NZD/JPY still trending up, although there is a very high risk of a trend reversal and therefore we are only expecting one strong wave to the upside.

Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice.

This analysis was done on MetaTrader 4.

Click below to open a Free Demo Account with our trusted brokers:

Trade Idea Details:

NZD/JPY symbol

Type: Bullish

Key support levels: 68.87, 68.40

Key resistance levels: 70.00, 70.42

Price Action:

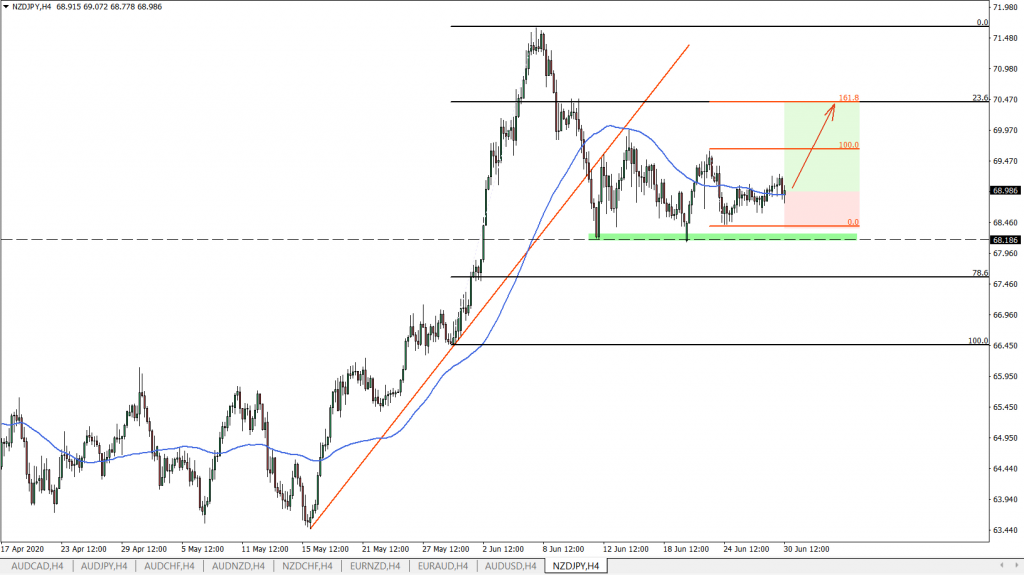

On the 4-hour chart, NZD/JPY formed a double bottom near 68.18 after which price broke above the 50 Exponential Moving Average. This might be a confirmation that the long term uptrend still remains valid.

Following the EMA breakout, the pullback was stopped at 68.40, where we applied the Fibonacci retracement indicator. The 61.8% Fibs is pointing out to the 70.40, which might be strong resistance in the coming days. This resistance is also confirmed by the 23.6% Fibs, applied to the last wave up, where NZD/JPY tested 71.66 high. Nevertheless, if the uptrend continuation will be the case, the pair is likely to test 71.00 psychological resistance. And only upon daily break and close above it, the long term uptrend could be confirmed.

Potential Trade Idea:

Currently, the price has approached the 50 EMA, which should act as the support. It makes an ideal entry point near 69.00 psychological support. The upside target is at 70.40 and in order to meed 1:2 risk/reward ratio, the stop loss should be placed at 68.36, which is just below the recently printed low, produced on the correction down after EMA breakout.

Leave a Reply