With a daily trading volume of over $6 trillion and close to 10 million active traders, it’s clear that the forex market is an attractive investment option. However, forex trading comes with some inherent risk and a stop order is one money management tool many traders rely on to minimize this risk. This leads to two important questions; what is a stop order and how does it work?

A stop order is an instruction to your broker to automatically buy or sell a currency pair once the market price reaches a certain level. The order increases the chances of achieving a predetermined entry or exit price by “stopping” order execution until the market price reaches the “stop price.”

By using a stop order, you’re able to limit losses if the market moves against you or lock in profits in a bullish market. In this article, we will look at the different types of stop orders, how they differ, and how to set them up and use them.

Table of Contents

Stop Orders in Forex Trading

In forex trading, you can use a stop order to exit an existing position or enter a new one. It is activated when the market price reaches or passes a specific stop price.

For example, let’s say that EUR/USD is trading at 1.1257 and you expect it to hit 1.1352 in the future, so you go long (buy the pair). To minimize huge losses in the event of a sudden market downturn, you direct your broker to set a stop order at 1.1190.

If the EUR/USD value does go up to 1.1352, you will realize a gain of 95 pips. Nonetheless, if the price goes down and reaches 1.1190, the stop order becomes a market order and your broker will automatically sell the currency pair to prevent any further losses.

However, it’s important to note that the broker won’t necessarily sell the pair at 1.1190. This is because the stop price simply acts as a threshold. They can fill your order at the stop price or another price above or below the stop price depending on market conditions. It all comes down to how much the market is fluctuating when the price reaches the stop price.

Various types of stop orders are available in forex trading and each order caters to a specific trading need. The following are the main types of stop orders:

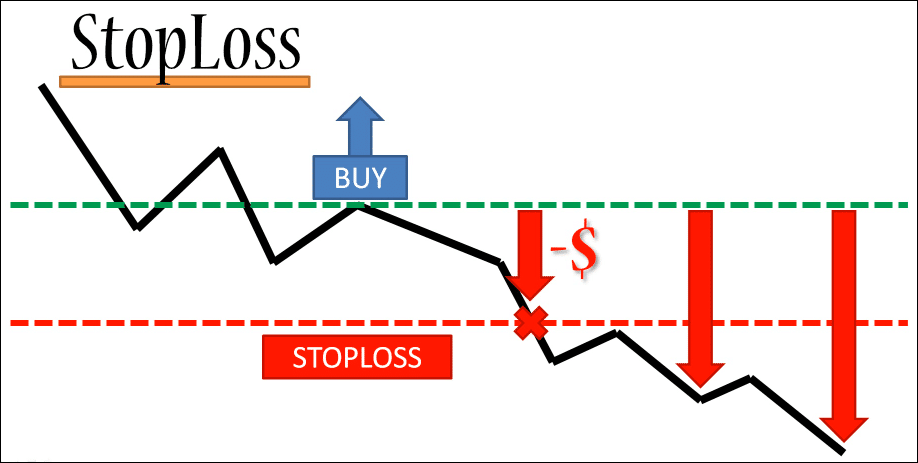

Stop Loss Order

A stop loss order is an order to close out a position if the market price reaches a specified level. This order is designed to minimize your risk on a position if the market goes against you.

For instance, if you go short on the GBP/USD at 1.2675 and place a stop loss order at 1.2690, you’re essentially limiting your risk on the trade to 15 pips. This means that you can’t incur any losses greater than the 15 pips and a buy order will be executed automatically at 1.2690. A stop loss order will remain effective until it’s triggered or you choose to cancel it.

Trailing Stop Order

A trailing stop is similar to a stop loss order but with some modification. While a typical stop loss order is triggered once a specific price is reached, a trailing stop moves by an attached “trailing” amount as the price fluctuates.

For example, a sell trailing stop order will set the stop price at a fixed amount below the market price, including the trailing amount. The stop price will increase by the trailing amount as the price increases, but it will remain unchanged if the price falls. A market order is submitted once the stop price is reached.

Let’s say that you decide to short EUR/USD at 1.1310 with a trailing stop of 15 pips. To start, your stop loss is at 1.1325. If the price goes down to 1.1295, the trailing stop will move down to 1.1310. Once the trailing stop moves down to 1.1310, it will stay there and not widen back to 1.1325 if the market moves higher against you.

If EUR/USD reaches 1.1286, the trailing stop moves to 1.1301 and locks in a 15 pip gain. The position will remain open as long as the market does not move against you by 15 pips. In this scenario, once the market price starts increasing and reaches 1.1301, your platform will execute a market order and close your position.

Stop Entry Orders

Similar to a trailing stop, an entry-stop order is a modification of a stop loss order. An entry-stop order is one that instructs your broker to buy at a price above the market price or sell below the market at a specific price.

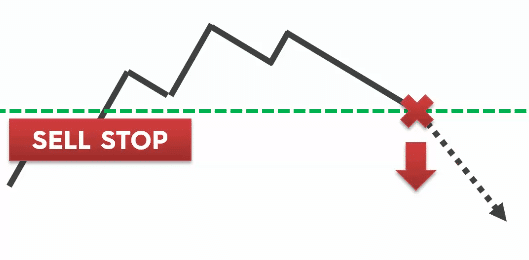

To protect a long position, you use a sell stop order which is triggered to sell a currency pair when the market reaches a certain price or lower.

For example, let’s say you want to short GBP/USD which is at 1.2488. Assuming that you will only enter short when the price makes new lows, you’ll place a sell stop order below 1.2488, for instance at 1.2390. The sell stop order is activated if GBP/USD reaches 1.2390 or lower.

To protect a short position, you use a buy stop order which is triggered to buy a currency pair when the market price reaches a certain price or higher.

Continuing with the previous example, let’s say you’re going long on GBP/USD which is at 1.2488. Assuming that you want to buy only when the price makes new highs, you’ll place a buy stop order above 1.2488, for instance at 1.2530. The buy stop order is triggered if GBP/USD hits 1.2530 or higher.

How to use Stop Orders to Improve your Trading

It’s important to know the different stop orders but it’s also equally important to know how to use them. As with many forex trading concepts, it takes lots of patience and practice to refine your skills but that is not to say that you can’t use some simple tips to make trading easier.

Tips to use Stop Loss and Trailing Stop Loss Orders

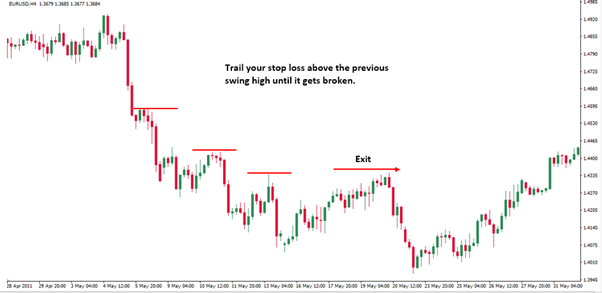

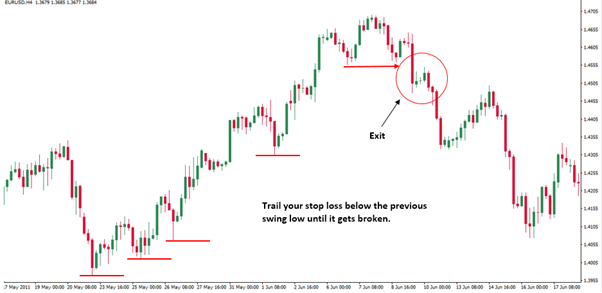

Your stop loss level is determined by how much risk you are willing to allow per trade. There are several ways to determine a stop loss level, but as a general rule, for long trades, a stop loss usually goes slightly below a recent swing low (support level). For short trades, a stop loss will go slightly above a recent swing high (resistance level).

Since a trailing stop loss order is, in effect, a stop loss order that moves by a specific amount below or above the market price, you can still generally use the same concept of swing highs and lows to set it up.

Generally, in a downtrend you can trail your stop loss above the previous swing high until it’s broken.

In an uptrend, you can trail your stop loss below the previous swing low until it’s broken.

If the price movement has no obvious swing lows and highs, using moving averages can help.

You can read more about correct stop loss and trailing stop loss placement here.

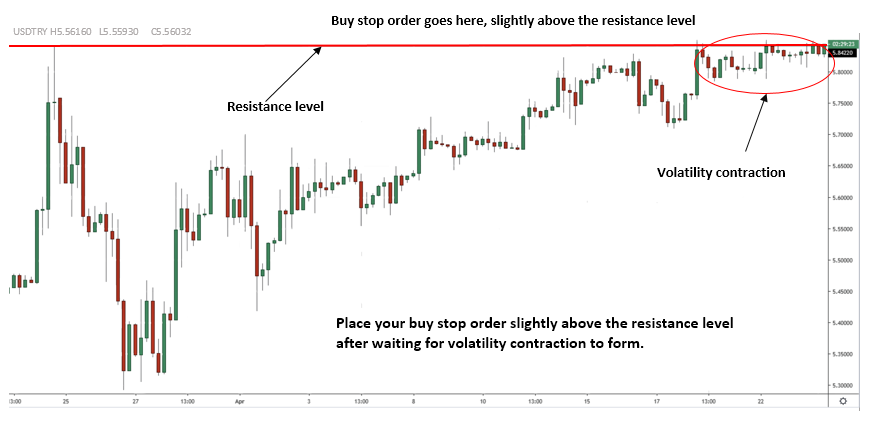

How to use Stop-entry orders

A buy stop order will automatically buy a currency pair if an uptrend triggers the order. To use a buy stop order, you:

1.Identify a resistance level based on the previous swing highs.

2. Wait for the price to form a volatility contraction near the resistance level. A volatility contraction, which is also known as a build-up, is a pause in the market.

3. Place your buy stop order slightly above the resistance level.

A sell stop order will automatically sell a currency pair if a downtrend triggers the order. To use a sell stop order you basically do the opposite of what you do for a buy stop order.

1.Identify a support level based on the previous swing lows.

2. Wait for a build-up to form near the support level.

3. Place your sell stop order just below the support level.

How to Setup Stop Orders in MetaTrader 4 (MT4)

Setting up stop orders in MT4 is relatively straightforward if you know how to go about it. Here’s how to set up the main orders.

How to add a stop loss order in MT4

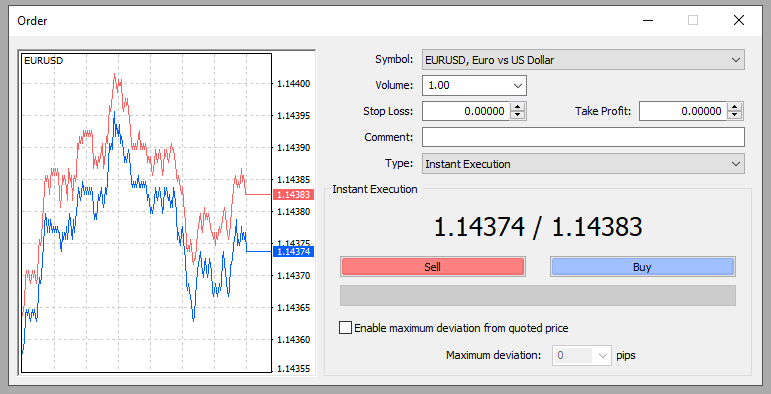

The easiest time to add a stop loss order is when you place a new order. To set up the order.

1.In the “Trade” tab, double click on the currency pair you want to trade. An order pop-up will appear.

2.Adjust the stop loss price to your required level and choose to “Sell” or “Buy”. Once you have entered a stop loss level, stop loss lines will appear on the chart and you can use them to modify your stop loss level quickly.

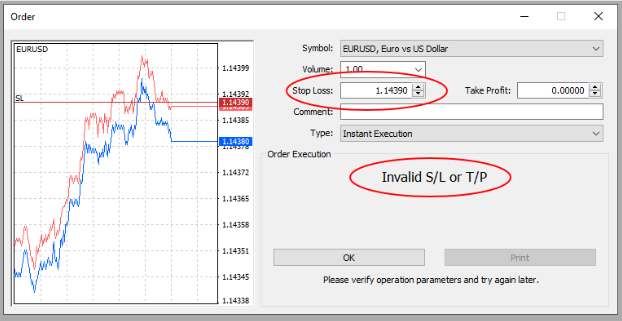

Note: If your stop loss price is too close to the current market price, the message “Invalid S/L or TP” will appear.

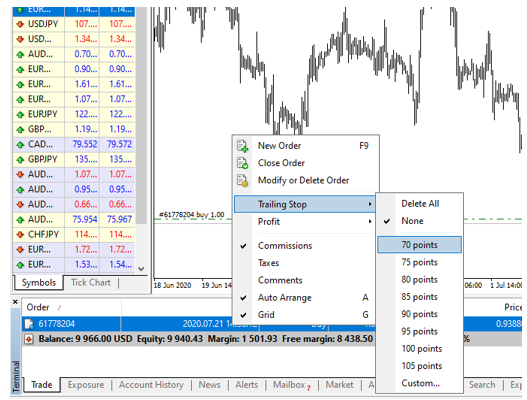

How to add a trailing stop order loss in MT4

To set a trailing stop on your position:

1.In the “Trade” tab, right-click on the open position and hover your mouse over “Trailing Stop”.

2.Choose your desired pip value. If you want a pip value outside the predetermined amounts, choose the “Custom” command and set a custom trailing stop level. Do note that a trailing stop order must exceed 15 points.

Note: A trailing stop works in the client terminal, not the server, so it will not work if the terminal is off.

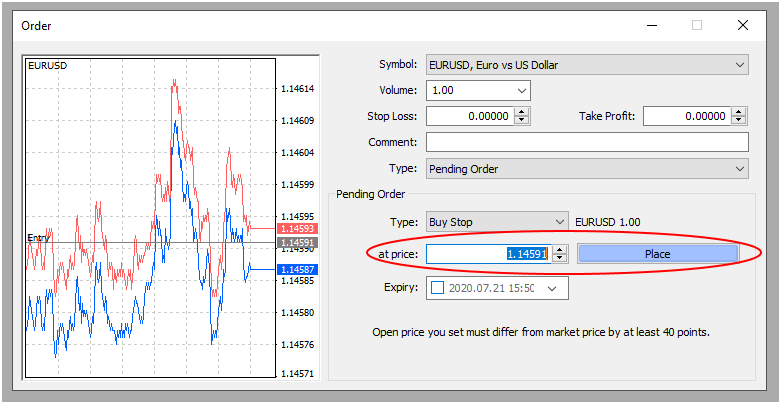

How to set up entry-stop orders in MT4

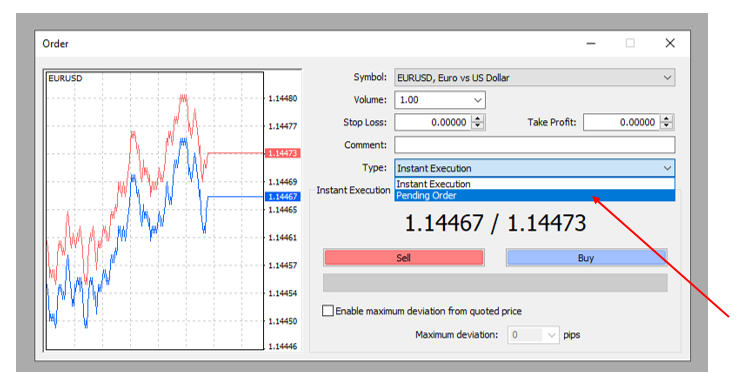

To set up either a buy stop or sell stop order:

1.In the “Trade” tab, double-click on the currency pair you want to trade. An order pop-up will appear.

2.Under the “Type” option, select “Pending Order”. Pending order options will appear.

3.Under the “Type” option, choose either “Buy Stop” or “Sell Stop” options.

4.Specify the price at which you want the order to be triggered.

5.Click in “Place” and you’re set.

Frequently Asked Questions

Stop orders are a very common tool among traders and so it’s perhaps unsurprising that certain stop order questions frequently crop up in forex trading conversations. In addition to the “What is a Stop Order and How Does it Work?” questions, the following are other frequently asked questions with regards to stop orders.

What is the difference between Limit Orders versus Stop Orders?

While a stop order triggers a market order when the market price reaches or passes any specified stop price, a limit order can only be executed at a price equal to or better than a specified limit price. In other words, a limit order guarantees that the broker will execute the order at your limit price or better.

There are two types of limit orders in forex trading – the buy limit and sell limit orders. These orders do the opposite of what the buy stop and sell stop orders do. A buy limit order is an order to buy at or below a certain price and a sell limit order is one to sell at a certain price or better.

What is the limit price on a stop order?

A limit price comes with a stop-limit order. A stop-limit order has both a stop price and a limit price. Once the order reaches the stop price, the stop-limit order becomes a limit order. The limit price is the price which must be reached for the broker to execute the order, i.e. the order is not completed unless the market price reaches this specified limit price or better.

The Bottom Line

The forex market comes with some risk and it’s important to understand how to limit that risk. Learning how stop orders work and applying them to your trading strategy remains one of the best ways to manage risk and increase your chances of succeeding in the market.

Leave a Reply