The Moving Average Convergence Divergence (MACD) is one of the more popular momentum indicators used by traders. It is an easy-to-use technical tool used by traders to measure the current market environment.

MACD or Moving Average Convergence/Divergence is a momentum indicator that gauges the market conditions to generate overbought and oversold signals. It works in such a way that it follows and captures the trend and displays the relationship between two moving averages (MAs) of prices.

In this guide, we’ll discuss:

- What is the MACD Indicator;

- How to read MACD forex indicator;

- The MACD trading strategy;

- Advantages and limitations.

Table of Contents

What is the MACD Indicator

MACD is one of the most widely followed trend-tracking indicators used in trading. The indicator was designed by Gerald Appel in the late 1970s. The original aim was to develop a technical tool that will help traders find potential reverse points during strong uptrends and downtrends.

MACD forex tools are classified as lagging indicators as they are based on historical data. In general, lagging indicators are reliable in confirming past trends, but may struggle in predicting future trends.

Applying MACD indicator on the EUR/USD daily chart (TradingView)

Its most important feature is to generate overbought and oversold conditions. This way, traders may learn that the current market trend is near completion as the market conditions are in an extreme territory.

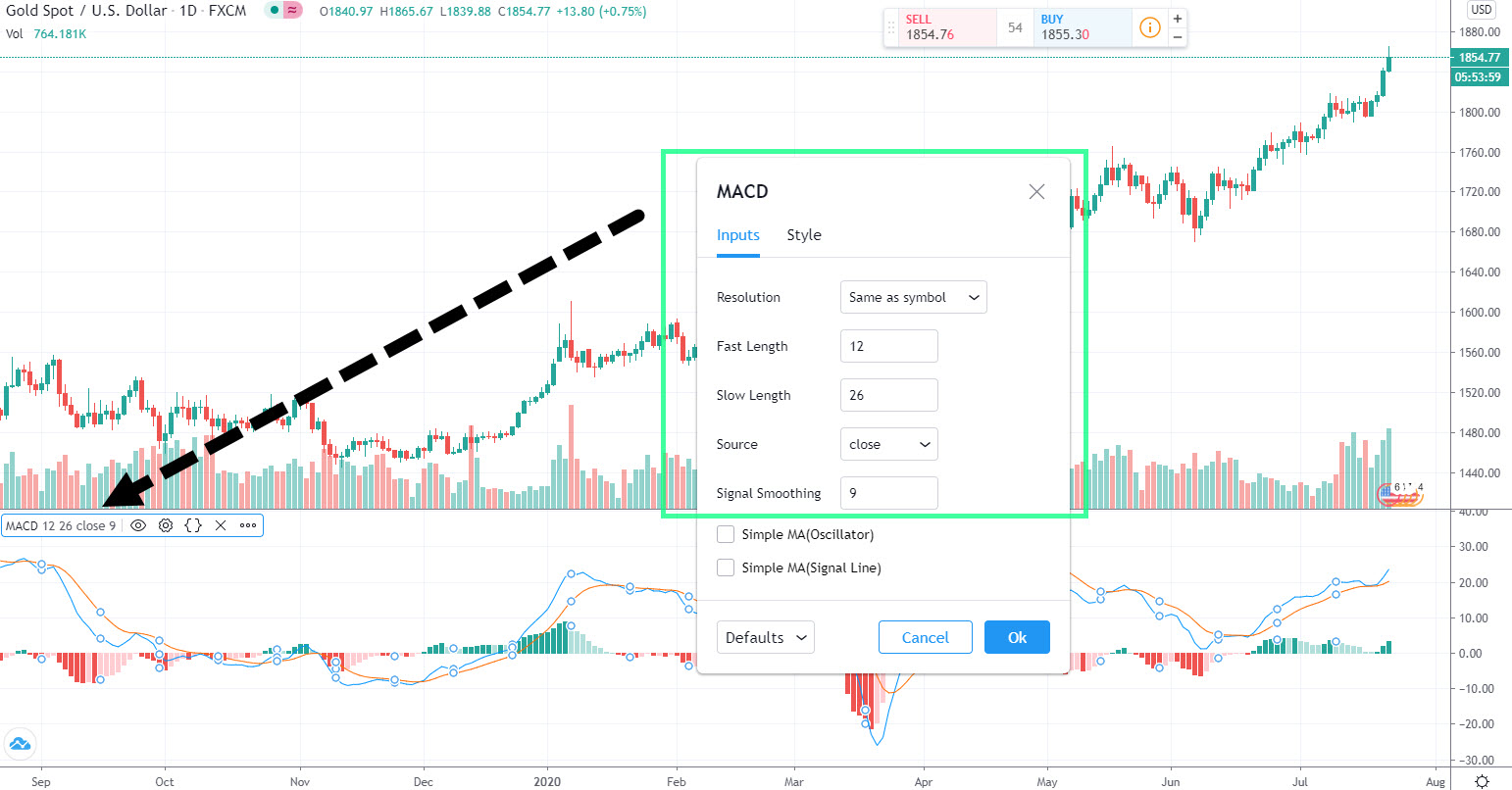

Which are the MACD parameters

According to the default setting, MACD is based on a formula that subtracts the 26-period Exponential Moving Average (EMA) – the so-called “fast lane” – from the 12-period EMA, a “slow lane”. In layman terms, the latter is quicker and the former is slower.

Moreover, MACD is also producing a “signal line”, which is the 9-period EMA. This way, two lines are seen on the indicator – the MACD line (the blue line) and the signal line (the orange line). The version with the two lines is called a “2-line MACD”.

There are three types of signals that the MACD is producing: A divergence, histogram, and crossover. A bullish and bearish divergence is arguably the most popular MACD output. Therefore, it is of paramount importance to how MACD divergence works.

MACD divergence

A bullish divergence occurs when the price is generating a lower low, but the indicator is generating a higher low. This way, the indicator is telling us that the price movements may turn upside to catch up with the indicator.

On the other hand, a bearish divergence takes place when the indicator is making a lower high, but the price is creating a higher high. Again, this signal points to a potential change in the trend direction.

In most of the cases, a divergence will emerge right after a sharp price movement up or down. It serves merely to indicate that the price reversal might happen, which is typically confirmed by a trendline break.

MACD histogram

The MACD histogram serves as a graphical representation of the difference between the indicator and the 9-day EMA. It displays positive values when the MACD is above its nine-day EMA and shows negative values when the indicator is below its nine-day EMA.

In case the prices are climbing, the histogram expands as the speed of the price movement increases and shrinks as price movement decreases. In general, this type of signal isn’t commonly used by analysts and traders.

MACD convergence

MACD convergence tracks the relationship between the MACD and signal lines. A bullish convergence is generated when the MACD crosses above its signal line.

Conversely, if the MACD crosses below its signal line, traders would classify this move as a bearish convergence.

Advantages and Limitations of MACD

One of the main benefits of the MACD indicator is its ability to point to a potential trend reversal. MACD signals, especially divergence and convergence, are very popular among traders as they proved to be a reliable tool for spotting extreme market conditions. Successful traders suggest using the MACD mostly on higher time frames, such as daily, weekly, and monthly.

On the other hand, MACD can also generate false signals. It may point to a potential reversal that never really occurs. Additionally, divergence doesn’t signify all reversals. Otherwise stated, it forecasts a high number of reversals that don’t happen and not enough genuine price reversals.

The problem with all momentum indicators that are measuring the market conditions is that overbought market conditions can always get more extreme. Hence, a trader may use a generated MACD signal to trade a market reversal, but the Forex pair may simply continue in the same trend.

This way, you’d be out of a trade before the actual reversal takes place. Hence, it is always suggested to cross-check MACD signals with other technical indicators. In this regard, it is advised to use non-momentum technical tools, such as the Fibonacci retracement and extension lines, trend lines, pivot points, major moving averages (100-period and 200-period MAs on a daily and weekly chart), etc.

In general, momentum indicators produce a specific set of signals which can work well with other technical indicators.

How to use the MACD in Forex Trading

As a lagging indicator, MACD uses historical price action to generate values that will help us come up with profitable trades. Momentum indicators, in general, are best used to confirm or invalidate that a market reversal is taking place, or about to take place in the near future.

In the EUR/USD daily chart below, we see the price movements heading south in a continuous downtrend. There is a series of lower highs and lower lows that push the price action lower.

At one point, the sellers’ momentum slows down as they are unable to extend the downtrend further lower. A simple candlestick analysis shows that the buyers are attempting to force a bullish reversal, with a strong bullish candle at the bottom of a downtrend.

EUR/USD daily chart – spotting MACD bullish convergence (Source: TradingView)

Hence, this bullish candle generates a signal that the trend is about to reverse. In this case, we apply a MACD indicator to confirm this signal as we are trying to capitalize on the market reversal. In the MACD window at the bottom of the chart we see that the MACD line (the blue line) is moving above its signal line (the orange line).

As noted earlier, this situation is classified as a bullish convergence. Therefore, we have a candlestick signal that the reversal may have started, in addition to the MACD bullish convergence.

Once we identify a potential trading opportunity, we move to define the trade setup. The entry is located once the MACD convergence is confirmed on a daily chart. As soon as the blue line opens the new daily trading session above the signal line, we are free to enter the market. Therefore, the entry (the blue horizontal line) is set at $1.0850.

EUR/USD daily chart – trading MACD bullish convergence (Source: TradingView)

A stop-loss order (the red horizontal line) is placed below the most recent low near $1.0780. We allow for a cushion of around 20-30 pips to protect us from the uncontrolled market whips. On the upside, the profit-taking order (the green horizontal line) should be measured according to your trading style and risk sentiment.

In this particular case, we are placing a take profit order just below the $1.10 mark, where the horizontal support line is located. This support is now likely to act as resistance, hence we are placing our profit-taking order there.

Traders looking for a more aggressive trading setup could also use the 100-DMA and 200-DMA as their profit targets, with both located around 50 to 100 pips higher.

Ultimately, our take profit order was hit just two days after we dipped into the market. The end result is 145 pips in profit, while we risked around 80 pips. As you can see, we had a 1 – 1.8 risk-reward (R:R) ratio, which is in a range that is generally suggested.

Summary

- Moving Average Convergence Divergence (MACD) is a popular momentum indicator that gauges current market conditions;

- MACD is calculated by subtracting the 26-period exponential moving average (EMA) from the 12-period EMA;

- A 2-line MACD consists of a basic MACD line and a signal line (9-period EMA);

- MACD mostly generates convergence and divergence signals;

- MACD’s best use-case is identifying when the Forex pair trades in the overbought or oversold market conditions.

Frequently Asked Questions

What time frame is best for MACD?

In general, the best time frame to use MACD are: a 4-hour chart, as well as daily and weekly charts. This way, the higher time frame charts produce fewer signals, but are considered to be more reliable.

For instance, MACD may produce an overbought signal on a 4-hour chart, while the market conditions on the daily and weekly charts are much more neutral. This way, a trader may learn that there is more upside left in the current uptrend.

Which MACD setting is best?

The standard settings for MACD indicators are 12, 26, and 9. In this setting, 12 refers to the 12-period exponential moving average (EMA), 26 refers to the 26-period EMA, while the 9-period EMA is a signal line.

Other groups of traders advocate for the application of different MACD settings – 19, 39, and 9. This setting is slower as it takes into account a higher number of data points.

Both standard MACD settings and the second settings have their purpose. Some traders use the standard (fast) MACD settings to enter the trade at the zero-line crossover. The second (slower) MACD is used to quit the trade when the MACD line passes through the signal line.

How accurate is MACD?

The MACD indicator provides many advantages, but it is far from faultless as it often struggles, especially in sideways markets. With MACD, overbought and oversold signals are not as reliable because the indicator is predicated on underlying price points. The MACD indicator should always be used in conjunction with other tools to verify signals provided by the MACD.

MACD’s ability to work together with other technical tools is actually one of its greatest advantages. MACD divergence can’t indicate a price reversal on its own, not with the accuracy required for day trading. This doesn’t mean the MACD is unusable, but traders should know about its shortcomings and not use the indicator alone.

In general, MACD is a reliable technical tool if used on higher time frames and in conjunction with other technical indicators.

Which one is better – MACD or RSI?

The Relative Strength Index (RSI) serves to tell investors whether a market is deemed overbought or oversold with respect to price levels. It computes average price gains and losses for a specific period of time. The standard time period used in RSI is 14 periods with values ranging from 0 to 100.

The MACD aims to determine the relationship between two EMAs, while the RSI determines price change with respect to recent price highs and lows. MACD and RSI are commonly used in conjunction to provide analysts with a comprehensive technical picture.

Both MACD and RSI measure the market’s momentum, but they sometimes provide opposite signs because they track different factors. For instance, the RSI could display a reading above 70 for a long period, telling us that the market is overextended to the bullish side with respect to recent prices, while the MACD tells us that the market’s buying momentum is still growing.

Which is one better – MACD or EMA?

The exponential moving average (EMA) is a type of a moving average that places more weight and importance to the most recent data. This is the opposite approach of the simple moving average (SMA) that sees all data points equally.

EMA is a simple technical indicator that calculates the average price. MACD, on the other hand, is a more complex technical tool that is actually based on the EMA. As such, MACD uses EMA to gauge the current market conditions.

Forex traders who are looking for more advanced trading signals, such as divergences and convergences, should use the MACD indicator.

Leave a Reply