The forex market is fast-paced, so much so that it’s easy to overlook how a winning trade can easily turn into a losing position and leave you with considerable losses. Good thing that a TakeProfit order exists, right? On that note, let’s start by giving a quick answer to the frequently asked “what is a TakeProfit and how to use it” question.

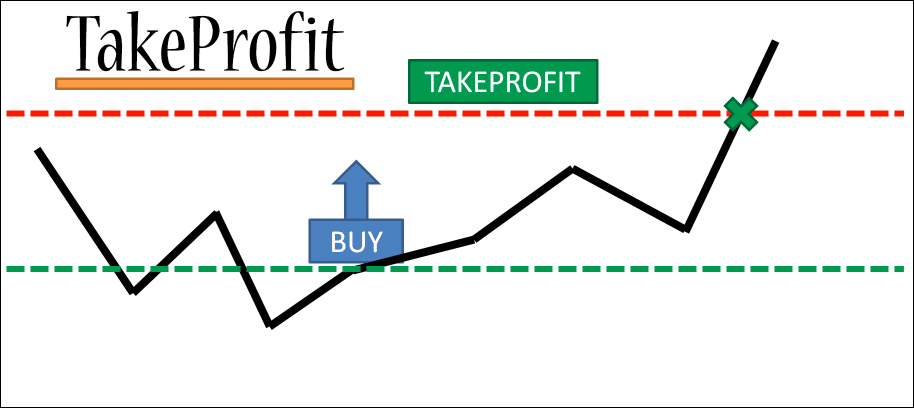

A TakeProfit in Forex is an order type you use to exit a profitable position or trade once the market reaches a specific price. The order, which is mostly used by short-term traders, is only fulfilled if the price reaches a certain level, helping you to lock in a profit.

You use the TakeProfit order when you want to secure profits that you could otherwise miss. With that in mind, let’s explore how the order works and how you can leverage it in your forex trading.

Table of Contents

TakeProfit Orders in Forex Trading

A TakeProfit order belongs to the limit order family. This means that it is only fulfilled if the market price reaches a specific level. If the currency pair you are trading never reaches the set limit price, the order is not executed.

Example: How to Take Profits in trading

Let’s say you buy (go long) 1 lot of EUR/USD. This means you expect to profit from the value of EUR increasing in relation to that of USD. If EUR/USD is trading at 1.2240, you will set your TakeProfit order at a higher price, for example, at 1.2310.

If the market price does reach 1.2310, your trading platform automatically closes the position and you get a profit of 70 pips. If there’s a sudden market downturn and EUR starts weakening before the market price reaches 1.2310, for example at 1.2295, your platform won’t execute the order.

Why Use a TakeProfit Order

Although there’s always the possibility of your TakeProfit order not being executed, the order remains one of the top risk management tools. It will give you several advantages in the forex market, like the following:

- The order locks in profits as long as it is executed.

- You don’t have to manually close a trade once it reaches your desired profit level. This limits the amount of time you have to spend waiting for your trade to reach the desired price. It also minimizes the risk of losing profits when you are not actively watching your charts and the market.

- The order helps with managing your emotions. Once you have set your TakeProfit order the trade will happen automatically; you won’t have to be second-guessing the level at which you will take profits.

A TakeProfit forex order has its merits in the market but you must also be aware of the drawbacks it carries.

The Limitations of a TakeProfit order

Perhaps the biggest disadvantage of a TakeProfit order is that it may not be executed at all. You could still end up incurring some losses if the currency pair doesn’t reach a certain market price.

Furthermore, the order doesn’t allow you to capitalize on longer-term trends. It’s more suited to short-term traders. If you’re a long-term trader with little to no interest in immediate profits, this order is inappropriate

Being familiar with the advantages and drawbacks of using a TakeProfit order is invaluable in forex trading. Other equally important aspects are knowing how to determine the TakeProfit levels and how to set up the order in your trading platform.

How to use TakeProfit Orders to Improve your Trading

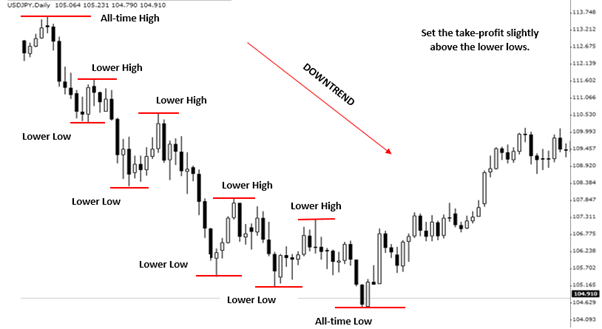

Although there are various methods for determining TakeProfit levels, you can generally use support and resistance levels. You can identify the support and resistance using several methods such as peaks and troughs, moving averages, and trend lines.

For example, when you are using peaks and troughs in a bullish market, each higher low is a support level and each higher high is a resistance level. You set your TakeProfit level just below the resistance level.

If you set the TakeProfit above the resistance level it means that if the price bounces at the resistance level, you will lose your profits. By setting your TakeProfit just below the resistance level, you sacrifice a few pips to lock-in your profits in case the currency pair can’t break through the resistance.

In a bearish market, a lower low is a support level while a lower high is a resistance level. You set your TakeProfit just above the support level.

If you set your TakeProfit below the support level and the price bounces back up, you will lose your profits.

Check out this webinar for more strategies you can use to establish TakeProfit levels.

Using A TakeProfit order to Lock-in Partial Profits

The execution of a TakeProfit order closes out a position. Nonetheless, you can still set up your order in such a way that you secure some profits without exiting your position entirely. To do this, you modify your TakeProfit order to only lock-in partial profits.

By locking in partial profits you secure some of your profits and reduce the size of your remaining open position. A smaller position size exposes you to less risk should the market move against you.

The level at which you choose to lock-in partial profits will come down to your risk appetite and trading strategy. For example, some traders book partial profits halfway through a profitable trade. Others use the triple scale method, splitting their trade into three TakeProfit orders and setting up three TakeProfit levels. You need to try out the different methods and find out what works for you.

Example: How to Lock-in Partial Profits

To lock-in partial profits, you can open multiple positions, each with a different TakeProfit level. You can also open a single position and modify your TakeProfit order to lock-in profits at different levels.

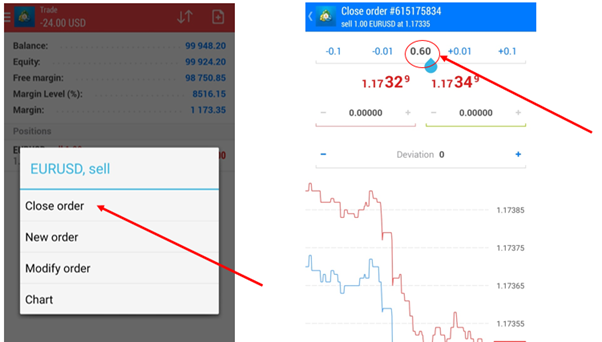

For instance, let’s say you open a trade to sell 1 lot of EUR/USD in the MT4 mobile app. To take partial profits, you modify your TakeProfitlevel by:

- Selecting the option to close the trade.

- Changing your lot size. Let’s say you choose to lock-in partial profits for 0.6 lots of your trade. You will change your lot size from 1.0 to 0.6 and close the trade

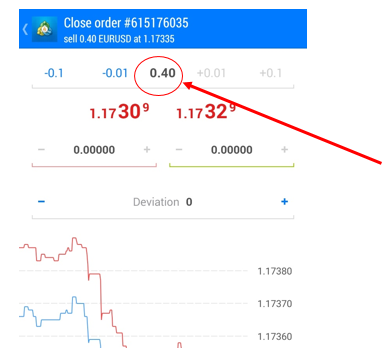

Doing this will secure profits for the 0.6 lots and leave 0.4 lots open for the next TakeProfit level.

The only problem with this approach is that you have to monitor your position for as long as it remains open. After all, dedicating all your time to waiting for the right exit level is hardly ideal.

You can simplify things by using an add-on such as the Partial Close expert advisor to set up multiple TakeProfit levels and close them automatically when they are triggered.

Note: Locking-in partial profits is an advanced concept. You should gain sound knowledge of the concept and practice before trying it in a real account.

TakeProfit orders and the Risk-reward Ratio

Consistent profitability is one of the keys to succeeding in the forex market. This means that you need to maintain a high win rate and minimize your losses. To do this you need to have a good risk/reward ratio for every trade.

You determine risk using a stop-loss order and potential reward using the TakeProfit order. Risk is the price difference between a trade entry point and the stop-loss level. The Reward is the difference between the entry price and the TakeProfit level. These two price differences will help you determine whether a trade is worthwhile.

The general rule followed by many traders is a risk/reward ratio of at least 1:2. This means that your TakeProfit should provide at least 2 units of reward (expected return) for every unit of risk you take on in a trade. Traders with a high-risk appetite may trade with a low ratio, but this is very risky.

Now that you’re familiar with how TakeProfit orders work and how to establish them, let’s take a look at how you set them up.

How to Setup TakeProfit Orders in MetaTrader 4 (MT4)

Setting up a TakeProfit order in MT4 is relatively straightforward. To set up the order for a new trade:

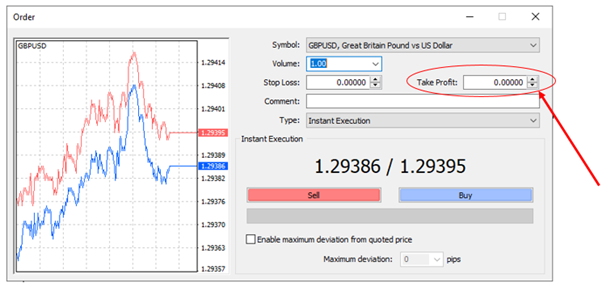

- In the “Trade” tab, double click on the currency pair you want to trade. The “Order” window will pop up.

- Click on the arrows in the “TakeProfit” field to set your TakeProfitto your required level.

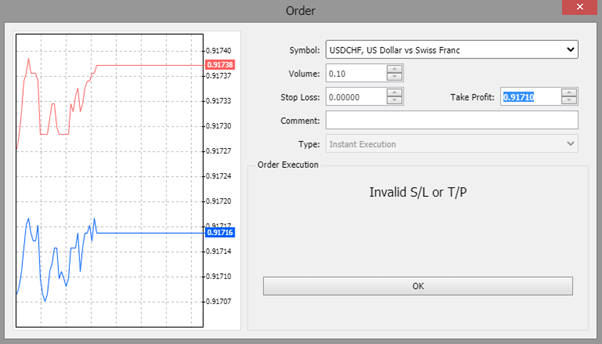

Note: If your TakeProfit level is too close to the current market price, the message “Invalid S/L or T/P” is displayed.

Besides a new trade, you can add a TakeProfit order to a trade you initially opened without the order. You can also modify your TakeProfit after you have already opened a position.

To add a TakeProfit order to a position initially opened without the order:

1.In the Terminal window in the “Trade” tab, double-click on the order you want to add a TakeProfit order to. The “Order” window will appear.

2. Click on the arrows in the “TakeProfit” to set your TakeProfit level.

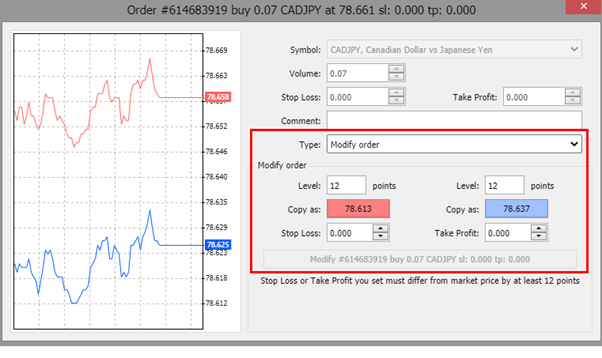

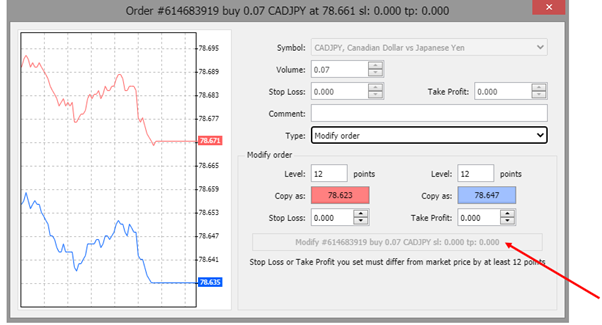

To modify an existing TakeProfit order:

1.In the Terminal window, in the “Trade” tab, right-click on the position whose TakeProfit order you want to modify.

2.Click on “Modify or Delete Order”.

3. Under the “Modify Order” section, change the TakeProfit order to your required level. To make modifying the order level easier, The “Copy as” field under the “Modify Order” section will show you the current currency pair price by default.

4. Click the “Modify” button at the bottom to submit the changes. Your new TakeProfit level will be visible on the chart and in the Terminal window. If the modified order is invalid, the “Modify” button will turn gray and remain like that until you correct the order level.

Note: If you use charts for your trading, you can simply drag the T/P line on the chart to modify the order level.

How to Setup TakeProfit Orders in TradingView

While the MT4 platform is the most popular forex trading tool, trading social networks are also growing in popularity. TradingView is one of the top ones with many resources and tools to help improve your trading.

To set up a TakeProfit order for a new trade on TradingView:

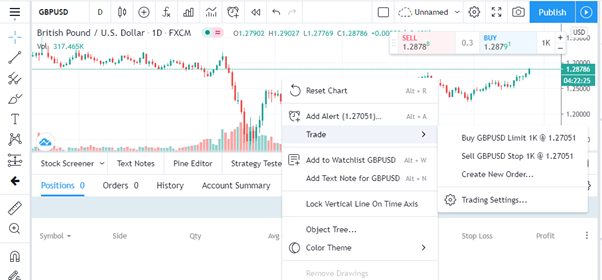

1.In the trading window, select the currency pair you want to trade. A new chart will appear.

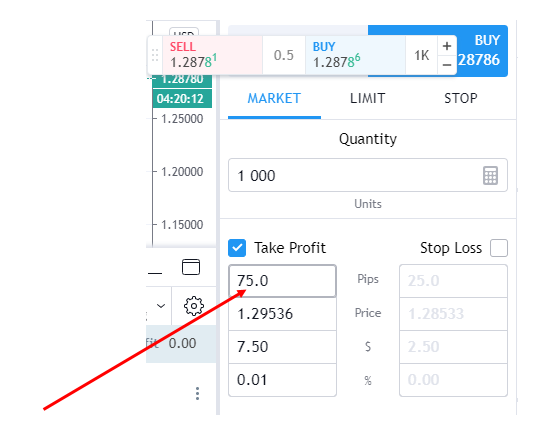

2. Right-click in the chart area. Select “Trade” and click on “Create New Order”. A new order entry window will appear.

3. Click on the “TakeProfit” option and set your required TakeProfit level.

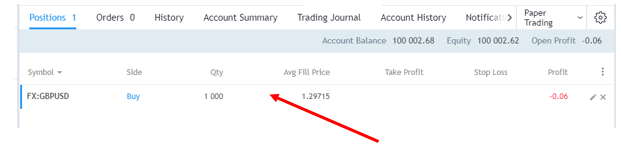

To add a TakeProfit order to an existing trade or modify an existing TakeProfit order:

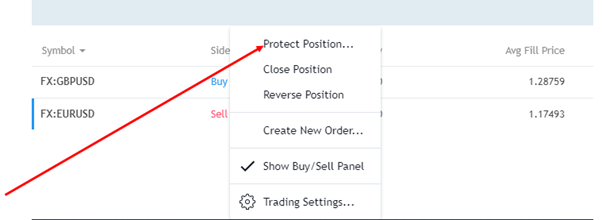

1.Under the “Positions” tab, right-click on the order you want to add the order to.

2. Click on “Protect Position”. The order window will appear.

3. Click on “TakeProfit”, set your order level, and click “Modify” to add the order.

Related Questions

It’s not uncommon for newbie traders to confuse TakeProfit orders and stop-loss orders. However, it’s easy to see why – both types of orders allow you to minimize risk by telling your broker the price at which to trade in the future.

Together with the “what is a TakeProfitand how to use it?” question, one of the most asked questions among forex traders is “what is a stop-loss order in forex?”

What is a Stop-Loss in Forex?

A stop-loss is an order to your broker to close a position once the market price falls to a specific level. By executing the order when the market is moving against you, you protect yourself against further losses.

It’s good to remember that a stop-loss will limit your losses, but it will not prevent them. Also, keep in mind that a gap between the stop-loss level you set and the price at which your trade is closed may exist in a fast-moving and volatile market.

Both TakeProfit and stop-loss orders are used to exit trades. To enter a trade, you have to use one of two order types – a marketing execution order or a pending order. This leads us to the next FAQ.

What is the difference between a pending order and a market execution order?

A market execution order enters you into a trade at the current market price. Your position is open as soon as you hit the “Buy” or “Sell” button. On the other hand, a pending order enters you into a trade when the market price hits a specific level in the future. The four basic types of pending orders are the Buy Limit, Buy Stop, Sell Limit, and Sell Stop orders.

Once the market reaches the required price, a pending order becomes a market execution order and it is fulfilled immediately. A pending order essentially lets your broker know that you want to trade, but not at the current market price. If the market never reaches the price you specify, the pending order is not executed and you won’t be entered into the trade.

Your Turn

Knowledge of how a TakeProfit order works is a must in every trader’s arsenal. After all, increasing your chances of succeeding in the forex market is about blending your skill with knowledge of all the fundamental principles. The TakeProfit order is one such fundamental principle and it’s prudent to apply it to your trading strategy.

Leave a Reply