The Forex market is where traders exchange currencies. Topping $5 trillion in daily turnover, it is the biggest financial market. It started in 1971 and was the exclusive preserve of the big banks. However, things changed in 1997 when the internet rose and liberalization of the market, enabling you and me to participate.

Forex trading refers to the exchange of currencies, usually paired with each other, to get a profit from predicting the direction of the exchange rate or price. The same way you buy an item to resell at a higher price, or you resell an item at a higher price and restock it at a lower price.

This article will give you a robust perspective of how Forex trading works:

Table of Contents

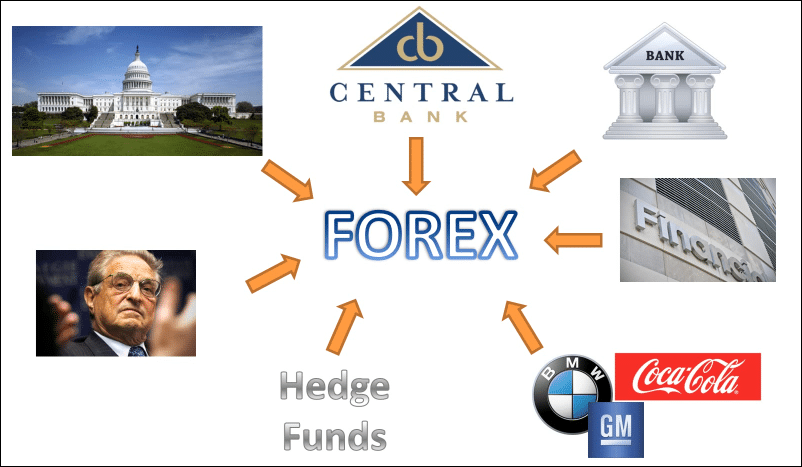

The Forex market features several participants. You need to understand who these people or entities are, what roles they play and how you fit into the equation. How do these participants affect you as a Forex trader? Let’s have a look

Players in the Forex Market

The Forex market does not have a physical venue. Instead, it has a virtual venue, which is simply the network of computers that connect the major banks, who act as liquidity providers and therefore make up the main source of all Forex volumes traded in the market.

The interbank FX market is the first level of this virtual venue, exchanging trillions of units of various foreign currencies daily. This is where you have the major banks and the central banks.

The central banks are the entities who print the money, and occasionally they may participate in the market to buy or sell the local currency in order to influence the local exchange rate. For instance, central banks that have intervened in the interbank market include the Bank of Japan (BoJ) as well as the Swiss National Bank (SNB).

In addition, 8 major banks are the liquidity providers that trade the hefty volumes seen in the interbank market. These are Deutsche Bank (largest volume), Citibank, Commerzbank AG, HSBC, JP Morgan, BOfA Merrill Lynch, Barclays, UBS and Goldman Sachs. They generate all the liquidity that forms the base for the interbank FX market.

The interbank market serves the next set of the Forex market players, which are global companies that conduct a lot of cross-country transactions. Therefore, they have to change currencies in large volumes. These are companies such as Amazon, Tesla, Apple, etc.

Institutional trading firms such as hedge funds also take part in this category as they trade Forex directly with the liquidity providers.

Then we have the retail Forex brokers, which obtain their liquidity from the interbank market and pass it on in smaller bits, albeit with a marked up price to their retail clients.

Retail Forex Trading

The retail Forex brokers typically fulfill the orders of clients using an in-house dealing desk. These are the brokers that individual traders such as yourself will deal with. These brokers receive the name of “market makers”.

Then we have the retail traders. These are the individual traders that participate in the Forex market with small trading volumes. You will interact with the market using the platforms and trading accounts provided by the retail FX brokers.

Think of the market using the supply chain of production where:

- Production: central banks take care of this, they occasionally intervene in the market by buying or selling large amounts of foreign currencies in exchange for the local currency in order to achieve a national monetary policy.

- Wholesale market: the wholesalers are the super banks that make up the liquidity providers. Here, we also have the prime brokers and institutional traders that trade in very large volumes.

- Retailers: this is where you have the market makers. They get their Forex positions from the wholesalers and form the liquidity bridge between the wholesalers and the retailers.

- Consumers: this is where the retail traders, also known as the individual traders, operate.

This is the structure of the Forex market and how the players interact with each other at various levels. Now let’s take a look at different concepts related to how Forex trading works, which be may be essential to your trading.

Forex Charts to Understand Price Movements

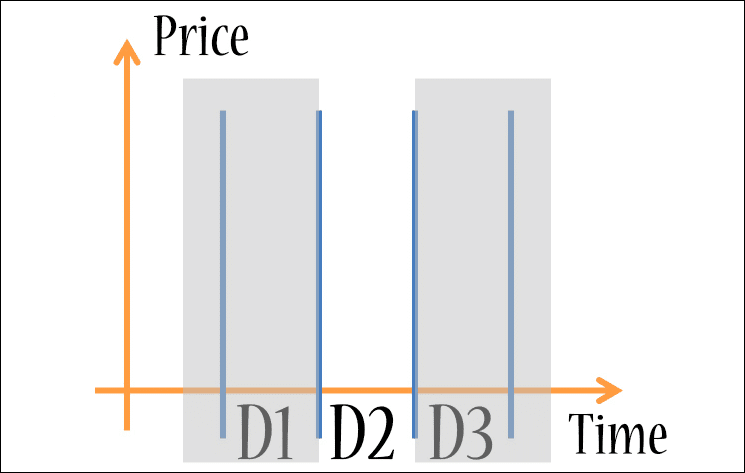

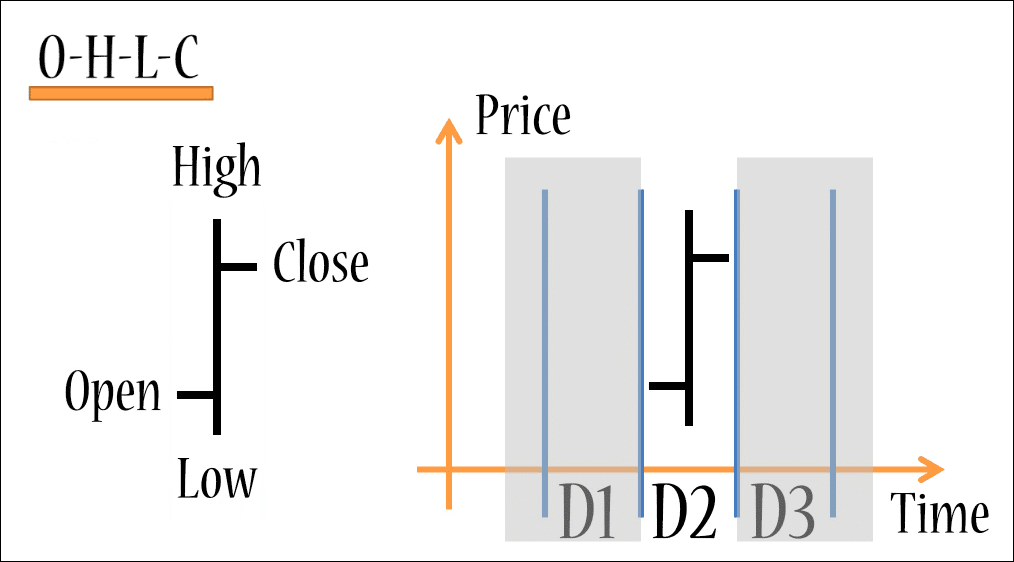

A Forex chart is simply a representation of the price changes on a currency pair. A Forex chart is a depiction of price on the y-axis, as well as time-lapse on the x-axis.

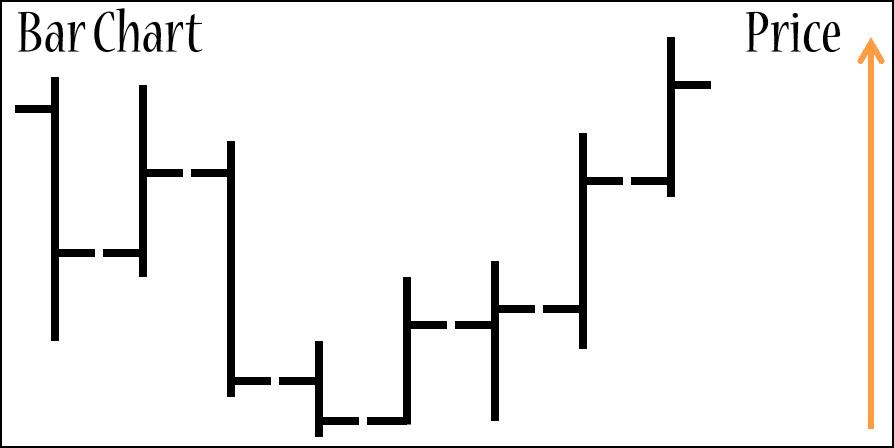

Bar charts

A typical bar chart uses a single vertical bar and two horizontal bars to show the high, low, open and close prices for each time period, in this case, a full day:

So, consecutive days would like like this in a chart:

In addition, there are other main types of Forex charts:

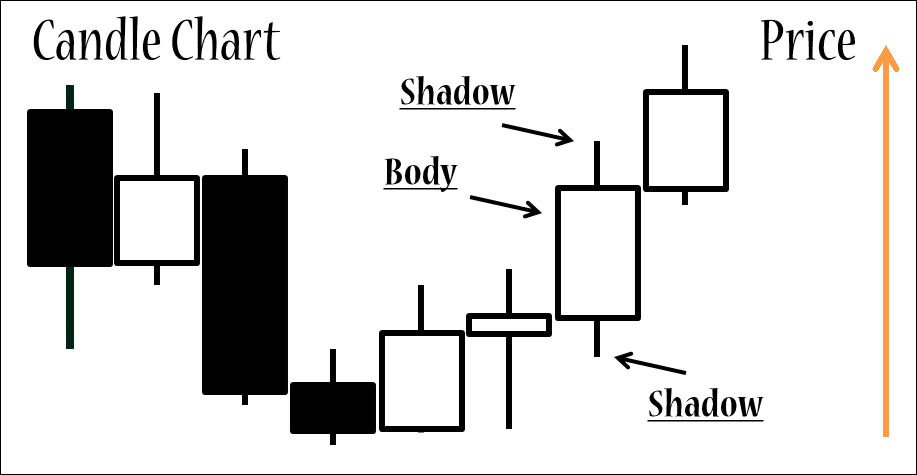

- Candle charts

- Line charts

Candle charts

Instead of vertical lines with horizontal dashes, we got these rectangles or candles, which usually have a body and two shadows. The top and bottom of the shadows represent the maximum and minimum prices on a period.

On the other side, it is important to highlight that the color of the body is key to identify whether the candle is bullish or bearish. As a general rule of thumb, “hollow” bars (in this case white as the background) represent bullish candles, while the “filled” candles are bearish.

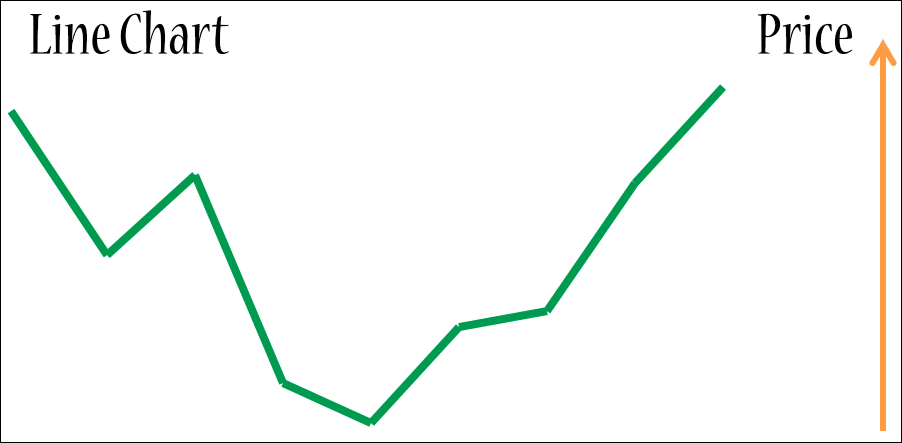

Line charts

A line chart is a simpler version and it only shows the close price.

To sum up, the Forex charts show information as to what buyers and sellers are doing. Then, it is important to clarify what are the main assets of the Forex market.

Currency Pairs

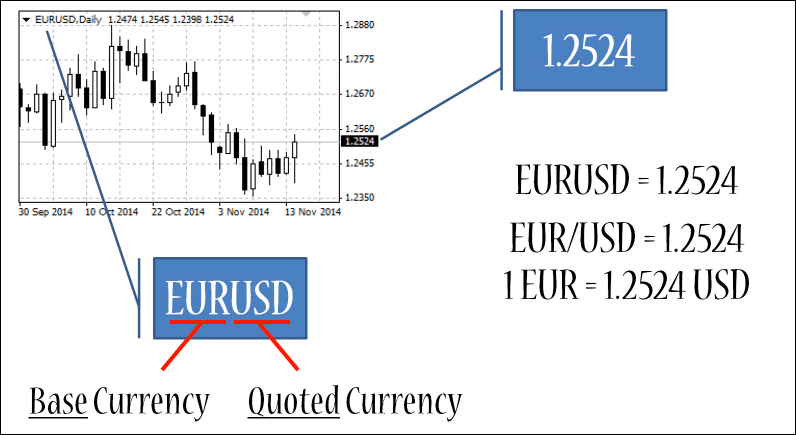

Forex market transactions are organized in currency pairs. Consequently, you will notice that the price of one currency is expressed in terms of another.

Each currency pair has a base currency and a quoted currency. In the example below, you can notice that the EURUSD consists of the Euro (base currency) and US Dollar (quoted currency). At the time of the snapshot, the price of 1 EUR was equivalent to 1.2524 USD, meaning that you had to pay 1.2524 US dollars in order to get 1 euro.

There are over 180 currencies all around the world and make different combinations to form currency pairs. Most traders identify two main groups of currency pairs:

The “Majors”:

- EURUSD: Euro/US Dollar

- USDJPY: US Dollar/ Japanese Yen

- GBPUSD: British Pound/US Dollar

- AUDUSD: Australian Dollar/US Dollar

- USDCHF: US Dollar/ Swiss Franc

- USDCAD: US Dollar/ Canadian Dollar

and the “Crosses”, which are all the currency pairs that do not contain the US dollar. For example, EURGBP, GBPJPY, AUDCAD, etc.

Bulls and Bears – Buying and Selling in the Forex Market

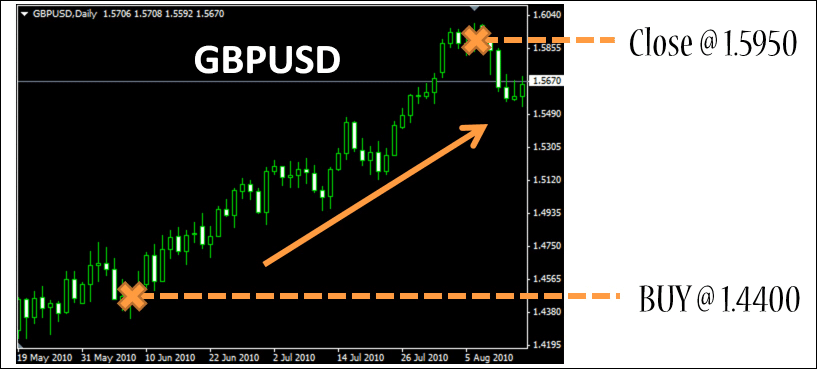

Bulls and bears describe traders who expect a currency pair’s price to go up (bulls) or come down (bears). Therefore, bulls will look for an opportunity to “go long” or buy, while bears will look for an opportunity to “short” or sell the currency pair.

For instance, a bull trader made a profit from the upward trend shown below by buying the GBPUSD at a low price and selling or closing the trade at a higher price:

To put it in simple terms, for a $1,000 investment, the trader bought 694 GBP at the initial price of 1.4400, then as the price rose, he sold the 694 GBP at 1.6950, getting $1,107 in exchange.

$1,107 – $1,000 = $107 profit

Short Selling

In contrast, bear traders can benefit from a downtrend by “short selling” a currency pair. This means that a trader can sell the currency pair at a high price. Then, if the price drops, they can buy or close the trade at a lower price. To explain the details behind a short selling transaction, we have prepared this video for you:

Brokers

Brokers are the intermediary between the retail trader (you) and the Forex market. There are two types of brokers: the market makers (retail FX brokers), and the ECN/STP brokers.

The difference between both models is that the market makers fulfill their clients’ orders in-house, while the ECN/STP brokers pass on the trade orders to a higher execution venue or the interbank market for execution. Usually, ECN/STP brokers demand higher account capital because of the execution venues they route their clients’ orders to.

Brokers play several functions. They provide traders with trading platforms that enable them to trade Forex. In addition, they hold the trading capital of their clients in custody and provide settlement as trades are conducted. They also have several resources for their clients to use for more effective trading, and a number of them are now doing a lot of Forex education as well.

Brokers are regulated by regulators so that there is a safe trading environment for retail traders. Brokers are also subject to oversight from time to time to ensure they maintain industry best practices. They constantly invest in technology that protects the user data of their clients as they interact with the broker website and with the trading platforms.

You can check our review on the Best Forex Brokers for Beginners to get more insights on how to choose the right broker.

Ask and Bid prices

Most of the time when you travel abroad, you need to convert the money from your home country into the currency of your destination.

When your trip ends, you need to convert the excess of the currency from your destination back to the currency from your home country.

Then, you might recall that in an exchange booth you will get quoted at a “buy” price or a “sell” price, respectively.

The same principle applies to the Forex market, any currency pair has an Ask Price and a Bid Price. The Ask is the price you will get if you want to buy the base currency and it will always be above the Bid price. On the other side, you will get the Bid price if you want to sell the base currency.

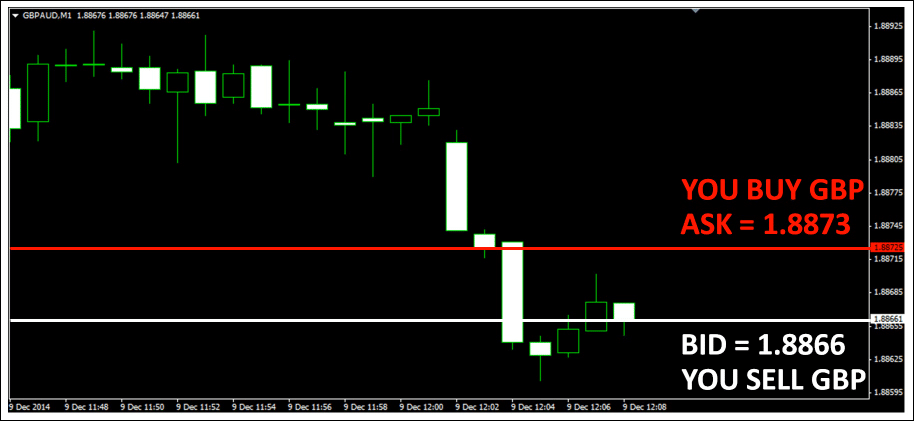

For instance, take a look a the following GBPAUD chart:

If you want to buy GBP, then you would be using the Ask price, paying 1.8873 AUD per GBP. In contrast, if you want to sell GBP, then you would be using the Bid price, getting 1.8866 AUD per GBP.

Spreads

The spread is the difference between the Bid and Ask price of a currency pair. Anytime you place a Forex trade, you need to pay the spread. Therefore, it is the commission that the broker gets for every trade.

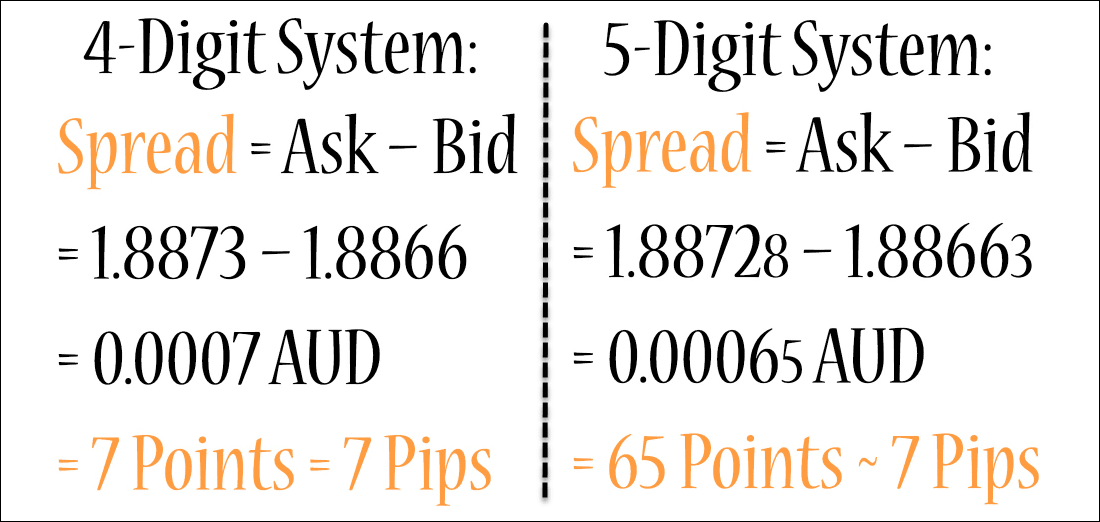

From the example above with GBPAUD, we can calculate the spread as follows:

Pips and Points

A pip is the smallest measurement of currency price movements and it is equivalent to 0.0001 points.

Depending on the broker that you choose, you will get 4-digit or 5-digit quotations, Forex brokers provide a 5-decimal system where the extra decimal is a tenth of the value of the 4th digit.

In both scenarios, one point is the minimum change that the price can experience. In the case of 4-digit quotations, the minimum change or point will be 0.0001 (a pip), while in 5-digit quotations a point will be equivalent to 0.00001 (a pipette). Also, it is important to mention that only the Yen crosses have a 3-decimal point system.

Let’s have a look at the example below to help us understand better the difference between a 4-digit quotation and a 5-digit quotation:

As you can see, the value in pips remains the same.

Lots

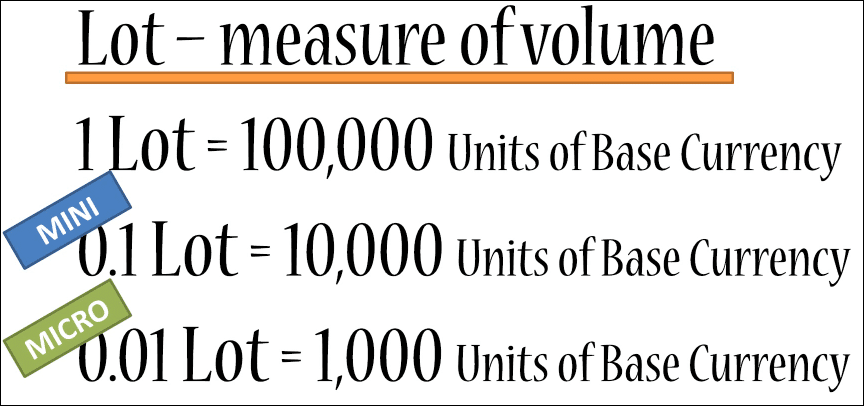

The lot is the measure of the trade volume a trader uses to set a position in Forex. The standard measurement is the Standard Lot, which is equivalent to 1.0 lots and is worth 100,000 units of the base currency.

A lot can be subdivided into mini-lots (0.1 lots to 0.99 lots), which command a trading volume from 10,000 to 99,999 units of the base currency. Also, a lot can be subdivided into micro-lots ( from 0.01 lots to 0.099 lots), which are equivalent to a trading volume of 1,000 to 9,000 units of the base currency:

For instance, if you want to buy EURUSD, 1 lot is equivalent to 100,000 EUR. Let’s assume that the Ask price is 1.23228. Therefore, to buy 1 lot you technically will need 123, 288 US. Considering this is a large sum for most traders to get into a market, the concept of Leverage comes to play a key role, helping traders to fund their transactions.

Leverage and Margin in Forex Trading

The Forex market operates using leverage. This is because the volumes required to maintain liquidity at the interbank level are too high for individual traders. The market makers “bridge” this liquidity gap, providing leverage to their clients to control larger positions using smaller amounts of money.

For instance, a typical trade by institutional clients on the interbank market can require up to 500 Standard Lots, which is about $50,000,000. Can a retail trader afford this? The answer is no.

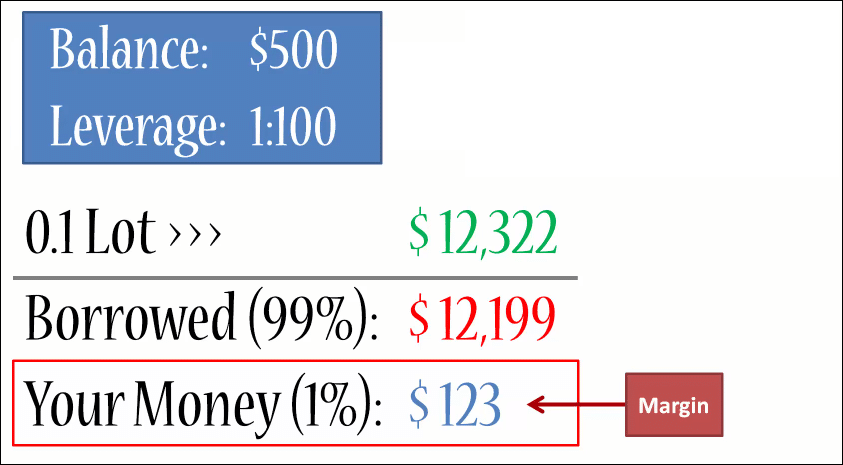

However, by providing leverage of say 1:100, a retail FX broker can lend 99% of the funds needed in a transaction, this leaves the trader with a lower amount required to open the trade, this amount is known as margin.

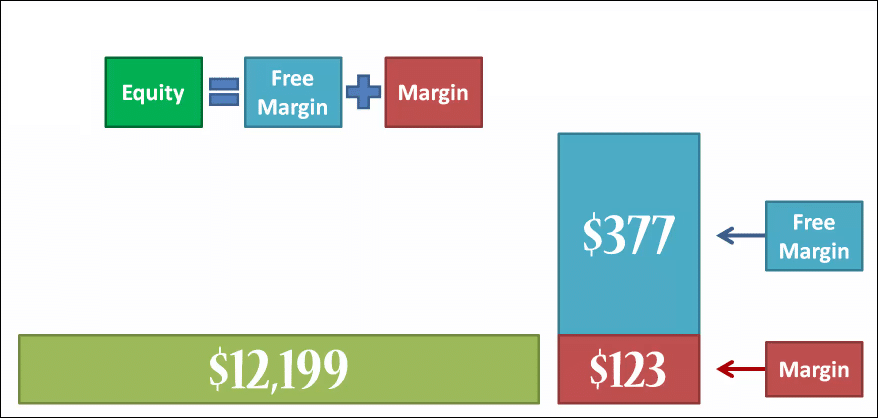

Here’s an example of a 0.1 lot EURUSD trade on a $500 account with 1:00 leverage:

It is important to mention that the account balance or equity becomes dynamic after you place the trade, meaning that the price fluctuations will affect the free margin:

If the market moves against the trade, there will be an unrealized loss, reducing the free margin. Moreover, if the unrealized loss exceeds the free margin ($377), there will be what is called a “stop-out” and the broker will close your position.

On the other side, if the market moves in favor of the trade, the unrealized margin will increase the free margin. If the trade is closed, the equity will be realized to your balance, and the broker will withdraw the money they lent.

If you are in the UK and EU, your leverage is capped at 1:30 for Forex trading. This is the result of new rules introduced by European regulators in 2018. Many UK and EU brokers also have offshore branches and they can migrate your account, increasing leverage up to 1:500.

Types of Orders (Buy, Sell, Buy Stop, Sell Stop, Buy Limit, Sell Limit )

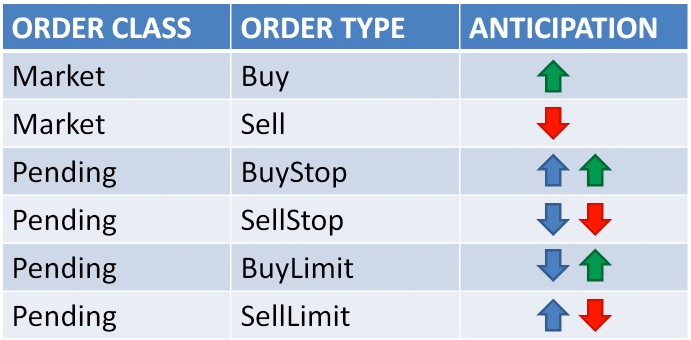

Trading Forex can be done using various types of orders: market/instant orders and pending orders.

The instant orders are executed at the current price of the currency pair in the market. These are the market buy or market sell orders. They instruct the broker to execute a buy order or the sell order at the current market price.

Pending Orders

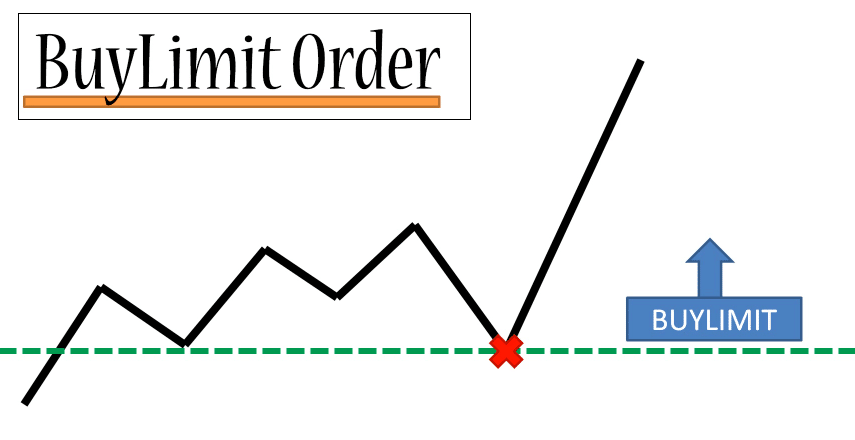

The pending orders are executed at a price different from the market price. Limit orders are placed at prices that are lower (Buy Limit) or higher (Sell Limit) than a market price, in which the price is expected to move against the trader’s expectation before continuing in the direction of the expectation.

For instance, you think the EURUSD will gain 50 pips in a trend. However, you expect it to lose 20 pips before it rises 50 pips. Then, you can use a Buy Limit order and set it at 20 pips below the market price.

A stop order is set at a distance that is higher than the market price (Buy Stop) or lower than the market price (Sell Stop). It is used if there is an expectation that the price could continue in the direction the trader expects it to go, but will have to break a support or resistance along the way first. So it is an order type the trader will use to make sure a support has been crossed before prices keep going down (Sell Stop), or that price will cross a resistance before it keeps going up (Buy Stop).

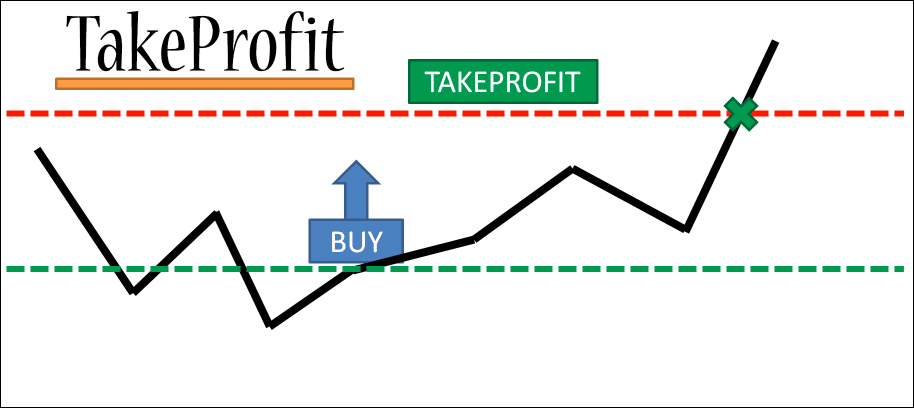

Take Profit (TP)

The Take Profit (TP) order closes a trade automatically when it hits a certain level of profits. This allows you to capture profits at a certain level if you are not able to close the trade manually.

The Take Profit is ideally set before the price reaches resistance in a long trade, or before it hits support in a short trade. This prevents a situation where the support or resistance is hit and the price starts retracing against your position, erasing profits you should have kept.

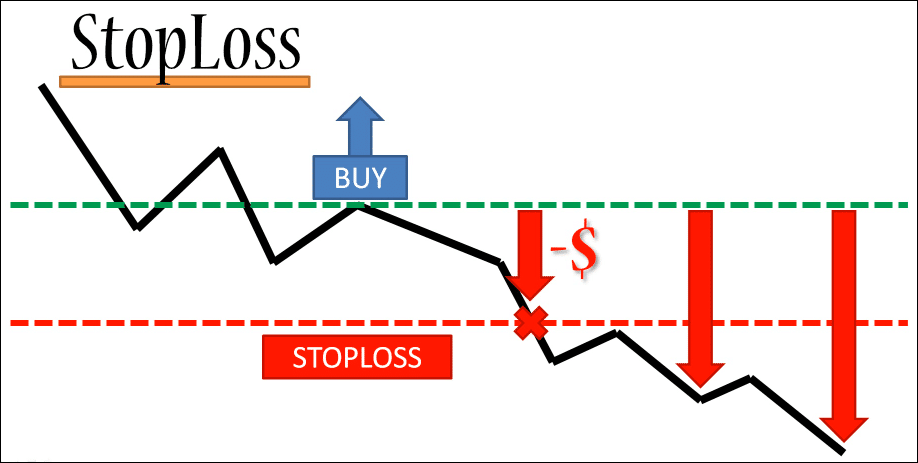

Stop-Loss (SL)

The stop loss is protection and it has two main applications. The first one is to protect trade from losing too much and wiping off the account capital. This notifies the broker to end the trade automatically if the position incurs a particular number of pips in losses.

Secondly, the SL is used is to lock profits if the price moves against your position. This takes the shape of a trailing stop order. Then, the SL will start chasing a profitable position from a specific pip distance that keeps the trade profitable. If the market moves against the expectations, the SL stands firm and closes the trade when it is hit.

This second function can help you preserve your profits especially if prices are retreating against your position.

Risk-reward Ratio

Typically, traders try to set a TP that is at least 2 or 3 times the number of pips used as stop loss. The ratio of SL to TP receives the name of the risk-reward ratio (RRR). For instance, if your TP for a trade is 150 pips and you set 50 pips as the stop loss (i.e. RRR of 1:3), you would need to lose 3 times to erase a single winning trade, assuming all parameters remain constant in all trades. If you have 20 trades and win 8, you win 1,200 pips (i.e. 150 X 8). If you lose the remaining 12 trades (12 X 50), you lose 600 pips. Yet, you still have 600 pips profit. See why you should keep your risk-reward ratios high?

Conclusion and Next Steps

Forex trading involves a wide set of concepts that we reviewed in this article. From the players in the Forex Market to the risk-reward ratio, we covered all the terms you need to get started in Forex trading.

The next step in your trading journey is to learn more about Forex Indicators and study how to use MetaTrader 4, the most popular trading platform.

Leave a Reply