The use of leverage enables traders to bank more profits with little initial capital invested in the forex market. That being said, it can also cause huge, unsustainable losses that can blow out accounts in a matter of months. Fortunately, it’s easy to control leverage in a way that lets you grow your account consistently without increasing risk.

So, how does leverage work in forex trading? Leverage is a facility or means by which a trader can hold a larger position in the forex market relative to the capital he/she deposited into the trading account.

The concept of leverage in forex trading is theoretically easy to understand. However, applying it to real-world trading strategies and situations remain extremely difficult, especially for novice and even mid-level traders. Read on further as we discuss how leverage works, the different concepts associated with leverage including risk/reward ratios, lot sizes, and margin calls, and the various governing bodies that regulate leverage limits amongst brokers.

Leverage in Forex – The Basics

In the context of forex trading, leverage is borrowing money, often from a broker, and then using that borrowed money to buy an asset, which in this case is currency. By increasing your position size in the market, you effectively increase your profit potential if the trade goes in your favor. However, if your trade ends up losing money, the losses are also amplified. Leverage acts as a doubled-edge sword in that it can generate as much profit as it can losses.

Pros of Leverage

- Higher profit potential per trade – Leverage, as mentioned earlier, can amplify your gains relative to the actual amount of money you have in your account.

- Access to more currency pairs – Some currency pairs, particularly exotic pairs such as USD/TRY and EUR/HUF, require higher margins in order to trade even the smallest lot size.

- Lower barrier to entry – Traders with $10 in their pocket can open an account and make trades.

- No cost – Leverage is offered at no charge to the trader. Despite the transaction being similar to a mortgage where your broker fronts you cash to acquire an asset, the debt is zero-interest.

Cons of Leverage

- Higher loss potential per trade – Being a double-edge sword, leverage also amplifies the inherent risk of each trade.

- Constant liability – Leverage creates this immediate and constant risk of the leveraged trade being closed and liquidated by your broker in order to cover losses. This is also known as a margin call. Using 100% of the allowed leverage can put every trade an inch into margin call territory. When that happens, even the slightest move in the opposite direction can lead to a realized loss.

- Difficulty reaching the breakeven point – When a leveraged trade gets margin called and closed by the broker, you then have to lower your next position or lot size, which means the trade has to move much higher or lower in your direction in order to recoup the losses realized from the previous trade.

Why Do Some Brokers Offer More Leverage Than Others?

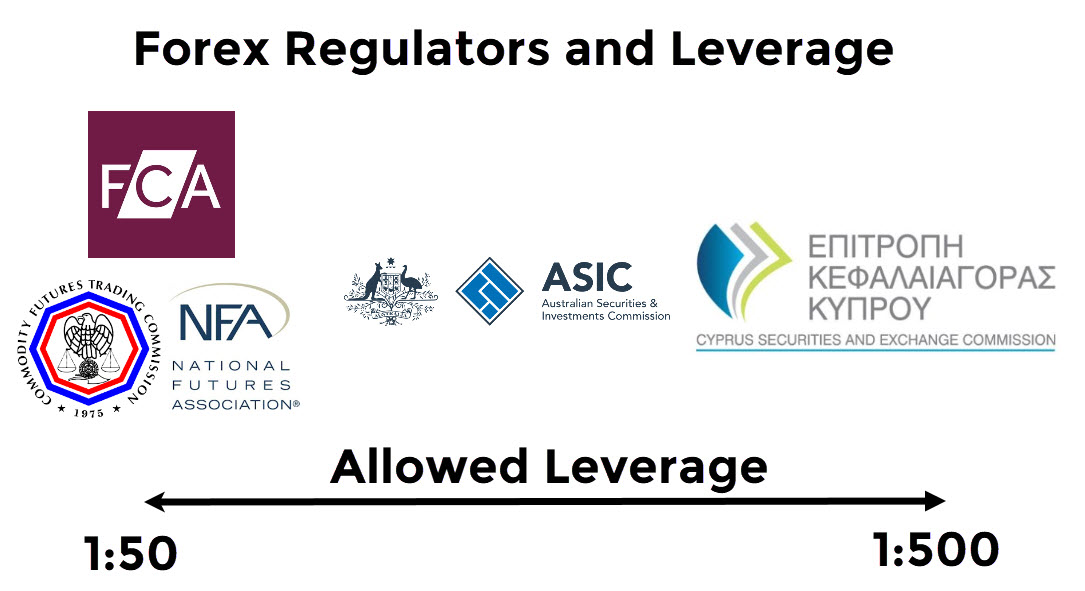

If you go browsing for a good broker online, you’ll notice that there are variations in terms of how much leverage you have access to as a trader. Institutions, such as the National Futures Association and Financial Conduct Authority (FCA), regulate the leverage accessible to traders. These institutions offer guidance and policies designed both to protect the derivatives market including forex as well as to protect customer capital.

These regulations and guidelines on how much leverage traders should be able to access were set in place in order to protect traders from the inherently risky nature of trading, specifically with borrowed capital. Different markets have different approaches when it comes to leverage limitations. The stock market, for example, is governed by Regulation T and is much stricter in terms of margin requirement per trade. Regulations surrounding forex are a lot more relaxed. A forex trader can use anywhere between 50 to 400 times the leverage. Futures trading, on the other hand, requires you to make “good faith” deposits that usually range between 5 to 15% of the net value of the contract.

You can check how much leverage a broker is offering by visiting their website. It’s usually advertised on the home page of the broker’s site to attract more new accounts. You can also find the information on third party websites that review and compare different brokers and their offerings. This is a good resource for learning about other broker-specific information, such as what currency pairs you can trade, what account tiers are offered, etc.

Leverage in Forex and Risk Management

Leverage can be subcategorized as part of risk management as it works hand-in-hand with other concepts including lot size, margin, and equity. Let’s define each of those concepts and how they relate to leverage:

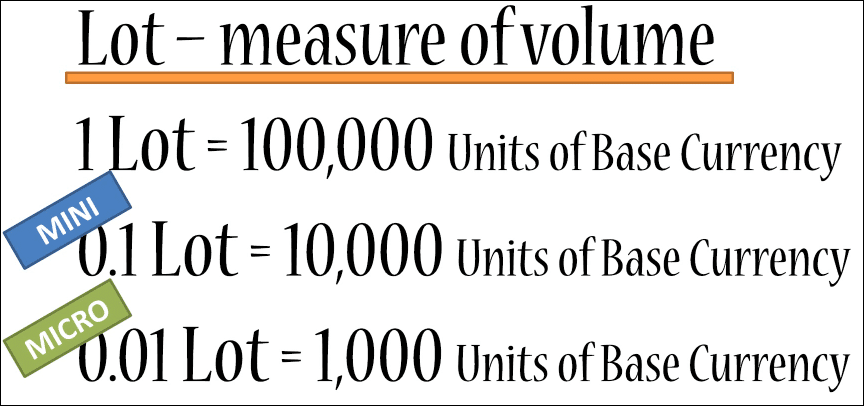

Lot – There are three main lot sizes in forex, namely Micro, Mini, and Standard. A standard lot is $100,000 worth of whatever currency is being traded. A mini lot is 1/10th of that, which is $10,000. Trades can have a combination of these lot sizes, such as a 1.5 lot being 1 standard lot and 5 mini lots, with a position value of $150,000. Choosing a proper lot size is key to succeed in the long-term.

Margin – Currency pairs have different margin requirements. For example, to buy 1 standard lot of EUR/USD, you’ll need to front 2% of the transaction while the rest is covered by your broker. Exotic pairs usually have a higher MMR or minimum margin requirement. For instance, USD/CZK requires an MMR of 10% while XAG/USD and XAU/USD require 100% MMR.

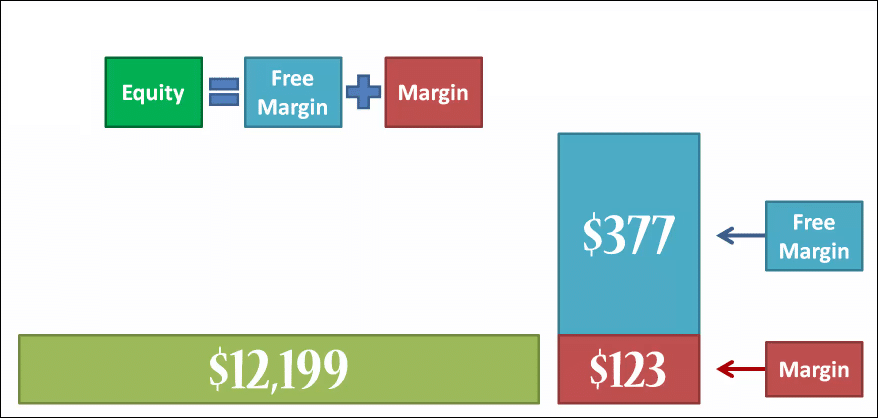

Equity – Equity refers to the current total net worth of your account at any given time. That includes both your unused account balance and the value of any open or floating positions you may have. The main difference is that equity includes the unrealized gains or losses while the account balance does not.

Pips – Pips are the percentage points or denomination of price movements in forex. A 1 pip move in a standard lot has a value of $10, $1 for a mini lot, and $0.10 for a micro lot.

Applying These Concepts to Achieve Proper Risk Management

To show you how these concepts are connected to each other, let’s use a real-world example. Say you have a trading account that has $1,000 and your broker is letting you access a leverage ratio of 1:50, meaning that for every $1 of your own money that you deposit, they’ll let you borrow $50. Assuming you use the max leverage, you can control up to $50,000 in currency.

Now let’s say you choose NZD/USD to trade. The pair has an MMR of 3%. That means that your account needs to have at least $983 in order for that 5 mini lot position to remain open. If your account goes down below that $983, your broker closes the position automatically, what the industry calls a “margin call”.

Using this example, you can see how proper lot sizing, currency pair selection, and margin calculation are key factors for a trade to make money or at the very least remain open long enough to break even.

Leverage, Risk and Money Management

Money management is key to profitable trading. Gauging how much you can lose per trade, how big your position should be, and what your projections are for an X number of trades in X number of days or weeks are important in order to position yourself in the market properly. Here are some tips for effective money management:

- Calculate risk – Determine how much you can lose on a trade. This can be either in pips or cash value. Going back to the example above, if you are to maximize the leverage on your $1,000 account, you can only afford to lose $17 or a 3-pip move.

- Calculate stop loss level – Figure out what price you want the trade to close at in order to minimize losses. To set a stop loss, you simply input a price on the “stop loss” section of your order ticket.

- Calculate lots – You can use a lot calculator to determine how big or small your position should be relative to the dollar risk and stop loss level you’ve accepted.

- Be consistent with your approach – Test out strategies until you find one that’s ideal for your chosen trade lifecycle and time frame as well as your risk appetite. Technical and fundamental analysis is a must to minimize as much capital risk as possible.

A general rule of thumb is to only risk 2% of your account per trade. 10% is said to be the roof of your risk per trade. Anything above that is considered extremely risky and unfavorable in the long run.

Frequently Asked Questions

What is a good leverage ratio for forex?

This will depend on your experience as a trader as well as your risk appetite. It’s common practice to use 1:10 leverage while more aggressive traders use up to 1:50 or 1:100 for their trades.

What is a 1:500 Leverage?

A 1:500 leverage means that for every $1 of your own money deposited into an account, your broker lends you $500 to invest in the market. If you deposit $1,000 into your trading account, you can control up to $500,000 worth of currency or 5 standard lots.

What is the Best Leverage For a Beginner?

The lower the experience level, the lower your leverage should be. Limit your trades to 1:10 leverage and only increment once you’ve gathered a large enough sample size of trades to determine your strategy’s effectiveness.

What is a 1:100 Leverage?

Similar to the earlier question, a 1:100 leverage ratio means that you can control up to $100 of asset for every $1 you invest. With a $1,000 account, you can buy up to 1 standard lot of a currency pair.

Why is Leverage Dangerous?

Leverage is only dangerous when misused. Traders, especially novices, often max out their account’s allowed leverage. After a single loss, they are margin called and are forced to cut their position size down. The cycle continues until your balance is eventually too low to even buy 1 micro lot.

Does Leverage Increase Profit?

It does, but how much and how consistently you can profit using the facility will depend on various factors including trading psychology, money management, and technical and fundamental strategies.

How to Change Forex Leverage in My Account?

You simply increase or decrease your lot size depending on how much leverage you want to use on a trade. Exceeding the maximum allowed leverage of your broker is not allowed as they must also comply with regulations set by the NFA, FCA, or whatever financial institution governs them.

Leverage is neither to be feared nor played with, especially in the context of forex trading. Market volatility and trader speculation are already risks that you must protect your capital from. Leverage can amplify the impact of failing to control these two risk factors. Use the aforementioned tips in this article to safely navigate your way around leveraged trades in the forex market.

Leave a Reply