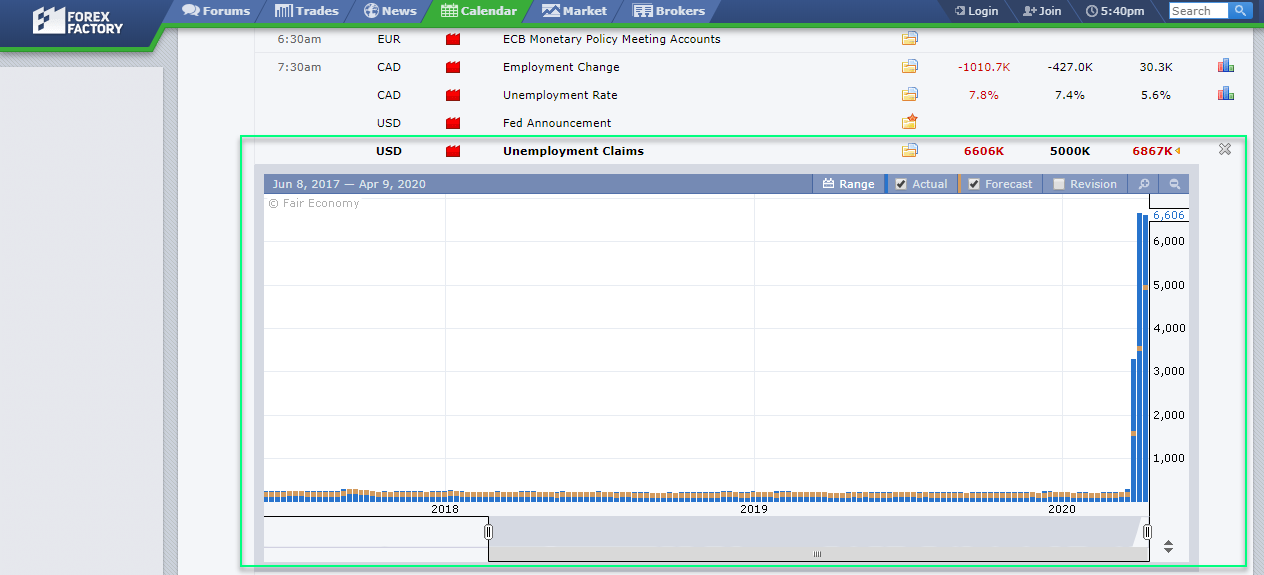

The actual column represents present figures that get released or have been updated recently. So, if you’re looking for actual statistics covering the unemployment claims in the US, and the news released that the US unemployment claims are 6606k, then you should see that number listed in the actual column.

The Forecast Column

Following the actual column, you’ll notice the forecast column. That column demonstrates what people were predicting before that news being released. You’ll see whether those predictions were correct or incorrect, and that’s measured by the “actual” figure information that is shown in the actual column.

It’s essential to understand both the forecast and actual columns. Most traders look at the differences between these two columns and analyze them. For example, let’s say experts are predicting that Australia’s Reserve Bank will drop the interest rate from two and a half percent to two percent within the month, if that prediction were made, traders can make trading decisions or adjust their strategies involving the AUD when the actual figure is released.

The Previous Column

When you click on the previous column, you’ll see the former figures for the news event you are searching for.

The Graph Column

The graph column can be used by clicking on the graph icon. Once you do that, you’ll see the actuals versus the forecast figures based on the news events and dates graphed out for you. This can help get a notion of how certain economic indicator has been evolving for a while.

For instance, you can see how the US Unemployment Claims increased exponentially during the COVID-19 crisis.

Setting up Your Timezone

One of the best things about the Forex Factory calendar is that you can tailor the schedule to fit your timezone. That way, you’ll get news events based on where you are living, which helps a lot when it comes to organization. To accomplish this, follow these steps:

- Move your mouse to the top right-hand area of your screen.

- Select the time stamp and then enter it according to your preferences.

- You should then see the feature configure the news event information so that it’s displayed in your time zone.

You shouldn’t overlook setting up your time zone when you first start using the Forex Factory calendar. That’s because you need to have the platform in your time zone. That way, you’ll have the right time for every event. Once you set-up your time zone, it should stay that way in your settings until you decide to change it again. So, you won’t need to do this each time you use your calendar.

Using the Event Filter

While it’s nice to see all the information, you’ll probably feel overwhelmed with all the data the forex calendar is going to give you. So, it’s better to stay organized and have only the information you need immediately. To avoid spending wasted time scrolling through news information that won’t apply to you, you should consider setting up an event filter.

Using the event filter in the Forex Factory calendar will give you the option to restrict the news that you see so that you’ll only have information about your preferences. If you only focus on particular currency pairs as a trader, then you’ll want to set-up your event filter to prevent yourself from feeling overwhelmed with unnecessary event information.

To set this information up, please do the following:

- Go to the “Calendar” tab located at the page’s top area.

- Click on the “Filter” button that’s located on the right-hand side of the screen.

- Enter a check on the orange and red boxes. By doing that, you’re asking the calendar only to tell you information that has a high and medium impact. If you also want to select low, that’s up to you.

Another thing you can do to save you time is to select the news only of the countries you want to follow. However, we’d recommend checking all the biggest economies because it’s important to know what’s going on and how the major currency pairs can be impacted.

You can also get access to breaking news when you need it so that you can be aware of new information that could impact your trades. To do this, follow the steps below.

- First, click on “News” located on top of the page.

- Then, go to “News/Hottest Stories,” which is located on the right side.

- Now, check the boxes that say “Breaking News” and “Latest.”

- Now, you’ll only see essential news updates on the right-hand part of your screen.

How to Trade Forex Using Fundamental Analysis

The best way to interpret economic news is to have a trading plan for the week/period ahead. Knowing what data follows is a great advantage ahead of the market. The problem is that everyone looks at the same data. Yet, not everyone makes money in the Forex market. One way to succeed is to use the FX trading calendar correctly. Keep in mind that fundamental analysis in Forex trading is as important as technical analysis.

Any discussion about Forex volatility and what causes it starts with the USD. As the world’s reserve currency, it influences the entire Forex dashboard like no other currency. Because of the dollar, the currency pairs form two categories: majors and crosses. Any major pair has the USD in its componence. Hence, a major don’t.

Only by splitting the pairs in such a simple manner, traders can avoid Forex volatility surrounding critical economic events. For example, one way to prevent wild swings in the trading account is to trade cross pairs during American Forex news. After the Bretton Woods conference, the USD became the pillar of the world’s financial system. Moreover, the Nixon shock in 1970’s decoupled it from the gold standard.

From that moment, it was only a matter of trust in the USD that kept foreign investors buying it. Nowadays, the USD is still the preferred choice when nations build foreign exchange reserves. This is an enormous privilege the USD enjoys, and other countries envy the USD status.

Most Relevant US Forex Trading News

The Forex calendar news out of the United States is one of the busiest of them all. Because of the dollar’s role, every market depends on the shape of the US economy.Moreover, the Intermarket correlation means the dollar will move not only the Forex market but also other markets like bonds, stocks, options, and so on. Hence, it is all about interpreting the economic news.

For a currency, it is all about the interest rate level. Hence, the Federal Reserve interest rate announcement and press conferences move the dollar. And, the Forex market. The Fed meets every six weeks. On a Wednesday, right after the London’s close, the Fed releases the FOMC (Federal Open Market Committee) Statement.This is a text describing the monetary policy.

Once a quarter, or every two sessions, a press conference follows the FOMC statement. Never has the Fed hiked or cut the federal funds rate without a press conference to follow.

Therefore, the federal funds interest rate level is THE Forex news to watch. As a rule of thumb, the higher the interest rate goes, the stronger the dollar becomes. The Forex market volatility increases tremendously during the Fed presser. Press representatives from around the world ask questions. And, the Chairman/Chairwoman answers. No one knows the questions. And, no one knows what the answer will be too. As such, the USD makes large swings all over the charts. Effectively, it trips stops both for longs and for shorts.

CPI or Inflation to Mark in the Forex Calendar News

Inflation shows the change in the price of goods and services over a period of time. Typically, the inflation or Consumer Price Index (CPI) comes out monthly. It is one of the closely watched Forex news. The market reaches extreme Forex volatility levels if the CPI deviates from the target. Traders know the Fed closely watches inflation. Part of its mandate, the Fed targets a two percent level for the CPI. However, it doesn’t look at the regular CPI. Instead, it considers the Core CPI. Or, inflation without transportation, energy and food costs.

The standard interpretation is that when inflation falls, the currency depreciates. When inflation is in the fall, expectations grow that the Fed will ease the monetary policy. Or, it’ll cut rates. Because there’s a lag between the two Forex news, traders react on the spot. After all, trading is a game of expectations.

As a Forex volatility indicator, inflation doesn’t “damage” the charts as when the Fed changes the rates. However, if deviates strongly, the Forex volatility spikes as traders bet the Fed will react.

ECB and Inflation

Everyone knows these days that the ECB has a problem with inflation in the Eurozone. More exactly, with the lack of it. As part of the ECB’s mandate, a normal inflation should hover around 2%. In this relation, levels of 1.8% or 2.2% are enough for a steady economic growth. Higher inflation levels lead to the central bank raising rates. Contrary, lower inflation results in the central bank cutting rates. Higher rates mean a higher currency, while lower rates are bearish for a currency.

It is clear now why inflation is so important for the central banks. Hence, it is one of the most important Forex fundamental analysis indicators.

The end of October 2013 saw the inflation in the Eurozone unexpectedly falling. As per the economic calendar, the expected or forecasted value was 1.4%. However, the actual number came at 0.8%. Before moving forward, please refer to the mandate of a central bank: to keep inflation below or close to 2%. Such a release was far, far away from the ECB’s mandate. Hence, market participants started to sell the Euro in a frenzy. Why?

Because part of the fundamental analysis of Forex market is to trade expectations. In this case, based on the inflation data, expectations grew that the central bank will cut rates at the next meeting. Cutting rates are bearish for a currency and sellers step in. So they did, as the chart above shows.

The next ECB meeting was after two weeks and traders sold the Euro on rate cut speculations. This is how the economic calendar Forex influences trading decisions. For the next two weeks, all Euro pairs suffered across the dashboard. No other news part of any economic calendars mattered anymore.

The ECB did deliver. The central bank cut the interest rate, and the EURUSD dropped like a rock: two hundred pips in a few minutes. However, the lows in that day turned out to be the lows for a long period ahead. The explanation comes from the press conference.

A press conference follows forty-five minutes after every ECB meeting. The President reads the statement, and press representatives ask questions. During the press conference, the ECB President (Mario Draghi) supported the rate cut. However, he added that the ECB expects inflation to pick up next year.

Because of that message, traders focused, yet again, on expectations. It turned out that was the low on the EURUSD pair for quite some time moving forward. It didn’t matter that the next day the NFP in the United States came better than expectations. So, bullish for the U.S. dollar. Traders simply disregarded the data and before you know the pre-ECB highs disappeared. So powerful the fundamental analysis in Forex is.

High-Frequency Trading

Part of understanding the fundamental analysis Forex market moves upon is to know the players. Who’s responsible for the sudden spikes or dips in a currency pair? Retail traders represent less than six percent of the Forex market. The rest are big commercial banks, Forex brokers, liquidity providers, investment funds, and so on.

The last decades brought a shift in the trading industry. Technological advances made room for one of the most powerful industries of them all: High-Frequency Trading (HFT). HFT stands for algorithmic trading. Super-computers or trading algorithms buy and sell a currency/currency pair thousands of times per second.

The Forex calendar news is the reason why these robots trade. They buy or sell based on the difference between the actual and forecast value of the economic calendar Forex news. Buying or selling happens in a blink of an eye. This is why the market moves so aggressively. This happens in less than a second after the economic calendar FX news comes out.

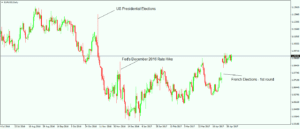

The chart above is only an example of how a Forex fundamental analysis strategy might work. While the U.S. Presidential elections and the 1st round of the French elections were difficult to interpret, the Fed’s rate hike wasn’t.

The best Forex fundamental analysis is the result of adjusting your positions to the central banks’ monetary policy. Instead of following a technical trend, traders follow a fundamental one after they learn Forex fundamental analysis.

Leave a Reply