One of the biggest dilemmas Forex traders face is where to put the stop loss order. Any trade should have a Forex stop loss order. Trading without a stop loss is not only risky but foolish too.

The Forex market swings aggressively. Not once, the currency pairs travel only to take the stops on a previous swing, and then reverse. In traders’ language, the market “triggers stops” or is in a “stop hunting” mode.

No matter how you put it, Forex trading is a dog-eat-dog world. Traders are in for a profit and only the toughest ones survive. As such, placing a stop loss order is as important as the actual trade.

In fact, placing a Forex stop loss is part of the actual trade.

There are three parts to a trade: the entry, the take profit, and the stop loss level. All equally important.

However, having a stop loss order in place doesn’t guarantee one hundred percent safety. A Forex loss bigger than the one planned can occur.

The perfect example comes from the SNB (Swiss National Bank). For a few years, the SNB kept the EURCHF rate pegged to the 1.20 level.

For Forex traders, it meant they can easily buy the pair with a stop loss order at the 1.20 level. It worked like a charm.

However, when the SNB unexpectedly dropped the peg, mayhem started. Because of the ECN (Electronic Communication Network) and STP (Straight Through Protocol) executions, Forex brokers do not guarantee a level.

Neither a Forex stop loss nor a take profit. Moreover, they guarantee execution when and if there’s a market.

Reasons to Use a Stop Loss Order

If the SNB example tells us anything, it is that Forex trading is risky. All traders know that.

In the case of the EURCHF longs, there was no market all the way down to 0.86 area. Hence, the stop loss order at 1.20 couldn’t be executed.

Brokers make sure traders know. The risk disclaimer appears everywhere.

This is not random. Part of the regulatory process, traders must be informed about the risks associated with trading the currency markets.

However, the SNB example is extreme. In fact, it was unprecedented and threatened the retail trading industry.

Because the Forex stop on the long trades couldn’t be executed, retail traders faced huge losses. Imagine one retail trader having one lot or more on the long side.

And then, in a blink of an eye, the market dips almost four thousand pips. Moreover, the broker couldn’t do anything. And, even more importantly, the broker was covered. There was no market.

The next thing the brokers did was to go after their clients. The retail traders were forced to come up with the difference.

However, this didn’t happen with all brokers. Most of them “covered” the negative balances of their clients.

It turned out it was a smart move. For a broker, the value of a trader comes from his/her activity. A client lost meant no more future revenues.

But, not all brokers did that. The retail traders that needed to cover the losses faced a tough reality.

When there’s no market, no stop loss order can help a trading account. Why should traders still use Forex stop loss orders?

The answer comes from the unprecedented of the situation. Most of the times, such a thing doesn’t happen.

On top of it, traders must have some sort of protection in their trading accounts.

Forex Stop Loss Order as Part of a Money Management System

Trading without losses doesn’t exist. As such, embracing losses is part of the process. This is a problem for retail traders.

When coming to the Forex market, retail traders have unrealistic expectations. I mean, they all go through the same process.

Firstly, they look for the perfect trade. That is the trade that repeats on and on. Moreover, the trade that always wins. There’s no such trade.

After spending a lot of time and money to find it, traders move to the next step. They combine all possible technical indicators in search of the holy grail. Again, they fail.

Finally, they’ll start embracing losses. The way to do that is to incorporate the Forex losses in a money management system.

Believe it or not, when the market hits a stop loss order, good things happen too. For example, as part of the money management system, when a Forex stop loss order gets hit, there’s more free margin available.

Free margin means new opportunities. Traders have margin now for other trades. A door closed, another one opened.

Forex Stop Loss Strategy – Risk-Reward Ratios

Before thinking of the reward, traders must define the risk. Managing the risk is crucial. And, to do that, risk-reward ratios help.

A risk-reward ratio represents the key to profitable trading. It incorporates a Forex stop loss as part of the trading strategy.

Moreover, it gives traders control over the trading process. When both the risk and the reward are well defined, traders can focus on finding the best trades possible.

As such, a stop loss order brings discipline in a trading account. If there’s a level to get out from a bad trade, the Forex stop loss order shows that level.

A proper risk-reward ratio for the Forex market is somewhere between 1:2 and 1:2.5. It means that for every pip risked, the expected reward is double or even more.

Every trader experienced Forex failure stories. This is normal. In fact, it is part of the trading process.

However, the reason for a Forex failure goes hand in hand with a bad stop loss order. Or, even worse, with no use of a Forex stop loss. There are many examples in the retail trading world that show why a Forex stop loss helps a trading account.

Now see how a Stop Loss order can protect your Forex trade. Below you will find a video example of a channel trade which does not go as planned. I went long to scalp the GBP/NZD on the 5-minute chart. The price was bouncing off the lower level of a bullish channel and I thought a new bullish impulse is on its way. However, the price broke the lower level of the channel and hit my Stop. The decrease was even sharper, meaning that the Stop Loss protected me from a bigger danger.

Now simply enter your details and you will be able to see the video for free.

How to Place a Stop Loss Order

Because a stop loss order is part of a money management system, its presence is mandatory. As a rule of thumb, traders should always have a stop loss order in place.

But, not everyone uses them. Some traders simply don’t want to use one. They’re afraid of being stopped only to see the market reversing.

Or, even worse, they’re afraid the broker sees the levels and goes for the stops. When the broker is a market maker, it does such nasty things.

In fact, market makers trade against their clients’ trades. Statistically, they have better chances to make a profit. When doing this, they’ll use all the tricks in the world. Tripping stops included.

Traders use a stop loss order based on the trading style and/or strategy. The stop loss order definition is straightforward. It stops the loss.

When trading, there’s a saying: cut your losses short. Or, in plain English: get out of a bad trade as quickly as possible.

Yet, it is difficult to pull the plug. Especially when a trade unfolds. As such, the better way is to have a plan in mind.

Go to war with a plan. The same in trading. Know your way out before going in.

Forex Stop Loss with Elliott Waves Theory

The Elliott Waves Theory is, perhaps, the most complex logical process in technical analysis. Traders count waves as part of identifying the right market cycle.

As such, they divide the market moves in impulsive and corrective waves. The rules defined by Elliott allow placing a stop loss order.

In other words, the level that invalidates a count is where the stop loss order should be. There’s no better way to illustrate this than in an impulsive wave.

According to Elliott, an impulsive wave is a five-wave structure. One of the most powerful rules in an impulsive wave states that no parts of the 2nd wave can move beyond the 1st wave’s start.

Moreover, in an impulsive wave, the typical retracement for the 2nd wave is around 50%-61.8% of the previous wave. That’s the entry.

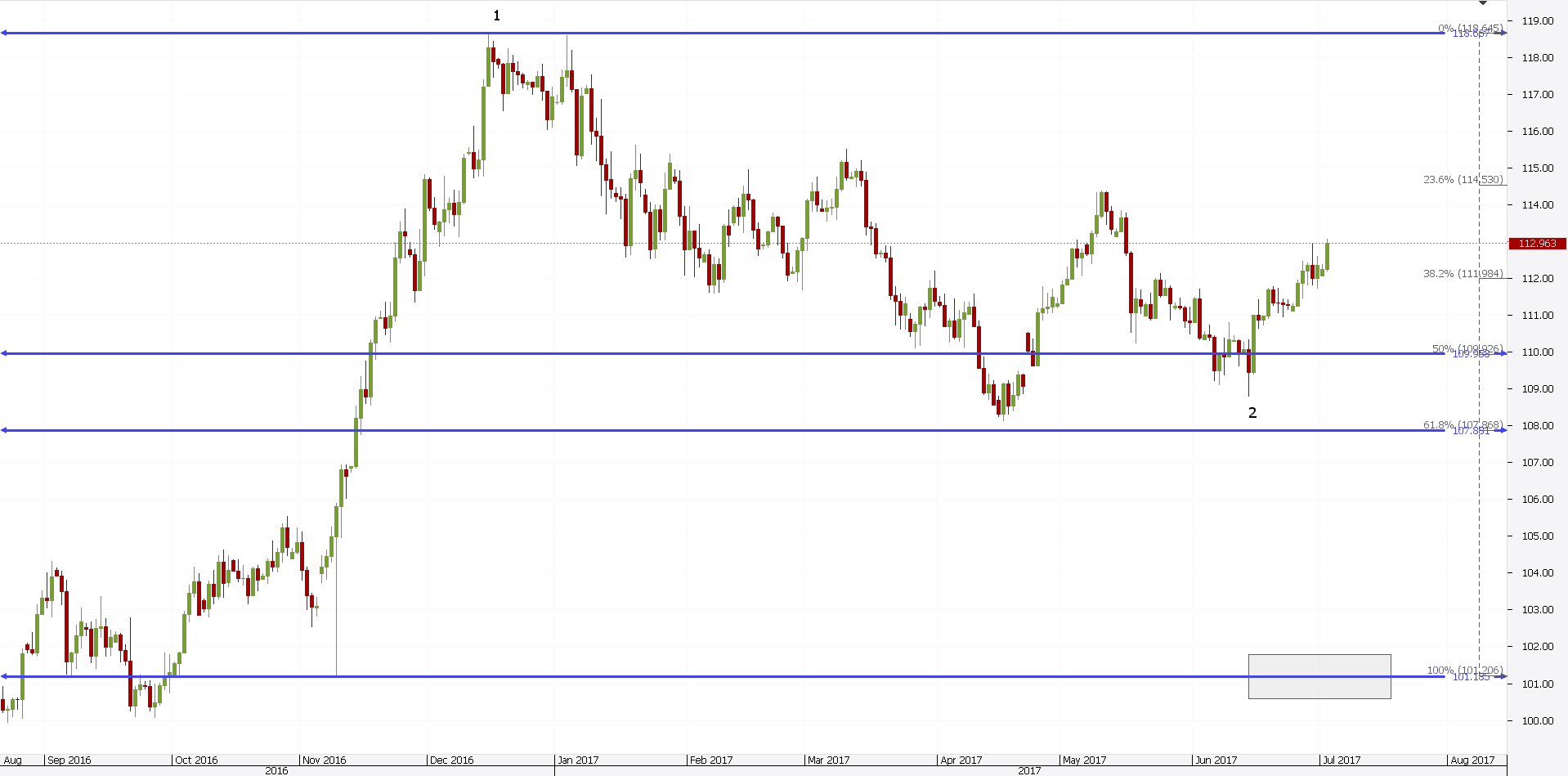

The USDJPY chart above shows how this works. If the move that followed Mr. Trump’s election is the 1st wave in an impulsive wave, traders went long when it was retraced 50%-61.8%.

The start of the 1st wave represents the stop loss order level. If the trade is part of a money management system with 1:2 or 1:2.5 risk-reward ratio, then the Forex stop loss order gives the target too.

Simply count the pips needed for the stop, then multiply the outcome with two or two and a half. As such, traders find the right target.

This is the most simplistic example possible. The Elliott Waves Theory is so complex and has so many rules that allow for tighter stops.

In fact, Elliott traders have a problem. They don’t know how to place stop loss order when counting bigger time frames.

Yet, the theory gives great trading opportunities. For this reason, it is one of the most popular technical analysis trading theories.

How to Place Stop Loss Orders with Trendlines

A trend line is the line of a trend. Therefore, as long as the trendline holds, the trend holds.

If the trend is a trader’s friend, the idea is to ride it until completion. Every trader in the world knows that.

Trendlines have the advantage of being visible. Moreover, a trendline needs only two points.

From those two points, traders project future support and resistance levels. These levels give the stop loss order for a trade.

A proper Forex stop loss doesn’t necessarily needs to be a physical order. A stop loss may be the invalidation of a count. Or, in this case, the break of a trendline.

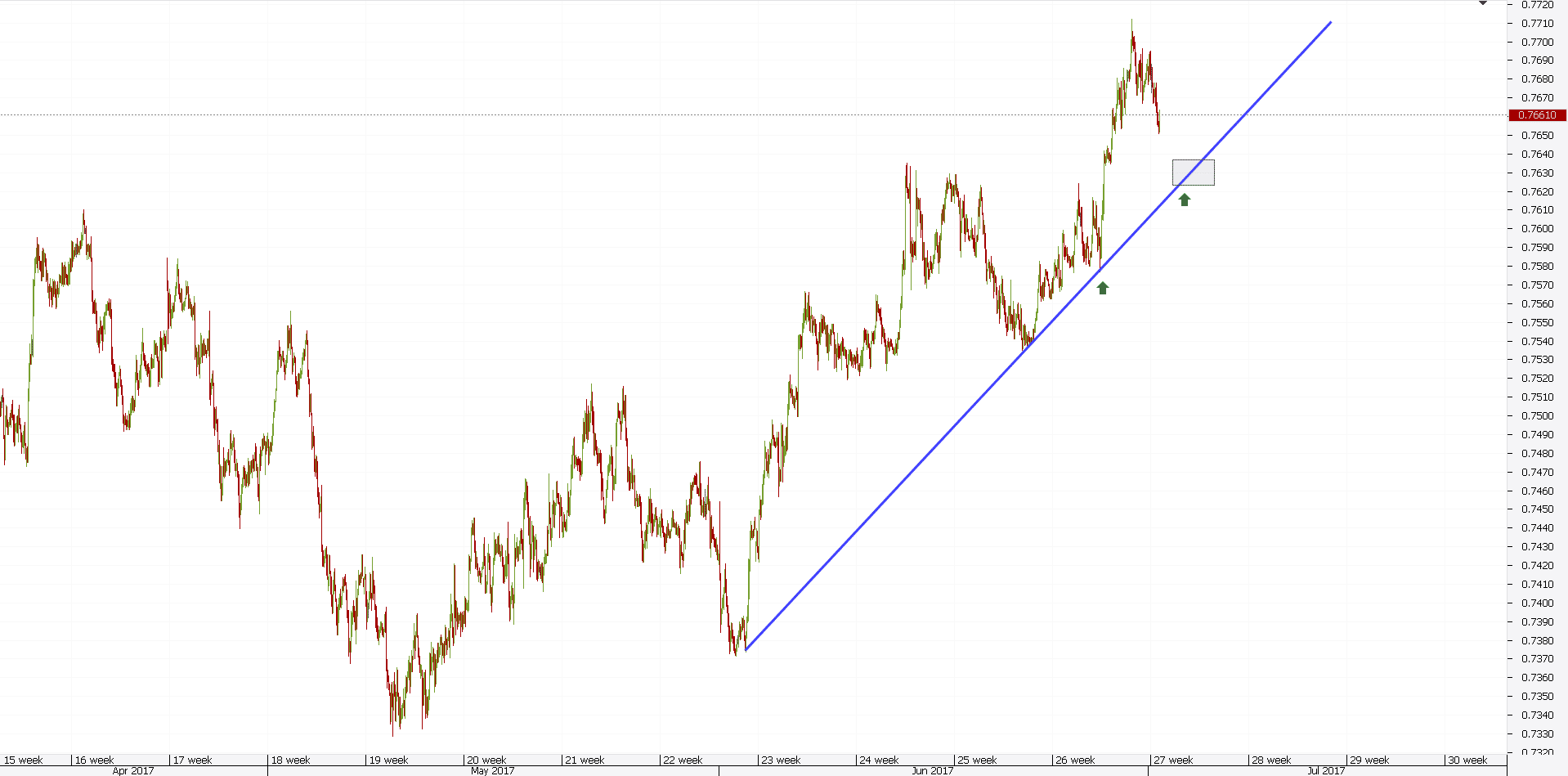

Take the AUDUSD hourly chart from above. The blue trend line defines the bullish trend.

Therefore, when the trend line gets broken, the bullish trend ceases to exist. Moreover, it means such a break represents the stop loss order.

The natural tendency is to assume that the account takes a loss when a stop loss order gets hit. That’s wrong. A Forex stop loss may protect profits.

When a trade goes in their favor, traders move the stop loss order. They lock in profits.

If this happens, the emotional factor disappears. That’s a big advantage when trading for a living.

Trailing a Stop Loss Order

Perhaps the most popular way to use a stop loss order is to trail it. Especially when trading on the bigger time frames.

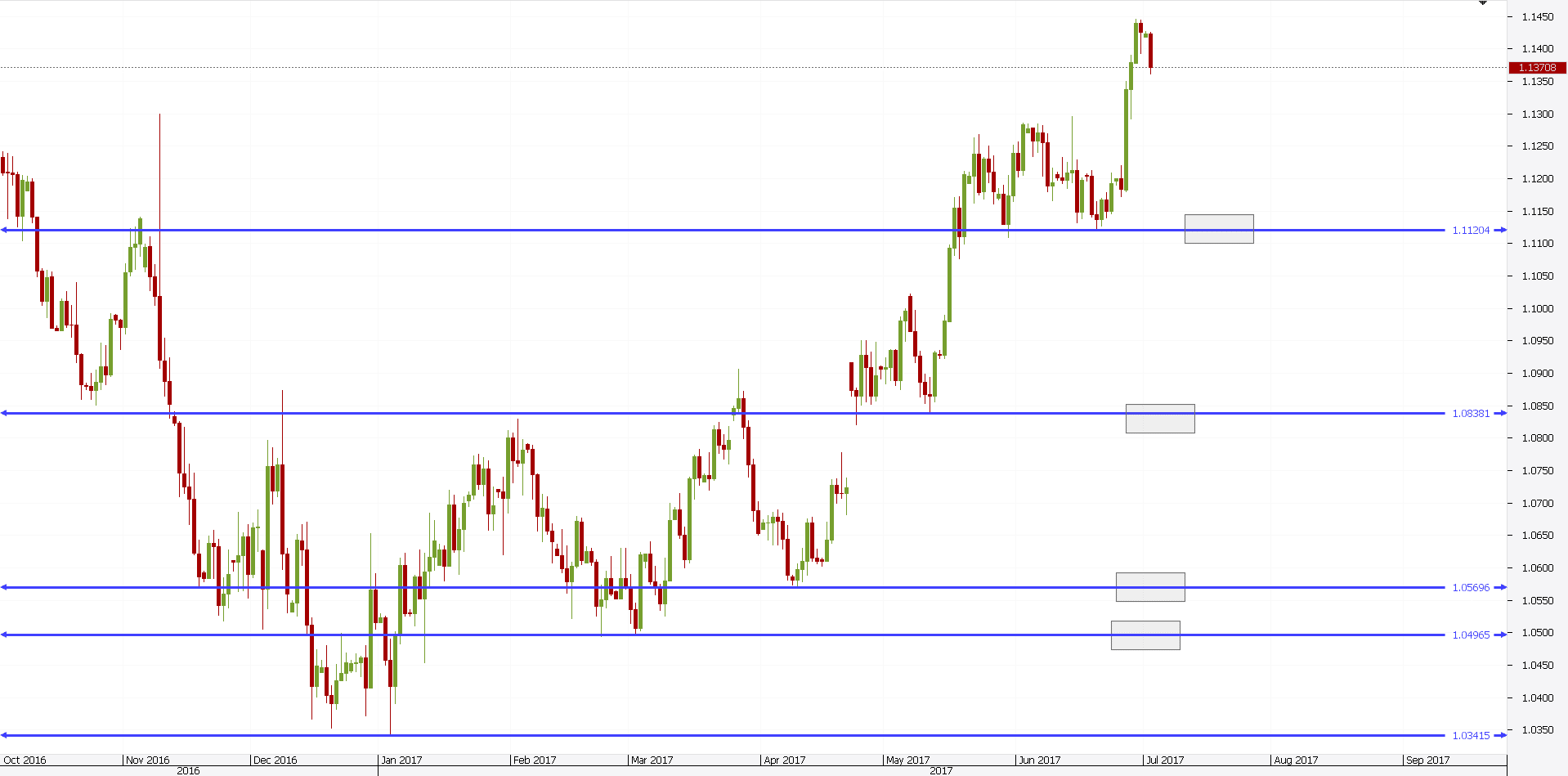

However, it can be done on lower time frames too. The EURUSD chart below shows the perfect trailing stop loss order example.

By definition, to trail a stop means to move it when the price moves. For example, the EURUSD chart above shows the market making multiple new highs.

Traders trail the stop loss order at the previous swing’s low. The process repeats every time the pair makes a new high.

As such, traders accomplish several things. First, they lock in profits. Next, they ride the trend. Finally, they use a disciplined approach to Forex trading.

As a trader, you’ll never know how strong a trend will be. Therefore, trailing a stop loss order gives you the means to ride a trend until its completion.

On the EURUSD example, traders had the opportunity to move the Forex stop loss four times. As long as the series of higher highs continues, they’ll keep trailing the stop loss order.

After all, what is a stop-loss order if not a trading tool part of a strategy?

What is Stop-Loss Order – The RSI Example

Not all traders use the Forex stop loss orders in the same way. It all comes from how traders define a trend and what is stop-loss order for them.

Some use trendlines. Others use trend indicators. Or, in some cases, even oscillators.

The most famous oscillator, the RSI (Relative Strength Index), shows the perfect place for a stop loss order.

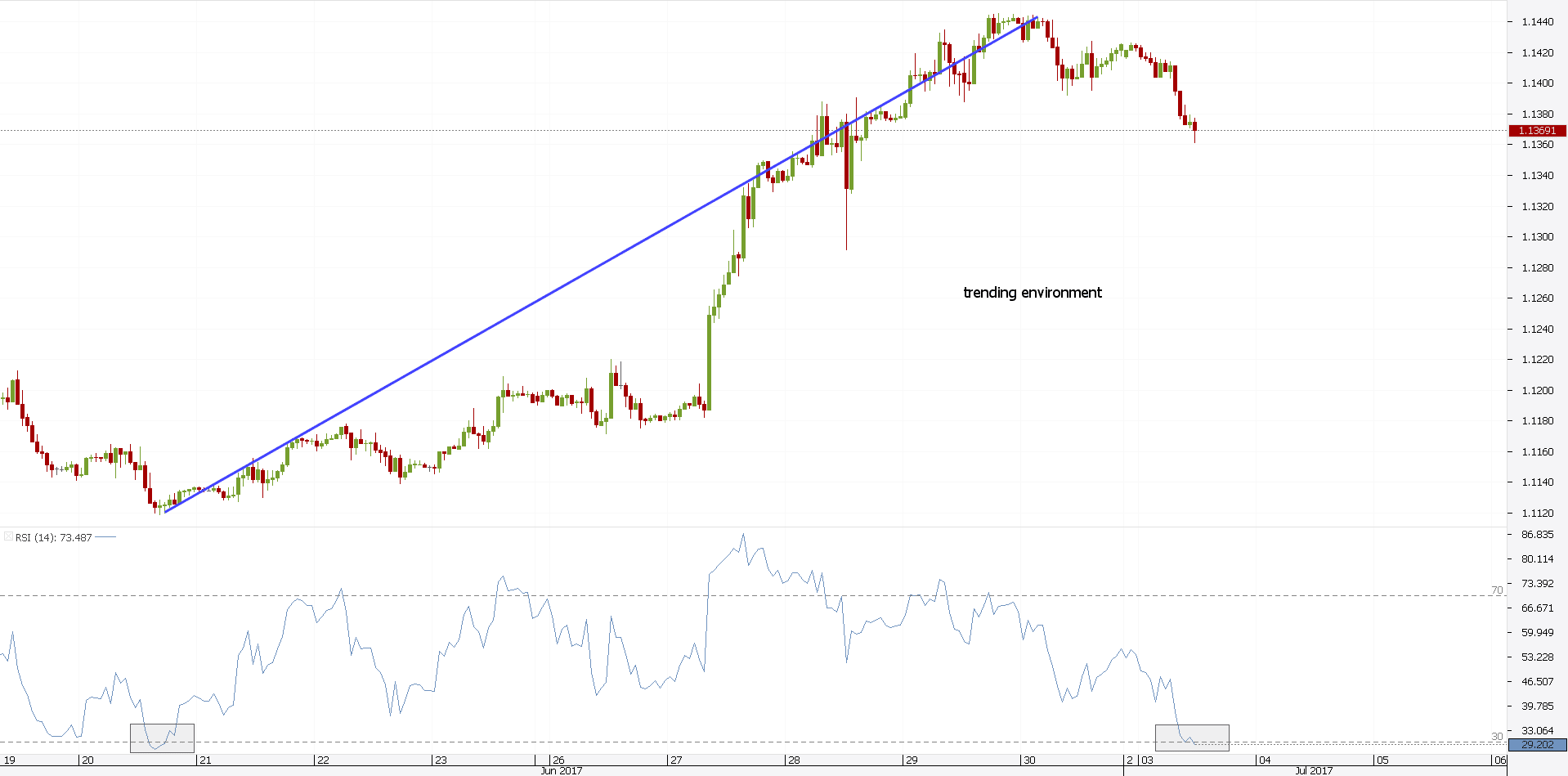

The RSI moves between overbought and oversold levels. However, in doing that, it also shows trending conditions.

The RSI indicator shows the perfect trending environment in the chart above. Between two oversold levels, the market traveled aggressively.

As such, it shows how to put stop loss order. Or, when to exit a trade. In essence, they represent the same thing.

Now that the RSI confirmed a full cycle, traders have two options. One is to exit the trade and book the profits. Another is to raise the stop loss order to the last swing.

This way, they protect profits and allow for yet another swing higher. However, because the RSI couldn’t stay in overbought territory, it shows the market hesitates.

This is a weak sign for a bullish trend. Yet, it offers a great stop-loss order example.

Forex Stop Loss Orders Strategy

There are other ways to use a stop loss in a trading account. It doesn’t need to be an order.

The idea behind a stop loss is to limit the losses. When this happens, traders have bigger chances to survive in the Forex market.

Limiting the losses is part of the trading strategy. Hence, a stop loss gives the exit from a bad trade. Moreover, it keeps the account afloat.

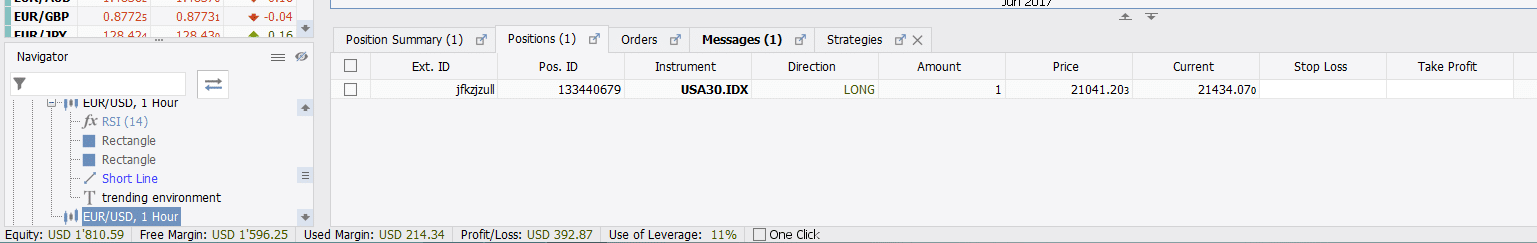

The image above shows the state of a trading account. The current open position has no stop loss order set. Nor take profit.

However, this may be for a reason. Traders look at other things to exit from a trade.

One is leverage. At this moment, the trading account uses 11% as leverage. Such a level is appropriate.

But, if the position turns against the trader, the leverage level will rise. More than 30% is not recommended.

As such, traders will start cutting parts or all the position when the account reaches 30% leverage level. This is a valuable trading strategy that shows a stop loss order example without actually using a Forex stop loss.

Conclusion

The most difficult thing in trading is to be consistent. To make consistent profits is every trader’s dream.

However, this comes as a sum of many trades. Some of them will fail. For this, a stop loss order comes to help.

Why use one? What is stop loss order if not a money management tool?

It is a great tool to define the risk in a market. Or, in a trading account. If traders can quantify the risk, they have a base to build on.

The first challenge of a trader is to deal with losses. Then, to handle the potential profits.

Over ninety percent of retail traders fail. Therefore, traders that do break-even in the long run must have a good strategy. The ones that manage to make some money in the meantime, must use a stop loss order.

The idea of this article was to show different ways to use a Forex stop loss. In the end, it doesn’t matter how you use it as long as the risk is contained.

Great trades have a great risk-reward ratio. But, to reach the reward, traders must start with managing the risk.

There’s no better way to do that than using a stop loss order. In fact, trading should start from the stop loss order level. Traders that understand this basic principle, have more chances to survive in this competitive environment.

START LEARNING FOREX TODAY!

share This:

Leave a Reply