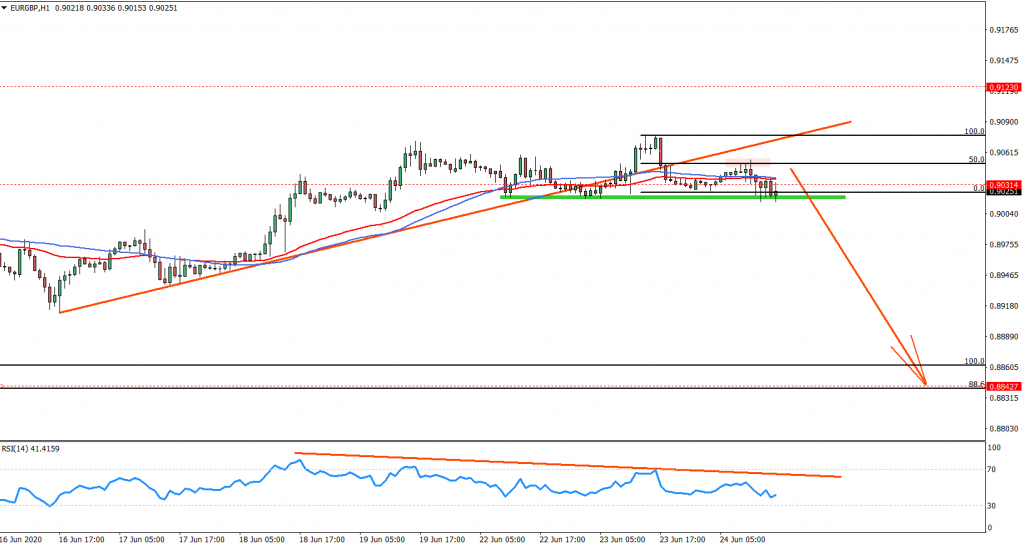

The EUR/GBP downside correction might be starting very soon, but only if the price remains below the recent high at 0.9078. The closer price gets to that key resistance, the better the Risk/Reward ratio can be obtained.

Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice.

This analysis was done on MetaTrader 4.

Click below to open a Free Demo Account with our trusted brokers:

Trade Idea Details:

EUR/GBP symbol

Type: Bearish

Key support levels: 0.9020, 0.9000

Key resistance levels: 0.9055, 0.9078

Price Action:

On the 1-hour chart EUR/GBP has formed a bearish divergence on the RSI oscillator, after which price broke below the uptrend trendline. Nonetheless, there is a strong support formed near 0.9020, which remains unbroken. Based on the most recent pullback up, price found the resistance at 50% Fibs, which is 0.9050. If EUR/GBP will confirm the support breakout, by closing below 0.9018 on the 1h timeframe, the downtrend or a strong downside correction should be expected.

There is one key support level that we can observe on the Daily chart. This is 0.8842 level confirmed by 88.6% and 61.8% retracement levels. The Fibonacci indicators were applied to the last wave down occurred between 21-30 April, and to the wave up, produced between May 5 – June 23. Along with the Fibonacci retracement, the support is also confirmed by the 200 Exponential Moving Averages, making 0.8842 a long term demand zone.

Potential Trade Idea:

To stay on safe side, it is best to go for selling opportunity as soon as 1h candle closes below the 0.9018, which is previously formed support. On the other hand, the selling opportunity will remain open while the price is between 0.9030 – 0.9078. And as already was mentioned, the closer the price gets to the recent high, the better RR will be. The idea might get invalidated if EUR/GBP will have a daily close above 0.9078, but in any case, hard stop loss must be placed at 0.9123. This means that even the entry at 0.9030 will provide a 1:2 risk to reward ratio.

Leave a Reply