Every business is about understanding people. So is trading. Only that it’s about understanding the market. Long term trading or position trading is a great way to trade. As such, long term trading strategies appeal to many retail traders.

When buying or selling a currency pair, traders make an investment. They hope, eventually, to make a gain.

Time, or an investment’s time horizon, is what makes a difference. Short term traders scalp their way in a market.

They buy and sell multiple times in a day. In doing that, the aim is to profit from the intraday market swings.

Medium term traders swing. It means they hold a position more than a day. And sometimes, even a week.

How about long term trading opportunities? Typically, these traders are investors.

They invest in an asset (a currency or a currency pair) and simply wait for the investment to pay off.

It is obvious that time makes a difference. The trading style depends on the time horizon of a trade.

As such, traders approach the market differently. Long term trading strategies differ from swing trading techniques.

And, scalping the market differs from position trading. But is this type of trading suitable for retail traders?

In this article, we’ll cover:

- What is position trading?

- Position trading vs swing trading

- The traits of a position trading trader

- The best long term trading strategies

- Fundamental long term trading

- Technical long term trading strategies

The aim is to present the advantages and disadvantages of position trading. And, what are the risks and limitations, if any.

As such, traders can compare their actual trading style and see whether long term trading fits better. The outcome will take many retail trader by surprise.

What is Position Trading?

When coming to the Forex market, retail trades have unrealistic expectations. They want to make millions from a thousand-dollar account.

That’s unrealistic. Not that is impossible. Just, the odds for this to happen are small.

Retail traders might stand a better chance using long term trading strategies.

Position trading is one and the same with buy and hold. Stock traders know better.

On the stock market, a buy and hold strategy means to bet against the doomsday. Ask Warren Buffet.

What he did was simple as simple can be. He bought every negative news.

Every dip in the stock market. While others were concerned about the 2008 financial crisis’s outcome, he simply bought the dip. And held the positions.

That’s long term trading. The willingness to hold positions for years to come.

But, such a trading style exists in every market. Long term Forex trading strategies end up having many fans.

Not only big shots investors. But Forex retail traders too.

Forex retail traders lose a lot of money. Especially the newbies.

Rookie traders believe they can make millions. With no effort. And super-fast.

While that’s a possibility, it’s not a realistic approach to trading. And, there’s one more crucial mistake: they don’t have patience.

Traders that constantly fail, might consider changing their strategy. Wouldn’t it be easier to simply take a position in a major trend?

This way, small changes in prices won’t bother you anymore. Moreover, spikes due to economic news will get to be filtered. Or, the market noise simply “disappears”.

A proper definition of position trading starts from the time of a trade. If you’re willing to hold a trade for months and even years, you’re in the long term Forex trading business.

Long Term Trading Advantages

People are drawn to long term Forex trading for various reasons. The most important one is failure.

They fail to make it in the Forex business. Many think trading is easy. In reality, it is one of the most complicated tasks in the world.

The Forex market changes instantly. Every day, over five trillion dollars change hands around the world.

To speculate on those moves, one needs a strategy. A strategy to avoid the daily swings that take you out.

Position trading is the answer. It helps traders avoiding daily market swings. And, high-frequency trading effects won’t matter anymore.

Another pro is given by traders’ availability. Or, the time available to analyze the market.

Some are technical traders. Others buy and sell based on fundamental analysis.

In both cases, any type of analysis needs time. Technical analysis is time-consuming. And so is the fundamental one.

But, almost all retail traders have a job. A different one.

While the dream is to quit the day job and become a full-time trader, that’s not happening. At least, not from the start.

As such, instead of trading here and there and chopping your trading account, position trading strategies are a better option. Both for the trader and for the trading account.

Moreover, stress disappears. When major economic news is scheduled for release, long term trading traders stay calm. There’s nothing to worry about when you ride a major trend.

These are only some of the advantages presented by long term trading strategies. However, traders can find others along the same lines.

Disadvantages of Long Term Trading Strategies

Long term trading has disadvantages too. A lot of them.

For instance, long term trading strategies end up with a high cost. Think only of the negative swaps to pay.

As a reminder, the swap is the interest rate differential. The two currencies in a currency pair have an interest rate.

Therefore, when traders hold a position overnight, they pay or receive a swap. A so-called positive or negative swap.

However, the issue is that most of them are negative. As such, instead of receiving swaps, position trading traders end up paying them.

When the time horizon is so big, like in the case of long term trading, that’s quite costly.

Another problem comes from the funds safety. I mean, the broker must offer segregated accounts.

But, if traders have such a long-term view about a market, the broker must be reliable. Therefore, long term trading traders choose their broker carefully.

Moreover, they diversify their assets. The use of multiple brokers is very common among long term Forex trading traders.

To continue with the negatives, traders need a bigger stop loss. Position trading trades typically come from bigger time frames.

Weekly and monthly charts are common. As such, the stop loss should be in direct proportion to the time frame.

By now, you have an idea about long term trading pros and cons. Moreover, you’ve learned what position trading Forex is.

But how about long term trading strategies?

Best Long Term Trading Strategies to Consider

Swing trading is less time intensive than day trading. On the other hand, position trading takes even less time than swing trading.

However, if two trading styles are alike, swing trading and investing are the closest one. They both consider and long/longer time horizon.

Therefore, the starting point of any long term trading analysis is not the lower time frames. But the bigger ones.

Technical analysis in Position Trading

Funny enough, long term trading strategies don’t have anything special. In fact, they are similar to short term ones.

But, the time frame differs. Therefore, the expectations too.

For example, if you buy the EURUSD based on the hourly chart, you won’t hold it for years. Probably.

But if bought it from a monthly pattern/analysis, you might do that.

Let’s run some examples. Every retail trader knows how a wedge looks like.

These are very common patterns. They rise or fall, giving short or long trades.

A common target is fifty percent of the wedge in less than half of the time it took to form. Traders enter on the 2-4 trend line break. Next, place the stop at the highs/lows (depending on the wedge), and set the take profit.

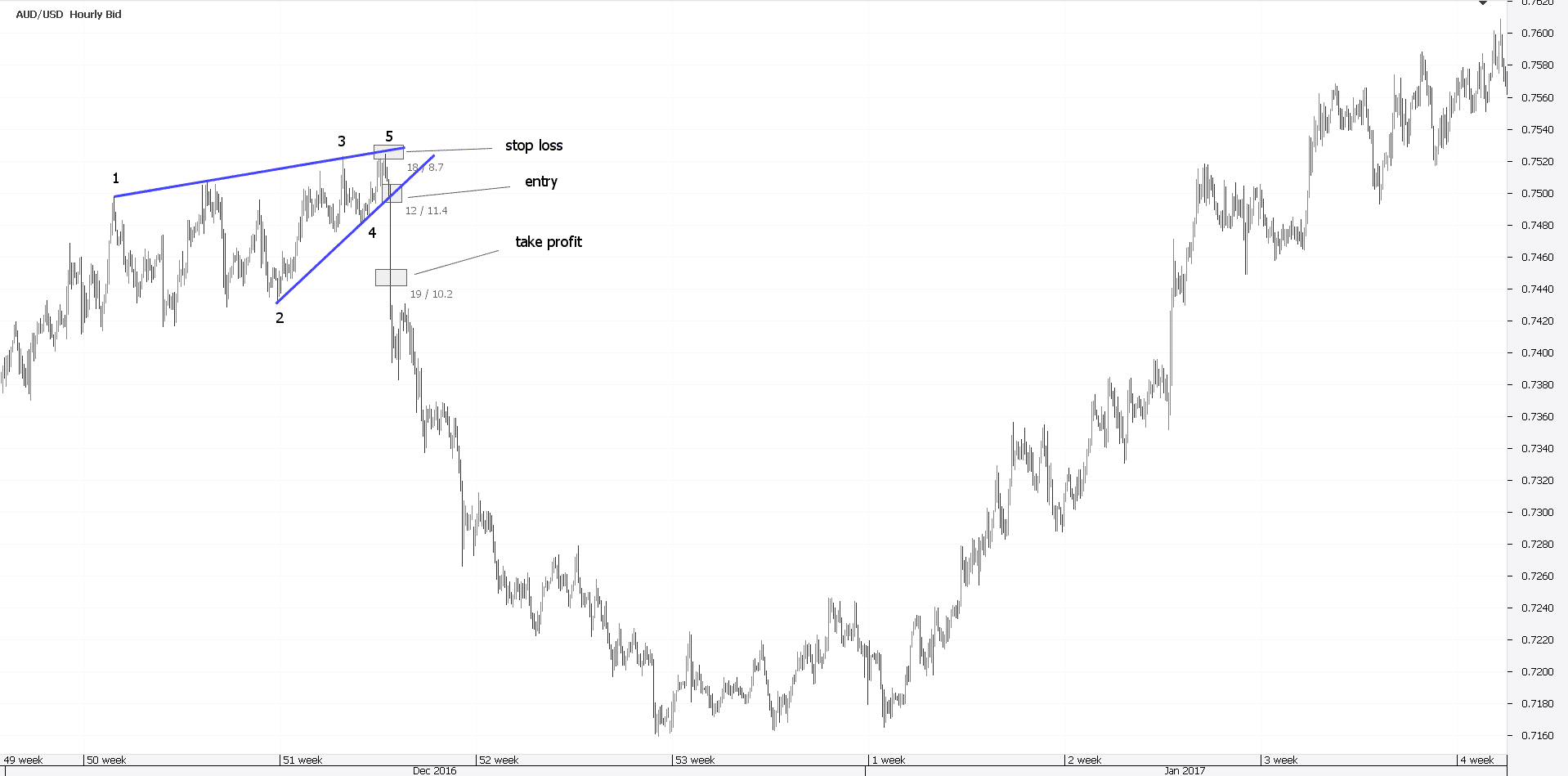

Here’s how a rising wedge looks like. This is the hourly AUDUSD chart.

Traders take several steps to trade it. First, they sell the 2-4 trend line break. Second, they set the stop loss at the highs. Finally, the take profit at fifty percent the distance.

It took price one hour to reach the take profit. Or, less than an hour.

However, the same pattern on the monthly chart takes more time. Much more time.

But it is the same pattern. Moreover, it has the same rules. Only the time differs.

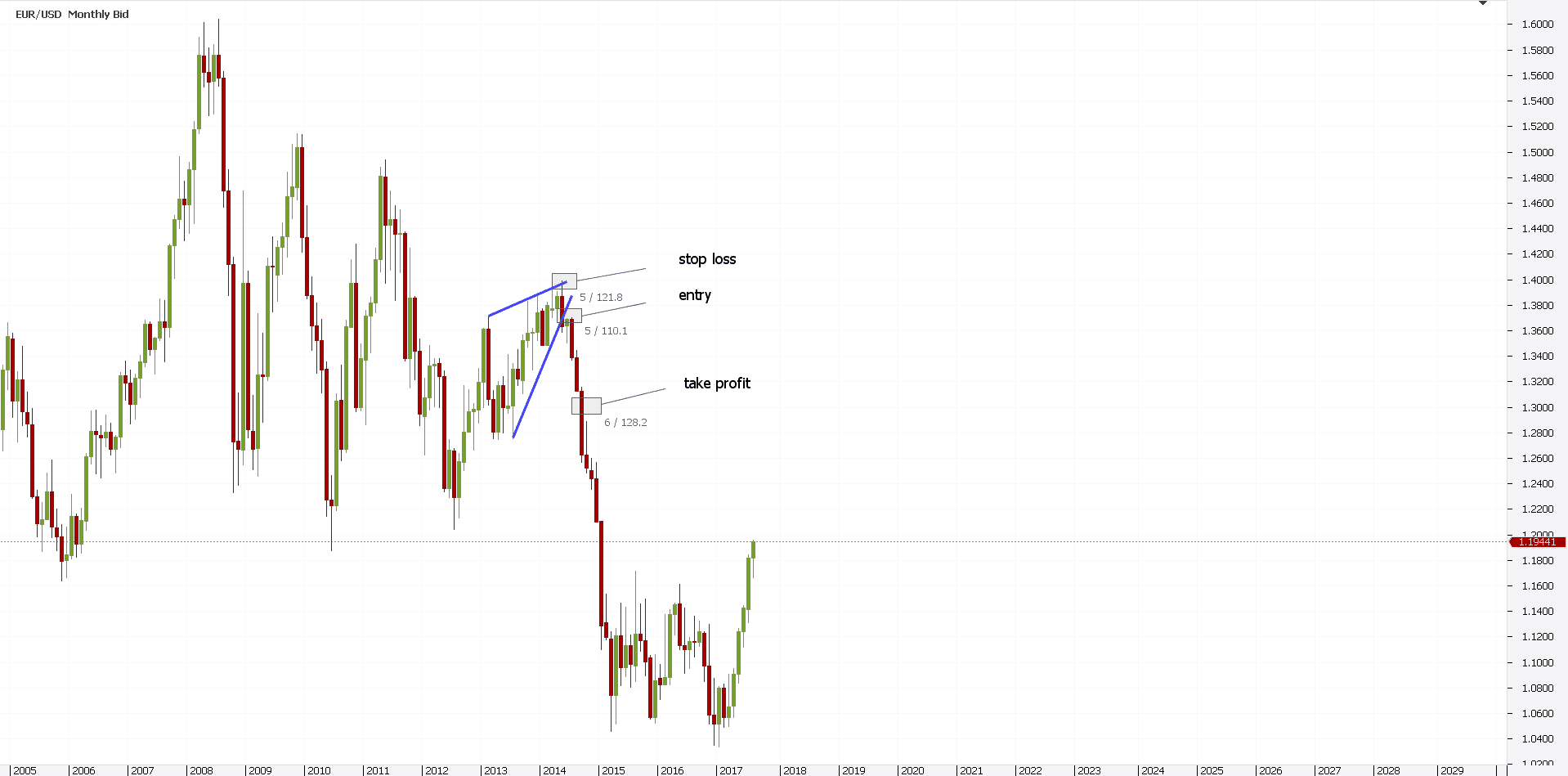

Here’s the monthly EURUSD time frame. A rising wedge formed.

Traders took the same steps. First, selling the 2-4 trend line break. Second, setting the stop loss. Finally, the target.

Only this time, it took price almost four months to hit the target. That’s position trading. That’s all that is.

Pattern Recognition Long Term Trading

Long term trading strategies are identical to short term ones. We explained so far what differs. The time for a trade.

Therefore, anything traders use in swing trading, scalping, day trading, and so on, can be used in position trading.

From a technical analysis point of view, there’s no difference. None.

Of course, except for the time.

Every trader knows the most common pattern’s name. That’s a contracting triangle.

Such triangles appear on all time frames. From smaller to bigger ones, there’s no difference in them.

But the time element gives the trading style. Long term Forex signals derive from such patterns.

In a triangle, the a-c and b-d trend lines show its shape. They mostly contract.

A great entry is when the price reaches the a-c trend line. As such, traders go in the opposite direction. After all, the b-d trend line must break.

But, what do you do when the triangle appears on the monthly chart? If you trade the b-d trend line, that’s position trading.

Position trading strategies like the one below are the same, as long as the pattern respects the rules.

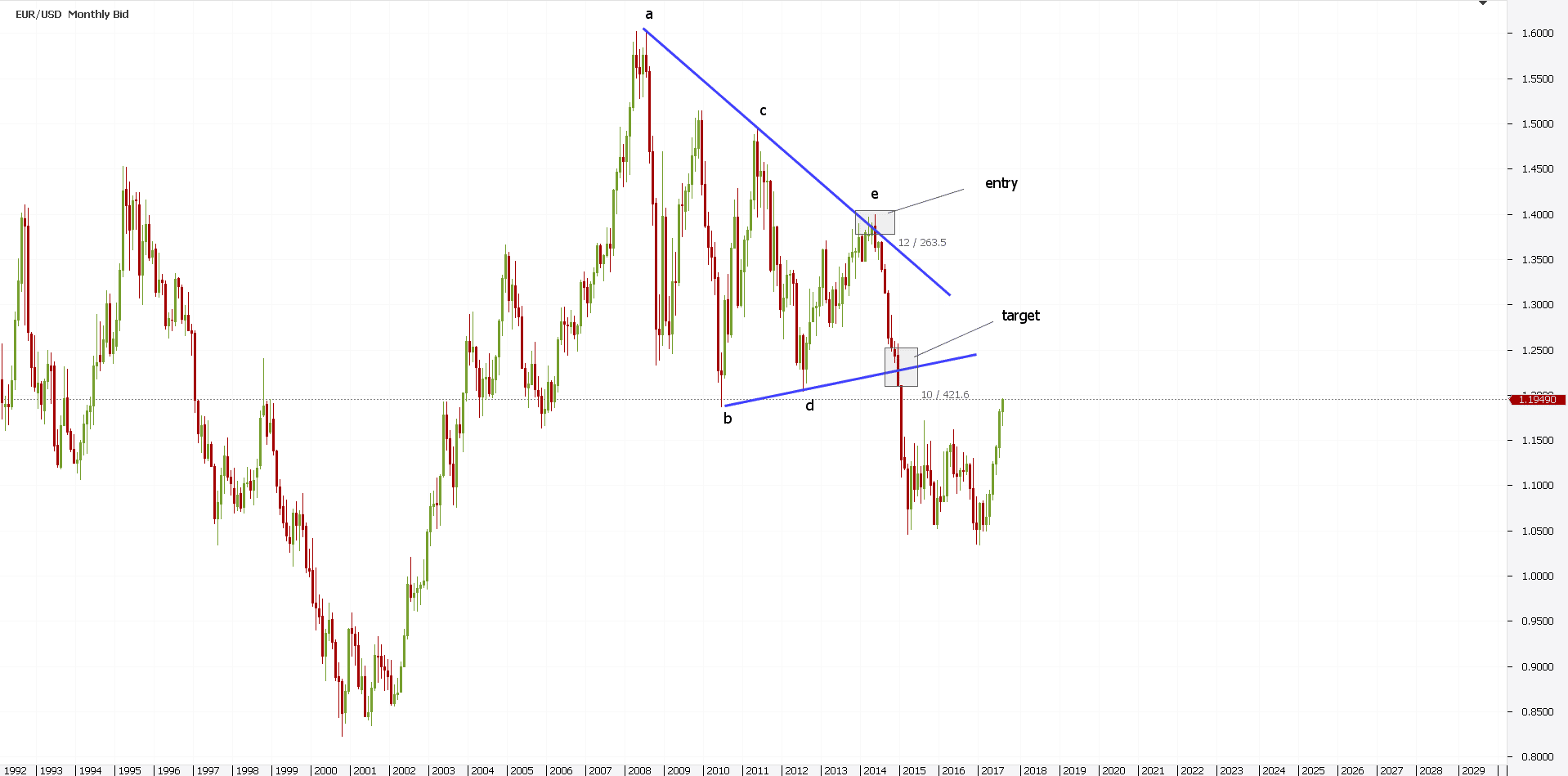

That’s the EURUSD pair. Recently, it formed a contracting triangle. On the monthly time frame.

Any trade derived from it is long term trading. Monthly and weekly time frames are the home of long term trading strategies.

First, the a-c trend line gets hit. That’s a great entry for a short trade.

Next, the b-d trend line is in focus. But, position trading Forex needs more time for such a break.

In this case, more than eleven candles. Or, eleven months since the a-c trend line got pierced.

That’s the finest example of long term trading using a pattern recognition approach.

Fundamental Analysis in Long Term Trading

There’s no better market to illustrate macro economic imbalances like the foreign exchange market. Think of it for a change.

A currency pair has two currencies. And, they belong to different economies.

These economies fluctuate. Some expand, others contract.

Traders around the world speculate on this. They move capital from country to country, region to region, in search for the best yield.

The first reaction always appears on the Forex market. The two currencies in a pair will show the economic differences between their economies. Hence, a trading opportunity arises.

However, there’s a catch. A fundamental change takes time. Any trade derived from it is long term trading.

Position sizing trading helps in such an environment. Traders scale into a position.

Or, they build one. As such, they split the invested amount. And enter in a trade in different places.

Monetary Policy as a Long Term Forex Strategy

When monetary policy changes, the value of a currency changes too. That’s what moves the Forex market.

Long term trading Forex implies understanding macroeconomics. And this, in turn, implies understanding how to interpret an economy.

Economic news moves the market. But, rarely just a piece of economic news is the reason for position trading.

Long term trading positioning is the result of interpreting all the economic news. Moreover, traders put the info together to find a new trend.

A fundamental trend. When an economy improves, the central bank will notice.

Central banks meet regularly to check the state of the economy. If the economy improves or expands, the central bank will send hawkish signals.

That’s bullish for the currency. It shows changes in monetary policy. Therefore, long term trading strategies derive from such changes.

In 2008, a terrible financial crisis crippled the world. It started in the United States and spread all over the world.

The Fed was the first central bank to move. It quickly slashed rates to zero.

Central banks around the world followed suit. Moreover, some were even more aggressive. They cut rates into negative territory.

As such, investors in search for higher yields looked for alternative options. The stock market proved to be the right place to go.

Position trading was caused by changes in monetary policy. The same is valid for long termforex trading strategies.

That’s especially true in the case of the U.S. dollar. Because it is the world’s reserve currency, when the Fed changes the monetary policy, it changes investors’ long term trading expectations.

The Traits of a Long Term Trading Investor

While there’s no recipe for what makes a position trading trader, here are some core position trading skills:

- Contrarian thinking. Best long term Forex trading strategies often start ahead of the curve. These are proactive traders. Not reactive ones. As such, they analyze the market. Then, they decide on a long term trading strategy. And finally, they implement it. To do all that, one needs to think differently.

- They simply ride the trend. And enjoy the ride, until long term factors change.

- Great understanding of economic data. Macroeconomic analysis is one of the most difficult areas. And in position trading, such an analysis is a must.

Besides this, long term trading traders need a big account. For trades to have an impact, the trading size must be big.

As such, a big account will help whether when the market retraces.

Long term trading strategies may end up in several hundred or even thousands of pips profit. But in Forex trading, the market doesn’t move in a straight line. In fact, all markets move in cycles.

A long term trading trader’s account will see good and bad times. It must face small trends against the general position trading direction.

Conclusion

There’s no trading style better than another. But, there’s a trading style for each person.

If you’re impatient and don’t like to wait much for a trade, position trading is not for you. Or, investing.

However, if you like reading about financial news around the world, long term trading will come consequently. It is impossible not to be tempted to apply long term trading strategies on economic differences you know.

But the reality tells us that most retail traders engaged in long term trading strategies do that for a different reason. They don’t have time.

As such, they simply look at the bigger picture. Preferably, over the weekend.

They check the monthly, weekly and daily charts. They read about what happened and the major monetary policy changes.

And they act. Next, they simply monitor the trade for months and even more.

That’s position trading. It shows the ability to spot the right direction. The general direction.

And, to stick with it. The most successful long term trading traders have their own view on the market. They like interpreting the news.

Moreover, they put their money on the line. Because the views imply a bigger picture, the account is big as well.

START LEARNING FOREX TODAY!

- core position trading

- long term forex trading

- long-term trading

- position trading

- position trading strategies

share This:

Leave a Reply