Across the board, the Australian Dollar still seems to be ready to outperform most if not all other major fiat currencies. While AUD might be very strong as expected, it will likely outperform AUD as well, sending AUD/USD price up, at least in the medium term.

Disclaimer: The analysis presented in this article is for educational purposes only and should not be considered as financial advice.

This analysis was done on MetaTrader 4.

Click below to open a Free Demo Account with our trusted brokers:

Trade Idea Details:

AUD/USD symbol

Type: Bullish

Key support levels: 0.6850, 0.6800

Key resistance levels: 0.6970, 0.7020

Price Action:

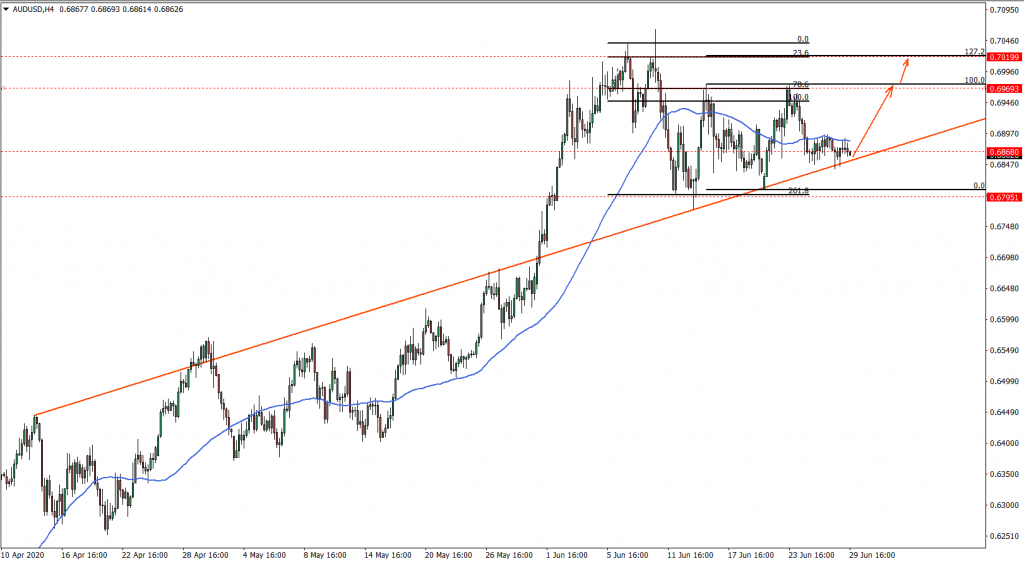

On the 4h chart, AUD/USD is rejecting the average-price uptrend trendline for the third time in a row. The last rejection occurred just today when the pair tested the 0.6840 low. Along with the trendline rejection, the 50 Simple Moving Average was also rejected. Price has produced few spikes below, marking the 0.6840 low as an important support area. At the same time, prior to that, there was a clear rejection of the 261.8% Fibs at 0.6800, which is also a strong psychological support. This fact just ads more confidence in the probability of an uptrend.

As long as the 4h closing price remains above 0.6840, AUD/USD should be expected to rise towards one of the Fibonacci resistance levels. We have applied Fibs to the last wave up. Where AUD/USD tested 0.7042 high. It provides two important levels, first being 78.6% Fibs at 0.6970. This level corresponds to the previous area of resistance and should be considered as the first key resistance. The second resistance is located at 0.7020 and is confirmed by 23.6% Fibs, and 227.2% Fibs applied to the correction wave down after breaking 50 SMA.

Potential Trade Idea:

Currency price remains very near the average-price uptrend trendline. The ideal buying opportunity should be presented when the price will re-test the trendline and will be in 0.6850 – 0.6870 area. There are two potential upside targets, first being the 0.6970 and second and key resistance is at 0.7020. In order to achieve a 1:2 Risk/Reward ratio, the stop loss must be placed at 0.6795, which is also below the 0.6800 psychological support.

Leave a Reply