The GBP/USD trend remains extremely bullish and probability is highly in favor of the uptrend continuation. Although 1.3000 must be watched for a break below very closely as it remains a key support area.

Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice.

This analysis was done on MetaTrader 4.

Click below to open a Free Demo Account with our trusted brokers:

Trade Idea Details:

GBP/USD symbol on the MT4 platform

Type: Bullish

Key support levels: 1.3046, 1.3000

Key resistance levels: 1.3130, 13170

Price Action:

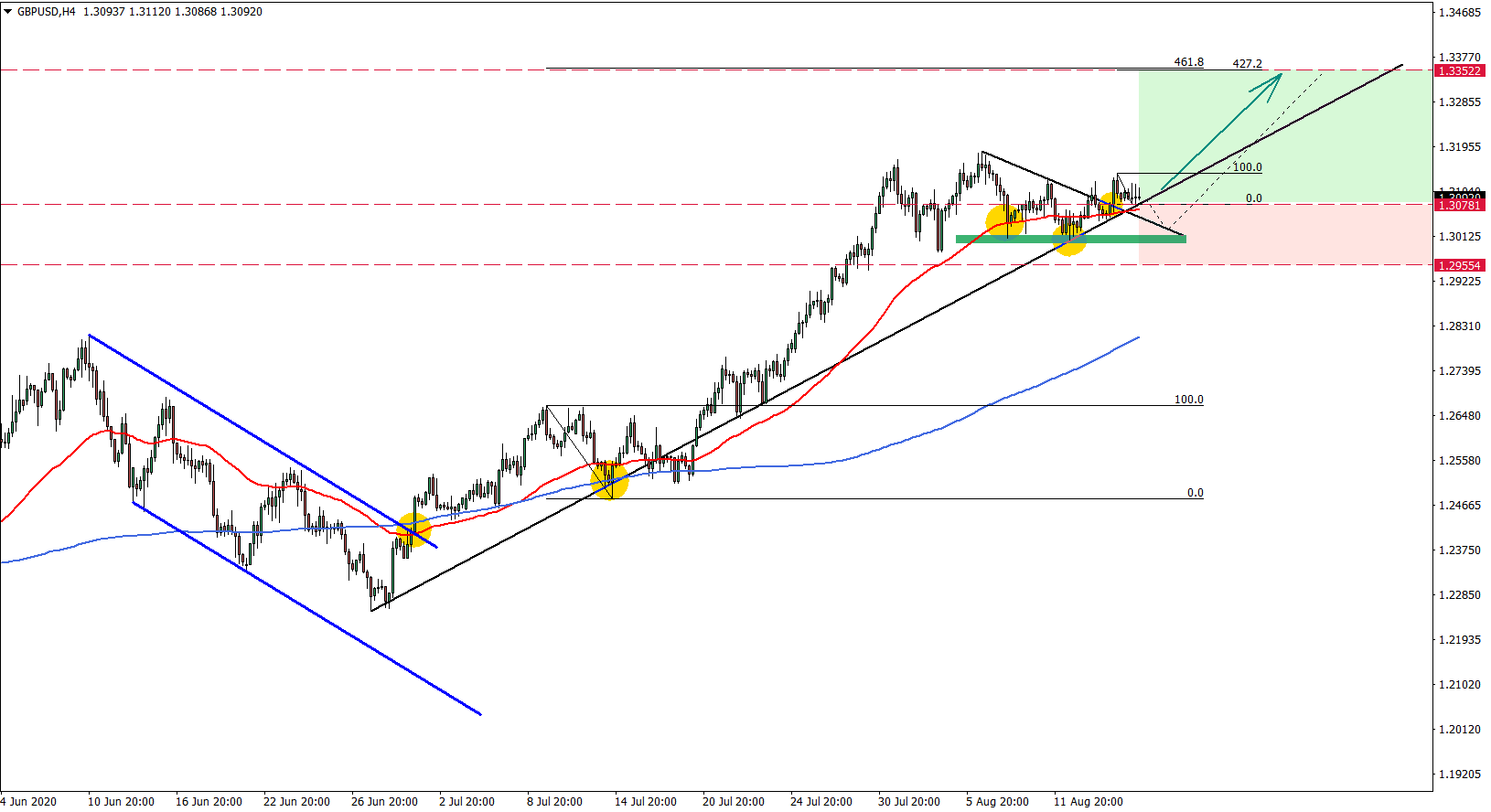

Since GBP/USD broke above the descending channel, back on the 01.07.2020, the price has been on a steady rise. During the period of June 29 – August 6, pair has risen by 7.63%, which equals 934 pips. Pair went up from the 1.2252 low up to the 1.3186 high, followed by a correctional move down.

On the correction, GBP/USD formed a double bottom near 1.3000 psychological support, where price rejected the 50 Simple Moving Average, suggesting the validity of the uptrend. Besides, the price has formed a triangle pattern that was broken to the upside on August 14.

All-in-all, the support has been rejected along with the Moving Average and the uptrend trendline, followed by the break above the downtrend trendline. Price continues to produce higher highs and higher lows and such price action will most likely result in further GBP/USD uptrend.

The key resistance and the upside target is seen at the 1.3350 area, which is confirmed by two Fibonacci retracement levels. The first is 461.8% Fubs applied to the first rejection of the 200 Exponential Moving Average. The second is 427.2% Fibs applied to the corrective wave down after price broke above the triangle pattern.

Potential Trade Idea:

The ideal buying point could have been at 1.3078, where price has rejected the long term uptrend trendline after breaking above the triangle. The upside target is at 1.3350 with a stop loss at 1.2955, which provides a 1:2 risk/reward ratio and prevents the early exit of the trade, in case there will be a spike below 1.3000 support.

Leave a Reply