You know that the Forex spread is an important factor in choosing which currency pairs to trade and even which broker to trade with.

But what is a Forex spread? And why does it matter?

In essence the spread is the difference between the Bid and the Ask price. It is what the broker charges you, the Forex trader. This is how the broker makes its money.

To understand the idea of Forex spreads better, including their importance within your trading day, let’s take a closer look at the concept, including how to calculate them.

Table of Contents

Why is the Forex spread important?

The spread is one of the most important concepts to understand when it comes to trading Forex because it can make a significant difference to your bottom line. Most Forex brokers will make their profit via the spread. Think of the spread as the price that you pay for your Forex transaction. To further push that point, consider that if a broker has tight spreads or offers no spreads, instead they will charge a commission. Many brokers do not nowadays charge what we classically understand as a commission per trade, rather they make a profit on the spread of your trade. Keep in mind that some brokers charge both spreads and commissions.

From the perspective of the broker, offering trading with Forex spreads allows them to make a profit without charging an actual commission per trade. This increases their appeal in their marketing campaigns, as they can use phrases like “commission-free trading” without lying.

From your perspective, the Forex spread is something you need to both consider and to account for when deciding whether to make a certain trade and also when calculating your profit. As a trader, you must think of the Forex spread as an alternative to commission. Instead of paying a flat rate that is easy-to-understand, you will pay a spread, which requires some calculations to determine.

The bottom line

You need to understand what the spread is for Forex trading because it is how you will pay for your transactions. Plus you will need to cover the spread in your trade before you can start to pull in the profit. If the spread is 3 pips then you will need to bring in 3 pips profit to simply cover your costs. Any extra is profit on top.

Ask and Bid prices

We have already established that the Forex spread is the difference between the Bid and the Ask price. But what are the Ask and Bid prices?

You may also hear ‘Bid’ referred to as BUY and ‘Ask’ as SELL.

Keeping things simple, Bid prices are the amount that a Forex dealer will pay for buying the currency.

The Ask price is the price they will sell it at. The Bid is always lower than the Ask price.

For a quick illustration of this in the real world, imagine the currency exchanges you see at the airport. The same principles apply.

You see a sign that says EUR 1 = 1.10/1.20 USD

You know the higher price is the Ask or BUY price. Meaning that if you want to buy 100 Euro, you would look at this price and know you need to pay 120 USD to purchase it. If, however, you have 100 Euro and want to sell it for USD, you would look at the lower price, which is the SELL or Bid price. In this case, you would get 110 USD for selling your 100 Euro.

In this case, the currency exchange would make a profit from the difference between the Bid and the Ask price. The current price of the Euro compared to the USD is likely between the Bid and Ask. This way, the currency exchange makes a small profit when they sell and when they buy Euros. In most situations, if you see a Bid and an Ask price for a currency, the lower one is the BUY/Bid price and the higher is the SELL/Ask.

How to calculate the spread

Now that you understand what the spread actually is, it is not time to learn to calculate it. The Forex spread is sometimes calculated in the form of a percentage with the following formula:

(Ask price – Bid price)/(Ask price) x 100

More commonly, the Forex spread calculation uses five digits in the calculation. In this case, it is as simple as:

(Ask price – Bid price)

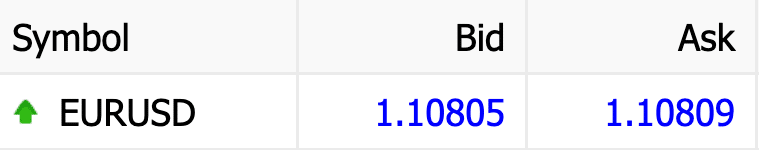

In our image below you can see the current price for the EURUSD, with both the Bid and the Ask price. Both are listed with 5 digits after the point. If you take the Ask price and delete the Bid you are left with 00004. This fifth digit is the spread.

You can also calculate the midpoint of a Forex spread. This is the price where trades would theoretically occur. It is just the average between the Bid and the Ask, so the calculations would be:

(Bid price + Ask price)/2

Example One

For the first example, assume that the EUR/USD Ask price is 1.15 and the Bid price is 1.05 on your chosen exchange. To calculate the spread as a five-digit figure, you would subtract the Bid from the Ask: 1.15 – 1.05 = 0.10

You may see this spread expressed as 0.10 USD. If you wanted to calculate the percent in that same example, you would complete the following calculations: (1.15-1.05)/(1.15)x100 = 8.6957%.

If you want to know the midpoint, you would do the following: (1.15+1.05)/2 = 1.10

This would show the midpoint is 1.10 EUR/USD.

How do brokers determine the spread?

As a general rule, the market makers for Forex will determine the spread. These market makers are specialists that facilitate trading. Market makers today can often be the Forex or CFD broker themselves, otherwise if the trades are passed on to third party liquidity providers, they would suggest the spreads.

Brokers will then add or subtract the spread from the current price of the currency pair to determine the Bid and Ask.

The spread will depend on numerous factors, including:

- The level of market activity – Increased activity decreases the spread.

- Currency liquidity – More popular pairs have lower spreads.

- Size of deal – Large and small deals have a higher risk, and therefore higher spreads in most cases.

- Political and economic risks – Risky economies typically have larger spreads due to risk.

- Volatility of currency – More volatile currencies have higher spreads due to risk.

How to Use That Information to Your Advantage

Since you know some of the reasons why brokers may adjust spreads, you can use that to your advantage.

Do your best to trade in situations that minimize the spread, such as when the market is more active and when trading with more popular currencies.

Fixed vs. variable spreads

As you look at spreads, you will notice that some are fixed and some are variable. These are exactly what they sound like:

- Fixed spreads remain the same, regardless of market conditions or other factors.

- Variable spreads will change based on the previously mentioned external factors.

Variable spreads tend to fluctuate within a given range and fixed spreads will usually stay in that range.

How to Choose

Most brokers let you choose your preferred spread structure depending on the account type. Long-term traders should consider variable spreads as they let you plan your entry and exit into the market to take advantage of the best spreads available.

Day traders should consider fixed spreads so that you may avoid needing to enter or exit a trade during high volatility times. Beginners should stick to working with fixed spreads as they are easier to understand and use.

The Difference Evens Out Mostly

Most experienced traders agree that the cost differences in fixed and variable spreads even out over time.

Checking Forex spreads on MT4

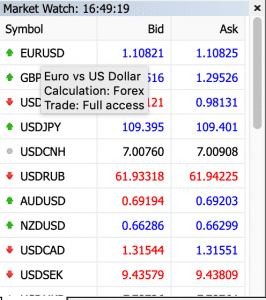

The most common Forex platform is the MT4 or MetaTrader 4, so you should know how to find the Forex spread for your chosen pair on this platform. The following is the simplest method:

1. Go to Market Watch

2. Right-click anywhere

3. Select “Spread” The spreads will appear.

You can also activate the Spread Indicator, which will display the spread over your chart.

Wrap-up on Forex spreads

You do not need to get too in-depth to understand the basics of what the spread is in Forex. To keep it simple, Forex spread is what separates the Bid and Ask prices, or the price that the broker is willing to sell the currency for and what they are willing to buy it for. In most trading types, Forex spreads replace traditional commissions.

Advanced traders will be able to analyze the various market factors that influence Forex spreads so they can trade when they are at their lowest to reduce the fees paid for trades.

TOP TIP! In high volatility times, fixed spreads will always be the better choice.

Takeaways

1. You must factor in the spread to your potential profit outcome before you trade eg. If a trade will cost you 2 pips then you have to cover 2 pips minimum before you can make a profit.

2. Fixed spreads will often be the better option as you can factor them in to your trading plan. They are definitely better in volatile markets.

3. Learn how to calculate spreads before trading, as they will be crucial to your bottom line.

START LEARNING FOREX TODAY!

share This:

Leave a Reply