Forex risk management is the cornerstone of trading the currency market. Therefore, understanding and managing Forex risks become a priority.

Any trading strategy, no matter how profitable, is subject to money management. In fact, its profitability comes from proper Forex risk management.

Think of it for a sec. Any trade has a stop loss.

And, a take profit. As such, even without knowing, traders apply some sort of risk management for dummies on any trade.

However, managing risk is an art. If you want, there’s a delicate balance between managing Forex risks and traders’ emotions.

A trading account’s enemy is the trader itself. Because emotions rule our trading decisions, we find it difficult to manage the trading account.

Therefore, to manage risk, one needs to learn to manage emotions. Or, to know yourself as a person and a trader, before anything.

This article will cover the following:

- What is risk management

- Why is risk management important?

- How to diversify a trading account

- Fundamental analysis of a risk management process

- The best foreign exchange risk management strategy

However, the focus is on the decision-making process when trading the markets. Or, on you, as a trader.

The main problem in Forex trading comes from lack of planning. Moreover, on top of it, from the failure to execute it.

What’s the point of planning then? An article about Forex risk management is like a motivational speech.

It gives traders the will to try the best risk strategy possible to succeed. Because traders deal with money, they lose objectivity.

When it happens, they receive a margin call from their broker. As simple as that.

Understanding Forex Risks

Have you noticed the terms and conditions of any Forex trading website? I’m sure you did.

The focus is on risk. Or, they highlight the Forex risks.

What’s to lose? Well, the trading account, for instance.

Because of advertising campaigns that promote trading as a piece of cake, almost all traders lose their first deposit. Yes, that’s how reality looks like.

Moreover, brokers need active traders. After all, they earn from commissions and fees.

The more active traders, the better. However, things started to change.

Right brokerage houses understand that coming clean has its advantages. As such, they explain the trading risk management process and even train traders.

Overtrading as a Forex Risk Calculator

It may sound like a cliché, but overtrading is the main reason traders fail. Even when the direction is the right one, traders still fail because of overtrading.

There’s nothing more frustrating when trading than to see the market moving to your target. However, without you, as you were stopped.

Too many times traders feel the need to do something. But, there is a problem.

It comes from the market itself. It doesn’t move all the time!

In fact, most of the times it consolidates. Or, it waits for a reason to move.

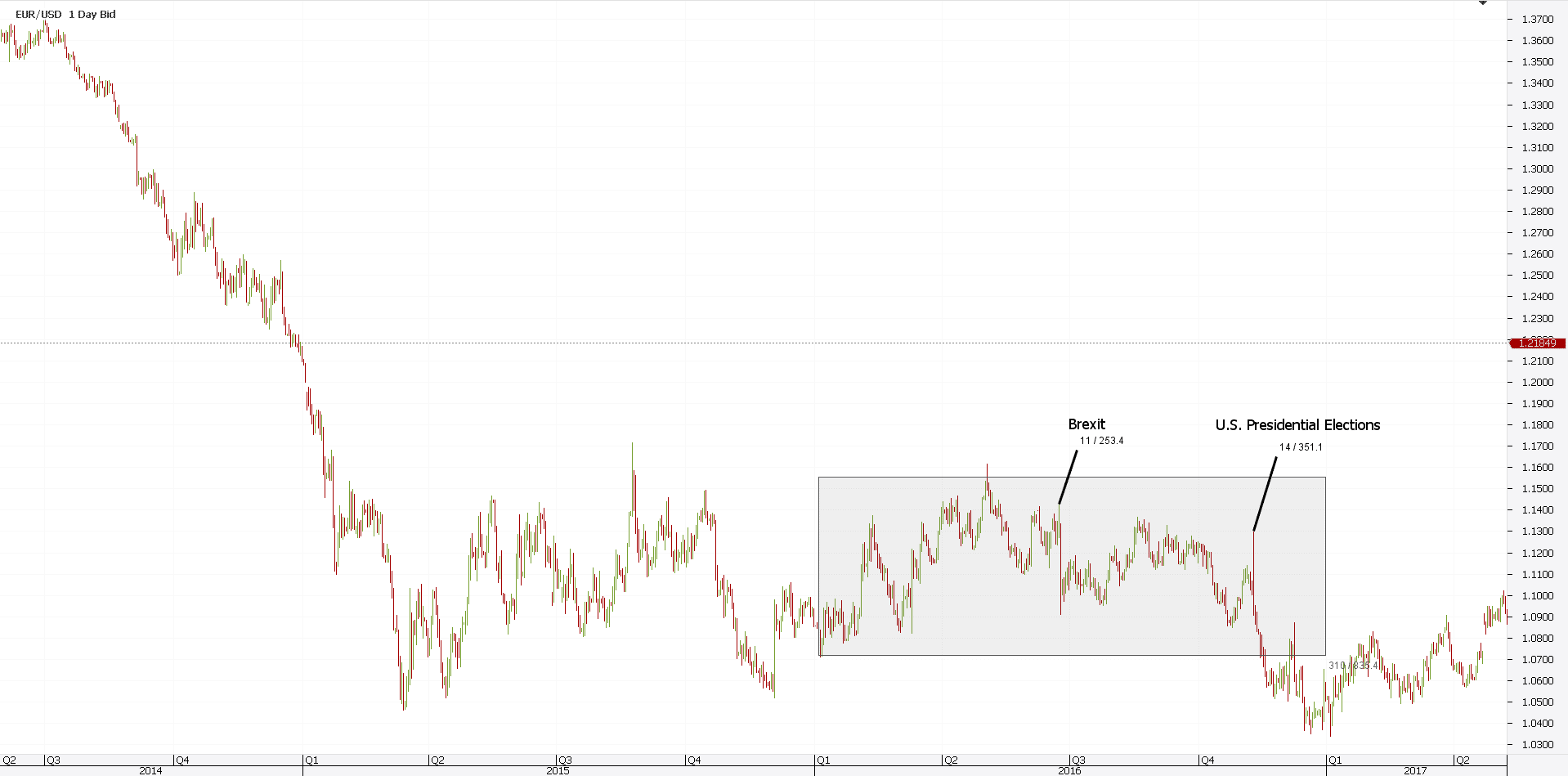

Sometimes, that reason is fundamental. If you look at the year 2016, the entire year was a big consolidation area. At least on the most popular currency pair, the EURUSD.

How come? Why did the EURUSD consolidate for such a long time?

Moreover, even before 2016, it kept tight ranges for another year. The market just needed a reason to move.

Or, it waited for risk events to pass. What risk events?

In 2016, there were two of them:

- The Brexit referendum

- The U.S. Presidential Elections

Because of that, no one wanted to take any risk. Or, any unnecessary risk.

A proper Forex risk management considers the event risks ahead. Or, how to avoid them.

Again, the problem comes from lack of understanding of Forex risks involved. Can traders use overtrading as a Forex risk calculator?

The answer is yes. Let me explain here how.

Risk Management Solutions to Avoid Overtrading

One way to avoid overtrading is to sit on your hands. Do nothing!

In fact, that’s great advice. So simple, and yet so compelling.

However, most traders fail at such a simple task. Because the market is open five days a week, they feel the need to do something.

That’s especially true when trading for a living. I mean, sitting in front of your screens the whole day and do nothing?

As a result, overtrading appears. Traders open a position. And then another one, in the same direction.

And another one. And so on.

Before you know it, a sizeable exposure appears. Yet, the market doesn’t move.

Hence, complacency kicks in. Traders lose focus.

And then, suddenly, a small swing destined to take out weak traders take the stops. And that’s how overtrading kills an account.

To counter this, a great Forex risk management technique is to limit the number of trades on a pair. For example, at any one moment of time, I cannot have more than two positions on the EURUSD pair.

In fact, it falls into the definition of risk management. Scaling is the name: different entries to average a position.

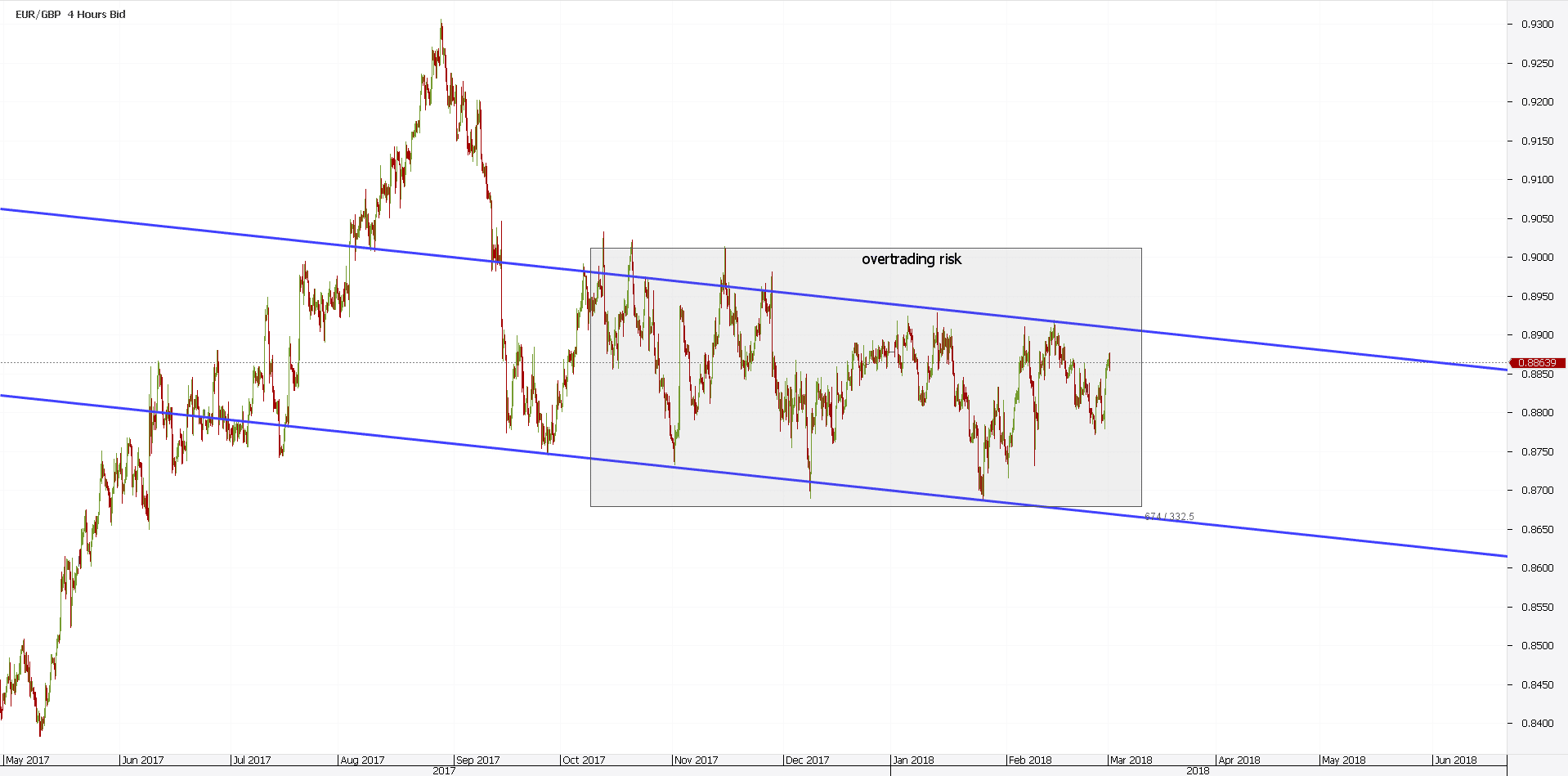

Take the EURGBP chart below. It shows the pair is in a consolidation area for quite some time.

Moreover, the chances are that it will remain the same until the price breaks above or below the channel. As such, overtrading is one of the Forex risks on this Euro cross.

Pending Orders Part of the Forex Risk Management

Situations like the one above with the EURGBP appear often. Think of the most critical reversal patterns, for example.

Let’s start with the rising or falling wedge. It is a consolidation, even though the market advances. A bit.

What matters is the moment the wedge breaks. That’s where traders want to go in.

Or, take the head and shoulders pattern. It has not one, but two consolidation areas: the two shoulders.

When the market breaks the neckline, the measured move starts. However, until it happens, ranges eat from the trader’s profit via:

- Commissions and fees paid to broker

- Negative swaps

How about using pending orders? In fact, most Forex risks disappear if the entry and exit use pending orders.

Want to buy at higher levels? Place a pending buy stop order and just wait.

With every single day that passes, and your order wasn’t filled, you gain. How come?

First, you don’t pay unnecessary costs as explained above. Second, more margin remains available for the open trades. Finally, the opportunity cost remains intact.

Most traders fear of buying elevated levels. But one of the most effective risk management techniques requires such a thing.

In fact, you buy strength. Or, sell weakness, in a bearish move.

How to do that? Simple. Just use pending buy stop or sell stop orders.

In doing that, your trading becomes organized. Hence, a proper strategy risk management technique comes from using pending orders.

Forex Risk Management Explained

The currency market is an ever-changing beast. An entity that sees so many inputs that it changes the conditions on the go.

Every day new technologies change the market. First, execution speed keeps improving.

It means the number of trades increases. Hence, the market differs from the one before.

As such, trading strategies that used to work, will have a problem. Moreover, risk management techniques that used to work will fail.

Or, won’t have the same result. Therefore, one of the most significant Forex risks comes from the ever-changing nature of the currency market.

Second, the inputs change too. For example, monetary policy.

All traders know that monetary policy moves the Forex market. More precisely, changes in monetary policy do.

The way to conduct monetary policy changes over time. Look at the Fed, for example.

Under Yellen’s guidance, it changed the way it communicates the monetary policy. More precisely, it introduces press conferences after every second meeting.

Effectively, every twelve weeks, a press conference with the Chairwoman/Chairman of the Fed follows the FOMC Statement.

A few years ago, it didn’t exist. Now that it does, it creates massive volatility.

Hence, the market changes, because traders’ expectations change too. To push things even further, every rate hike or change in monetary policy came only when a press conference followed the FOMC Statement.

Such a small detail matters, because Forex risk management strategies change too. I mean, no one expects a rate hike or cut if a press conference doesn’t follow the FOMC Statement. Period.

What is Risk Management and Why is it Important

To manage risk in Forex trading means to manage money. After all, this is what gets traders to this market: the desire to make a profit.

Therefore, risk management deals with understanding the factors that affect the trading account. And, positioning in such a way to diminish the Forex risks.

However, there’s no holy grail in trading. No strategy has only winning trades.

Hence, learning to lose is a significant step forward in any Forex risk management plan. Yes, learn to lose, to learn how to win.

Diminishing Forex risks means having a tight stop? No.

Instead, it means to risk a proportion of the expected reward. And, the reward to outsize the risk.

That’s the definition of an interesting concept called the risk-reward ratio. Savvy traders know that the higher the ratio, the better for the Forex risk management plan.

A proper risk-reward ratio for the Forex market looks for about three times the reward. Of course, when compared with the implied risk.

For example, if you risk fifty pips, look for one hundred and fifty in return. This way, a single winner allows for a few losers, and you’ll still end at break even.

What to do when you need a wider stop loss? Because some trading strategies (e.g., Elliott Waves Theory) require bigger stop loss levels, the Forex risks increase, right?

Wrong! The secret is to adjust the traded volume to the number of pips needed for the stop loss.

Therefore, a bigger stop loss results in a lower volume. And, a tighter one, at a higher volume.

This way, the proportion helps to protect the trading account. Moreover, such a simple Forex risk management strategy leads to profitable trading.

Trading Risk Management Example

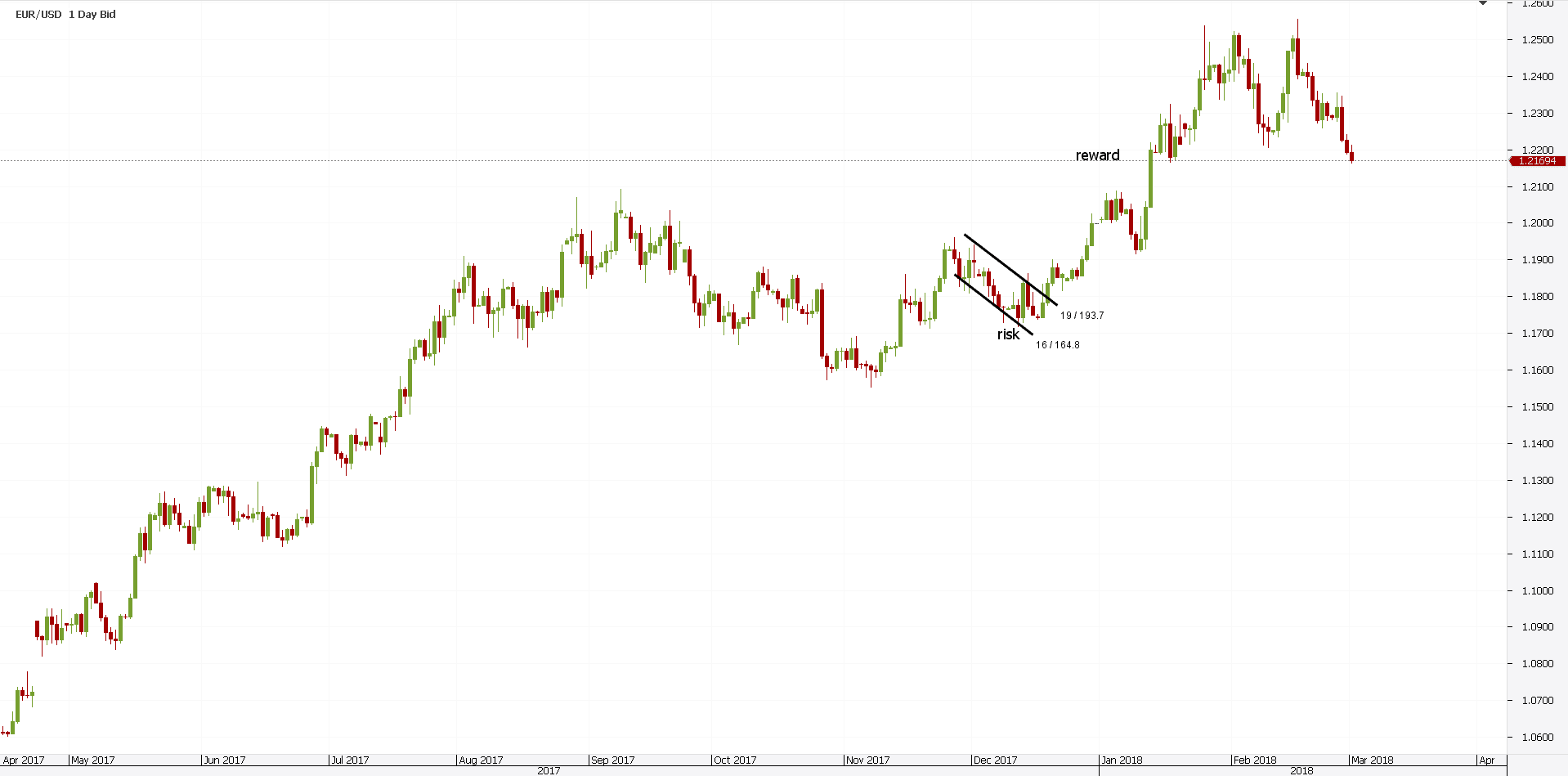

To understand risk management and risk-reward ratios, let’s have a look at the recent EURUSD price action. It shows a steady bullish trend on the daily chart.

Before breaking above the 1.20 mark again, the pair took its time to consolidate. It formed a bullish flag.

However, flags don’t always work. In fact, they fail as many times as they work. As such, traders use caution when dealing with a flag.

A proper Forex risk management strategy first looks at the risk. And only after it, at the reward. Moreover, for a 1:3 risk-reward ratio, the trader MUST stay for the take profit, no matter how difficult it is.

Here’s how to handle Forex risks in a setup like the one above.

The first thing to do is to place a pending buy stop order. But where to place it?

If the series of lower highs remains in place, the flag won’t break. Hence, place the pending buy stop order above the previous lower high.

Next, set the risk. Or, the stop loss. The logical place is the bottom of the flag.

Finally, set the reward respecting the 1:3 ratio. The boxes in the chart above show how to set the proper reward on a 1:3 risk-reward ratio.

Diversification – a Way to Manage Risk

Another way to manage Forex risks is through diversification. One must think of the trading account as a portfolio to manage.

The starting point is cash. Always have a cash position.

In Forex trading it means more than a simple cash position. It implies margin for future trades.

The next thing is to decide on the diversification degree. Or, diversify over one or more markets?

Traders may think they buy and sell only currencies, but that’s wrong. In fact, they trade oil and stock indexes too. How come?

Correlations play a decisive role. Ever traded the USDCAD pair?

If yes, you traded oil. Because of the direct correlation between the oil price and the CAD, having a position on the USDCAD pair means trading oil.

The same goes for equities and the JPY pairs. And so on.

Therefore, the thing is to split the dashboard in:

- USD pairs

- Oil-related pairs

- Stocks-related pairs

Finally, spread the rest of your trading account (the initial funds minus the cash position) across the three asset classes. This way, you balance the risk.

How to Avoid Fundamental Forex Risks

The same applies to news trading. Not all traders use technical analysis.

But even the ones that do look at the economic calendar and the news ahead. If markets move, they move for a reason.

Any Forex risk management plan starts over the weekend. Or, when the previous weekends.

Savvy traders check the economic news ahead to see what the Forex risks are. The next thing they do is to adopt the strategy.

For example, let’s assume a major USD event is due. One great way to diversify is to…sit on your hands and not trade any USD pair.

Keep in mind that having no position is, in fact, a position. Why not focusing on a cross pair, instead of a USD pair?

Or, the ECB will have its regular press conference the next Thursday. Avoiding EUR pairs means avoiding unnecessary Forex risks.

However, it also means missing on opportunities. Therefore, a balance should exist between the two.

Conclusion

Any Forex risk management plan starts and ends with the trader. The pillar of any strategy is the trader.

Do you have what it takes to ride a trend? Many will answer yes.

However, reality tells us differently. Riding a trend comes with a plethora of issues and problems.

Even the steepest trends have strong reversals. Such reversals make traders reassess the Forex risks.

Some don’t bear the market going against them. They only think of the profits lost.

As such, the next thing you know is they close the position. Of course, like in one of many Murphy’s laws, the strong trend resumes shortly after.

Discipline, therefore, is vital. If you have a plan, follow it.

But what to do when the weekend comes? For example, you are bullish EURUSD.

Moreover, have a position from 2017 when the market enjoyed a nice upward trend. Enjoying profits!

Yet, over the upcoming weekend, Italian elections are due. Do you keep the position over the weekend?

To you take these Forex risks? Or close everything on Friday?

These are everyday decisions Forex traders face. And, not everyone can handle the pressure.

Remorse, regrets, self-questioning, doubts…they all come to hound the trader. The solution comes from Forex risk management.

Simple things like pending orders, risk-reward ratios, patience, planning, discipline, will overcome them in time. And, they’ll lead to profits.

Diversification helps too. Avoid overexposure and overtrading at all costs.

Moreover, build strategies considering time as well as price. And, keep a close eye on the fundamental analysis. It moves markets and can override any Forex trading plan in a blink of an eye.

To sum up, risk management or money management must follow all trading strategies. Without risk acknowledgment, traders remain in peril.

START LEARNING FOREX TODAY!

- FOREX

- Forex Risk

- Forex Risk Management

- FOREX Strategy

- Importance of Forex

- Importance of Forex Risk

- Risk Management

share This:

Leave a Reply